dr. ratajczak's weekly economic commentary

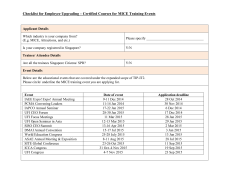

DR. RATAJCZAK’S WEEKLY ECONOMIC COMMENTARY December 1, 2014 ECONOMIC INDICATORS FOR THE WEEK BEGINNING DECEMBER 1, 2014 Date Announcement Estimate Last Announcement 12/02/14 Construction Spending 0.6% $956.63 Oct -0.4% $950.92 Sep 12/05/14 Payroll Employment 200 139,880 Nov 214 139,680 Oct 12/05/14 Civilian Unemployment Rate 5.7% Nov 5.8% Oct 12/05/14 Manufacturers'-Shipments -0.4% $ 501.41 Oct 0.1% $ 503.42 Sep 12/05/14 -Inventories 0.2% $ 656.50 Oct 0.2% $ 655.19 Sep 12/05/14 -Orders -0.4% $ 497.40 Oct -0.6% $ 499.40 Sep 12/05/14 Consumer Installment Debt 5.5% a.r. $3,281.97 Oct 5.9% a.r. $3,267.00 Sep 12/05/14 Trade-Deficit $ (39,400) Oct $ (43,032) Sep 12/05/14 Goods-Exports 0.1% $ 136,209 Oct -1.9% $ 136,073 Sep 12/05/14 -Imports -1.8% $ 195,167 Oct -0.1% $ 198,744 Sep 12/05/14 Services-Exports 0.2% $ 59,631 Oct -0.7% $ 59,512 Sep 12/05/14 -Imports 0.5% $ 40,073 Oct 0.5% $ 39,874 Sep Changes denoted by bold type. All percent changes are from the previous period unless the next column shows a.r. which means the percentage change then is the annual rate. Payroll changes are in thousands, not percentages. WEEKLY COMMENTARY FOR WEEK BEGINNING DECEMBER 1, 2014 COMMENTARY - There are many economic stories this week, but none more significant than OPEC, who could not decide how to share production cuts and therefore chose not to even try. Therefore, Libyan production probably will rise (depending upon militant controls of ports or oil fields), Iraq production also will rise, Iran will remain on hold at current levels while it continues talks about nuclear development, and most importantly, U.S. production will continue growing well into next year even as capacity growth slows from 10% to zero gain by next fall. In short, a world that already is oversupplied by about 1.5 mbd will need to absorb another 1.5 mbd by next fall before production stalls. Because of slow growth in Europe, China and Japan, the world is only increasing its absorption by less than a million barrels a day per year. Unless something drastic happens to supply or demand jumps sharply, the world can be oversupplied into 2016. Certainly, price reductions will increase quantities demanded. Even with a very low price elasticity in the short run (about 0.15), the 30% plunge in prices should lead to a 4% gain in consumption from where it otherwise would be. Unfortunately, slow economic growth puts downward pressure on where demand otherwise would be. In the U.S., gasoline consumption already has reversed direction, growing 3% or 0.3 mbd from last year levels in recent weeks. I expect to see further gains in consumption as gasoline prices fall toward $2.50 at the gas pump. Indeed, the current oil price of $70 a barrel may induce enough additional demand to eliminate the oversupply that is developing. In the meantime, more than a billion barrels of crude and oil product are suffering large inventory losses around the world. The size of the losses may even compromise a few lending institutions (though this is much smaller than the housing price collapse and should only impact a few institutions). Already producing wells will not be impacted (the lift costs are far below these oil prices), but new exploration will slow dramatically. This year’s production budget in the U.S. assumed $85 oil. At $70, more than a third of that “Dr. Ratajczak's Weekly Economic Commentary” is prepared by Dr. Donald Ratajczak, PhD., Raymond James & Associates, Inc. Fixed Income Consulting Economist. This report is a transcript of comments made by Dr. Ratajczak and should be read in that context. Additional information is available upon request. The information contained herein is based on sources considered to be reliable but is not represented to be complete and its accuracy is not guaranteed. The opinions expressed herein reflect the judgment of the author at this date and are subject to change without notice and are not a complete analysis of every material fact respecting any company, industry or security Raymond James & Associates, Inc. and affiliates and their officers, directors, shareholders and employees and members of their families may make investments in a company or securities mentioned herein before, after or concurrently with the publication of this report. Raymond James & Associates, Inc. may from time to time perform or seek to perform investment banking or other services for, or solicit investment banking or other services from any company, person or entities mentioned herein. