Index Stock Update >> Aditya Birla Nuvo Visit us at www.sharekhan.com

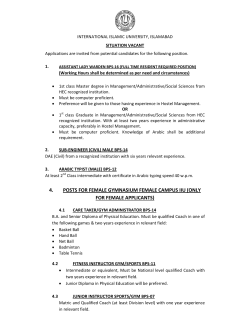

Visit us at www.sharekhan.com November 12, 2014 Index Stock Update >> Aditya Birla Nuvo For Private Circulation only Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Fax: 67481899; E-mail: [email protected]; Website: www.sharekhan.com; CIN: U99999MH1995PLC087498. Sharekhan Ltd.: SEBI Regn. Nos. BSE- INB/INF011073351 ; CD-INE011073351; NSE– INB/INF231073330 ; CD-INE231073330; MCX Stock Exchange- INB/INF261073333 ; CD-INE261073330; DP-NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/ CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626; For any complaints email at [email protected] ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Do’s & Don’ts by MCX & NCDEX and the T & C on www.sharekhan.com before investing. investor’s eye stock update Aditya Birla Nuvo Reco: Buy Stock Update Strong performance; Maintain Buy Key points Company details Price target: Rs2,000 Market cap: Rs23,630 cr 52 week high/low: Rs1,827/1,030 NSE volume: (no. of shares) 2.0 lakh BSE code: 500303 NSE code: ABIRLANUVO Sharekhan code: ABIRLANUVO Free float: (no. of shares) 5.6 cr Shareholding pattern Public & Others 10% Foreign 19% Institutions 12% Non-promoter corporate 3% Promoters 56% Price chart 1800 1600 1400 1200 Nov-14 Sep-14 Jul-14 May-14 Mar-14 1000 Jan-14 Aditya Birla Nuvo Ltd (ABNL)’s Q2FY2015 result is not directly comparable on a Y-o-Y basis, as the last year’s performance included ITES business, which was sold off in May 2014. Excluding the impact and on a like-to-like basis, the overall performance was very healthy with a revenue growth of 15% YoY. Led by efficiencies in business verticals, the overall operating profit grew by 34% YoY, while the net earnings grew surged by 75% on a Y-o-Y basis. On a reported basis, the revenue grew by 1.6% YoY; while operating profit and the net earnings grew by 26% and 56% respectively. The company sounded confident on its non-banking finance business and continues to nurture its plans to grow the loan book size. It has forayed into the housing finance business and has started lending; further, the company has also entered into the health insurance business. On the life insurance vertical, it sounded positive on the product portfolio front and expects revival in the business with revival on the macro economy front, while on the lifestyle segment it has mentioned that the competitive intensity has increased and 2HFY2015 would remain challenging for the overall lifestyle-led businesses. ABNL’s strong positioning in each of its business verticals it operates in (life insurance, telecom, lifestyle and asset management), along with its quest for profitable growth and attractive valuation which makes us maintain our Buy rating on the stock with a price target of Rs2,000 (arrived using sum-of-theparts approach valuing each business vertical). Results (consolidated) 2000 Nov-13 CMP: Rs1,816 Price performance (%) 1m 3m 6m 12m Absolute 6.5 22.5 56.4 43.2 Relative to Sensex 0.3 11.8 27.2 3.5 Rs cr Particulars Q2FY15 Q2FY14 YoY % Q1FY15 QoQ % Total income from operations 6,597.3 6,492.6 1.6 6,207.1 6.3 Total expenditure 5,187.8 5,362.5 -3.3 5,009.0 3.6 Operating profit 1,409.5 1,130.1 24.7 1,198.2 17.6 Other income 107.0 73.2 46.2 74.6 43.4 Interest 420.0 356.6 17.8 408.8 2.7 Depreciation 381.8 384.1 -0.6 405.0 -5.7 PBT 714.7 462.6 54.5 459.0 55.7 Tax 236.9 155.3 52.6 167.6 41.4 Adjusted PAT after MI 452.1 290.1 55.8 277.0 63.2 34.8 24.1 OPM (%) 21.4% 17.4% 396 BPS 19.3% 206 BPS PATM (%) 7.2% 4.7% 251 BPS 4.5% 276 BPS 33.2% 33.6% -41 BPS 36.5% -336 BPS EPS Tax rate (%) Sharekhan 2 November 12, 2014 19.1 Home Next investor’s eye stock update Valuations (stand-alone) Particulars Segmental performance (consolidated) FY12 FY13 FY14 Revenues (Rs cr) 8675.3 9595.2 8338.4 Net profit (Rs cr) 426.6 423.1 484.7 538.3 584.2 Shares in issue (Cr) 11.4 13.0 13.0 13.0 13.0 Adj. EPS (Rs) 32.8 32.5 37.3 41.4 