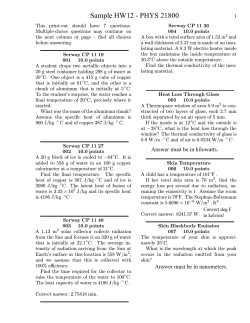

FORM 10-Q