Tennessee Market Highlights

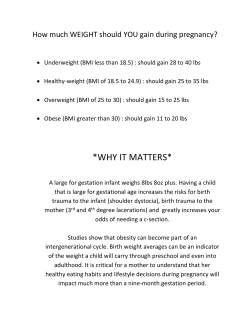

Tennessee Market Highlights Trends for the Week Compared to a Week Ago Slaughter Cows Steady to $2 higher Slaughter Bulls $2 to $3 higher Feeder Steers Steady to $3 higher Feeder Heifers $2 to $4 lower Feeder Cattle Index Wednesday’s index: 240.38 Fed Cattle The 5-area live price of $167.53 is up $0.66. The dressed price is up $0.87 at $261.13. Corn December closed at $3.81 a bushel, up 14 cents a bushel since last Friday. Soybeans January closed at $10.22 a bushel, down 14 cents a bushel since last Friday. Wheat December closed at $5.60 a bushel, up 46 cents a bushel since last Friday. Cotton December closed at 59.8 cents per lb, down 4.16 cents per lb since last Friday. November 14, 2014 Number: 46 Livestock Comments by Dr. Andrew P. Griffith FED CATTLE: Fed cattle traded $3 higher on a live basis compared to a week ago. Prices were mainly $170 to $171 on a live basis while dressed trade ranged from $264 to $265. The 5-area weighted average prices thru Thursday were $167.53 live, up $0.66 from last week and $262.00 dressed, up $0.87 from a week ago. A year ago prices were $130.85 live and $205.00 dressed. Cattle feeders continue to pull rabbits out of the hat as they find ways to push live cattle prices higher. As soon as one might think prices will break and soften or at a minimum be steady with a weak ago, feedlot managers are able to squeeze a couple more dollars out of packers. The ability to squeeze a few more dollars out of packers has resulted in steady to stronger margins for the feedlot industry, but has pressured the packing industry into red ink on the bottom line. How long feeders can continue to rule over the packer is unknown because the seasonal leverage shift that normally occurs has been anything but normal, and it has been one sided for the most part. BEEF CUTOUT: At midday Friday, the Choice cutout was $252.87 up $1.52 from Thursday and up $3.71 from last Friday. The Select cutout was $238.35 down $0.58 from Thursday and down $0.09 from last Friday. The Choice Select spread was $14.52 compared to $10.71 a week ago. The market continues to give the packing industry fits. Though gains were made in the Choice cutout, packers are finding it difficult to move product at higher prices. Seasonality is playing into the uptick in Choice beef prices as retailers are gearing up for holiday beef sales as is somewhat represented in the widening of the Choice Select spread. However, packers are pressured on the front end purchase of live cattle as feedlot managers continue to hold steadfast for higher money. Packers are showing resistance to paying higher prices, but they have orders to fill and feedlot managers are willing to feed cattle a little longer if the price is not satisfactory. The packer has little to no leverage in the marketplace, and there is no indication of the leverage shifting from the feeder at this time since cattle numbers are tight. The Choice cutout is expected to press forward and be supported by holiday purchases. However, as soon as holiday purchases wrap up then the Choice cutout could come under serious pressure. TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were mostly steady to $3 higher. Heifers were $2 to $4 lower. Slaughter cows were steady to $2 higher while bulls were $1 to $3 higher. Average receipts per sale were 905 head on 12 sales compared to 883 head on 12 sales last week and 964 head on 11 sales last year. OUTLOOK: Cattle producers are actively weaning calves and hauling them to town. Many of these calves are green and will be high risk especially with the large swings in temperature. Stocker producers and feedlot operators are willing to pay higher prices for low risk cattle that have been weaned and have some health management behind them. It could pay cow-calf producers to consider adding value to calves by weaning and providing clostridial and respiratory vaccinations. Additionally, some producers may need to defer income into the next