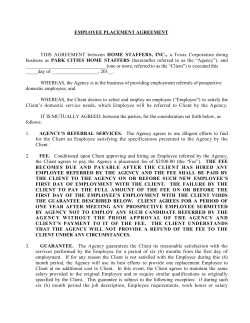

Government Notice Department of Trade and Industry