Received an Audit Notice?

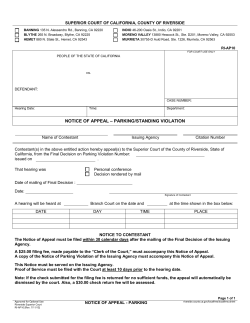

This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! BUREAU OF INDIVIDUAL TAXES PO BOX 280432 HARRISBURG PA 17128-0432 XXX-XXXX XX XXX XXXX XXXXXX X XXXXXXX XX XXXXXX X XXXXXXX XXXX XXXXXX XXX XXX COLLEGEVILLE PA 19426-3176 DETACH AT PERFORATION BUREAU OF INDIVIDUAL TAXES REV-364C (01-05) PERSONAL INCOME TAX. DETACH AT PERFORATION TAXPAYER NAME: NOTICE DATE: SOCIAL SEC. NUM: TAX YEAR: TOTAL DUE NOW: XXXXXXXX X XXXXXXXXX XX JAN 04 20 11 XXX -XX -XXXX 2009 63.70 PAYMENT AMOUNT; 100 $ MAKE CHECK OR MONEY ORDER PAYABLE TO: “PA DEPT. OF REVENUE” DO NOT WRITE IN THIS SPACE ########################################## This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! IF YOU HAVE ANY QUESTIONS CONCERNING THIS NOTICE, PLEASE CALL (717) 783-5250. FOR SERVICE FOR TAXPAYERS WITH SPECIAL HEARING AND SPEAKING NEEDS. TDD# 1-800-447-3020. OFFICE HOURS 8:00 A.M.- 4:00 P.M. YOU MAY ALSO WRITE TO: PA DEPARTMENT OF REVENUE, BUREAU OF INDIVIDUAL TAXES, PO BOX 280432, HARRISBURG PA 17128-0432. PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES PO BOX 280432 HARRISBURG PA 17128-0432 This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES PO BOX 280432 HARRISBURG PA 17128-0432 PERSONAL INCOME TAX NOTICE OF ASSESSMENT XXXXXX X XXXXXXX XX XXXXXX X XXXXXXX XXXX XXXXXX XXX XXX COLLEGEVILLE PA 19426-3176 XXX-XXXX XX XXX XXXX DLN: XXXXXXXXXXXX DATE OF NOTICE: JAN 04 2011 SOCIAL SEC. NUM: XXX-XX-XXXX ASSESSMENT #: XXXXXX TAX YEAR: 2009 ASSESSMENT AMOUNT 63.70 BALANCE(S) DUE FOR YOUR ACCOUNT AS OF JAN 14 2011: OWED PAIDBALANCE UND PNLTY 2.95 .00 2.95 EST PNLTY .00.00.00 LEGAL .00.00.00 INTEREST 1.75 .001.75 TAX/RFD 59.00 .0059.00 2009 BALANCE DUE 63.70 PLUS OTHER TAX YEAR(S) LIABILITIES (SEE REVERSE SIDE OF NOTICE) .00 TOTAL DUE NOW - (PLEASE PAY THIS AMOUNT USING THE ENCLOSED COUPON) THE FIGURES SHOWN BELOW REPRESENT AMOUNTS AS ORIGINALLY REPORTED ON YOUR 2009 TAX RETURN OR AS ADJUSTED BY THE DEPARTMENT. ORIGINAL OR ADJUSTED AMOUNTS. 1A. GROSS COMPENSATION...........................53,439 1B. SCHEDULE UE EXPENSES.........................0 1C.COMPENSATION.................................53,439 2.. INTEREST (SCHEDULE A)........................1 3.. DIVIDENDS (SCHEDULE B).......................0 4.. NET INCOME OR LOSS...........................0 5.. TAXABLE SALE - GAIN OR LOSS..................0 5A. CAPITAL GAIN EXCLUSION.......................0 6.. RENTS, ROYALTIES, PATENTS, COPYRIGHTS........0 7.. ESTATES AND TRUSTS (SCHEDULE J)..............0 8.. GAMBLING AND LOTTERY WINNINGS................0 9.. GROSS TAXABLE INCOME (ADD LINES 1C,2-5,6-8)..53,440 10. OTHER DEDUCTIONS(MEDICAL, HEALTH, TUITION).N.0 11. NET PA TAXABLE INCOME(LINE 9 MINUS LINE 10)..53,440 12. TAX LIABILITY (MULTIPLY LINE 11 BY .03070)...1,641 13. TAX WITHHELD (FROM W2’S).....................1,582 14. CREDIT FROM PREVIOUS TAX YEAR................0 15&16ESTIMATED TAX & EXTENSION PAYMENTS...........0 17. TAX WITHHELD AS REPORTED ON NRK-1............0 18. TOTAL CREDITS (ADD LINES 14-17)..............0 .19B.NUMBER OF DEPENDENTS.........................2 21. TAX FORGIVENESS CREDIT.......................0 22. RESIDENT CREDIT (SCHEDULE G).................0 23. CREDITS (SCHEDULE OC)........................0 24. TOTAL CREDITS (ADD LINES 13,18,21-23)........1,582 25. TAX DUE (LINE 12 MINUS 24)...................59 26. PENALTIES AND INTEREST....................... 