Change Acknowledgement Form

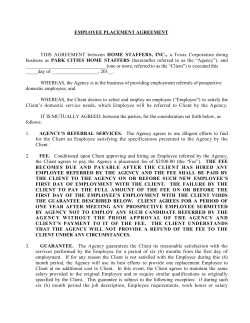

Change Acknowledgement Form Complete proposed changes and submit by fax: 800.576.9431 or email: [email protected]. Credit Analysis will determine if proposed fee changes are valid. They will inform the broker if further changes to the Change Acknowledgement Form are needed. Broker acknowledges and understands that U.S. Bank Wholesale Prime Plus will provide the applicant(s) with a revised Good Faith Estimate, if required. U.S. BANK REFERENCE NUMBER BORROWER NAME NOTE: Changes from loan to HELOC or HELOC to loan require full re-submission. * Changing Broker Compensation from LPC to BPC: A hand written letter from the borrower (not broker) will be required stating that they understand the change, they desire the change and know that they will not get a credit from the lender for the fee. For questions regarding disclosed compensation, contact our Credit department at 800.803.4212 option 2. NEW LOAN / LINE AMOUNT OR APPRAISED VALUE NEW COLLATERAL PROPERTY TYPE Loan / Line Amount $ Single Family / PUD Vacation / second home Appraised Value $ 2-Unit Townhouse 3-Unit Row Home NEW LOAN PRODUCT 15 year fixed rate 1 year ARM 7 year ARM 4-Unit 2-Flat 20 year fixed rate 30 year fixed rate 3 year ARM 7 year IO ARM Condo Investment 3 year IO ARM 10 year ARM Condo > 4 stories 30 year fixed w/10 Yr. IO 5 year ARM HELOC - No Lender Fee 5 year IO ARM Modular Year Built BORROWERS Adding / removing an applicant requires a full re-submission. NEW FLOATING INTEREST RATE BROKER COMPENSATION - Change from original request to % Updated FLOATING interest rate requested Borrower Paid Compensation1 (BPC) $ To lock the interest rate, submit lock request in USubmit or call the Lock Desk at 800-803-4212 #4 (10 AM - 5 PM CST) PAYOFF(s) Price (include all applicable pricing adjustments) HELOC - Up-front broker fees ADD REMOVE $ For HELOC products, WPP will only pay a flat $500.00 fee to the Mortgage Broker regardless of the line amount or the initial advance amount. $ $ 1 $ Must include hand written letter from borrower (see details above.) Borrower must pay balance of settlement charges at closing. COMMENTS COMPLETE ONLY FEES AFFECTED BY THIS PROPOSED CHANGE. ALL FEES MUST BE EXACT. Any changes to fees after initial submission may result in closing delays or Broker credits Update settlement information if different from initial submission. Hud Line Fee Code 1101 DEED Deed Prep Fee 1101 NOTF Notary Fee 1103 TINO Owners Title Insurance 1201 RDFE 1201 DESCRIPTION FEE Hud Fee Line Code back to the customer. DESCRIPTION FEE $ $ $ $ $ $ Recording Fee - First Lien $ $ RDF2 Recording Fee - Second Lien $ $ 1101 SUBA Subordination Agreement Fee $ $ 1101 SUBP Subordination Preparation Fee $ $ 1201 SUBR Subordination Recording Fee $ $ 1203 TSTF Tax Stamps / Transfer Tax 1101 TINS Title Insurance Fee Required for purchase transactions $ $ Required $ $ Settlement Date First Payment Date Settlement Agent Phone Number Contact Name Email Address Settlement Address November 6, 2014

© Copyright 2026