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any security. Raymond James & Associates, Inc. makes no representation as to the legal, tax, credit, or accounting treatment of any transactions mentioned herein, or any other effects such transactions may have on you and your affiliates or any other parties to such transactions and their respective affiliates. You should consult with your own advisors as to such matters. Page 1 of 8 production would not have occurred. Until oil prices find a floor, even more production will be curtailed. Some small oil service companies may not survive in this environment, especially if they used debt to expand during the boom. Despite the negative impact upon oil exploration (which added 0.8 percentage points to the growth of U.S. industrial capacity in the past year), more good than bad should come from this oil price decline in the U.S. and around the world. To be sure, the impact will not be as large as in 1986, when a plunge in prices from $28 to $10 basically saved the U.S. economy from recession. As a much smaller percentage importer, the impact in the U.S. will be much smaller. However, Europe should gain from the price reductions despite fears that this will create deflation (it might, but only temporarily and it does put more jingle into European pockets unless you are Britain or Norway). It also should be a boon to most developing countries though Russia and Brazil must be accepted as major oil producers. It does not solve the deflation problem in Japan, but it certainly aids consumers there. China also is a major beneficiary. Indeed, the selloff in emerging markets on Friday almost certainly was misguided, though Brazil is 12% of the emerging market index. Although I have pegged $70 as an equilibrium price for oil under current conditions, prices certainly could fall further as desired inventory levels are slashed (or some are forced to sell to cover collateral calls, which will intensify after the annual review of oil property values following the end of the year). Such declines should be temporary, however, and should be exhausted soon after the New Year. Overall, the U.S. investors appear to be on target by raising the value of American enterprises because of falling oil prices. Some countries, such as producers in the Middle East, European producers, Canada, Brazil, and Russia, certainly will suffer. However, the emerging engines of India and China as well as most of Europe and even the U.S. should benefit on balance from falling oil prices. If I were an IMF forecaster, I would be adding to my growth estimates, not subtracting from them. As a U.S. forecaster, I will be adding a few tenths to my 2015 projections even as I cut my inflation and long term interest rates. The Case-Shiller index of home prices also was released this week. It showed a continued slowing in price gains for homes. Price increases now are slightly under 5% higher than a year ago. In the long run, housing prices tend to rise with inflation. Any excess returns either occur during booms that are subsequently erased, as we saw in this latest cycle; or from tax incentives as mortgage interest is deducted from taxable income. I would not be surprised to see this index growing only 2% by the end of next year. Income and consumption revisions also changed the savings rate as well as the growth of spending entering the fourth quarter. I will touch on those revisions under consumer activity. However, at 5%, the savings rate no longer is adequate to sustain current living standards in the future. Thus, I would be cutting my estimates of consumer growth for next year if not for the fall in oil prices. GDP - The second GDP estimate for the third quarter was a surprise to the upside as more consumption, less inventory reduction and more capital spending offset less strength in the trade accounts. Inflation also was slightly higher than expected. As most of the income components already were reported, this upward gain in nominal GDP flowed into corporate profits. Operating profits jumped a surprisingly strong 3.2%, which certainly will add to my equilibrium stock market projections in the next monthly summary. Because of a reduction in inventory profits, which will intensify next quarter for oil companies, after tax profits grew much slower and might even fall next quarter. Auto sales should grow slightly faster during