Document 432242

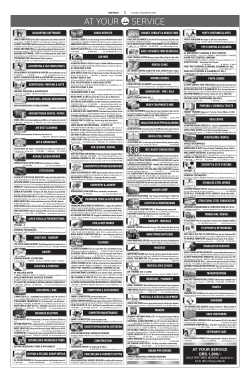

FX QE Index 13763 0.13% Saudi Arabia (TASI) 9290 -2.77% UAE (ADX) 4909 -1.09% UAE (DFM) 4527 -1.64% TOP NEWS West Texas Intermediate and Brent fell for a second day as investors weighed the likelihood of an output cut by OPEC when the group meets next week amid signs of weakening global demand. Futures dropped as much as 0.5 percent in New York. Venezuela, a member of the Organization of Petroleum Exporting Countries, met with Russia to discuss ways to support falling oil prices, according to the Latin American nation. A large output cut by OPEC isn’t in the group’s interest because it’s likely to bolster U.S. shale production, according to Goldman Sachs Group Inc. Oil has slumped into a bear market as U.S. output surges to the highest level in more than three decades, adding to concern the global market is oversupplied amid signs that demand is weakening. Japan, the world’s third-largest oil consuming country, unexpectedly slipped into a recession after its economy shrank in the third quarter. U.S. stocks were little changed, with the Standard & Poor’s Index 500 Index at an all-time high, as a slump in small-cap shares and concern over Japan’s recession offset corporate deals. Treasury yields were one basis point away from a seven-week high relative to their Group of Seven peers, bolstering speculation the premium will lure investors to America’s debt. U.S. government securities due in a decade and more have returned 19 percent this year, the best performance in dollar terms among 144 bond indexes around the world tracked by Bloomberg and the European Federation of Financial Analysts Societies. The Treasury is scheduled to report today on overseas holdings of U.S. securities for September, after foreign ownership of the nation’s debt climbed to a record in August. Beijing home prices fell for the first time in almost two years as China’s property slowdown deepened, prompting developers to offer discounts to cut inventories. New-home prices dropped in October in 67 cities of 70 tracked by the government from a year earlier, and in 69 from September, the National Bureau of Statistics said today. Prices in Beijing declined 1.3 percent, the first annual decrease since November 2012 and a reversal from the 14.7 percent jump in January from the previous year. Amid criticism over the lack of uniformity in approaches to risk at European banks, the Bank for International Settlements has urged emerging markets to only move to the internal ratings-based approach for some risk-weighted assets when ready. The IRB method can allow lower implicit risk weights, given the use of models, pressuring supervisors to approve such practices, BIS said, creating arbitrary cushions against expected and unexpected losses, as well as weakening consistency. Saudi Arabia, the United Arab Emirates and Bahrain agreed to send their ambassadors back to Qatar, resolving an unprecedented diplomatic spat in the history of the oil-rich Gulf Cooperation Council. GCC leaders announced the decision to “consolidate the spirit” of cooperation after an emergency meeting in Riyadh yesterday, according to a statement carried by the official Saudi Press Agency. Kuwait (KSE) 7054 -0.76% Oman (MSM) 7030 -0.22% The gauge bucked the sluggish trend in the region and the world after Japan said its GDP Bahrain (BAX) 1451 0.24% shrank for the second quarter straight. But news from the UAE, Saudi Arabia and Bahrain that FX Rates (Mid) USD QAR USD - 3.64 EUR 1.247 4.543 JPY 116.56 0.031 GBP 1.565 5.701 CHF 0.963 3.781 AUD 0.872 3.177 INR 61.84 0.059 TRY 2.231 1.632 ZAR 11.11 0.328 BRL 2.609 1.396 QIBOR RATES Duration QIBOR Duration QIBOR Overnight 0.80 3 Months 1.06 1 Week 0.85 6 Months 1.24 1 Month 0.90 9 Months 1.35 2 Months 0.99 1 Year 1.45 US RATES US Rates Treasuries Libor Swaps 3M 0.02 0.23 - 6M 0.07 0.33 - 5Y 1.61 - 1.75 10Y 2.32 - 2.45 Index Level 1 Day % GLOBAL MARKETS Indices GCC Qatar’s QE 20 Index added 0.13 per cent to reach 13,762.76 points on Monday, November 17. they would re-instate their ambassadors in Doha after they withdrew them in March raised GLOBAL the mood. Qatar National Bank advanced 0.90 per cent to hit QAR228. The Investors lost the Dow Jones 17648 0.07% S&P 500 2041 0.07% Nasdaq 4671 -0.37% FX COMMENTARY FTSE 6672 0.26% Euro Stoxx 50 3085 0.81% Nikkei 17249 1.62% Hang Seng 23620 -0.75% The Dollar held its own after European Central Bank officials raised the prospects of further stimulus steps and as investors waited to see if Japan's leader would call a snap election after the country unexpectedly slipped into recession. ECB President Mario Draghi said on Monday that the central bank is ready to take more steps to support the Euro Zone's recovery. Earlier in the day, ECB Executive Board member Yves Mersch detailed what such steps might include, and said the ECB could theoretically buy gold, shares, exchange traded funds (ETFs) or other