year and alternative management strategies may provide that opportunity. Producers are encouraged to evaluate different marketing strategies provided the available resources. For instance, depending on forage availability and current year income, producers may find it advantageous to market some calves now and some after the first of the year. An example may be for a producer to market heavier steers before the end of the year and continue to grow lighter weight calves and market at a later date. Additionally, the (Continued on page 2) Livestock Comments by Dr. Andrew Griffith The RSI is 65.70. April live cattle closed at $169.30. Support is at $169.00, then $168.23. Resistance is at $169.40, then $169.41. The RSI is 66.39. November feeders closed at $239.35. Support is at $238.98, then $238.36. Resistance is at $239.61 then $240.23. The RSI is 61.05. January feeders closed at $234.23. Support is at $233.44, then $231.69. Resistance is at $235.19 then $236.94. The RSI is 62.98. March feeders closed at $232.83. Support is at $232.80, then $231.80. Resistance is at $232.85, then $234.28. The RSI is 64.54. Friday’s closing prices were as follows: Live/fed cattle –December $170.20 +0.55; February $171.28 +0.25; April $169.25 -0.05; Feeder cattle - November $240.00 +0.65; January $236.13 +1.90; March $234.60 +1.78; April $234.80 +1.25; December corn closed at $3.82 down $0.05 from Thursday. (Continued from page 1) correct decision may be to market all of the steers now and continue to grow heifers until a later marketing date. This is not an exhaustive list of alternatives, but they are a couple of alternatives worth considering to maximize the total value to the operation. There are few if any signs of weakness in the calf and feeder cattle markets. The only market factor working negatively against feeder cattle is the uptick in corn prices the past couple of months. However, the increase in grain prices has not seemed to have as large of a negative impact as in years past. There are too many factors supporting the anticipated short supply of cattle and beef for feed prices alone to override the steady feeder cattle market. Market prices continue to encourage increased management of calves before entering a feedlot and this increased management will either take place on the cow-calf operation or stocker producers will look to capitalize on mismanaged calves. Regardless, feedlots are hesitant to take the risk on $1,800 to $1,900 per head animals. Milk Futures Month Nov Dec Jan Feb Mar TECHNICALLY SPEAKING: Based on Thursday’s closing prices, December live cattle closed at $169.65. Support is at $168.56, then $166.71. Resistance is at $170.41 then $172.26. The RSI is 62.85. February live cattle closed at $171.02. Support is at $170.16, then $168.78. Resistance is at $171.53, then $172.91. Average Daily Slaughter Cattle Hogs Thursday November 10, 2014 Class III Close Class IV Close 21.61 17.69 18.70 16.40 17.50 16.19 16.74 15.68 16.63 15.20 USDA Box Beef Cutout Value Choice 1-3 600-900 lbs ———— Number of head ———— This week (4 days) 108,750 Last week (4 days) 111,250 Year ago (4 days) 117,000 This week as percentage of Week ago (%) 98% Year ago (%) 93% 417,750 430,000 422,000 Select 1-3 600-900 lbs ———————— $/cwt —-——————— Thursday Last Week Year ago Change from week ago Change from year ago 97% 99% 251.35 250.52 203.01 +0.83 +48.34 238.93 237.25 188.49 +1.68 +50.44 Crop Comments by Dr. Aaron Smith Overview Corn and wheat were up; cotton and soybeans were down for the week. Estimated domestic corn yields were dropped 0.8 bpa to 173.4 bpa in the latest USDA-WASDE report surprising many analysts, as most thought that the USDA would increase corn yields. At this point, minor revisions to corn yield will not substantially change the estimated 2 billion bushel carryover into the next marketing year. As such, there is limited upside in corn futures prices for this marketing year, until new information is revealed. This week soybean futures closed down slightly from last week (January soybean futures closed 14 cents lower than last Friday’s close). However the past week had a great deal of price volatility. For the January futures contract we saw daily trading ranges of 36 ¼ (Monday), 53 ¼ (Tuesday), and 42 cents (Wednesday). To put this in context for those that are not familiar with soybean futures contacts, a 53 cent change in price for one contract of soybeans is $2,650 (5,000 bu x $0.53/bu) or roughly 5% of the total contract value in one day. This price volatility can be partially attributed to the battle between greater than anticipated year-to-date demand (exports, crush, soybean meal etc.) and record supply (both domestic and potentially South American). So far, soybeans have managed to maintain an upward trend since the beginning of October, however it is likely that soybean futures markets will reverse course due to two reasons: i) the pent up demand (US soybean ending stocks for 2013/14 marketing year were estimated at a record low 92 million bushels) for soybeans/soybean meal will eventually be satisfied from record production 2 Crop Comments by Dr. Aaron Smith and ii) producers will face additional pressure to sell soybeans in storage as we enter the new year. Producers with unpriced soybeans in storage should strongly consider establishing a price. Additionally, those planning on planting soybeans this spring should consider the options available to them for pricing some of their estimated 2015 production. December cotton futures established new lows this week breaking below the 60 to 68 cent trading range that the market had been bound by since mid-July. A new December 2014 futures contract low was established Thursday at 59.51 cents/lb. Wheat prices received support from cold temperatures, causing concerns of winter kill, and reduced foreign production estimates for Australia and Eastern Europe. Additionally, US wheat production and ending stocks were revised down in the latest WASDE report. Full details of the latest USDA- WASDE report can be found at: http://economics.ag.utk.edu/outlook.html. Corn December 2014 corn futures closed at $3.81 up 14 cents a bushel since last week with support at $3.72 and resistance at $3.96. Across Tennessee average basis (cash price- nearby future price) strengthened or remained unchanged at Memphis, Northwest Barge Points, Northwest, and Upper-middle Tennessee and weakened in Lower-middle Tennessee. Overall average basis for the week ranged from 45 under to 20 over the December futures contract with an average of 13 under at the end of the week. Ethanol production for the week ending November 7th was 946,000 barrels per day up 17,000 barrels per day from last week. Ending ethanol stocks were 17.705 million barrels up 536,000 barrels from last week. Nationally, the November 10th Crop Progress report estimated corn harvested at 80% compared to 65% last week, 82% last year, and a 5-year average of 80%. In Tennessee, the Crop Progress report estimated corn harvested at 98% compared to 96% last week, 92% last year, and a 5-year average of 97%. This week December 2014 corn futures prices traded between $3.64 and $3.89. Dec/Mar and Dec/Sep future spreads were 13 cents and 35 cents, respectively. January cash forward contracts at elevators and barge points for the week averaged $3.83 with a range of $3.48 to $4.14. March 2015 corn futures closed at $3.94 up 14 cents from last week with support at $3.84 and resistance at $4.08. Corn net sales reported by exporters from October 31st to November 6th were within expectations with net sales of 19.9 million bushels for the 2014/15 marketing year. Exports for the same time period were up from last week at 23.7 million bushels. Corn export sales and commitments were 44% of the USDA estimated total annual exports for the 2014/15 marketing year (September 1 to August 31) compared to a 5-year average of 48%. September 2015 futures closed at $4.16. Downside price protection could be obtained by purchasing a $4.20 September 2015 Put Option costing 37 cents