Requirements and Characteristics of Title Registration Loan

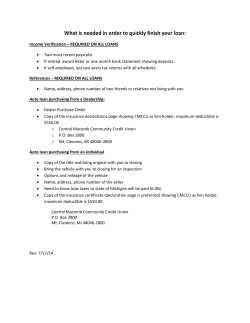

Requirements and Characteristics of Title Registration Loan A customer who is short for cash might make a title registration loan using their car as security for the loan. These types of loans are made on a clear vehicle’s title. There are some important criteria about the skill to secure such type of loan, but for some, these are the loans for those people who don’t need cash immediately and wish a credit check. Title registration loans would be given to the owner of car if the title is clear. It indicates that there are not any types of financial compulsions associated to the vehicle. Any insurance or taxes owed on the vehicle will need to be compensated before a title borrowing can be comprehensive to the vehicle’s owner. The vehicle should even be registered under the person’s name that wants to take the loan; it can’t be vehicle of someone else. And it should remain in the name of recipient for the loan duration; the vehicle can’t be sold without first fulfilling the loan. A car being provided for logbook loan needs to be in excellent shape and not too much old. To cover that the vehicle is being properly cared for and that coverage of insurance is held on the vehicle always, the vehicle owner should have a certificate MOT on it. Then, the period of every three years, a current MOT inspection would happen to confirm the vehicle is in good condition. Besides maintaining the car in perfect shape, owner of a vehicle have to pay all the insurance and taxes on their vehicle while it is under Title registration loans in Phoenix. It would need a compelling license at all times and the vehicle driver will have to cover any road taxes which arise throughout the vehicle’s ownership. The vehicle’s owner should have a permanent job or a regular income stream to get a logbook lending. So that it is the responsibility of owner to repay the loan amount on time. As these kinds of loan don’t need credit verification, there is not any requirement to be worried over poor credit. These types of loans on the vehicle's title are mainly planned for people with downright or poor credit. It is a wonderful way for them to get fast cash when they want it most. Before you are applying for a title registration loan, owner of a car have to confirm they can suitably pay back the amount through the set schedule. If the per month payments are becoming too much of a tension, then officials advise against going throughout with a title loan. On the other hand, if a vehicle owner can perfectly fit the title loan payments into their financial plan and are in requirement of the cash, then it is one excellent way to get it if all the criteria are perfectly met and rules are remained to throughout the loan time. For some people who want cash instantly, for urgent conditions, they can get the funds they want throughout a logbook loan conveniently and quickly. There are title registration loans online, throughout banks and financial institutions. Applying for a title loan is easy, quick and confidential.

© Copyright 2026