assets if needed. The Euro was steady on the day at $1.2450, down from a more than two-week peak of $1.2580 hit overnight. The Dollar index, rose to 87.999, pushing closer to a four-year high of 88.267 set on Friday. The Dollar was steady on the day at 116.68 Yen, within sight of its seven-year peak of 117.06 Yen touched Monday after Japan's downbeat gross domestic product data. Japan's economy contracted an annualised 1.6 percent in July-September, after plunging 7.3 percent in the second quarter following a rise in the national sales tax, which hit consumer spending hard. The technical recession sets the stage for Prime Minister Shinzo Abe to delay an unpopular further hike to the sales tax and call a snap election. The Australian and New Zealand Dollars edged up, as the outlook for sustained monetary policy support from the European Central Bank and Bank of Japan favoured carry trades. The Aussie received some support after Australia and India said they will push for a free trade pact. The news came a day after the finalisation of a trade agreement between China and Australia. Also underpinning the currency was the outlook for aggressive stimulus in Japan and in Europe, which should encourage investors there to seek higher yields offshore. This spurs carry trades where investors borrow in economies with low rates and use the proceeds to buy financial assets where rates are higher. Likewise, the New Zealand Dollar nudged up to $0.7931, from $0.7914 in early trade. It peaked on Monday following better-than-expected retail sales data. Nifty India 8439 0.09% Borsa Istanbul 80500 -0.88% Crude Oil 75.31 -0.44% Natural Gas 4.29 -1.13% 1187 0.02% COMMODITIES Gold US ECONOMIC DATA Time 16:30 18:00 Event PPI Final Demand MoM NAHB Housing Market Index Period Survey Oct -0.10% Prior 0.10% Nov 55 54 most, ending off 2.70 per cent at QAR46.70. Tuesday, November 18, 2014 REGIONAL STOCK MARKETS % CHG Yesterday 1.00 Year to Date EGYPT DUBAI DOHA BAHRAIN ABU DHABI SAUDI MUSCAT JORDAN LEBANON KUWAIT 0.50 (0.50) (1.00) (1.50) (2.00) (2.50) (10.00) (3.00) - 10.00 20.00 30.00 40.00 QSOV. USD YIELD CURVE Yield % Today 01/01/2014 200 5.0 150 4.0 100 3.0 50 2.0 - 1.0 (50) 0.0 -1.0 Spread bps Spread to Bench 6.0 (100) QATAR 4 01/20/15 QATAR 3 QATAR QATAR QATAR 5 QATDIA 5 QATAR 4 QATAR QATAR 9 QATAR 6.4 QATAR 5 1/8 2.099 6.55 1/4 07/21/20 1/2 3.241 3/4 01/20/40 3/4 01/20/17 01/18/18 04/09/19 01/20/20 01/20/22 01/18/23 06/15/30 01/20/42 Sukuk Sukuk (150) CHART OF THE DAY Indian investors are so confident in Prime Minister Narendra Modi’s plans to boost growth that two- thirds of record equity fund offerings will be locked for at least three years. The CHART OF THE DAY shows 53 equity funds started up this year, according to the Association of Mutual Funds of India. The portion in so-called closed-ended funds rose to 66 percent, the most since at least 2000. The funds bind assets for a minimum three years. “India is in the throes of a multi-year bull run and the best way to capitalize on that is to stay invested,” Sunil Subramaniam, deputy chief executive officer at Sundaram Asset Management Co., said in an interview in Mumbai on Nov. 12. “Most of the investment ideas tied to economic fundamentals will come to fruition in five years.” India’s S&P BSE Sensex has rallied 32 percent to a record this year, the best-performing equity gauge among the world’s 30 biggest markets. The nation’s shares sank in the 12 months after new fund sales last approached current levels in 2007. This time, investors are betting things will be different as Modi takes steps to open the economy to overseas investors and cut bureaucracy after winning the biggest election mandate in three decades. Higher commissions paid by asset management companies to brokers for selling closed-ended funds have also contributed to their popularity, according to New Delhi-based Value Research India Pvt., which tracks mutual funds. Domestic investors have poured a net 392 billion rupees ($6.4 billion) into equities since the fiscal year that started April 1, compared with an outflow of 85.8 billion rupees in the same period last year. Foreigners have plowed $15.1 billion into local shares this year, the most among eight markets tracked by Bloomberg in Asia. Disclaimer: It is understood that any opinions expressed by CBQ or its affiliates as to the commentary, market information, and future direction of prices of specific securities reflects the views of the individual analyst who issued them, and not necessarily represent the views of CBQ or its affiliates in any way. In no event shall CBQ or its affiliates have any liability for any direct or indirect losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this materials or for any delays, inaccuracies, errors in, or omissions of the said information Contact Cb Dealing Room: Telephone: +974 - 44202253, 44202259, 44202261 Email: [email protected] Tuesday, November 18, 2014

© Copyright 2026