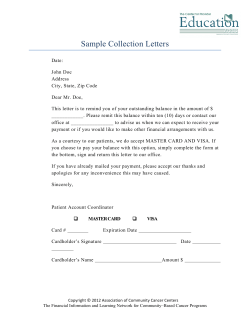

Small Business Financial Services