the fall though some of that gain will be offset by slower growth in recreational goods and vehicles. Gasoline consumption is turning positive and should add a tenth to GDP growth even as grocery sales begin to rebound. Also, services will grow more vigorously as cold weather came early. Instead of a negative .23 percentage contribution to growth, utilities should provide a positive 0.2 percentage contribution. Financial services may grow more slowly, but not slow enough to offset gains in utility consumption. As a result, consumption should provide about 1.8 percentage points to growth in the fourth quarter or about 0.3 percentage points more than during the summer. Fixed investment appears to be growing about the same as during the summer as slower growth in industrial and transportation equipment are offset by stronger gains in construction for both housing and structures. Inventory investment should subtract modestly from economic growth as desired oil product inventories are slashed even as other inventories rise modestly. I see modest growth in exports, but even more growth in non-petroleum imports. So far, I am unclear as to the imports of crude petroleum, but expect it to decline. Nevertheless, trade probably will subtract from GDP growth after adding nearly 0.8 percentage points during the summer. ® RAYMOND JAMES Page 2 of 8 I expect government to provide further modest gains as some of those strong defense orders become shipments during the quarter. Also, state and local governments should be spending some on infrastructure projects as financing appears to be available. About a 1.3 percentage point reduction in contributions to growth from trade and government should be only partially offset by stronger gains in consumption. Inflation will be substantially lower than during the summer because of falling oil prices though core prices will be growing within the Fed target range (though at the lower end). Profits will be challenged by returns from the rest of the world because of the strong dollar and by petroleum activity. Combined, they probably will take away about $60 billion from their third quarter levels. Despite some problems with petroleum loans, the financial sector should be able to add about another $30 billion to their profits. Utilities should show moderate gains while durable manufacturing might repeat the strong profit gains of the spring. I doubt that information can provide the strong gains of earlier in the year, but trade should do better than during the summer. While I expect overall profits to show little change, the drop in inventory profit suggests that operating profits will achieve moderate gains during the fall. However, the profit margins should contract modestly from the 10.8% that was achieved for nonfinancial domestic corporate business in the summer. EMPLOYMENT - A further increase in claims led me to cut my payroll employment estimates further to 200,000. This would be a surprise that is not anticipated in the markets. An increase of 21,000 in claims during the week after the survey (though with some impact on that survey) caused the adjustment. The four week average was down 17,750, which suggests some recalls. However, I wanted to register my concern that employment growth is slowing by cutting the payroll estimates. Aside from a large fluctuation in California, six other states showed more than a thousand decline in claims for the previous week. New Jersey, Pennsylvania and Oregon topped that list with lodging and food services being cited most often. Five states had increases of more than a thousand with Montana and Colorado citing weather conditions for their layoffs. My guess is that some of the New York weakness also was weather related. While the cause of the slower growth in payrolls may be temporary because of weather conditions, it still needs to be registered in the estimates. BUSINESS ACTIVITY - Take out a $1.7 billion, or 45%, increase in orders for defense aircraft and parts and the durable goods report becomes disappointing. Boeing plane orders fell from 107 to 44 though the dollar amounts appear to be largely unchanged. Communications orders partially rebounded from a disappointing decline in September. That plus a modest gain in motor vehicle orders were the bright spots in the durables report. Appliances, computers, machinery, and primary metals all suffered large declines in orders. I expect defense to reverse direction though gains are anticipated in other