CONDITION IF YOU RECEIVE THIS CONDITION IT MEANSâ¦.

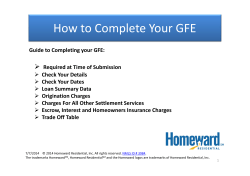

CONDITION Date of the disclosures are not within 3 days of application date. IF YOU RECEIVE THIS CONDITION IT MEANS…. Federal law requires lenders provide the borrower disclosures within 3 business days of the initial application. The initial disclosures given to the borrower are outside of this time window. The dates, loan amount and interest rate on the 1003, GFE, TIL, and Fee Itemization do not match. The dates, loan amount, and interest rate must match on the 1003, GFE, TIL, and Fee Itemization. Appraisal Code (TWO BORROWERS) - ??? has accepted the disclosures; however, there are two separate borrowers on this loan. Therefore, we will need for both borrowers to accept their disclosures before we can release the appraisal code. When a loan has unrelated borrowers (requiring two separate 1003s) the lender is required to send a separate disclosure package to each borrower. Borrower - Disclosures The borrower has not yet acknowledged receipt of their disclosures. Each borrower must acknowledge receipt of their disclosures before issuing the appraisal code. Have the borrower respond to our initial email stating that they have received, reviewed, and accepted the disclosures. Once the borrower’s response is received, the code for ordering the appraisal will be released. Comp Plan/Origination Disclosed – your comp plan with Angel Oak is set at ???%; however, you disclosed ???%. Please note, AOMS will disclose only ???% as your origination fee - which is what your compensation plan reflects. The Broker Compensation Agreement sets the brokers compensation level on a quarterly basis. Missing Broker Agreement – please get with your AE in regard to this condition Currently loans with properties located in California and Texas must be submitted through Angel Oak Home Loans; all other states must be submitted through Angel Oak Mortgage Solutions. The maximum broker/origination fee that a broker may charge on any loan submitted to AOMS is the level selected on their Broker Compensation Agreement. They may charge less than their selected level, but not more. In order to submit loans through AOHL the broker must have executed the Broker Agreement for AOHL. Brokers submitting loans through AOMS must have executed the Broker Agreement for AOMS. Any broker that submits loans through both companies must have executed both an AOHL agreement and an AOMS agreement. Please provide signed written permission from all borrowers dated no later than ??? granting ??? permission to pull the credit report dated ???, because the 1003 submitted in the file is dated after the date of the credit report. (You cannot pull credit on a borrower without written permission.) Our legal counsel has confirmed this requirement. GFE – third party processing fee was not disclosed correctly. All third party fees should be disclosed in box 3 of the GFE. Please provide the correct GFE. There two different types of Processing Fees and they are disclosed differently on the GFE. If the date of the credit report is before the date of the 1003, then the broker must have written permission from all borrowers in order to pull a credit report. • The Processing Fee charged by the broker for in-house processing is disclosed in Block 1 along with their Origination Fee and Angel Oak’s Underwriting Fee • A Third-Party Processing Fee is disclosed in Block 3 of the GFE as it is not a fee payable to the broker. Processing Fee - please provide us with the 3rd party processing invoice and a copy of the state license for the 3rd party processor. This condition is tied to the condition above. When a third-party Processing Fee is being disclosed, AOMS requires a copy of the invoice from the processing company AND the MLO license of the third-party processor or the person supervising the third-party processor. An employee of the broker cannot be the supervisor of the third-party processor. Please provide documentation showing the borrower received the initial disclosures within 3 days of the application date. (Application date is ???; however, documents were not signed until ???) Provide the email with the disclosures attached that was sent to the borrower, or a print screen from their LOS showing the disclosures were provided within the 3-day window. LOs DON’T MATCH - ??? is listed as the Loan Officer on the signed 1003; however, ??? is reflected as the loan officer in our LOS. Please contact Sammy LaRoche to have ???? added to our system as an LO. There have been many instances where the LO on the 1003 has not been setup in Encompass; therefore, that LO cannot be selected when submitting the file. Often times in this situation the person submitting the file will just select any LO in the pull-down menu and submit the file that way. This creates a discrepancy in Encompass, because the LO selected from the pull-down menu will populate the 1003 screen in the system. However, this LO will not match the one shown on the broker’s 1003 submitted with the file submission. Contact information for Sammy LaRoche listed below: Sammy LaRoche, Compliance Specialist Phone: 404-844-5733 [email protected] © Angel Oak Mortgage Solutions LLC NMLS #1160240, Corporate office, 3060 Peachtree Road NW, Suite 500B, Atlanta, GA 30305. This communication is sent only by Angel Oak Mortgage Solutions LLC and is not intended to imply that any of our loan products will be offered by or in conjunction with HUD, FHA, VA, the U.S. government or any federal, state or local governmental body. This is a business-to-business communication and is intended for licensed mortgage professionals only and is not intended to be distributed to the consumer or the general public. Condition Explanations 18 May 2015 ANR

© Copyright 2026