A3.15 PAYMENT OF RATES, CHARGES & SUNDRY DEBTS

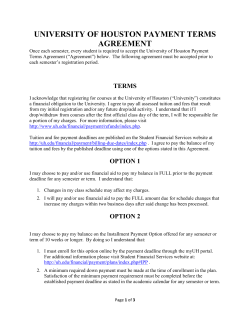

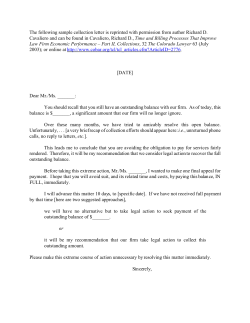

A3.15 PAYMENT OF RATES, CHARGES & SUNDRY DEBTS A3.15 PAYMENT OF RATES, CHARGES AND SUNDRY DEBTS CORPORATE SERVICES - FINANCIAL MANAGEMENT POLICY OBJECTIVE To ensure efficient collection of rates, charges and debts owing to Council. 1 Recovery of debts Rates and charges 1.1 Recovery action will commence when rates and/or charges are not paid by the due date for each quarterly instalment unless arrangements have been entered into to make periodical payments under Section 564 (1) of the Local Government Act 1993. 1.1.1 Where a statement of claim is filed, the amount of the claim will be the whole unpaid amount including all or part of the current year’s rates. Water Service and usage charges 1.2 Recovery action will commence when water service and/or usage charges are not paid by the due date unless arrangements have been entered into to make periodical payments under Section 357 of the Water Management Act 2000. Other Debts 1.3 Recovery action will commence if other debts including other statutory charges, debts in contract, or other civil claims, are not paid within sixty (60) days. Court action may be deferred if a repayment schedule is approved and adhered to by the debtor. 2 Agreements for periodical payment Rates and water rates and charges 2.1.1 Ratepayers who are unable to pay rates and charges and/or water usage charges by the due date, either because of reasons beyond their control or because payment would cause hardship, may apply to enter into an agreement with Council to make periodical payments under Section 564 (1) of the Local Government Act 1993 or Section 356 of the Water Management Act 2000. Where a satisfactory agreement cannot be made, the ratepayer will be invited to make application to Council’s Hardship Committee in the format outlined in Council Hardship Policy, A3.06 in the prescribed format for consideration. 2.1.2 If a ratepayer fails to meet the terms of an agreement, the agreement shall be terminated and the full amount of the outstanding rates and charges and/or water usage charges and accrued interest shall be due and payable. Recovery action shall be taken immediately for recovery of the amount due. Payment of Rates, Charges and Sundry Debts Gosford City Council Policy Manual 1 Review by September 2017 Other Debts 2.2 Arrangements to pay other debts may be agreed to by the General Manager or delegate. If a sundry debtor fails to meet the terms of an agreement, the agreement shall be terminated and the full amount of the outstanding sundry debt and accrued interest, if applicable, shall be due and payable. Recovery action shall be taken immediately for recovery of the amount due. 3 Interest Interest on overdue rates and water usage charges shall be in accordance with Council Policy, Interest on Overdue Rates and Charges, A3.05. 4 Writing off accrued interest Applications for writing off accrued interest under the hardship provisions of the Local Government Act 1993 S567 are to be made through Council’s Hardship Committee in the prescribed format as outlined in Council Policy A3.06. Each application shall be determined on the merits of each individual case, on the basis of whether the hardship criteria have been satisfied by the applicant and whether it is appropriate in the circumstances to exercise the discretion. 5 Writing off by resolution or by order 5.1 Rates and charges (including accrued interest) of $10,000 or more will be written off only by resolution of Council. Amounts under $10,000 may be written off by the General Manager. 6 Government debts This policy does not apply to amounts due from State and Federal Government. PROCEDURE The procedure (attached), being an administrative process, may be altered as necessary by the General Manager. (Minute No 216/03 – 23 September 2003 (Minute No 214/2005 - 8 March 2005 - Review of Policies) (Minute No 311/2009 – 5 May 2009 – Review of Policies) (Min No 2013/388 - 16 July 2013 - Review of Policies) Payment of Rates, Charges and Sundry Debts Gosford City Council Policy Manual 2 Review by September 2017 ATTACHMENT - PROCEDURE A3.15 PAYMENT OF RATES, CHARGES & SUNDRY DEBTS 1 Recovery action Recovery action includes but not limited to letters, notices of demand, Final Notices, statements of claim, writs, garnishee orders, Section 569 notices, warrants of apprehension, notices to wind up a company and sale of land for unpaid rates and charges under Section 713 of the Local Government Act 1993. 2 Agreement for periodical payment of rates and charges, water usage charges and sundry debts 2.1 Agreements in an approved form shall be signed by applicants and by the General Manager or delegate. Each agreement must specify the amounts of each regular payment and the dates by which each payment must be made to Council. 2.2 Payments under an agreement should be payable at regular intervals not exceeding one month apart. The payments should be scheduled so as to ensure that outstanding amounts are paid in full by 30 June of the financial year in which the rates are levied, or the charge is imposed or the debt is incurred. 2.3 Amounts outstanding under an agreement continue to accrue interest on the unpaid balance until paid in full. 3 Writing off accrued interest In general terms, Council will not write off interest except where: Council has made an error or omission causing interest to accrue; Interest accrued is minor and ratepayer has no previous history of late payments. Where interest has accrued, is of significant value and a request to write off the accrued interest claiming hardship has been received, an application to Council’s Hardship Committee in the prescribed format as set out in Policy A3.06 requesting the write off is required for consideration as to the level of hardship and action to be taken. 4 Sundry debtors 4.1 Monthly statements are to be forwarded to sundry debtors. Amounts outstanding for more than thirty (30) days are to be regarded as overdue and the debtor is to be advised accordingly. 4.2 Where amounts are outstanding for more than sixty (60) days, credit is to be stopped and recovery action is to be commenced. Recovery action may be deferred if a repayment schedule is approved and adhered to by the debtor. 4.3 At least on an annual basis, consideration is to be given to the recoverability of outstanding debts and recommendations for write off to be made to Council or the General Manager. Payment of Rates, Charges and Sundry Debts Gosford City Council Policy Manual 3 Review by September 2017

© Copyright 2026