28. OVERPAYMENT (LINE 24 MINUS 12)...............0 29.REFUNDED.....................................0 30. CREDITED TO NEXT YEARS ESTIMATED TAX.........0 .31-35. TOTAL DONATIONS (LINES 31-35)................0 THE REASON(S) FOR THIS NOTICE ARE AS FOLLOWS: PENALTY FOR FILING TIMELY BUT UNDERPAYING YOUR TAX DUE IS 5% OF THE UNPAID BALANCE. ANY UNPAID BALANCES WILL REDUCE OR ELIMINATE ANY FUTURE REFUND. YOU HAVE THE RIGHT TO APPEAL FOR A REASSESSMENT OR REFUND. DETAILS OF YOUR APPEAL RIGHTS ARE ENCLOSED (SEE REV-554). IF YOU HAVE ANY QUESTIONS CONCERNING YOUR APPEAL RIGHTS, PLEASE CALL (717)783-5250. A TAXPAYER DISAGREEING WITH THE ASSESSMENT OF TAX MUST FILE A PETITION FOR REASSESSMENT OR REFUND. APPEALS MUST BE FILED BY THE FOLLOWING DATE: 1) ON OR BEFORE APR 04 2011 A PETITION FOR REASSESSMENT MUST BE FILED OR 2) ON OR BEFORE JUL 05 2011 REMIT THE BALANCE DUE TO THE PA DEPARTMENT OF REVENUE AND FILE A PETITION FOR REFUND. APPEALS ARE CONSIDERED TIMELY IF POSTMARKED BY THE U.S. POSTAL SERVICE ON OR BEFORE THE LAST DAY FOR PETITIONING FOR REASSESSMENT OR REFUND OR IF RECEIVED AT THE ADDRESS BELOW ON OR BEFORE THE LAST DAY FOR PETITIONING FOR REASSESSMENT OF REFUND. AN APPEAL CAN BE FILED ON-LINE @ WWW.BOARDOFAPPEALS.STATE.PA.US ON OR BEFORE THE FILING DEADLINES NOTED ABOVE. INITIATE AN ELECTRONIC APPEAL BY SUBMITTING A PETITION BY MEANS OF COMPUTER AND RECEIVING A CONFIRMATION NUMBER AND PROCESSED DATE FROM THE BOARD OF APPEALS WEBSITE. AN APPEAL CAN ALSO BE FILED IN PAPER FORM BY COMPLETING REV-65, MAILING THE COMPLETED PETITION OR DELIVERING IT TO: PA DEPARTMENT OF REVENUE, BOARD OF APPEALS, PO BOX 281021, STRAWBERRY SQUARE, 10TH FLOOR, 4TH AND WALNUT STREETS, HARRISBURG, PA 17128-1021. PETITIONS MAY NOT BE FAXED. ALL TAXES FOR PERIODS SUBSEQUENT TO THE BANKRUPTCY DATE SHOULD BE PAID IMMEDIATELY UNLESS INCLUDED IN A DULY APPROVED MODIFIED PAYMENT PLAN. IF YOU ARE IN AN ACTIVE BANKRUPTCY PROCEEDING, THIS DOCUMENT IS FOR INFORMATION PURPOSES ONLY. IF YOUR CASE HAS BEEN PLACED WITH A COLLECTION AGENCY YOU MAY BE SUBJECT TO ADDITIONAL FEES FOR COLLECTION COSTS. UNDER ACT 40 OF 2005, ADDITIONAL COLLECTION COSTS, INCLUDING BUT NOT LIMITED TO FEES OF UP TO THIRTY-NINE (39%) OF THE AMOUNT DUE, AND ATTORNEY FEES INCURRED IN SECURING PAYMENT, MAY BE IMPOSED ON ANY LIABILITY NOT PAID PRIOR TO REFERRAL TO A COLLECTION AGENCY OR CONTRACT COUNSEL. SEE REVERSE SIDE FOR MORE INFORMATION 63.70 This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! OTHER TAX YEAR LIABILITIES LISTED FROM FRONT OF NOTICE: IF YOU WOULD LIKE TO ESTABLISH A DEFERRED PAYMENT PLAN AGREEMENT TO RESOLVE THIS ACCOUNT PLEASE CONTACT THE HARRISBURG CALL CENTER AT (717) 783-3000. A PORTION/OR ALL OF YOUR UNREIMBURSED EMPLOYEE BUSINESS EXPENSES WERE DISALLOWED. EXPENSES NOT RELATED TO BUSINESS OR EXPENSES INCURRED FOR THE PERSONAL CONVENIENCE OF THE EMPLOYEE/PARTNER/ SHAREHOLDER CANNOT BE DEDUCTED FROM COMPENSATION. A FEDERAL K-1, PA RK-1 OR PA NRK-1. EXPENSES THAT ARE EXCESSIVE OR DO NOT QUALIFY AS ORDINARY AND REASONABLE EXPENSES CANNOT BE DEDUCTED FROM COMPENSATION. A FEDERAL K-1, PA RK-1 OR PA NRK1. YOUR TAX RETURN HAS BEEN ADJUSTED BECAUSE YOU FAILED TO RESPOND TO THE DEPARTMENT’S PREVIOUS REQUESTS FOR ADDITIONAL INFORMATION TO PROCESS YOUR RETURN. IF YOU HAVE ANY QUESTIONS CONCERNING THIS NOTICE, PLEASE CALL (717) 783-5250. FOR SERVICE FOR TAXPAYERS WITH SPECIAL HEARING AND SPEAKING NEEDS. TDD# 1-800-447-3020. OFFICE HOURS 8:00 A.M.- 4:00 P.M. YOU MAY ALSO WRITE TO: PA DEPARTMENT OF REVENUE, BUREAU OF INDIVIDUAL TAXES, PO BOX 280432, HARRISBURG PA 17128-0432. This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! REV-554 EO (07-08) (I) REV-554 EO (01-10 (07-08)) (I) REV-554 EO (07-08) (I) COMMONWEALTH OF PENNSYLVANIA, OF REVENUE DISCLOSURE STATEMENT DISCLOSURE STATEMENT: DEPARTMENT TAXPAYERS’ RIGHTS AND OBLIGATIONS COMMONWEALTH OF PENNSYLVANIA, DEPARTMENT OF REVENUE DISCLOSURE COMMONWEALTH OF PENNSYLVANIA, DEPARTMENT OF REVENUE DISCLOSURE STATEMENT STATEMENT OF THE DEPARTMENT OF REVENUE OF THE DEPARTMENT’S AND TAXPAYERS’ RIGHTS AND OBLIGATIONS OF THE DEPARTMENT’S AND TAXPAYERS’ RIGHTS AND OBLIGATIONS OF THE DEPARTMENT’S AND TAXPAYERS’ RIGHTS AND OBLIGATIONS It is the the obligation obligation of of all all taxpayers taxpayers in in the the Commonwealth Commonwealth to file all all tax tax returns returns and and pay pay all all taxes taxes to to which which they they are are subject. subject. However, However, It is It of taxpayers the Commonwealth to file all tax returns all taxes to they are subject. However, when Department determines ain return washas not