establishing a $3.83 futures floor. Soybeans January 2015 soybean futures closed at $10.22 down 14 cents for the week with support at $9.98 and resistance at $10.65. Jan/ Dec soybean to corn price ratio was 2.68 at the end of the week. For the week, average soybean basis strengthened in all five regions. Basis ranged from 20 under to 52 over the January futures contract at elevators and barge points. Average basis at the end of the week was 18 over the January futures contract. The Crop Progress report estimated soybeans harvested at 90% compared to 83% last week, 90% last year, and a 5-year average of 91%. In Tennessee, the Crop Progress report estimated soybeans harvested at 73% compared to 62% last week, 55% last year, and a 5-year average of 77%. January cash forward contracts averaged $10.57 with a range of $9.96 to $10.99. This week January 2015 soybean futures traded between $10.20 and $10.86. March 2015 soybean futures closed at $10.30 down 10 cents for the week with support at $10.07 and resistance at $10.71. Net sales reported by exporters were below expectations with net sales of 39.5 million bushels for the 2014/15 marketing year. Exports for the same period were down from last week at 83.4 million bushels. Soybean export sales and commitments were 78% of the USDA estimated total annual exports for the 2014/15 marketing year (September 1 to August 31), compared to a 5-year average of 68%. Jan/Mar and Jan/Nov future spreads were 8 cents and -8 cents. Nov/Sep 2015 soybean to corn price ratio was 2.44. Novem3 (Continued on page 4) Crop Comments by Dr. Aaron Smith ber 2015 futures closed at $10.14. Downside price protection could be achieved by purchasing a $10.20 November 2015 Put Option which would cost 79 cents and set a $9.41 futures floor. Cotton December 2014 cotton futures closed at 59.8 cents down 4.16 cents for the week with support at 59.15 and resistance at 60.69. Cotton adjusted world price (AWP) decreased 0.79 cents to 48.57 cents. The Crop Progress report estimated cotton harvested at 62% compared to 50% last week, 54% last year, and a 5-year average of 64%. In Tennessee, the Crop Progress report estimated cotton harvested at 60% compared to 52% last week, 33% last year, and a 5-year average of 70%. December cotton futures traded between 59.51 and 65.77 cents this week. March 2014 cotton futures closed at 59.63 down 2.98 cents for the week with support at 58.41 and resistance at 60.31. Net sales reported by exporters were up from last week at 158,300 bales for the 2014/15 marketing year. Exports for the same period were up from last week at 88,600 bales. Upland cotton export sales were 66% of the USDA estimated total annual exports for the 2014/15 marketing year (August 1 to July 31), compared to a 5-year average of 62%. Dec/Mar and Dec/Dec futures spread were 0.17 cents and 4.18 cents. December 2015 cotton futures closed at 63.98. Downside price protection could be obtained by purchasing a 64 cent December 2015 Put Option costing 5.23 cents establishing a 58.77 cent futures floor. Wheat December 2014 wheat futures closed at $5.60 up 46 cents from last week with support at $5.27 and resistance at $5.71. In Memphis, old crop cash wheat traded between $4.72 and $5.08 for the week. December wheat futures traded between $5.11 and $5.64 this week. December wheat to corn price ratio was 1.47. Dec/Mar and Dec/July future spreads were 2 cents and 15 cents. March 2015 wheat futures closed at $5.62 up 36 cents from last week with support at $5.44 and resistance at $5.76. Net sales reported by exporters were above expectations at 15.3 million bushels for the 2014/15 marketing year. Exports for the same period were up from last week at 11.6 million bushels. Wheat export sales were 63% of the USDA estimated total annual exports for the 2014/15 marketing year (June 1 to May 31), compared to a 5-year average of 63%. The Crop Progress report estimated winter wheat planted at 93% compared to 90% last week, 94% last year, and a 5-year average of 93%; winter