44.9 12.4 -0.8 14.6 11.1 8.5 55.3 55.8 48.7 43.9 40.4 500.2 527.1 548.0 589.4 634.3 3.6 3.4 3.3 3.1 2.9 32.0 30.4 26.9 24.5 22.2 RoCE (%) 8.1 8.2 8.7 8.7 8.8 RoNW (%) 7.5 6.2 6.8 7.0 7.1 Growth YoY (%) PER (x) Book value (Rs) P/BV (Rs) EV/EBIDTA (x) FY15E Particulars FY16E 9237.3 10260.1 Segment revenue Branded apparels 1,543 and accessories Rayon yarn 232 Insulators 150 Other textiles (spun 351 yarn & fabrics) Fertilisers 779 Financial services 627 Life insurance 1,149 premium income Telecom 1,769 Total revenue 6,597 Segmental PBIT Garments 126.3 Rayon yarn 46.7 Insulators 23.5 Other textiles 36.2 Fertilisers 63.3 Financial services 130.1 Life insurance 97.3 IT and ITES Telecom 306.7 Total segmental PBIT 830.0 PBIT margin (%) Garments 8.2 Rayon yarn 20.1 Insulators 15.6 Other textiles 10.3 Fertilisers 8.1 Financial services 20.8 Life insurance 8.5 Telecom 17.3 Key result highlights Excluding ITES business; the topline grew at a 15% YoY-On a reported basis, ABNL posted a 1.6% year-onyear (Y-o-Y) growth in the revenues. The results are not directly comparable as the same quarter last year had full revenue of the information technology enabled services (ITES) business, which was sold in May 2014. Thus, excluding the ITES business performance, the consolidated topline grew at a 15% on a Y-o-Y basis. On the business performance front, growth was witnessed across verticals. The company’s financial services business was a star performer for the quarter, posting a 40.5% growth on a Y-o-Y basis. Operating efficiencies led to margin expansionDecent revenue performance coupled with efficiency gain from employee cost and other expenditure resulted in 24.7% Y-o-Y growth in the consolidated operating profit. Consequently the operating profit margin (OPM) also improved by a strong 396 basis points (BPS) on a Y-o-Y basis from 17.4% in Q2FY2014 to 21.4% in Q1FY2015. Adjusting for its ITES business, the overall operating profit grew much stronger at 34% on a Y-o-Y basis. Blended 12.6 Q2 FY14 YoY % Q1 FY15 QoQ % 1,303 18.5 1,155 33.6 213 116 311 8.7 29.3 12.7 212 87 375 9.4 73.0 -6.4 664 446 1,083 17.2 40.5 6.1 564 588 1,068 38.2 6.5 7.6 1,596 6,493 10.8 1,879 1.6 6,211 -5.9 6.2 72.2 43.0 13.4 30.3 39.9 81.3 74.6 43.6 225.4 623.8 75.0 (6.6) 8.6 42.9 75.3 2.5 19.3 44.2 58.5 18.6 60.0 124.7 30.4 82.6 -100.0 (16.5) 36.1 337.4 33.1 629.7 NA 8.8 851.8 -18.2 240.2 4.3 17.9 -100.0 -9.1 31.8 5.5 20.1 11.5 9.7 6.0 18.2 6.9 14.1 264 BPS -3 BPS 410 BPS 57 BPS 211 BPS 253 BPS 158 BPS 321 BPS (0.6) 876 BPS 20.2 -10 BPS 2.8 1,279 BPS 11.8 -148 BPS 3.3 483 BPS 21.2 -44 BPS 7.7 74 BPS 18.0 -61 BPS 9.6 297 BPS 10.1 244 BPS Key result positives Strong operating performance reported by all the business segments with the strongest growth reported by the financial services business, which grew by 40.5% on a Y-o-Y basis. Margin improvement was witnessed across all the segments barring Rayon yarn, with highest improvement from the insulators (+410BPS) followed by financial services (+253BPS Y-o-Y). Adjusted earnings grew 75% YoY-On the back of a strong operational performance coupled with reduction in the depreciation expense (depreciation down 1.5% YoY on account of disposal of its ITES business), the reported earnings grew at a 55.8% on a Y-o-Y basis, while the adjusted earnings grew at a 75% on a Y-o-Y basis. Sharekhan Q2 FY15 (Rs cr) Aided by the receipt of fertiliser subsidy, the net debt position of the company improved, leading to reduction in debt from Rs3,200 crore in June to Rs2,450 crore as on September, while the net debt to earnings before interest, tax, depreciation and amortisation (EBITDA) improved to 1.9x (annualised for 1HFY2015) from 2.6x in FY2014. 