filed or liability was pay nothas paid, may enforce tax law and collect a theobligation Department determines a required return been or a and liability notitbeen paid, it has rights granted byon law It is is the the obligation of all all taxpayersthat in required the Commonwealth to not file all taxafiled returns and pay all taxes to which which they are subject. However, when the determines that a not filed or a has been paid, has rights by taxpayer’s obligations. The Commonwealth areturn Taxpayers’ Billbeen of Rights, provides legal rights toitit the taxpayer and creates that how it may enforce tax andhas collect onhas a taxpayer’s obligations. In conjunction with the Department’s rights, the whendictate the Department Department determines thatlaw a required required return has not been filed or which a liability liability has not not been paid, has rights granted granted by law law that how it may enforce and collect on a obligations. In with the Department’s rights, obligations the ensure equity and fairness prevail tax administration and enforcement. Commonwealth has a Taxpayers’ Billlaw of Rights, which legalinrights on behalf of the taxpayer obligations for the that dictate dictatefor how it Department may enforcetotax tax law and collect onprovides a taxpayer’s taxpayer’s obligations. In conjunction conjunction withand thecreates Department’s rights, the Commonwealth has a Taxpayers’ Bill of Rights, which provides legal rights on behalf of the taxpayer and creates obligations Department so that and fairness these requirements are on enforced. Commonwealth hasequity a Taxpayers’ Bill ofcontrol Rights,how which provides legal rights behalf of the taxpayer and creates obligations for for the the Department equity control these requirements enforced. TAXPAYERS’ RIGHTS ANDhow THE DEPARTMENT’S OBLIGATIONS DURING AN AUDIT Department so so that that equity and and fairness fairness control how these requirements are are enforced. RIGHTS & THE DEPARTMENT’S OBLIGATIONS DURING AUDIT When examining aTAXPAYERS’ taxpayer’s books and records to determine if the appropriate tax liability has beenAN paid, the rights of a taxpayer TAXPAYERS’ RIGHTS & THE DEPARTMENT’S OBLIGATIONS DURING AN AUDIT RIGHTS &an THE OBLIGATIONS DURING AN AUDIT and theexamining obligations of the Department during audit are as follows: When aTAXPAYERS’ taxpayer’s books and records to DEPARTMENT’S determine if the appropriate tax liability has been paid, the rights of a taxpayer When examining a and records to if tax has paid, rights taxpayer the obligations of the Department during an audit are aascomplete follows: When examining a taxpayer’s taxpayer’s books and records to determine determine if the the appropriate appropriate taxofliability liability has been been paid, the rights of of athat taxpayer and The Department willbooks provide the taxpayer with explanation the audit process as the it relates to a and the obligations of the Department during an audit are as follows: of the Department during anduring auditwith are a ascomplete follows: explanation of the audit process as it relates to that and the individual taxpayer and his/her rights the process. obligations The Department will provide the taxpayer The Department will provide the taxpayer with a complete explanation of the process as to individual taxpayer his/her rights during The The Department Department willand provide taxpayer aprocess. complete explanation the audit audit processduring as it it relates relates to that that will prepare athe written basis with ofthe the assessment of any tax of liability determined the audit. individual taxpayer and his/her rights during the process. individual taxpayer and his/her rights during the process. The Department will prepare a written basis of the assessment of any tax liability determined during the audit. The Department will explain the taxpayer’s right toassessment appeal the assessment of anydetermined tax liability during determined during The Department will prepare