wheat emerged at 83% compared to 77% last week, 83% last year, and a 5-year average of 79%; and winter wheat condition at 60% good to excellent and 6% poor to very poor. In Tennessee, winter wheat planting was estimated at 75% compared to 60% last week, 55% last year, and a 5(Continued on page 5) 4 Crop Comments by Dr. Aaron Smith year average of 70%; winter wheat emerged at 45% compared to 30% last week, 27% last year, and a 5-year average of 40%; and winter wheat condition at 77% good to excellent and 1% poor to very poor. June/July 2015 cash forward contracts averaged $5.33 with a range of $4.82 to $5.74 at elevators and barge points. July 2015 wheat futures closed at $5.75. Downside price protection could be obtained by purchasing a $5.80 July 2015 Put Option costing 43 cents establishing a $5.37 futures floor. Farm Bill Update Important deadlines for producers/landowners for the 2014 Farm Bill: 1. 2. September 29 to February 28th. During this period, paperwork dealing with the program yield updating and program acre reallocation decisions can be completed for each FSA farm. November 17 to March 31. During this period, paperwork dealing with program choice (Agricultural Risk Coverage - County (ARC-CO), Price Loss Coverage (PLC), and Agricultural Risk Coverage - Individual Coverage (ARC-IC)) can be completed for each FSA farm. Additional details and helpful links can be found on the University of Tennessee Extension Farm Bill webpage: http:// economics.ag.utk.edu/farmbill.html. If you would like further information or clarification on topics discussed in the crop comments section or would like to be added to our free email list please contact me at [email protected]. 5 Futures Settlement Prices: Crops & Livestock Commodity Soybeans ($/bushel) Friday, November 7, 2014 — Thursday, November 13, 2014 Contract Month Friday Monday Tuesday Wednesday Nov 10.40 10.27 10.66 10.48 Jan 10.36 10.25 10.64 10.47 Mar 10.40 10.30 10.67 10.53 May 10.44 10.34 10.71 10.58 Jul 10.48 10.39 10.75 10.62 Aug 10.48 10.39 10.75 10.63 Thursday 10.50 10.53 10.59 10.64 10.69 10.69 Corn ($/bushel) Dec Mar May Jul Sep Dec 3.67 3.80 3.89 3.96 4.03 4.13 3.69 3.82 3.91 3.98 4.05 4.15 3.73 3.86 3.95 4.02 4.09 4.19 3.77 3.90 3.99 4.06 4.13 4.22 3.86 3.98 4.07 4.14 4.21 4.29 Wheat ($/bushel) Dec Mar May Jul Sep 5.14 5.26 5.34 5.40 5.49 5.17 5.27 5.35 5.41 5.51 5.25 5.30 5.38 5.44 5.54 5.42 5.48 5.55 5.61 5.70 5.53 5.56 5.62 5.68 5.77 Soybean Meal ($/ton) Dec Jan Mar May Jul Aug 390 371 354 347 346 346 380 364 348 342 342 341 400 384 366 357 356 355 395 380 365 357 355 354 393 379 365 358 357 356 Cotton (¢/lb) Dec Mar May Jul Oct 63.96 62.61 63.57 64.33 65.78 62.43 61.32 62.36 63.23 64.56 63.30 61.53 62.57 63.45 64.77 61.94 60.34 61.41 62.33 63.65 59.73 58.75 59.82 60.75 62.19 Live Cattle ($/cwt) Dec Feb Apr Jun Aug 166.80 168.37 167.15 156.80 154.50 167.12 168.52 167.55 156.90 154.27 167.25 168.40 167.50 157.60 155.10 167.75 169.57 168.22 158.75 155.97 169.65 171.02 169.30 159.62 157.00 Feeder Cattle ($/cwt) Nov Jan Mar Apr May Aug 238.52 232.45 229.65 229.95 229.70 230.27 239.02 232.75 230.30 230.75 230.17 231.20 238.85 232.65 230.55 230.87 230.77 231.42 239.35 233.37 231.80 232.27 231.60 232.22 239.35 234.22 232.82 233.55 233.27 234.02 Market Hogs ($/cwt) Dec Feb Apr May Jun 88.77 88.42 90.10 90.75 94.25 89.55 89.10 90.80 90.75 94.85 89.90 89.45 91.00 92.50 95.35 90.67 90.80 91.70 93.25 95.50 91.27 91.60 92.85 93.75 96.50 6 Prices on Tennessee Reported Livestock Auctions for the week ending November 14, 2014 Low This Week High Weighted Average Last Week Weighted Average Year Ago Weighted Average —————————————————————— $/cwt —————————————————————— Steers: Medium/Large Frame #1-2 300-400 lbs 270.00 345.00 301.56 300.29 196.97 400-500 lbs 231.00 305.00 272.66 271.68 172.63 500-600 lbs 217.00 264.00 243.96 242.68 160.37 600-700 lbs 206.00 246.00 228.39 225.16 149.67 700-800 lbs 190.00 230.00 216.25 217.57 145.23 300-400 lbs 220.00 305.00 274.14 272.60 174.83 400-500 lbs 240.00 285.00 259.52 234.30 153.08 