sectors. If not, I will need to slash my estimates for capital spending in the quarter. The backlog continued to grow, but at a slower rate than inventory. Aside from the goods in process, inventory appeared excessive in motor vehicles. Metals inventories also were beginning to provide some concerns. Computers, on the other hand, appear to be rebounding following early year sluggishness. As I am expecting a large price decline for petroleum products, which might also lead to some softness in chemical prices, I am assuming that manufacturing shipments and orders will fall while inventories will grow about half as fast as the inventory gains for durable goods. Price declines for petroleum and chemicals should hold down business sales, but slightly higher durable inventories than I expected caused me to raise my estimates of business inventories. In light of falling petroleum prices, inventory probably is excessive at these sales levels, though a major inventory adjustment is not required at this time. CONSTRUCTION ACTIVITY - After a downward revision, housing sales were able to beat previous month levels. Inventory is now near normal at 5.6 months of sales. However, sales after completion are at a lean 3 months, which should allow some financing and further building of homes. The median price is up 15.4%, but this is because the fastest growing sales segment is $750,000 and above. Most of the sales strength is in the Midwest as both the South and the West had sales declines for the month. Except in the Midwest, sales did not change very much. I saw no reason to change my estimates of housing starts based upon this growth in sales from a lower base. I also believe sales will continue to slowly increase, although I am watching the weather, especially in the Midwest. ® RAYMOND JAMES Page 3 of 8 CONSUMER ACTIVITY - Downward revisions in income along with modest gains in consumer spending led to lower savings rates than had originally been projected. As a result, the savings rate no longer is consistent with maintaining living standards in the future. This means that I would expect slower growth in spending than income for next year. I am concerned about the failure of wages and salaries to reflect the extended hours worked. Will this mean another downward revision in hours worked, as happened last month? Or are the income estimates wrong this time? I am opting to assume hours are wrong, which will mean a downward revision in real earnings and the household capacity to spend. Of course, falling oil prices will offset that, so I am not making large changes in my consumption estimates. Aside from the slower than anticipated growth in wage income, transfer payments showed a rare decline as medical transfers were lower than the month before. I do not expect a repeat of that dip, but am not sure how to handle the wage component. Therefore, I modestly accelerated the growth of income for November. Given the shift in weather (natural gas draws began a week early this year) as well as my retail projections, I am assuming some modest acceleration in consumption. Despite the need to build savings, these estimates suggest that savings will not change in November. The core inflation rate over the previous year accelerated modestly as a result of those mildly disappointing inflation reports. I do not see further disappointment in the core for November while headline inflation should disappear. With the core neither drifting lower nor accelerating, the Fed can hold its ground on policy changes at this time. PRICES - Finally, no surprise occurred in agricultural prices. Crop prices were unchanged while livestock prices fell. However, the change in mix as well as seasonal factors led to a 2% gain for the index. I expect further weakness in livestock prices and little change in crop prices for December. If so, a slight drop in agricultural prices is likely. Farm incomes remain stressed, but the parity ratio rose as production costs also declined (they use fuel too). The dip in farm income is much smaller during this quarter than was estimated for the summer. As no change in crop prices was expected, no change in export or import prices or in the other price indices is required. INDICATORS - It appears that October’s enthusiasm was the aberration. Expectations fell as much in November as they rose in October. Perceptions of current conditions also eroded despite evidence that current conditions were improving. Could the public believe those