a basis of of the the Theaudit. Department a written written basis right of the the of any any tax tax liability liability the audit. audit. The Department will will prepare explain the taxpayer’s toassessment appeal the assessment of anydetermined tax liability during determined during The Department will explain taxpayer’s right the of tax liability determined during the The Theaudit. Department will will conduct explain the the taxpayer’s right to to appeal appeal the aassessment assessment of any any liability during Department a post-audit conference, at which representative will tax explain thedetermined audit findings and the audit. the audit. recommendations on how to correct conference areas of noncompliance. make The Department will conduct a post-audit at which a representative will explain the audit findings and The Department will conduct a conference at make recommendations on how to correct areas manner. of noncompliance. The The Department Department will process conduct a post-audit post-audit at which which a a representative representative will will explain explain the the audit audit findings findings and and will the audit in a conference timely make recommendations on how to correct areas of noncompliance. make recommendations on how to correct areas of noncompliance. The Department will process the audit in a timely manner. in TAXPAYERS’ APPEAL RIGHTS The The Department Department will will process process the the audit audit in a a timely timely manner. manner. TAXPAYERS’ APPEAL To appeal any adverse decision of the Department, a taxpayer must file anRIGHTS appeal with the Board of Appeals. The Board of Appeals TAXPAYERS’ APPEAL RIGHTS will reviewany theadverse case asdecision provided by Department, the taxpayer. If the taxpayer satisfied withDepartment’s the decis ionBoard of theof Board, may To appeal of the TAXPAYERS’ a taxpayer must APPEAL fileisannot appeal RIGHTS with the Appeals.he/she The Board To appeal adverse decision of the a must file with the Board of The Board subsequently appeal to the Boardbyofthe Finance and IfRevenue. taxpayer is not satisfied with the outcome of the appeal to of willsubmit reviewan the case as taxpayer. the taxpayer is not satisfied with the decision of the Board, he/she may ToAppeals appeal any any adverse decision of provided the Department, Department, a taxpayer taxpayer must fileIfan ana appeal appeal with the Department’s Department’s Board of Appeals. Appeals. The Board of will review the case as by the taxpayer. the is not satisfied the of the he/she may the Board of and Revenue, anBoard appeal that decision maytaxpayer be filed Commonwealth Court Pennsylvania. subsequently submit to provided the Finance andIf If a taxpayer is not with satisfied with theof outcome of the appeal to of Appeals Appeals willFinance reviewan theappeal case as provided byofof the taxpayer. IfRevenue. the taxpayer iswith not the satisfied with the decision decision of the Board, Board, he/she may subsequently submit to and If taxpayer is with of the Board of Finance andappeal Revenue, anBoard appealof that decision may be filed the Commonwealth of outcome Pennsylvania. subsequently submit an an appeal to the the Board ofofFinance Finance and Revenue. Revenue. If a a with taxpayer is not not satisfied satisfied Court with the the outcome of the the appeal appeal to to the Board of Finance and Revenue, an appeal of that decision may be filed with the Commonwealth Court of Pennsylvania. APPEAL TO THE BOARD OF APPEALS the Board of Finance and Revenue, an appeal of that decision may be filed with the Commonwealth Court of Pennsylvania. An appeal must be received byOF theAPPEALS Board of Appeals within 90 days from the mailing date of the assessment or appraisement notice. APPEAL TO THE BOARD APPEAL THE BOARD OF APPEALS The specificTO number of days for each type of listedabelow. An appeal APPEAL TO must THE be received BOARD by OF the APPEALS Board of decision Appeals iswithin specific number of days from the