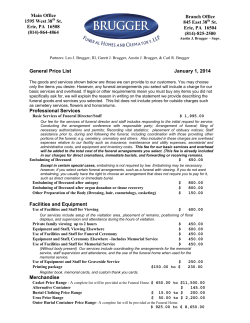

Funeral Planning Guide A Planning Guide to Assist My Family