ITC Ltd. – Q2FY15 Result Update Nov 07, 2014 RETAIL RESEARCH

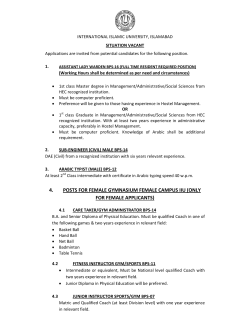

ITC Ltd. – Q2FY15 Result Update RETAIL RESEARCH Nov 07, 2014 HDFC sec Scrip code Industry CMP (Rs.) Recommended Action Averaging price band (Rs.) Target (Rs.) Time Horizon ITCLTDEQNR FMCG 355.7 Buy at CMP and add on dips 326-341 377 1 quarter In our Q1FY15 result update dated Aug 07, 2014, we had recommended existing investors to buy ITC at the then CMP of Rs. 346.4 and add it on dips to Rs. 312-326 for a price target of Rs. 377. Thereafter the stock touched a low of Rs. 341.9 on Aug 22, 2014 and subsequently made a high of Rs. 379.8 on Sept 25, 2014 thus meeting our target. Currently, it is quoting at Rs. 355.7. ITC’s Q2FY15 results were more or less in line with our estimates. We present an update on the stock. Q2FY15 Results Review Y-o-Y: Net sales increased by 14.8% Y-o-Y to Rs. 89.9 bn as against Rs. 77.8 bn in Q2FY14, driven by cigarettes & Agri business (which grew by 14.2% & 16.1% Y-o-Y respectively). Cigarettes volumes declined by ~3-4%. FMCG business witnessed moderation in growth, which stood at 11.9% (though slightly better than Y-o-Y growth in Q1FY15). Paperboard & Packaging and Hotels grew in single digits by 8.9% & 5.9% Y-o-Y respectively. The core operating profit grew by 10.4%, while the OPM fell by 145 bps Y-o-Y to 36.3%, impacted by higher material cost (up 19.4% Y-o-Y) and other expenses (up 18.2% Y-o-Y). However, relatively lower growth in the employee cost (up 7.6% Y-o-Y) restricted further margin contraction. Cigarettes business witnessed margin expansion of 304 bps Y-o-Y (after adjusting for one off gains in Q2FY14), while margins of Agri business fell by 157 bps Y-o-Y. FMCG - others business lowered its losses from Rs. 126.9 mn in Q2FY14 to Rs. 103.1 mn in Q2FY15. Paperboard & Packaging business witnessed marginal margin expansion of 13 bps Y-o-Y respectively. Hotels business reported loss of Rs. 95.8 mn compared to profit of Rs. 87.2 mn in Q2FY14. Reported PAT grew by 8.7% Y-o-Y, impacted by higher tax rates (up 130 bps Y-o-Y) and absence of one off gains (in Q2FY14, ITC reported one off gains of Rs. 1579.1 mn pertaining to write back of liability for earlier years towards rates & taxes no longer required). However, Adjusted PAT (after adjusting for one off gains) grew by 15.6% Y-o-Y, while PAT margins improved by 18 bps Y-o-Y to 27.2%, aided by higher other income (up 35.1% Y-o-Y). EPS for the quarter stood at Rs. 3 (on equity of Rs. 7974.3 mn) vs. Rs. 2.6 in Q2FY14 (on equity of Rs. 7920 mn). Q-o-Q: Sequentially, the net sales de-grew by 2.6%, led by FMCG Others & Hotels (up 13.5% & 5.2% respectively). Cigarettes business grew marginally by 1.2% Q-o-Q, while Paperboard packaging & Agri business witnessed a decline of 0.3%. & 37.5% Q-o-Q in their respective revenues. Operating profit rose 1.4% Q-o-Q, while OPM rose by 140 bps Q-o-Q, aided by decline in material & employee cost (down 10.6% & 21.8% Q-o-Q respectively). PAT grew by 10.7%, while PAT margins improved by 330 bps Q-o-Q, aided by higher other income (up 41.2% Q-o-Q) & decline in effective tax rate (down 73 bps Q-o-Q). Segment-wise, Cigarettes business witnessed margin expansion of 301 bps Q-o-Q, while FMCG & Hotels business managed to reduce their respective PBIT losses sequentially. Agri business witnessed 835 bps Q-o-Q expansion in margins. However, Paperboard & Packaging PBIT margins fell by 248 bps Q-o-Q. RETAIL RESEARCH Page | 1 Quarterly Financials: (Rs. in Million) Particulars Q2FY15 Q2FY14 VAR [%] Q1FY15 VAR [%] Net Sales 89303.2 77757.9 14.8 91644.2 -2.6 Total Expenditure 55350.9 46866.9 18.1 59707.0 -7.3 Raw Material Consumed 27927.2 25704.5 8.6 26606.2 5.0 Stock Adjustment Finished Goods Purchased Employee Expenses Other Expenses Operating Profit Other Income PBIDT Interest PBDT Depreciation PBT Tax (incl. FBT & DT) 1234.5 6389.9 3978.7 15820.6 32373.2 4496.4 38448.7 183.9 38264.8 2432.2 35832.6 11581 -1335.7 5415 3698.7 13384.4 29311.9 3329.3 34220.3 -326.7 34547.0 2208.7 32338.3 10033 -192.4 18.0 7.6 18.2 10.4 35.1 12.4 -156.3 10.8 10.1 10.8 15.4 -6038.6 19208 5086.6 14844.8 31937.2 3184.2 35121.4 151.5 34969.9 2313.2 32656.7 10792.8 -120.4 -66.7 -21.8 6.6 1.4 41.2 9.5 21.4 9.4 5.1 9.7 7.3 Reported PAT 24251.6 22305.3 8.7 21863.9 10.9 Extra-ord Items Adjusted PAT EPS Equity Face Value OPM (%) PATM (%) 0 24251.6 3.0 7974.3 1.0 36.25 27.16 1329.5 20975.8 2.6 7920.0 1.0 37.70 26.98 -100.0 15.6 14.8 0.7 0.0 -3.8 0.7 0 21863.9 2.7 7955 1 34.85 23.86 10.9 10.7 0.2 0.0 4.0 13.8 Remarks Y-o-Y growth was driven by Cigarettes & Agri business (which grew by 14.2% & 16.1% Y-o-Y respectively). Cigarettes volumes declined by ~3-4%. FMCG business witnessed moderation in growth, which stood at 11.9% (though slightly better than Y-o-Y growth in Q1FY15). Paperboard & Packaging and Hotels grew in single digits by 8.9% & 5.9% Y-o-Y respectively. Material Cost / Net Sales (including stock adjustment & finished goods purchased) increased by 151 bps Y-o-Y, but fell by 359 bps Q-o-Q.to 39.8% in Q2FY15. The effective tax rate on PBT increased by 129 bps Y-o-Y, but fell by 73 bps Q-o-Q to 32.3% Reported PAT grew by 8.7% Y-o-Y, impacted by higher tax and absence of one off gains (in Q2FY14, ITC reported one off gains of Rs. 1579.1 mn pertaining to write back of liability for earlier years towards rates & taxes no longer required) Y-o-Y Adjusted PAT growth was aided by higher other income Y-o-Y margin contraction was on account of higher material cost & other expenses. (Source: Company, HDFC Sec) Segmental Results: (Rs. in Million) Particulars Revenue (Net) Q2FY15 Q2FY14 VAR [%] Q1FY15 VAR [%] FMCG Cigarettes 42508.6 37238.1 14.2 42010.6 1.2 RETAIL RESEARCH Remarks The volumes declined by ~3-4% due to steep price hikes undertaken by the company (following 22% weighted average increase in excise duty and VAT changes in few Page | 2 FMCG Others 21960.1 19622.2 11.9 19346.1 13.5 Paper Boards, Paper & Packaging 12840.7 11787.4 8.9 12884.8 -0.3 Agri Business 20586.7 17724.6 16.1 32960.6 -37.5 2615.9 100512.0 11208.8 89303.2 2469.7 88842.0 11084.1 77757.9 5.9 13.1 1.1 14.8 2486.9 109689.0 18044.8 91644.2 5.2 -8.4 -37.9 -2.6 28820.6 25696.1 12.2 27217.5 5.9 -103.1 -126.9 -18.8 -155.9 -33.9 2421.4 2207.6 9.7 2749 -11.9 2982.5 2845.9 4.8 2024.5 47.3 Hotels Total Less: Inter Segment Revenue Net sales/inc. from Operations Segment Results FMCG Cigarettes FMCG Others Paper Boards, Paper & Packaging Agri Business Hotels -95.8 87.2 -209.9 -120.9 -20.8 34025.6 -183.9 30709.9 326.7 10.8 -156.3 31714.2 -151.5 7.3 21.4 1990.9 1301.7 52.9 1094.0 82.0 35832.6 32338.3 10.8 32656.7 9.7 Net EBITM (%) FMCG – cigarettes FMCG - others 67.8 -0.5 64.8 -0.6 bps 304 18 64.8 -0.8 bps 301 34 Paperboards, paper & packaging 18.9 18.7 13 21.3 -248 Agri-business 14.5 16.1 -157 6.1 835 Total Interest Other un-allocable expenditure net off un-allocable income Total Profit Before Tax RETAIL RESEARCH states). Volume decline was broad‐based and across segments like 64mm, RSFT and KSFT. It was the sixth straight quarter of volume decline. However, price hikes supported the overall value growth. FMCG business witnessed moderation in growth (though better