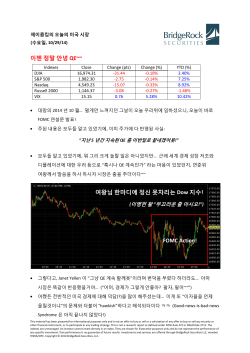

NEXT 10 th WISCONSIN ENERGY’S SYMPHONY