mailing date of the assessment or An be by Board a number days from appraisement notice. The specific ofAppeals days forwithin each type of decision is of listed An appeal appeal must must be received received by the thenumber Board of of Appeals within a specific specific number of daysbelow. from the the mailing mailing date date of of the the assessment assessment or or TYPE number OF ADVERSE DECISION NUMBER OF DAYS appraisement notice. The specific of days for each type of decision is listed below. appraisement notice. The specific number of days for each type of decision is listed below. TYPE OF ADVERSE DECISION NUMBER OF DAYS Sales Tax Bond Notice 5 days TYPE OF ADVERSE DECISION NUMBER OF DAYS TYPE OF ADVERSE DECISION Personal Tax Jeopardy Assessment Sales TaxIncome Bond Notice Sales Tax Bond Notice Sales TaxIncome Bond Notice Personal Tax Jeopardy Assessment Personal Income Tax Assessment Personal Income Tax Jeopardy Jeopardy Assessment Corporation Tax Jeopardy Assessment Inheritance Tax Appraisement Inheritance Tax Appraisement Inheritance Tax Appraisement Inheritance Sales & UseTax Tax,Appraisement Fuel Use Tax, Liquid Fuels Tax, Malt Beverage Tax, Cigarette Tax, Sales & Use Tax, Fuel Use Tax, Liquid Tax, Malt Beverage Tax, Cigarette Tax, Corporation Tax, Motor Carrier Tax, Oil Fuels Franchise Tax, Personal Income Tax,Cigarette Salesand & Use Tax, Fuel Use Tax, Liquid Fuels Tax,Tax, MaltMalt Beverage Tax, Tax, Cigarette Tax, Tax, Sales Use Tax, Fuel Use Tax, Liquid Fuels Beverage Corporation Tax, Motor Carrier Tax, Oil Franchise Tax, Personal Income Tax, Employer Withholding Tax, Property Tax/Rent Rebate, Realty Transfer Tax Corporation Tax, Motor Carrier Tax, Oil Franchise Tax, Personal Income Tax, Corporation Motor Carrier Tax, Oil Franchise Tax, Personal Income Tax Employer Employer Withholding Withholding Tax, Tax, Property Property Tax/Rent Tax/Rent Rebate, Rebate, Realty Realty Transfer Transfer Tax Tax NUMBER OF DAYS 10 days 5 days 5 5 days days 10 days 10 days days 30 days (see10 P.S. § 7402.2) 6072 days 60 days 60 60 days days 90 days days 90 90 days days APPEAL TO APPEAL TO THE THE BOARD BOARD OF OF FINANCE FINANCEAND ANDREVENUE REVENUE APPEAL TO THE BOARD OF FINANCE AND REVENUE An be the Board of of Finance Revenue within a specific number of days from from the mailing date of the of Board An appeal appealmust must bereceived receivedbyby the Board Finance and Revenue within a specific number of days the mailing date the APPEAL TO THE BOARD OF FINANCE AND and REVENUE An appeal must be received by the Board of Finance and Revenue within a specific number of days from the mailing date of of Appeals’ decision. The specific number of days for each type of decision is listed below. Board of Appeals’ decision. The specific number of days for each type of decision is listed below. An appeal must be received by the Board of Finance and Revenue within a specific number of days from the mailing date of the the Board Board of of Appeals’ Appeals’ decision. decision. The The specific specific number number of of days days for for each each type type of of decision decision is is listed listed below. below. TYPE OF ADVERSE DECISION TYPE OF ADVERSE DECISION TYPE OF ADVERSE DECISION ADVERSE DECISION Sales and Use Tax, Fuel UseTYPE Tax, OF Liquid Fuels Tax, Malt Beverage Tax, Cigarette Tax, Sales & Use Tax, Fuel Use Tax, Liquid Fuels Tax, Malt Beverage Tax, Cigarette Tax, Corporation Tax, Motor Carrier Tax, Oil Franchise Tax, PersonalTax, Income Tax Tax, (including Sales Tax, Fuel Tax, Liquid Tax, Malt Beverage Corporation Carrier Oil Fuels Franchise Tax, Tax, Sales & & Use UseTax, Tax,Motor Fuel Use Use Tax,Tax, Liquid Fuels Tax, Tax, Malt Personal BeverageIncome Tax, Cigarette Cigarette jeopardy assessment), Employer Withholding Tax, Property Tax/Rent Rebate, Corporation Tax, Motor Carrier Tax, Oil Franchise Tax, Personal Income Tax, Employer Withholding Jeopardy, Tax/Rent Rebate,Income Realty Transfer Tax Corporation Tax, MotorTax, Carrier