3 November 12, 2014 Home Next investor’s eye stock update Strong operational performance rebound seen in the Pantaloons business, wherein the revenue grew by 13.5% on a Y-o-Y basis led by 8.9% same-store sales growth, while the operating profit grew manifold from Rs5 crore to 31crore in Q2FY2015. Business-wise performance Life insurance business The net premium income grew by 3.2% on a Y-o-Y basis, led by a 9.5% growth in the renewal premium. While the new business premium declined by a 12% on a Y-o-Y basis. Key result negatives Life insurance business profitability continues to deteriorate due to change in the product mix. Share of non-unit linked insurance plan (ULIP) products in individual business increased from 57% in Q2FY2014 to 61% in Q2FY2015, while PAR products accounted for a 38% of the individual new business. Key management comments Guided for ~ Rs400 crore capex for FY2015 on a stand-alone basis-The management guided for a capital expenditure (capex) of Rs400 crore for FY2015, which it stated that it would be largely spend for the distribution and expansion of Madura stores (plans to add 200-250 stores annually), along with its capacity expansion in the Rayon and the textile business. Asset management business ABNL’s asset management company (AMC) outgrew industry and reported a 27% Y-o-Y growth in its assets under management (AUM) to reach over Rs1 lakh crore. ABNL’s share in the industry improved from 5.5% in Q2FY2014 to 6.55% in Q2FY2015. It ranks 5th in terms of domestic equity AUM. Pantaloon’s business may take around two years to reach industry level margins and returns-The Madura garments’ business has been growing very strong, with 7-8% same-store sales growth in a challenging environment, displaying the brand strength. For the Pantaloons business, the management believes that the transition in terms of organisation restructuring has been done in FY2014, while FY2015 would be the time to lay strong foundation for strengthening and communicating the brand values and identity with the consumers which the company is strongly undertaking. Other financial services business ABNL entered into the housing finance business, while it is all set to enter the health insurance business, and has signed a Memorandum of Understanding (MoU) with a South African company. The non-banking business loan book grew by 63% on a Y-o-Y basis. It currently is Rs13,550 crore with 27% of the lending towards capital market. The management aims to continue to grow this business. Focus on the NBFC business to continue-The management in the conference call sounded positive about the non-banking financial company (NBFC) business and is confident of the growth in other financial services namely the mortgage and the capital market, as their portfolio is well diversified. The management has also deployed better manpower in the segment and hence is positive of scaling up and growing its lending book. It has ventured into housing finance and is also entering the health insurance business. Madura business Madura business posted a good show despite challenging business environment. The topline/EBITDA and earnings before interest and tax (EBIT) grew at a 25.1%, 36.4% and 51.6% year on year (YoY) respectively. Madura continues to enjoy star performance in the industry with its annualised return on capital employed at 33%. Pantaloons business Life insurance business to witness revival in FY2015On the life insurance business, it stated that despite the challenging environment, the company was able to grab a market share in the industry. Further, now it has a stable product offering coupled with a revival in the macro economy front. The overall industry is expected to witness growth. Sharekhan Marked improvement was witnessed in the performance of the Pantaloons business, wherein the revenue grew by 13.5% on a Y-o-Y basis, while the operating profit increased over five fold from Rs5.1 crore in Q2FY2014 to Rs31 crore in Q2FY2015. It incurred a capex of Rs20 crore, while the full year’s capex guidance is Rs150 crore. 