500-600 lbs 210.00 240.00 223.98 219.19 140.03 600-700 lbs 202.50 224.00 216.50 209.20 135.14 Steers: Small Frame #1-2 Steers: Medium/Large Frame #3 300-400 lbs 220.00 307.50 269.08 276.02 173.07 400-500 lbs 200.00 286.00 244.65 236.89 156.08 500-600 lbs 195.00 242.50 222.81 224.96 145.42 600-700 lbs 200.00 230.00 213.36 201.99 142.50 205.80 134.62 700-800 lbs Holstein Steers 300-400 lbs ——— ——— ——— 182.14 104.85 500-600 lbs ——— ——— ——— ——— 107.48 700-800 lbs 150.00 160.00 155.39 148.99 ——— Breakers 75-80% 94.00 114.50 105.14 103.50 75.66 Boners 80-85% 97.00 119.00 106.77 104.44 75.40 Lean 85-90% 86.00 104.00 94.88 91.93 67.15 Bulls YG 1 119.50 137.00 127.50 124.62 89.82 Slaughter Cows & Bulls Heifers: Medium/Large Frame #1-2 300-400 lbs 225.00 285.00 253.91 256.36 164.76 400-500 lbs 213.00 265.00 237.90 241.50 151.63 500-600 lbs 198.00 240.00 221.90 226.50 142.09 600-700 lbs 180.00 226.00 207.70 204.97 135.17 300-400 lbs 175.00 270.00 228.29 210.69 134.21 400-500 lbs 180.00 234.00 210.24 213.24 128.10 500-600 lbs 180.00 225.00 209.18 199.34 123.48 600-700 lbs 200.00 215.00 207.50 190.64 123.70 Heifers: Small Frame #1-2 Heifers: Medium/Large Frame #3 300-400 lbs 200.00 270.00 231.46 238.86 142.94 400-500 lbs 190.00 247.50 217.22 218.29 135.24 500-600 lbs 170.00 225.00 201.28 204.31 128.57 600-700 lbs 162.00 203.00 192.30 188.77 127.98 Cattle Receipts (# sales): This week: 10,863 (12) Week ago: 10,600 (12) 7 Year ago: 10,600 (11) Tennessee 500-600 lbs. M-1 Steer Prices Tennessee 700-800 lbs. M-1 Steer Prices 2013, 2014 and 5-year average 2013, 2014 and 5-year average 260 240 220 200 180 160 140 120 100 220 200 180 160 140 120 100 80 2008/2012 Av g 2013 2014 200 8/20 12 Avg 201 3 201 4 5-Area Finished Cattle Prices Tennessee Slaughter Cow Prices 2013, 2014 and 5-year average Breakers 75-80% 2013, 2014 and 5-year average 175 165 155 145 135 125 115 105 95 85 115 105 95 85 75 65 55 45 35 2008/2012 Avg 2013 200 8/20 12 Avg 2014 201 3 201 4 Prices Paid to Farmers by Elevators Friday, November 7, 2014 — Thursday, November 13, 2014 Friday Low High Monday Low Tuesday High Low High Wednesday Low High Thursday Low High ————–-——–——————————————— $/bushel ———————————————————–——— No. 2 Yellow Soybeans Memphis 10.71-10.81 10.65-10.70 ——— 10.92-10.92 10.88-10.96 N.W. B.P. 10.65-10.70 10.56-10.60 ——— 10.83-10.90 10.86-10.92 N.W. TN 10.16-10.32 10.05-10.26 ——— 10.32-10.48 10.38-10.54 Upper Md. 10.33-10.35 10.23-10.24 ——— 10.43-10.47 10.46-10.58 Lower Md. 10.20-10.42 10.11-10.31 ——— 10.38-10.53 10.36-10.59 Memphis 3.77-3.87 3.79-3.89 ——— 3.87-3.97 3.96-4.06 N.W. B.P. 3.67-3.86 3.79-3.84 ——— 3.88-3.93 3.96-4.01 N.W. TN 3.22-3.48 3.24-3.50 ——— 3.33-3.58 3.41-3.61 Upper Md. 3.32-3.38 3.34-3.39 ——— 3.42-3.58 3.61-3.63 Lower Md. 3.53-3.77 3.55-3.85 ——— 3.63-3.78 3.71-3.86 4.69-4.69 4.72-4.72 ——— 4.97-4.97 5.08-5.08 Yellow Corn Wheat Memphis 8 Video Sales Video Board Sales and Graded Sales EAST TENNESSEE LIVESTOCK CENTER - Nov. 12, 2014 1 load out of 85 heifers; BQA certified producer; est. wt. 715 lbs., wt. range 665 to 765 lbs.; Slide: $0.04 on first 50 lbs., over 51 lbs. $0.06 back to first lb. over 716 lbs.; 100% M-1s; medium flesh; 100% Black/BWF; Feed: pasture receiving corn silage/ ground hay/corn gluten mix; vaccinated twice; dewormed twice; gathered early a.m., hauled 3 miles to barn, weigh on grounds after sort; 2% shrink $226.00 705-775 lbs 214.00-217.50 780-850 lbs 219.00 855-950 lbs 204.00-205.00 705-775 lbs 171.00-186.50 780-850 lbs 170.00-173.00 Steers: Med & Lg 2 300-395 lbs 280.00 400-475 lbs 250.00 480-550 lbs 239.00-243.00 555-625 lbs 200.00-231.00 630-700 lbs 185.00-202.00 705-775 lbs 196.00-216.00 Heifers: Med & Lg 2 300-395 lbs 215.00-237.00 400-475 lbs 195.00 480-550 lbs 206.00-213.00 555-625 lbs 185.00-224.00 630-700 lbs 212.00 705-775 lbs 170.00-179.50 780-850 lbs 155.00-160.00 1 load out of 77 Holstein steers; BQA certified producer; est. wt. 740 lbs., wt. range 690 to 790 lbs.; Slide: $0.04 on first 50 lbs., over 51 lbs. $0.06 back to first lb. over 741 lbs.; 