Tax, OilProperty Franchise Tax, Personal Tax, Realty Transfer Tax Tax, Jeopardy, Property Tax/Rent Rebate, Realty Transfer Tax Employer Employer Withholding Withholding Tax, Jeopardy, Property Tax/Rent Rebate, Realty Transfer Tax NUMBER OF DAYS NUMBER OF DAYS NUMBER NUMBER OF OF DAYS DAYS 90 days 90 days 90 90 days days To an appeal appeal to the the appropriate appropriate county county To appeal appeal an an Inheritance Tax Tax decision decision issued issued by by the the Board Board of of Appeals, Appeals, the the taxpayer taxpayer must file an To an Tax issued by Board of the taxpayer must file an appeal to Orphans’ at county courthouse days ofofthe ofofAppeals’ decision. Orphans’ Court at the the appropriate appropriate county courthouse within60 daysofofreceipt receipt theBoard Board Appeals’ decision. To appeal appealCourt an Inheritance Inheritance Tax decision decision issued by the the within Board of60Appeals, Appeals, the taxpayer must file an appeal to the the appropriate appropriate county county Orphans’ Orphans’ Court Court at at the the appropriate appropriate county county courthouse courthouse within within 60 60 days days of of receipt receipt of of the the Board Board of of Appeals’ Appeals’ decision. decision. APPEAL APPEAL TO TO COMMONWEALTH COMMONWEALTHCOURT COURT APPEAL TO COMMONWEALTH COURT An bebereceived byby Commonwealth within a specific number of days mailing date ofdate the Board Finance An appeal appealmust must received Commonwealth Court within a specific number of from days the from the mailing of theofBoard of APPEAL TO COMMONWEALTH COURT Court and Revenue decision. The specific number ofnumber daysCourt forofeach type ofspecific decision is decision listedofbelow. An appeal must be received by Commonwealth within a number days from the mailing date of the Board Finance and Revenue decision. The specific days for each type of is listed below. An appeal must be received by Commonwealth Court within a specific number of days from the mailing date of the Board of of Finance Finance and and Revenue Revenue decision. decision. The The specific specific number number of of days days for for each each type type of of decision decision is is listed listed below. below. TYPE OF ADVERSE DECISION TYPE OF ADVERSE DECISION ADVERSE Sales and Use Tax, Fuel UseTYPE Tax, OF Liquid Fuels DECISION Tax, Malt Beverage Tax, Cigarette Tax, TYPE OF ADVERSE DECISION Sales & UseTax, Tax,Motor Fuel Use Tax, Tax, LiquidOilFuels Tax, Malt Beverage Cigarette Corporation Carrier Franchise Tax, PersonalTax, Income Tax Tax, (including Sales & Use Tax, Fuel Use Tax, Liquid Fuels Tax, Malt Beverage Tax, Cigarette Tax, Corporation Tax, Motor Carrier Tax, Oil Franchise Tax, Personal Income Tax, Sales & Use Tax, Fuel Use Tax, Liquid Fuels Tax, Malt Beverage Tax, Cigarette Tax, jeopardy assessment), Employer Withholding Tax, Property Tax/Rent Rebate, Corporation Tax, Motor Carrier Tax, Franchise Tax, Tax, Employer Withholding Jeopardy, Tax/Rent Rebate,Income Realty Transfer Tax Corporation Tax,Tax MotorTax, Carrier Tax, Oil OilProperty Franchise Tax, Personal Personal Income Tax, Realty Transfer Employer Employer Withholding Withholding Tax, Tax, Jeopardy, Jeopardy, Property Property Tax/Rent Tax/Rent Rebate, Rebate, Realty Realty Transfer Transfer Tax Tax Inheritance Tax Inheritance Tax Inheritance Inheritance Tax Tax NUMBER OF DAYS NUMBER OF DAYS NUMBER NUMBER OF OF DAYS DAYS 30 days 30 days 30 30 days days 30 days 30 days 30 (From Orphans’ Court’s decision) 30 days days From Orphans’ Court’s decision (From Orphans’ (From Orphans’ Court’s Court’s decision) decision) This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! Petitions to the Board of Appeals may be filed online at www.boardofappeals.state.pa.us Petitions may also be mailed to the appropriate address listed below: BOARD OF APPEALS PO BOX 281021 HARRISBURG PA 17128-1021 BOARD OF FINANCE AND REVENUE TREASURY DEPARTMENT SUITE 400 1101 S FRONT ST HARRISBURG PA 17104-2539 COMMONWEALTH COURT OF