Optimizing Value Market Research

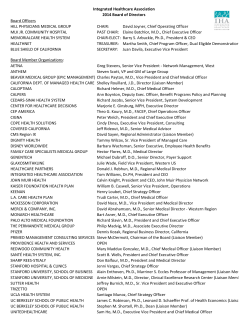

Optimizing Value from Market Research (Part Two) Panel Discussion with ORC International experts: Scott Laing Senior Vice President, Marketing Research Natasha Kennedy Senior Vice President, Strategy Research Solutions Brian Cruikshank Managing Director Executive Summary In Part One of our roundtable discussion about best practices in extracting maximum impact from business intelligence, we looked at the reasons companies struggle with getting the most value from their market research efforts. In Part Two, we offer suggestions about how organizations can take strides to improve in this area. Brian Cruikshank Managing Director There are four key areas of research that when aligned (or used to their fullest throughout the organization) promise optimal business growth: • • • • Customer — Focuses on customer experience, customer acquisition and retention. Strategy — Big picture industry and market trends — How should companies change/modify/realign their strategy to best meet changing industry or market conditions? Marketing — Includes brand positioning and strength along with issues involving products, prices, promotions, and place. Employee engagement — Focus on employee motivation Natasha Kennedy Senior Vice President, Strategy Research Solutions and innovation as well as alignment with business strategy and culture. Our panel is composed of: • Scott Laing, Senior Vice President, Marketing Research • Natasha Kennedy, Senior Vice President, Strategy Research Solutions • Brian Cruikshank, Managing Director Scott Laing Senior Vice President, Marketing Research 2 How can organizations enhance performance by harnessing synergies across more than one or two of the four areas? How can they better use business intelligence across the organization? Natasha: The customer and/or marketing team could use strategy research to better understand the market prior to launching a new product. They should know the size of the available market, whom they will compete against, what their customers value, and map that to products or solutions concepts. They also have to figure out how they will differentiate themselves. This would then assist in fine tuning parameters for product development or market positioning research. Organizations should also align human capital to where the market will grow. We worked with an organization that was about to staff salespeople in Indiana and California. Through our in-depth interviews and secondary research, we discovered that most of the growth, however, was going to come from Arizona and Illinois. Organizations can more effectively plan execution tactics and budgets by determining potential revenue growth via revenue forecasts based on real market-sizing numbers. Furthermore, organizations should keep tabs on their competitors by leveraging competitive intelligence dashboards and/or monitoring reports. This will provide timely knowledge of changing market trends, competitor advances, innovations, and potential market disruptions. 3 How can organizations enhance performance by harnessing synergies across more than one or two of the four areas? How can they better use business intelligence across the organization? Scott: I think there’s some low-hanging fruit with marketing. For example, clients commonly ask for segmentation, the bedrock of nearly any marketing program. Many clients are frustrated with traditional segmentation approaches — the big primary research studies that do deep profiling. The result is typically a range of interesting personae, but rarely a clear next step about how to find and reach out to customers and prospects. We’ve taken the traditional segmentation assignment and significantly enhanced it by making use of the new world of data. Clients want to make use of all assets, particularly customer relationship management and sales force automation resources. To address this, we create direct linkage from segmentation back to clients’ databases, enabling them to implement clearly targeted programs. This requires some database skill that’s not typically part of the researcher’s toolkit, but we see our investment in this area embraced by clients across a wide range of industries. What’s most exciting is hearing a client say, “I know what to do next!” — a great compliment to any researcher. 4 How can organizations enhance performance by harnessing synergies across more than one or two of the four areas? How can they better use business intelligence across the organization? Brian: I think there is an opportunity to use strategy research more effectively in the innovation process by informing marketing research and customer experience leaders as they develop plans and analyze the marketplace from many angles. For example, we have conducted substantial work in the tablet PC category for a major mobile phone provider. Our strategy research team examines the tablet PC market to understand how rapidly tablet prices are dropping and the features/functionality consumers are willing to trade off for a lower-priced device. We can help our clients determine the market opportunity for lower-end tablets sold by a mobile phone provider and where the competitive threats/opportunities lie. We can then take that into a primary market research program that identifies segments of homogenous tablet users based on their attitudes and behaviors regarding tablets. Then, additional quantitative market research helps to identify the price sensitivity and feature, brand and size trade-offs each target segment is willing to make. The resulting simulations not only help our clients determine the strength of various offer scenarios, but also allow them to determine the strongest response options when competitors react to their initial offer in the marketplace. Effectively use strategy research to inform your innovation process 5 About the Authors Scott Laing Senior Vice President, Marketing Research Providing substantial experience across all areas of product development marketing, Scott Laing – Senior Vice President of Markets & Products for ORC International – is focused on developing and delivering services that support client decisions for market entry and expansion, product line innovation, and go-to-market execution. Scott possesses a wealth of experience in multiple areas, such as defining and implementing partnership and lead generation strategies, leading executive workshops aimed at helping clients define their marketing objectives and measurement strategy, and various analytical marketing and product management roles. Prior to his current role, Scott was co-founder and principal of Parametric Marketing, a research and advanced analytics specialist company. For more information follow us on FACEBOOK TWITTER LINKEDIN Natasha Kennedy Senior Vice President, Strategy Research Solutions Brian Cruikshank Managing Director With over 24 years’ experience in market research, Brian Cruikshank – Managing Director for ORC International – is focused on client development and expanding the services in the Customer, Employee, Markets and Products, and Strategy research areas. A seasoned leader, Brian held EVP and other senior leadership roles at Ipsos Marketing, Ipsos MediaCT and Ipsos Insight divisions in the U.S. He successfully guided the growth strategy and integration of multi-industry and cross-functional teams. He was also a founding member of the Angus Reid Group in the U.S. and prior to that worked for Custom Research Inc. Natasha Kennedy – Senior Vice President of Strategy Research Solutions for ORC International – is responsible for managing the strategy practice’s core offerings, which include market sizing, emerging and adjacent market strategies, competitive intelligence, and knowledge management solutions, all with a focus on developing and managing a portfolio of strategic research solutions that support and accelerate client growth initiatives. Natasha draws on more than 20 years of executive-level experience in global market research, strategy, and consulting. Her deep expertise also includes managing business development, operations, product development, knowledge management, HR, finance, and IT. During her career, Natasha has also worked with client organizations as wide-ranging as Starbucks, eBay, and USAA. Learn more about this topic and others at ORCInternational.com, on LinkedIn, and on Facebook. 6

© Copyright 2026