political ads rather than the economic news? At any rate, I must believe that falling gasoline prices and lower unemployment rates will aid current perceptions next month. I also believe expectations will improve, though I don’t see why anyone is enamored by our leadership in Washington (choose the Congress or the White House depending upon your political allegiance). MONETARY ACTIVITY - M1 continued the pattern of a plunge in demand deposits, but an acceleration in currency despite falling fuel prices. I still have no explanation for why currency is growing so strongly. Other checkable deposits saw modest gains at both commercial and thrift institutions. Could those demand deposit declines reflect lower loan activity? I am assuming a rebound in those deposits despite the approach of the holiday. Commercial banks continued to grow their savings deposits, but the thrifts showed minimal gains. The thrifts continued to hold their CDs while time deposits continued to drift lower for commercial banks. Precautionary balances other than those savings deposits were largely unchanged for a second week. The money growth spans remain unusually low with M2 growing only 4.2% at annual rates in the last thirteen weeks. This is not sufficient to support above trend growth and maintain current inflation levels. Falling oil prices are lowering inflation at this time, so real balances have not yet been squeezed. The Fed need not rush to withdraw support for the economy under these conditions. INTEREST RATES - The decline in oil prices unquestionably will lower inflation rates around the world in the next few months. As transportation is in core inflation rates, some moderation in the core also is likely. Under these circumstances, the governments fighting deflation, such as the ECB and the BOJ will become bolder in their stimulus programs. When Italy is borrowing 15 basis points under the U.S. treasury for ten year sovereign debt, it is hard to envision a rise in U.S. interest rates. To be sure, a floor will develop under oil prices and inflation rates will begin to rise again, but that clearly is months away. I am certain that current conditions will encourage more ease where stimulus already has been contemplated, but will it delay rate ® RAYMOND JAMES Page 4 of 8 increases in the U.S.? I am assuming it will not, as our growth rates are well above sustainable rates and unemployment continues to fall. However, long term yields will be slower to rise in this inflationary environment than I had expected. Therefore, I have flattened the yield curves even as short term rates rise in the second half of next year. In the meantime, treasury rates have fallen faster than tax exempts. I can see the tax exempt as a favored place in the bond market until more reasonable spreads are reestablished between the taxable treasuries and the tax exempt municipals. Why should the ten year tax exempt yield six basis points more than the ten year treasury? CURRENCY ACTIVITY - While equity investors are not sure that falling energy prices are good for Europe (though it is other than for the North Sea producers), the currency markets were more confident. The euro rallied, although the North Sea production held back the pound. Oil prices also caused the Canadian dollar to fall sharply, as their shale production almost certainly will be impacted by current oil prices. (Will the Keystone pipeline carry much oil when it is completed? At current prices, that oil better be Bakken rather than Alberta stuff.) Canada needs oil price stability to strengthen the loonie. Despite obvious Japanese benefits from falling oil prices, the yen fell further. I now see the target as 120, but doubt that it will go much higher (but you heard that at higher yen values). The dollar is now very strong and probably should begin to ease. Of course, an oil price exists that will stop expansion of oil production in the U.S., but production in Canada will stop first. At current trade deficits, too many dollars are being distributed abroad, but no one cares until oil prices stabilize. EQUITIES - Another week, another record for many stock indices. At least the rate of ascent has slowed from a clearly unsustainable 60% annualized rate to a more manageable gain in the small teens. The Nasdaq was the champ with a gain of well over 1.6%. The S&P gained 0.24% while the Dow and the Russell 2000 eked out minor gains. Large stocks showed the greatest variability with growth up 0.75%, but value down 