PA COMMONWEALTH AVE AND WALNUT ST 624 IRVIS OFFICE BUILDING HARRISBURG PA 17120 TAXPAYERS’ PROCEDURE FOR REFUNDS OF OVERPAID TAX If a taxpayer determines he/she overpaid taxes or paid tax to which he/she is not subject, a petition for refund must be filed within three years of the date of payment. If payment(s) is/are made in full as a result of an assessment, a petition for refund must be filed within six months of the date of the assessment. All petitions for a refund, except Liquid Fuels Tax refunds, are filed with the Board of Appeals. TAXPAYERS’ COMPLAINTS If a taxpayer has a complaint about an action the Department took in regard to Personal Income Taxes, Employer Withholding or Inheritance Tax, the Department’s Taxpayers’ Rights Advocate may be contacted at the following address: PA DEPARTMENT OF REVENUE TAXPAYERS’ RIGHTS ADVOCATE LOBBY, STRAWBERRY SQUARE HARRISBURG PA 17128 The Advocate will then facilitate the resolution of the complaint by working with appropriate Department personnel or issuing an assistance order requested by the taxpayer and warranted. DEPARTMENT’S ENFORCEMENT METHODS If a taxpayer has not paid a tax liability nor filed a timely appeal of the liability, the Department may take the following actions: Contact a delinquent taxpayer and attempt to resolve the liability through payment in full, payment plan or compromise. Submit a request to have the taxpayer’s federal Personal Income Tax refund applied to his/her delinquent Pennsylvania Personal Income Tax liability. Employ private collection agencies to collect delinquent taxes. Under Act 40 of 2005, additional collection costs, including but not limited to fees of up to 39 percent of the amount due and attorney fees incurred in securing payment, may be imposed on any liability not paid prior to referral to a collection agency or contract counsel. Deny issuing of a tax clearance certificate to a taxpayer applying for or requesting renewal of a liquor, lottery, cigarette or small games of chance license. The Department may also deny issuing a tax clearance certificate to a taxpayer seeking clearance for a Commonwealth contract or a corporate bulk sale clearance certificate. Deny the initial issuance of or revoke a Sales Tax license if delinquencies exist in the licensee’s account. If a business makes taxable sales without a valid Sales Tax license, the Department may file a formal criminal complaint. Department of Revenue enforcement agents may issue citations to people who sell or lease items subject to PA Sales Tax without a valid Pennsylvania Sales Tax license. Disclose, by publication or otherwise, the identity of any person whose Sales Tax license was refused, suspended or revoked. File a lien against the taxpayer and, in some cases, against the person responsible for payment of the delinquent tax. The Office of Attorney General may file an action to seize the liened property of a taxpayer. Disclose, by publication or otherwise, the taxpayer’s name or business name and liability information as a result of a lien recorded in a county Prothonotary’s Office. Garnish andndividual’s wages for delinquent taxes owed to the Commonwealth. When an Inheritance Tax return was not filed or Inheritance Tax was not paid, the Department may file a petition for citation against the personal representative of the decedent’s estate, which requires the representative to file the return, pay the tax or appear before the Orphans’ Court. Investigate and advance, through the Courts of Common Pleas, actions against delinquent taxpayers violating criminal statutes. This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! Interest is calculated on a daily basis using the following formula: INTEREST = LATE OR UNPAID TAX x NUMBER OF DAYS x APPLICABLE DAILY INTEREST RATE Outstanding taxes due on or before Dec. 31, 1981 will bear interest at the old rates and using the old calculation methods governed by individual laws and regulations for each of the various taxes. This Pennsylvania Tax Notice