4 November 12, 2014 Home Next investor’s eye stock update It plans to add 18-20 stores to reach a mark of 100 stores. For the quarter, it has refurbished 21 stores through infrastructure and assortment upgrade. realised voice revenue per minute stood at 36.2 paise as against 37.1 paise in Q1FY2015. Idea Cellular continues to post strong execution skills coupled with the stabilising competitive environment that keeps us to be positive on the vertical. Telecom business Q2FY2015 was seasonally a soft quarter for the telecom service providers. It typically witnessed a topline decline owing to traffic contraction on a sequential basis and reported a decent 0.1% quarter-on-quarter (Q-o-Q) growth in the revenue on the back of improvement in the blended realisation by 1.8% quarter on quarter (QoQ) (from 45.1 paise in Q1FY2015 to 45.9 paise in Q2FY2015). Though the traffic growth declined by 1.7% QoQ, the decline was less pronounced than the earlier periods in FY2014 and FY2013, where the volume contracted by 5.8% and 4% sequentially in the Q2. Manufacturing business Agricultural business–Agricultural business posted a strong 17.2% Y-o-Y growth in the revenue, while the EBIT grew by 58.5% on a Y-o-Y basis. Aided by receipt of subsidy amount from the government the working capital improved. Rayon business–New Superfine yarn capacity is driving profitable growth in viscose fibre yarn (VFY) segment partly offset by lower electro chemical unit (ECU) realisation in the chemical segment. Data was the prime reason for the growth in the blended realisation and hence the overall growth for the company. All the key indicators for data showed strong traction (viz-data realisation +0.8% QoQ, data volume growth; +21.3% QoQ and overall data revenue grew strong at a 14.9% QoQ). Insulators-Volume growth was majorly on account of spill over of contracts due to disruption/suspension of plant operations in Q1. Improved product mix in substation segment and pass-through of rise in costs led to an increase in realization. The only weakness in the revenue performance was a sequential 2.4% decline in the voice realised rate. The Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article. Sharekhan 5 November 12, 2014 Home Next Sharekhan Stock Ideas Infrastructure / Real estate Gayatri Projects ITNL IRB Infra Jaiprakash Associates Larsen & Toubro Pratibha Industries Punj Lloyd Automobiles Apollo Tyres Ashok Leyland Bajaj Auto Gabriel India M&M Maruti Suzuki India Rico Auto Industries TVS Motor Company Banks & Finance Allahabad Bank Andhra Bank Axis (UTI) Bank Bajaj Finserv Bajaj Finance Bank of Baroda Bank of India Capital First Corp Bank Federal Bank HDFC HDFC Bank ICICI Bank IDBI Bank LIC Housing Finance Punjab National Bank PTC India Financial Services SBI Union Bank of India Yes Bank Consumer goods GSK Consumers Godrej Consumer Products Hindustan Unilever ITC Jyothy Laboratories Marico Zydus Wellness IT / IT services CMC Firstsource Solutions HCL Technologies Infosys Persistent Systems Tata Consultancy Services Wipro Capital goods / Power Bharat Heavy Electricals CESC Crompton Greaves Finolex Cables Greaves Cotton Kalpataru Power Transmission PTC India Thermax V-Guard Industries Oil & gas Oil India Reliance Ind Selan Exploration Technology Pharmaceuticals Aurobindo Pharma Cadila Healthcare Cipla Divi's Labs JB Chemicals & Pharmaceuticals Glenmark Pharmaceuticals Ipca Laboratories Lupin Sun Pharmaceutical Industries Torrent Pharma Agri-Inputs UPL Building materials Grasim Orient Paper and Industries Shree Cement The Ramco Cements UltraTech Cement Discretionary consumption Cox & Kings Eros International Media Indian Hotel Company KKCL Raymond Relaxo Footwears Speciality Restaurants Sun TV Network Zee Entertainment Enterprises Diversified / Miscellaneous Aditya Birla Nuvo Bajaj Holdings Bharti Airtel Bharat Electronics Gateway Distriparks Max India Ratnamani Metals and Tubes Supreme Industries Technocraft Industries (India) To know more about our products and services click here. Disclaimer This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report. The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of SHAREKHAN. Sharekhan 6 November 12, 2014 Home Next

© Copyright 2026