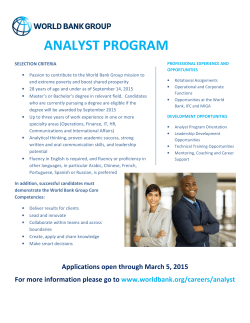

Mr Green & Co AB - AG Equity Research AB

Bull or Bear Independent Analysis Mr Green & Co AB Value Drivers Quality of Earnings Risk Profile Growth expected: organic growth (Q1 2015: +26,2% in game wins) paired with promising success of the recently closed acquisitions of “Garbo” (for mSEK 4,4) and “Spin Towers” (for mSEk 35,5) Analyst Dorothea Agricola [email protected] Diversification: fast geographical expansion and i.e. entering the strong and revenue promising Italian gambling market this year with the acquisition and granted license of operating Mybet Italia operations (for mEUR 1,0), (slightly delayed launch in Q3 2015) Austrian tax dispute: Risk of high dependency on state laws and tax regulations as experienced in 2014 Competitive advantage: Enormous sensibility and quality of management in regards to trends and brand image creation of Mr. Green i.e. focusing on new target groups “Women” and Social Network Applications “Facebook” Mobile application sector: Early focus on this attractive market with an expected growth of about 10% yearly over the next 4 years SEK 45 SEK 43 SEK 41 SEK 39 SEK 37 SEK 35 SEK 33 SEK 31 SEK 29 SEK 27 SEK 25 Quality of Management Share price (SEK) 52wk high / low Nyckeldata Shares outstanding Market cap (MSEK) Net debt (MSEK) EV (MSEK) Sector List / Ticker Next report Performance 1 month 3 month 1 year YTD Major owners Hans Fajerson and companies Henrik Bergquist and companies Fredrik Sidfalk and companies Martin Trollberg and companies The Avanza Pension insurance company Mikael Pawlo and companies The Avanza Pension insurance company Euroclear Bank Robur Försäkring Försäkringsaktiebolaget, Avanza pension Others Management Per Norman Tommy Trollberg Management Date 2015-03-06 2015-02-25 2015-02-24 2015-01-01 2015-01-01 2014-12-02 2014-09-05 2014-09-04 2014-09-03 40,1 52,82/52,95 35 849 413 1438 -155 1283 online gambling MRG 2015-05-19 -6,25%% 1,35%% 6,24% 13,31% Ownership (%) 19,91 18,70 12,00 5,48 5,41 5,04 4,20 2,89 26,36 CEO Chairman Insider Transactions Insider Shares Total Niclas Enhörning +100 643 Niclas Enhörning -400 0 Niclas Enhörning +143 543 Niclas Enhörning +400 400 Niclas Enhörning +400 400 Niclas Enhörning 0 0 Stein Erik Myhre +40 000 40 000 Simon Falk +40 000 40 000 Simon Falk +5 000 20 000 Value Drivers & Prospects Additional geografical expansion and targetting of new markets growth through M&A activities faster technology implementation techniques organic growth through new licenses expected fast growth of mobile and tablet segment refer to important disclosures at the end of this document Var vänlig ta del av Please våra ansvarsbegränsningar i slutet av rapporten dfddddddAwwwwww 2015-05-20 Investment Thesis Value Drivers: For the future one can expect the online casino market to grow by approximately 8% in 2015. Mobile gaming growth is forecasted exceptional with about 37% in Europe in this financial year. Furthermore within the next 3 years mobile gaming is expected to make up 50% of the online gambling market. (Source: Mr Green and H2GC). Since Mr Green’s Management recognized trends early, mobile gaming already made up 30% of the revenues in Q1 of 2015. This field can be identified as a major value driver. In general the operational and organic EBITDA growth (game wins) of Mr Green was around 26,2%. Accounting for nonrecurring events, a negative net income of 112.1 mSEK was disclosed though. However, considering the strong and stable financial position, the company is able to deal with such, also from a credibility standpoint of view. The intense growth of the company besides the revenues can also be detected in the increase of employees by 33% to 152 employees. In 2014 two acquisitions took place, which are expected to influence future growth. The brand “Garbo” was acquired. It is an online casino, specified on mobile applications and targeting Women mainly. Furthermore the acquisition of the brand “Spin Tower”, a UK Facebook gambling application, was completed. The brands itself will not be fully integrated but pursue to operating autonomously. Concluding one can identify the strong brand image, meeting market demand on time and acquisitions in relation to this as main value drivers. strategies are set in the holding. The entrepreneurs are partial owners of the company and the former CEO Michael Pawlo is still involved in the management of the holding and investment company, but in early 2015 the Per Norman a non-founder was appointed as the CEO of of the Mr. Green & Co. AB. Management: Due to the managements’ extraordinary sensibility to market industry trends sand following them strategically, earnings were growing in the past years. With offering online casino only a niche was served. This was very successful with creating a unique and young brand image of Mr Green and transferred into rapid growth within Europe. The trend research is mainly done in the operating Maltese casino, whereas investment Overview and Outlook: Mr Green has potential to further outperform the gambling market because if the innovativeness and well-marketed brand character, which also proofed to be successful in Europe. In the near future the mobile and tablet applications will be launched further and promising markets like the Italian gambling customers are targeted. High bargaining power of customers and capital strong competitors offering attractive deals mainly determine pressure in the market. Risk: Regarding the risks of the stock the strong dependency on laws and state regulations regarding gambling and gambling taxes should be mentioned. 