Letter sample is provided by TaxAudit.com, the nation’s leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Received an Audit Notice? We can help! December 2009 INTEREST RATE AND CALCULATION METHOD FOR ALL TAXES DUE AFTER JAN. 1, 1982 EVENUE DISCLOSURE STATEMENT ENUE DISCLOSURE STATEMENT E STATEMENT The PA Department of Revenue will calculate daily interest using an annual interest rate, which varies by calendar year. The following TS AND OBLIGATIONS S AND OBLIGATIONS NS interest rates are applied on any outstanding tax balance originally due on or after Jan. 1, 1982 and on delinquent taxes originally due duringthey the are years indicated below: pay all taxes to which subject. However, yare allsubject. taxes toHowever, which they are subject. However, lity has not been paid, it has rights grantedby bylaw law Daily Rate Calendar Year Interest Rate has notgranted been paid, it has rights granted rights by law In conjunction with the Department’srights, rights,the the conjunction with the Department’s partment’s rights, the 2010 4% alf of the taxpayer and creates obligationsforforthe the 0.000110 of the taxpayer and obligations tes obligations for thecreates 2009 5% 0.000137 ed. 2008 7% 0.000192 TIONS DURING AN AUDIT AN 2007 8% 0.000219 ONS DURING AUDIT DIT ax liability has been paid, rights taxpayer 0.000192 paid, 2006 7% liability thethe rights ofof a ataxpayer e rightshas of abeen taxpayer 2005 5% 0.000137 n of the audit process as it relates to that f relates the audit process as it relates to that 2004 4% 0.000110 to that 2003 5% 0.000137 tax liability determined during the audit. xng liability determined during the audit.6% the audit. 2002 0.000164 ment of any tax liability determined during nt of anyduring tax liability determined during 2001 9% 0.000247 ermined 2000 8% 0.000219 sentative will explain the audit findings and tative will explain the audit findings and dit findings and REV-1611 AD+ (1209) S ith the Department’s Board of Appeals. The Board Department’s Boardofofthe Appeals. Board ofthe Appeals. Board atisfied with The the decision Board,The he/she may fied withsatisfied the decision of the Board, mayto he he/she may r isBoard, not with the outcome ofhe/she the appeal not satisfied with the outcome of the appeal to come of the appeal to of Commonwealth Court Pennsylvania. mmonwealth Court of Pennsylvania. nnsylvania. days from the mailing date of the assessment or tedthe below. ys from the mailing or date of the assessment or of assessment d below. OF DAYS ays NUMBER OF DAYS NUMBER OF DAYS 5 days 5 10 days days days 1060 days days 60 days days 90 days days 90 days ific number of days from the mailing date of the n is listed below. days enumber mailingofdate of from the the mailing date of the listed below. NUMBER OF DAYS OF DAYS NUMBER OF DAYS 90 days days 90 days yer must file an appeal to the appropriate county the Board of Appeals’ decision. file an appeal hemust appropriate countyto the appropriate county e Board of Appeals’ decision. sion. r of days from the mailing date of the Board of ision is listed below. fdate daysoffrom the mailing date of the Board of the Board of on is listed below. NUMBER OF DAYS OF DAYS NUMBER OF DAYS 30 days 30 days 30 days (From Orphans’ Court’s decision) 30 days days (From Orphans’ Court’s decision) Court’s decision) days Charged From 1/1/10 - 12/31/10 1/1/09 - 12/31/09 1/1/08 - 12/31/08 1/1/07 - 12/31/07 1/1/06 - 12/31/06 1/1/05 - 12/31/05 1/1/04 - 12/31/04 1/1/03 - 12/31/03 1/1/02 - 12/31/02 1/1/01 - 12/31/01 1/1/00 - 12/31/00 Calendar Year 1999 1995 - 1998 1993 - 1994 1992 1988 - 1991 1987 1986 1985 1984 1983 1982 SEE REVERSE SIDE Interest Rate 7% 9% 7% 9% 11% 9% 10% 13% 11% 16% 20% Daily Rate 0.000192 0.000247 0.000192 0.000247 0.000301 0.000247 0.000274 0.000356 0.000301 0.000438 0.000548 Charged From 1/1/99 1/1/95 1/1/93 1/1/92 1/1/88 1/1/87 1/1/86 1/1/85 1/1/84 1/1/83 1/1/82 - 12/31/99 12/31/98 12/31/94 12/31/92 12/31/91 12/31/87 12/31/86 12/31/85 12/31/84 12/31/83 12/31/82

© Copyright 2026