100% #1s; medium flesh; Feed: pasture plus hay, receiving 9 lbs/hd/day corn gluten; double-vaccinated; dewormed twice; implanted; gathered early a.m., hauled 6 miles to barn, weigh on grounds after sort; 2% shrink $182.00 11/7/14 East Tennessee Livestock Holstein Sale Receipts: 979 For complete report: http://www.ams.usda.gov/mnreports/nv_ls180.txt MID-SOUTH LIVESTOCK - Nov. 10, 2014 1 load of 58 steers, avg. wt. 854 lbs., $225.00 11/7/14 Lower Middle TN Cattle Association Video Board Sale Columbia, TN Receipts: 674 (Delivery current thru Dec. 4th, 5-7 cent slide and 0-2% shrink) Video Board Sales and Grades Sales Steers Med & Lg 1 few 2 Heifers Med & Lg 1 few 2 1 ld 765 lbs $226.25 TN 20 hd 725 lbs $215.50 TN 28 hd 775 lbs $218.75 TN 2 lds 825-835 lbs $205.60-211.25 TN 1 ld 840 lbs $221.50 TN 4 lds 875-880 lbs $220.25-220.75 TN 11/6/14 Athens Replacement Sale Replacement Cows: 370 head 4-6 years old 1100-1300 lbs 7-8 months bred 1800.00-2450.00/head 7-9 years old 1150-1350 lbs 6-8 months bred 1750.00-2350.00 5-7 years old 1100-1250 lbs 2-4 months bred 1600.00-2100.00 9 years & older 1100-1200 lbs 5-7 months bred 1450.00-1850.00 Mixed load Steers & Heifers Med & Lg 1 few 2 (heifers $10 back of steers) 40 +/- steers 675 lbs, 40+/- heifers 650 lbs $231.00 TN Cow and Calf Pairs: 11/6/14 Hodge Video Sale Receipts: 32 loads Next video sale will be Dec. 4, 2014 4-6 years old 1150-1350 lbs baby to 300 lb calves 2500.00-3000.00/pr 7-9 years old 1100-1300 lbs baby to 250 lb calves 1850.00-2550.00 STEERS 1/2 LOAD 650 LBS TN $230.50 1 LOAD 750 LBS TN $223.00 1 LOAD 800 LBS TN $230.00 1 LOAD 825 LBS TN $228.50 1 LOAD 850 LBS TN $229.50 1 LOAD 850 LBS TN $216.50 Video Board Sales and Grades Sales 11/11/14 Tennessee Livestock Producers - Fayetteville Receipts: 792 (404 graded and grouped) Steers: Med & Lg 1-2 300-400 lbs 297.50-306.00 400-500 lbs 260.00-290.00 500-550 lbs 235.00-260.00 600-700 lbs 224.00-239.50 700-800 lbs 200.00-224.00 Heifers: Med & Lg 1-2 300-400 lbs 244.00 400-500 lbs 237.00-250.00 500-600 lbs 220.00-234.00 600-700 lbs 185.00-216.00 700-800 lbs 199.00 11/5/14 Browning Livestock Market, Lafayette TN Feeder cattle sale Next sale Nov 19, 2014 For complete report: http://www.ams.usda.gov/mnreports/nv_ls180.txt 11/4/14 Tennessee Livestock Producers - Fayetteville Receipts: 680 (373 graded and grouped) Bulls: Med & Lg 1-2 400-500 lbs 254.00-275.00 500-600 lbs 224.00-240.00 600-700 lbs 207.00-210.00 700-800 lbs 196.00 800-900 lbs 152.00 11/10/14 Cookeville Steers: Med & Lg 1 300-395 lbs 283.00 400-475 lbs 263.00 480-550 lbs 245.50-252.25 555-625 lbs 226.00-234.00 630-700 lbs 219.00-225.00 HEIFERS 1 LOAD 650 LBS TN $217.50 1 LOAD 775 LBS TN $216.00 1 LOAD 775 LBS TN $210.00 Steers: Med & Lg 1-2 350-400 lbs 292.00-304.00 400-450 lbs 290.00-300.00 450-500 lbs 271.50-286.00 500-550 lbs 250.00-273.00 550-600 lbs 248.00-260.00 600-700 lbs 230.00-250.00 700-800 lbs 224.00-232.50 800-900 lbs 220.00 Receipts: 552 Heifers: Med & Lg 1 300-395 lbs 235.00-260.00 400-475 lbs 230.50 480-550 lbs 206.00-229.00 555-625 lbs 190.00-228.00 630-700 lbs 190.00-207.00 Heifers: Med & Lg 1-2 350-400 lbs 262.00-266.00 400-450 lbs 240.00-256.00 450-500 lbs 240.00-247.00 500-550 lbs 230.00-233.00 550-600 lbs 222.00-233.00 600-700 lbs 189.00-217.00 Bulls: Med & Lg 1-2 400-450 lbs 274.00-286.00 500-550 lbs 235.00-243.00 450-500 lbs 255.00-263.00 550-600 lbs 219.00-224.00 600-700 lbs 186.00-190.00 9 Beef Industry News Featured Article from DROVERS CattleNetwork Waters of the U.S. update The rule defining “Waters of the U.S.” under the Clean Water Act (CWA) that has been proposed by the Environmental Protection agency (EPA) and the U.S. Army Corps of Engineers (USACE) has a comment period that will end Nov 14th 2014. This has been a controversial topic since the comment period started on April 24th 2014. Some of the main topics of debate have been jurisdiction over ditches, agricultural impacts from fertilizer and pesticide application, and jurisdiction over “other waters”. Ditches Ditches are being