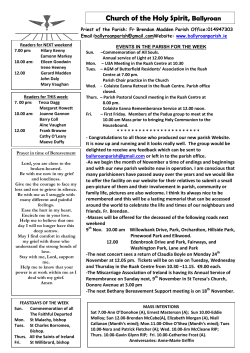

ANNUAL OPERATING BUDGET