2014 the company experienced a major obstacle in this area since priory no provisions were build and the Austrian government later raised substantial tax claims. As further risks the dependency on seasonal fluctuations and gambling behaviour of customers can be mentioned. Due to the expansionary strategy, the company is furthermore practicing partial hedging only and is therefore exposed to exchange rate risk. The geographical development of Mr Green in Europe was enormous in the past years. In the last year alone, the Nordic Region accounted for 15% less of the annual revenues than in the year before. Recently in 2015 a new licensee of Mybet Italia operation was obtained Mr Green is launching its services in Q3 2015 in the strong Italian gambling market. The competitive advantage if the company of focusing on one product niche only, can also be classified as a risk due to low product diversification and the risk of changing customer demands paired with low switching barriers for customers. Company Description Maltese online gambling company with its holding Mr Green & Co AB based and traded in Stockholm. Founded in 2007 by three entrepreneurs and experienced a successful IPO in 2013. Offering customers a sustainable and responsible gaming solutions with protective measures. Please refer to important disclosures at the end of this document 2015-05-20 Valuation Investment Characteristics: The company pays out dividends since its IPO in June 2013 and lastly paid out a high dividend of 1,3 SEK (payout ratio -1,66) in regards to the net income. Mr Green is mainly held by the entrepreneurs, also through investment companies, managers and a relatively undiversified shareholder base, consisting of 2638 shareholders in total. Trade liquidity can be recognized as low with a weekly frequency of 18 702. The stock with its relatively high dividend payouts is suitable for active traders with interests in observance of further growth and monitoring abilities in expected growth periods. In regards to the immatureness of the stock holding the stock would not match the expectations of long term cash dividend tending and risk adverse investors. In contrast to other online gambling companies Mr Green stands for a sustainable gambling environment with a focus on long-term profitable stock growth. Q1 results 2015 give indication on growth in remaining 2015, which fosters the perceived undervaluation. msek 2012 # of shares in m. shareprice Revenue Revenue Growth Gross Profit Gross Margin Profit (Loss) Profit margin FCF Equity Debt Leverage Solidity (Equity/Assets) Sales /Share Equity /Share Earnings/Share FCF/share 42,2 200,50 2204 27% 1854 84% 681,9 0,309 31,7 1578 1379 87% 53.4% 52,2 37,4 13 0,75 Betsson AB 2013 2014 43,4 196,23 2477 12% 2074 84% 708,2 0,286 529,2 2032 1484 73% 58% 57,1 46,8 13 12,19 46,5 275,00 3035 23% 2546 84% 949,2 0,313 371,7 3074 1937 63% 61% 66,6 67,4 16,9 8,15 Notes on Multiple Valuation: The online gambling industry is lead by market leaders like Unibet and Bwin which determine the fast pace of development and highly competitive market Mr Green build up its position in the highly competitive Swedish gambling market and started well off. As the multiple comparison with the market peers Betsson, Cherry and Nordic Leisure (Lifeland Gaming), which are also operating in Online Gambling shows, Mr Greens growth is stronger than its peers. Besides the non-recurring tax provisions, causing a lower profitability in 2014 investments are fruitful and stable with regards to profits. The operations are strong with high gross margins, close to the largest competitor. The non-recurring happening is also responsible for making the EPS comparison against the Swedish market leader look weak with -0,78. Levering up slightly is reasonable considering the closed deals in 2014. Mr Green & Co AB 2012 2013 2014 2012 x x 36,6 x x x 0,05 0,0013 1,24 122,1 5,86 5% 95% 2,02 6,74 0 0,07 12,8 20,46 231,5 -51% 107,6 47% 30,4 0,131 54 332,2 53,9 16% 86% 18,1 25,9 2,37 4,22 35,9 34,33 349,8 856% 292,2 84% 29,1 0,0831 110,6 743,8 203,6 27% 79% 15,3 32,5 1,27 4,84 35,9 35,00 659,4 89% 537,9 82% -28 -0,0425 89,9 671 341,9 51% 66% 18,4 18,7 -0,78 2,51 Cherry AB 2013 2014 12,8 31,20 266,3 15% 86,2 32% -7,89 -0,0296 152,3 175,8 58 33% 75% 20,8 13,7 -0,62 11,9 13,4 34,50 340 28% 210,5 62% -38,3 -0,113 22,9 94,3 67,8 72% 58% 26,5 7,35 -2,99 1,79 Forcasted Growth in # Million Devices Source: Mr Green and Juniper Research 1500 1000 500 0 2015 2016 2017 2018 Tablet Smartphone 2019 Please refer to important disclosures at the end of this document Nordic Leisure AB 2012 2013 2014 32,1 2,15 101,8 31% 73,7 72% 6,67 0,0656 -2,15 27,7 41,3 149% 40% 3,64 0,99 0,25 -0,08 38,2 2,70 69,9 -31% 54,9 73% 49,4 0,706 5,44 84,7 8,06 10% 91% 1,83 2,22 1,3 0,14 38,2 2,20 67,1 -4% 48,9 73% -1,33 -0,0198 19,9 85,5 13,6 16% 86% 1,76 2,24 -0,03 0,52 2015-05-20 Interview 2015/05/11 Per Norman (CEO of Mr Green & Co AB) From detecting trends to making money: How does the management anticipate turning potential trends and potential value drivers into value? The market research and monitoring is conducted by the Maltese operational departments, where special industry and country specific knowledge is hold and markets monitored closely. Ideas and detected investment possibilities are set into strategic