0.8%. Both growth and value fell for midcap stocks, but value fell harder. Small caps showed minimal gains with value doing better than growth, but worse than the S&P. These patterns reflect a market looking for direction. It could be a topping pattern or merely a pause before new leadership emerges (or has emerged in technology). Bonds had a banner week with long treasuries gaining even more than technology stocks. Long corporates did nearly as well. TIPs, mortgage backed and municipal bonds all improved, but were left far behind the long issues. Lower inflation, especially because of oil, clearly aided the bond investors. Internationally, the Chinese markets went wild, clearly sensing the significance of low oil prices to their economy. Shanghai stocks rose nearly 8% in local currency. The Hang Seng jumped well over 2%, although that gain was halved after adjusting for the soaring dollar. By contrast, the Nikkei could only register a small gain, which did not even reflect the change in the yen’s value even though Japan should also benefit from low energy prices. The DAX was the big European winner while the FTSE lagged (because they are oil exporters). Latin America, more than half of which is Brazil, was the biggest loser though the oil producing Canadian markets were not far behind. India continued to outperform as a major oil consumer. In general, oil producers suffered while oil consumers gained, though Japan clearly was an exception to that. Although oil was the biggest change, the largest sector loss was in basic materials. A strong dollar clearly impacted the sector, but the rally in China suggests that selling may be overdone, especially in some of the metals. Energy clearly was a loser as well, though the declines were much less than I would have expected from the drop in oil prices. Perhaps further downward adjustments will occur this week as full trading resumes following the holidays. The weakness in industrials was more of a surprise. Lower interest rates should encourage home building, although the sales of new homes were disappointing. Price changes for homes also were less than expected. Having industrials as one of the laggards is a red flag that might indicate topping in stocks (though I believe investors are hoping for an 18,000 Dow). Consumer discretion was a leader as investors thought that lower oil prices meant stronger consumer activity. Indeed, despite a strong dollar, the consumer staples also were among the better performers. Technology also was a strong performer, as the Nasdaq suggests. Consumer technology clearly was favored in the group. This might continue through Christmas. While interest rates were falling, the interest sensitive stocks were mixed. Real estate did well, gaining more than 1.6%. However, utilities lagged with increases of only half a percent despite signs that production will be strong because of the weather. ® RAYMOND JAMES Page 5 of 8 Healthcare continued to be among the leaders. Current enrollments for affordable care appear to be down, but the process is operating seamlessly (or nearly so). Also, pharmaceuticals continue to gain from new drugs (an Ebola vaccine may be available soon) and mergers. The merger premiums eventually will go away, so some caution is warranted in the sector. Communications services also shared in the gains, probably because more consumer technology may mean more service revenues. Of course, that has not been true recently, but investors continue to hope. Finally, financial services continue to struggle. A flatter yield curve is not a desired outcome for the sector, but that appears to be what is facing the sector in 2015. I cannot see leadership status for the group at this time. The worst performer, basic materials, fell 3.2%. The best performer, consumer discretion, rose 2.1%. While I am surprised that basic materials did worse than energy, this attempt to change sector values because of the change in oil prices is healthy and denotes a market that is trying to create relevant prices for an unexpected changing event such as in the oil markets. However, weakness in the industrials is worrisome and could suggest some problems ahead. ® RAYMOND JAMES Page 6 of 8 ECONOMIC INDICATORS FOR THE WEEK BEGINNING DECEMBER 1, 2014 2014 2015 2016 Ann. Ann. Ann. Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 H1 H2 2013 2014 2015 0.05 0.03 0.02 0.01 0.03 0.07 0.28 0.56 0.88 1.47 0.06 0.03 0.24 91-Day Bills 3.25 3.25 3.25 3.25 3.25 3.25 3.36 3.62 4.07 4.59 3.25 3.25 3.37 Prime Rate 0.09 0.09 0.09 0.10 0.10 0.14 0.23 0.57 1.05 1.58 0.11 0.09 0.26 Fed. Funds 0.36 0.42 0.52 0.51 0.58 0.66 0.78 0.93 1.38 1.85 0.31 0.45 0.74 2-Yr. Note 1.56 1.66 1.47 1.60 1.62 1.69 1.78 1.85 2.16 2.62 1.18 1.57 1.74 5-Yr. Note 2.71 2.62 2.50 2.29 2.36 2.50 2.64 2.83 3.15 3.52 2.35 2.53 2.58 10-Yr. Note 3.65 3.44 3.26 3.03 3.07 3.23 3.38 3.55 3.88 4.39 3.45 3.35 3.31 30-Yr. Bond 4.47 4.22 4.11 3.98 4.03 4.18 4.35 4.52 4.80 5.26 4.24 4.20 4.27 Aaa 5.17 4.82 4.74 4.82 4.89 5.05 5.24 5.43 5.72 6.21 5.10 4.89 5.15 Baa 1848 1900 1976 2035 2059 2107 2136 2194 2286 2390 1643 1940 2124 S&P 16243 16604 16954 17746 17863 18156 18349 18842 19767 20653 14993 16887 18303 Dow Jones 4243 4196 4484 4692 4826 4892 4968 5109 5342 5597 3538 4404 4949 NASDAQ Aaa and Baa corporate bond yields represent Dr. Ratajczak’s forecast of Moody’s index of longer-dated seasoned corporate bonds with maturities ranging between 20 and 30 years. SHORT TERM FINANCIAL PROJECTIONS Past Week This Week 30 Days 60 Days Federal Funds 0.10 0.10 0.10 0.11 Commer. Paper Aaa 0.09 0.10 0.10 0.11 10-Yr Treasury 2.26 2.15 2.24 2.33 30-Yr Treasury 2.96 2.89 2.99 3.09 3.85 3.77 3.84 3.92 Baa 4.69 4.63 4.72 4.80 Blm. 30 Yr Muni 3.21 3.15 3.22 3.30 3.99 17828 * 3.96 17856 * 4.01 17923 4.10 17742 2068 * 2074 * 2087 2060 4792 * 4813 * 4832 4805 Blm. 30 Yr. Mtg. Dow Jones S&P NASDAQ *Friday midday CURRENCY MARKETS Euro Pound Yen Canadian Broad Index Friday Next Week End of 2014 End of 2015 1.244 1.562 118.6 1.143 108.5 1.245 1.563 119.0 1.145 108.6 1.241 1.563 119.5 1.143 108.5 1.263 1.588 115.5 1.145 107.3 MONEY MEASURES M-1 M-2 ® RAYMOND JAMES -14.7 15.0 11.9 25.3 13 week annual rate 2.2% 13 week annual rate 4.1% Page 7 of 8 Ann. 2016 1.18 4.33 1.32 1.62 2.39 3.34 4.14 5.03 5.97 2338 20210 5470 Date 12/11/14 12/11/14 12/11/14 12/11/14 12/11/14 12/11/14 12/11/14 ECONOMIC INDICATORS FOR THE WEEK BEGINNING DECEMBER 1, 2014 Announcement Estimate Last Announcement Business Inventories 0.2% $ 1,759.61 Oct 0.3% $ 1,756.10 -Sales 0.0% $ 1,352.58 Oct 0.0% $ 1,352.52 Retail Sales 0.3% $ 445.82 Nov 0.3% $ 444.49 Nonauto Retail Sales 0.2% $ 355.54 Nov 0.3% $ 354.83 Import Prices -0.8% 135.31 Nov -1.3% 136.40 - Less Fuel -0.2% 119.16 Nov -0.2% 119.40 Export Prices -0.4% 130.08 Nov -1.0% 130.60 12/11/14 - Less Food and Fuel -0.1% 101.80 Nov -0.4% 101.90 12/11/14 Monthly-M1 0.1% $2,857.15 Nov -0.1% $2,854.30 12/11/14 -M2 0.4% $11,557.35 Nov 0.3% $11,511.30 12/12/14 Producer Price Index -0.3% 111.07 Nov 0.2% 111.40 12/12/14 PPI less food and energy -0.1% 108.79 Nov 0.4% 108.90 12/15/14 Industrial Production 0.4% 105.32 Nov -0.1% 104.90 12/15/14 Capacity Utilization rate 0.1% 78.98 Nov -0.4% 78.90 12/16/14 Housing -Starts 4.3% 1.053 Nov -2.8% 1.009 12/16/14 -Single Family 1.3% 0.705 Nov 4.2% 0.696 12/16/14 -Multi Family 10.4% 0.348 Nov -14.9% 0.315 12/16/14 -Permits -2.6% 1.052 Nov 4.8% 1.080 12/17/14 Real Weekly Earnings 0.2% $ 358.45 Nov 0.4% $ 357.73 12/17/14 Consumer Price Index 0.0% 238.70 Nov 0.0% 238.70 12/17/14 CPI less food and energy 0.2% 239.28 Nov 0.2% 238.80 12/18/14 Leading Indicators 0.6% 105.83 Nov 0.9% 105.20 12/23/14 GDP - Real (Q) 2.8% a.r. $16,277.25 IV 3.9% $16,164.10 12/23/14 Implicit Price Deflator (Q) 0.9% a.r. 108.85 IV 1.4% a.r. 108.61 12/23/14 Chain-Type Price Index (Q) 0.9% a.r. 108.89 IV 1.4% a.r. 108.65 12/23/14 After-Tax Corp. Profits (Q) -0.1% $1,870.83 IV 1.7% $1,872.70 12/23/14 After-Tax Oper. Profits (Q) 1.3% $1,566.91 IV 3.2% $1,546.80 12/23/14 Durable Goods-Shipments 0.3% $ 247.20 Nov 0.1% $ 246.46 12/23/14 -Orders -0.5% $ 242.59 Nov 0.4% $ 243.81 12/23/14 Nondefense Capital Orders 1.7% $ 83.56 Nov -0.1% $ 82.16 12/23/14 New Single Family Sales 2.1% 0.468 Nov 0.7% 0.458 12/23/14 Personal Income 0.3% $14,912.90 Nov 0.2% $14,868.30 12/23/14 Personal Consumption 0.3% $12,060.17 Nov 0.2% $12,024.10 12/23/14 Core PCE y/y 1.6% Nov 1.6% 12/30/14 Agricultural Prices -1.0% 99.99 Dec 2.0% 101.00 12/30/14 Consumer Confidence 2.5% 90.92 Dec -5.7% 88.70 12/30/14 - Expectations 3.3% 89.87 Dec -7.8% 87.00 12/30/14 - Current 2.0% 93.13 Dec -3.3% 91.30 Changes denoted by bold type All percent changes are from the previous period unless the next column shows a.r. which means the percentage change then is the annual rate. Payroll changes are in thousands, not percentages. ® RAYMOND JAMES Sep Sep Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct Oct III III III III III Oct Oct Oct Oct Oct Oct Oct Nov Nov Nov Nov Page 8 of 8

© Copyright 2026