debated because some Ag groups contend that the wording in the proposed rule will grant jurisdiction under the CWA to ditches not currently regulated. According to the EPA, no new land will be subject to the CWA that hasn’t historically been jurisdictional. The proposed rule explains that ditches that would be excluded must be dug in upland areas and have less than perennial flow. To be excluded, the ditch also cannot meet the definition of a “tributary”. According to the proposed rule, the term tributary means a water body physically characterized by the presence of a bed and banks and ordinary high water mark, which contributes flow, either directly or through another water. So a ditch that only has ephemeral flow, can still be jurisdictional if it has a bank, bed, and ordinary high water mark. A wetland, lake, or pond can also be a tributary if it acts as a conduit for flow contribution to another location; such as a wetland in a floodplain or riparian area. Fertilizers & Pesticides: Permit concerns Many farmers are concerned that they will be required to obtain permits for the application of fertilizers and pesticides. No permits will be required according to EPA on agricultural application on dry lands. This still concerns the farmers because of the uncertainty of what constitutes dry land. Many acres that are dry during an application may run or contain water after a heavy rainstorm. As long as the areas that have chemicals applied onto them do not have a bed, bank, ordinary high water mark, or meet the definition of a tributary, EPA has deemed those areas as non-jurisdictional. Permit-Exempt Practices For many agricultural practices that may discharge pollutants to “waters of U.S.” such as stream crossings or tile outlets, 56 NRCS approved conservation practices have been written into the Interpretive Rule. No permit is required as long as the agricultural activity follows the standards written for the associated practice. A list of the 56 practices is available courtesy of the EPA. Besides the 56 conservation practices, the same historic exemptions will exist for agricultural practices. These include “normal” farming and ranching, construction and maintenance of farm or stock ponds or irrigation ditches, maintenance of drainage ditches, and construction or maintenance of farm roads. Other Waters Jurisdiction for “Other Waters” currently lies in listing out types of water bodies that if degraded or destroyed would impact interstate or foreign commerce including any such waters. This list was omitted because it was thought to be repetitive when many of the items are jurisdictional under different criteria. For a water body to fall into the “Other Waters” category, it would have to be determined on a case-specific basis. An example of this might be a prairie pothole. If the pothole doesn’t meet any other criteria for jurisdiction, then it will be evaluated for a significant nexus to another interstate water or territorial sea. Opponents & Critics Opponents of the Proposed Rule claim that it will give the EPA greater reach over areas that they historically haven’t covered, despite EPA’s claims that they will not have any additional jurisdictional areas. The EPA has created a website to explain and defend the Proposed Rule named Ditch the Myth. The American Farm Bureau Federation, one of the most vocal critics of the proposed rule, has also created a website that opposes the rule named Ditch the Rule. Public Commentary Producers and stakeholders that are interested in the proposed rule and its potential impacts are encouraged to learn more and provide comments to the EPA before the end of the public comment period. University of Tennessee Extension Department of Agricultural and Resource Economics 314 Morgan Hall • 2621 Morgan Circle http://economics.ag.utk.edu/ http://economics.ag.utk.edu/curmkt.html USDA / Tennessee Department of Agriculture Market News Service http://www.tennessee.gov/agriculture/marketing/marketnews.html 1-800-342-8206 10

© Copyright 2026