than growth reported in Q1FY15), impacted by slowdown in consumption expenditure and high base of last year. However, despite slowdown, ITC was able to gain market share across categories, which was encouraging. Strong uptick was reported in growth of Aashirvaad Atta, and launch of 'Sunfeast Mom's Magic' range of cookies. Growth was driven by higher capacity utilization & operating efficiencies, improvement in product mix and scale-up of Cartons and Flexibles packaging business. Robust Y-o-Y & Q-o-Q growth in Agri Business revenues was driven by trading opportunities in wheat, soya and coffee. Growth was subdued, impacted by weak economic conditions and pricing environment. The segment managed to reduce its losses at PBIT level. Higher input cost curtailed the margin expansion in the segment. The segment reported loss during the quarter due to change in the depreciation policy (additional depreciation charge of Rs. 134 mn due to revision in useful life of fixed assets in accordance with Companies Act, 2013). Adjusted for this, the business reported marginal profit of Rs. 38.2 mn in Q2FY15 Margin expansion on Y-o-Y & Q-o-Q basis was driven by steep price hikes. The Y-o-Y improvement (though marginal) in margin was encouraging, led by improved mix and higher utilization. However, input prices, particularly that of wood, remained at elevated levels during the quarter Segment margins declined due to deterioration in mix and lower leaf tobacco sales. Page | 3 Hotels Total Capital Employed FMCG Cigarettes FMCG Others Paper Boards, Paper & Packaging Agri Business Hotels Total Capital Employed -3.7 33.9 3.5 34.6 -719 -71 -4.9 28.9 120 494 56618 39632.8 46636.1 31624 21.4 25.3 50874.6 39417.4 11.3 0.5 55225.5 50688 9.0 54540.9 1.3 16777.3 37058.4 205312.0 11199 35138.2 175285.3 49.8 5.5 17.1 22990.3 36484.6 204307.8 -27.0 1.6 0.5 (Source: Company, HDFC Sec) Other highlights / developments: In FMCG business, amidst a sluggish consumer demand environment, the Branded Packaged Foods Businesses recorded further improvement in market standing during the quarter growing well ahead of the industry across most categories. In the Staples, Spices and Ready-to-Eat Foods Business, ‘Aashirvaad’ atta recorded robust growth driven by premium variants and the ‘Select’ offering which continues to gain impressive consumer franchise. The Bakery and Confectionery Foods business launched the ‘Sunfeast Mom’s Magic’ range of premium cookies in two variants, ‘Cashew & Almond’ and ‘Rich Butter’. The Business also forayed into the Chewing Gums segment with the launch of ‘GumOn’ in select markets. The products have met with favourable consumer response and are being rolled out to target markets. In the Snack Foods Business, ‘Bingo!’ registered robust growth driven by the finger snacks portfolio comprising the ‘Mad Angles’, ‘Tedhe Medhe’, ‘Tangles’ and ‘Galata Masti’ sub-brands. The recently launched 'Original Style' variants of Bingo! Yumitos potato chips also gained good traction during the quarter. In the Instant Noodles and Pasta categories, ‘Sunfeast YiPPee!’ sustained its high growth trajectory and enhanced market standing. During the quarter, the Personal Care Products Business augmented its product range in the Deodorants category with the launch of ‘Engage’ Cologne in six variants - 3 each for men and women. In the Personal Wash category, the Business expanded its presence in the fast-growing male grooming segment with the introduction of several new variants of Gel Bathing Bars, Shower Gels and Face Wash under the 'Fiama Di Wills' brand. These products have received encouraging consumer response and are being extended to target markets. The Scheme of Arrangement between Wimco Limited (‘Wimco’) and the Company became effective on 27th June, 2014 on filing of the Order of the Hon’ble High Court with the respective Registrar of Companies. The Scheme, with effect from 1st April 2013, provided for the demerger of the Non Engineering Business of Wimco into the Company. The results for the quarter ended 30th June, 2014 & 30th September, 2014 and for the six months ended 30th September 2014 reflect the effect of the Scheme and consequently, the figures for the previous periods are not strictly comparable. Conclusion & Recommendation: ITC’s Q2FY15 results (Y-o-Y) were more or less in line with our estimates. Cigarettes volumes declined for sixth straight quarter by ~3-4%. However, this was on expected lines. Steep price hikes initiated supported the overall growth, which remained in high double digits. Growth in the FMCG business continued to moderate (on expected lines), impacted by slowdown in consumption expenditure. Rise in Agri business revenue growth was driven by trading opportunities in wheat, soya and coffee. Growth in RETAIL RESEARCH Page | 4 Paperboard & Packaging was below our expectations, but still decent, while Hotels continued to disappoint with a mid single digit revenue growth. We were disappointed with the overall margin contraction on Y-o-Y basis (impacted by input cost inflation & relatively higher other expenses). Margin expansion (Y-o-Y) in Cigarettes (led by price hikes) & Paperboard & Packaging was encouraging (led by improved mix and higher utilization). While FMCG business managed to lower its losses, we expected better performance from the segment on profit front (higher material cost restricted margin expansion in the segment). In the recently held FY15 Union Budget, the government hiked the excise duty on cigarettes by 11-72% (72% on cigarettes of length not exceeding 65 mm and to 11-21% hike for cigarettes of other lengths). For ITC, weightage average hike was ~22%. To neutralize this impact, ITC undertook steep price hikes over the last few months, which impacted its volume growth in Q2. It is important to note that the cigarette prices have increased by ~40% in the past 18 months which has impacted the offtake over the last few quarters. While price hikes would continue to support the overall value growth & margins, volume growth is likely to decline in near term. Further steep hikes in excise duty (in next budget) could put more pressure on the volumes in the coming quarters. Non-Cigarettes FMCG business has been clearly witnessing moderation in revenue growth over the last few quarters, in line with the industry slowdown. We expect this to persist in near term. However, we expect some recovery in FY15 & meaningful recovery in FY16, as we expect the economic growth & spending power to improve. The segment has managed to breakeven at EBIT level during FY14. However, in H1FY15, the segment has reported losses (though these have reduced over H1FY14). We feel the segment is taking longer to become profitable than the company expectations. We expect a gradual improvement on the profit front, since we feel the company is still scaling up the business rapidly and focusing on market share gains. Packaged foods, personal care and stationery businesses would be the key growth drivers of the business growth going forward. We feel the hotel business revenue growth could continue to remain subdued until there is a meaningful improvement in domestic travel & tourism industry, which could be