context with the Stockholm based holding, such as investment decisions. There is no distinctive investment strategy, which allows for a certain flexibility. Market reregulation and tax laws: In the recently published quarterly results the monitoring in regards to changing regulatory determinants are mentioned. Which risk management mechanisms are applied? of controlling for acting in accordance with the legal regulations. Due to the good industry and country knowledge such as network, prevailing in the operating department in Malta a close monitoring is possible. Organic growth or M&A activities? In 2014 growth was possible organically (+ 1,5% of active customers) and through acquisitions. What can the shareholders expect for 2015 and what special deals are offered to the customers to boost customer acquisition and can the stockholder expect M&A events? Unfortunately Mr Green is not publishing forecasts, only backward looking financial data. Therefore neither special marketing measure or planned acquisitions can be named. Nevertheless it can be confirmed that both growth opportunities are further focused strategically. Firstly one has to mention that the management believes in the movement of a stronger market reregulation. A compliance department is in charge Bull or Bear Value Drivers Quality of Earnings Risk Profile Quality of Management & Ownership Overall View Modern brand image. Growth triggers through acquisitions in the field of fast developing applications and devices (mobile and tablet) such as geographical expansion in Europe. Nevertheless a certain necessity can be detected to keep up with market peers in high growth speed of competitive environment. Earnings growth could be recognized in the past years, which can be valued as stability or earnings in an in general fluctuating relatively in transparent earnings generating industry. Through an unforeseen tax claim by Austrian authorities 2014th net income dropped considerably because of provision building measures. Growth in profitability is forecasted in 2015. Q1 showed higher cost of sales, marketing and other expenses and therefore lower EBIT. The low financial leverage minimizes the default risk. Geographical diversification within Europe and recently lower dependency on Nordics. High dependency on online casino, due to no activities in other gaming applications and as the industry implies framework setting state regulations. Well lead and marketed company with extraordinary brand image created by founders and entrepreneurial thinking, internationally connected, industry experienced management board. Stability was recently disordered by management changes in various leading positions of the group. Well-structured young company with stable growth, besides one extraordinary event in the past year. Exceptional growth in past. Currently stages of declining growth in terms of customer acquisition. Responding to the high competitive market, organic growth is accomplemented by M&A activities. Please refer to important disclosures at the end of this document 2015-05-20 Disclaimer These analyses, documents and any other information originating from AG Equity Research AB (Henceforth Analyst Group) are created for information purposes only, for general dissipation and are not intended to be advisory. The information in the analysis is based on sources, data and persons which Analyst Group believes to be reliable. Analyst Group can never guarantee the accuracy of the information. The forward-looking information found in this analysis are based on assumptions about the future, and are therefore uncertain by nature and using information found in the analysis should therefore be done with care. Furthermore Analyst Group can never guarantee that the projections and forwardlooking statements will be fulfilled to any extent. This means that any investment decisions based on information from Analyst Group, any employee or person related to Analyst Group are to be regarded to be made independently by the investor. These analyses, documents and any other information derived from Analyst Group is intended to be one of several tools involved in investment decisions regarding all forms of investments regardless of the type of investment involved. Investors are urged to supplement with additional relevant data and information, as well as consulting a financial adviser prior to any investment decision. Analyst Group disclaims all liability for any loss or damage of any kind that may be based on the use of analyzes, documents and any other information derived from Analyst Group. The recommendations in the form of Bull alternatively Bear aims to provide a comprehensive picture of Analyst Group's opinion. The recommendations are developed through rigorous processes consisting of qualitative research and the weighing and discussion with other qualified analysts. Definition Bull Bull is a metaphor for an optimistic view of the future. It indicates a belief in improvement. Definition Bear Bear is a metaphor for a pessimistic view set on the future. It indicates a belief deterioration. This analysis is copyright protected by law © AG Equity Research AB (2014-2015). Sharing, dissemination or equivalent action to a third party is permitted provided that the analysis is shared unchanged. Analyst Group has not received payment or other compensation to make the analysis. Please refer to important disclosures at the end of this document

© Copyright 2026