! IMPORTANT MESSAGE !

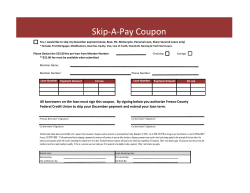

! IMPORTANT MESSAGE ! Everyone’s FCU recently received notice that that the United States merchant’s network had experienced a security breach. Co-op network engaged a data security firm to conduct a forensic investigation. The alert received by the credit union disclosed the payment account numbers of our MasterCard accounts that were exposed to potential compromise. A process has been established to address this issue, and is as follow: Step 1 is to call members on the list obtained from Co-op Network. Step 2—if member can be reached by phone, staff verifies member’s information, address and phone #. (Password, etc.) Step3 Close the current card. Step 4 Reorder new Card IMPORTANT NOTE: If we do not have a valid phone number or address. Close the card, but will not reorder a new card. During this process we have found that many phone numbers listed on the account are no longer in service. It is so important for you to keep the credit union informed of your current address and phone numbers. We also have to verify all addresses as we don’t want the new debit card to be mailed to the wrong address. In addition, we have to obtain passwords from members who have not already furnished one to the credit union. Always, inform your financial institution if you have moved or changed phone numbers. We are in the process of sending letters to all the accounts that have been listed as an account exposed to potential compromise. It is our mission to protect your funds and personal information. Thank you, members for your help and patience in this matter. Holiday Skip-A-Payment November 15, 2014 thru January 15, 2015 and the loan is SIX months old. Please submit application a minimum 15 days before payment is due (Bi-Weekly & semi-monthly payments 30 days in advance) Not available for; Summer Vacation, Holiday Recovery Loan, Mobile Home Loans, Back 2 School, or Business Loans. $35 fee must be presented with application. Fee will be refunded if loan does not qualify. Andi Baum, CEO * * * * A p p l i c a N o v e m b e r t i o n 1 5 , H o l i d a y 2 0 1 4 t h r u L o a n E x t e n s i o n * * * * J a n u a r y 1 5 , 2 0 1 5 Account Number__________ Loan #_________ Criteria posted upper left of Newsletter Print Member Name: _______________________________________ ** Holiday Skip-a-Payment Extension-Limited - one month only - per loan ** (Title Loans- GAP insured-not available after 1st 2 extensions/Holiday-Skip Pay) (Not available for Mobile Home Loans, Holiday Recovery Loan, Business Loans, Summer Vacation, Back 2 School) I'm requesting that an extension be granted on the above loan. ** I request this extension be effective for my ___/____/20____ Loan Payment. [$35 Application Fee required to process — returned if request denied] Required Member's Signature________________________ *** Date_________ Approved ______Denied_______ Loan Officer's Signature_______________________________ Happenings here in Tucumcari November 1-2 CRAFT Fair November 8 Quay County United Way Auction November 11-12 Tucumcari Lobby—M—TH 9-4 Friday 9-4:30 Tucumcari Drive-up Hours: 8-5 M - F; Saturday Mornings 9—12 noon Pure Energy Expo December 6 Christmas Light Parade December 7 Annual Christmas Expo For more information contact the Tucumcari Chamber of Commerce 461-1694 Patsy Gresham, Executive Director The holidays are upon us and you won’t have to worry about identity theft with VISA Gift Cards and they are just the right gift for anyone. Don’t forget the Visa Travel Cards. Great for shopping online for any purchase, or give one to your college student. The travel card is re-loadable with a minimum of $100.00 up to $5,000.00 and you can load them as often as you would like. $5.00 PER MONTH AVOID DORMANT ACCOUNT FEE’S BY MAKING A $1.00 CONTRIBUTION ANNUALLY TO YOUR ACCOUNT! Members mail all loan payments including your credit card payment to Everyone’s Federal Credit Union, PO Box 1023, Tucumcari, NM 88401, or bring your payment to any branch. Everyone’s Discover® Card payment can be made at any branch or go online to https://cucard.ilcusys.com/eCustService/ Open up a Kirby Kangaroo Club Account for your little ones today. They will thank you in years to come. Ages 1 thru 12 years old. Auto Recapture/Refinance Program Rates as low as 1.99% APR!! (ANNUAL PERCENT RATE) RATE BASED ON CREDITWORTHINESS NO EFCU LOANS REFINANCED ALL LOANS SUBJECT TO POLICY AND APPROVAL SERVING QUAY, GUADALUPE AND UNION COUNTIES Santa Rosa & Vaughn: M—F 9-4 Closed Saturdays Everyone’s Discover® Credit Card No Balance Transfer Fee Low Rates Consolidate your debt Great member service No hidden fees What are you waiting for? Ask any employee for Everyone’s Discover® Credit Card application.

© Copyright 2026