possible only if the global environment improves. As regards the Agri business, the growth in revenue & profits would improve due to scaling up of operations at the recently commissioned state-of-the art green leaf tobacco threshing plant in Mysore, resulting in better quality and supply chain efficiencies. The Paperboard & Packaging Business has made marginal progress during the quarter towards scaling up its in-house pulp manufacturing capacity at the Bhadrachalam unit. The project is expected to be commissioned in Q3FY15. This will help in improving the business profits in FY16. We feel ITC is on track to meet our FY15 & FY16 estimates. Hence we are keeping them unchanged. At CMP, the stock trades at 24.5xFY16, which is at a discount of 2030% to its FMCG peers. The discount has widened over the last few quarters (compared to historical discount of 12-13%) on the back of cigarettes industry being taxed heavily (over the last two years) due to increasing health issues due to smoking. In The Union Health Ministry recently issued a notification making it mandatory for cigarette manufacturing companies to carry statutory warning against smoking on both sides of a cigarette pack and covering at least 85% of the packaging. Further, an expert panel set up by the health ministry has proposed measures like ban on sale of loose cigarettes, raising the age limit for consumption and increasing the fine for smoking in public spaces. If accepted, these suggestions on curbing tobacco consumption could soon be part of tougher legislation being drafted by the Modi government, which it wants to introduce in the Parliament. The current discount in the stock price is reflecting these concerns. In the last five years, the stock price is not fallen significantly below 23.5x, while it has not traded much above 31-31.5x its one year forward PE. While the downside in the stock price is limited from current levels, a sharp rerating is unlikely to happen until we see a meaningful recovery in the cigarettes volume growth and FMCG & Hotels business. The company still relies heavily on its cigarettes business for revenue & profit growth (40% of total revenues & 85% of total PBIT). For ITC to gain benefits in terms of volume growth in cigarettes business and improvement in valuations, its competing products (bidis) should be taxed heavily in the coming years. RETAIL RESEARCH Page | 5 Currently the pessimism is at its peak. Hence if the negatives (pertaining to cigarettes business) do not play out to the extent anticipated in the next 1-2 quarters, then the stock could be re-rated. We are maintaining our price target at Rs. 377 (valuing the stock at 26xFY16E EPS). We feel investors could buy this stock at current levels and add it on dips to Rs. 326341 (22.5-23.5xFY16E EPS) band for our price target over the next quarter. Financial Estimations: (Rs. in Million) Particulars Net Sales Operating Profit Net Profit Equity EPS (Rs.) OPM (%) PATM (%) PE FY11 211675.8 71213.1 49876.1 7738.1 6.4 33.6 23.6 55.2 FY12 247984.3 84995.9 61623.7 7818.4 7.9 34.3 24.8 45.1 FY13 296055.8 103324.2 74183.9 7901.8 9.4 34.9 25.1 37.9 FY14 328825.6 119408.9 86522.61 7953.2 10.9 36.3 26.3 32.7 FY15E 378004.1 137593.5 99037.1 7955.0 12.4 36.4 26.2 28.6 FY16E 438484.8 160485.4 115321.5 7955.0 14.5 36.6 26.3 24.5 (Source: Company, HDFC Sec Estimates) Analyst: Mehernosh K. Panthaki – IT, FMCG & Midcaps; Email ID: [email protected] RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: [email protected] Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients RETAIL RESEARCH Page | 6

© Copyright 2026