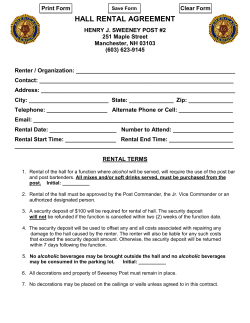

Document 45798