16.12.2014 - Acuity Partners

Daily Review | 16 December 2014

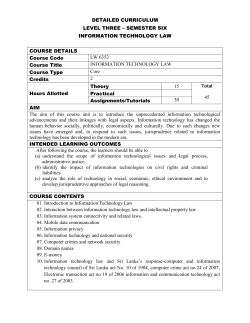

ASPI

0.09% | S&P SL20

0.05%

The downtrend persisted with both indices declining

during the day. The ASPI lost 6.70 points to close at

7223.56 points while the S&P SL20 Index closed at

4067.46 points, down 2.15 points.

Market turnover however, increased relative to yesterday

to amount to LKR 543.75mn with crossings in JKH, LLUB

and COMB accounting for 15.7% of total turnover value.

Foreign investors meanwhile, recorded a net buying

position of LKR 57.36mn.

Top Gainers & Losers

7245

7233

7221

7209

7197

7185

9.30

10.10

10.50

8%

0%

-8%

-16%

Top Turnover (excl. Crossings)

Current

(Price)

Turnover

(Rs. Mn)

Share Volume

(‘000s)

250.00

102.00

22.10

1015.00

74.00

71

56

37

34

25

283

556

1,568

34

334

11.30

12.10

12.50

1.30

2.10

Market Statistics

ASPI

S&P SL20

Volume (Mn)

Turnover (Rs. Mn)

Market Cap. (Rs. Mn)

Net Foreign Position

(Rs. Mn) :

Foreign Purchases

Foreign Sales

PER (x)

PBV (x)

16%

JKH.N

UML.N

TFC.N

CTC.N

HHL.N

Intraday Trading

Current

Previous

%

7223.56

4067.46

26,770

544

3,070

7230.26

4069.61

25,738

340

3,073

-0.09%

-0.05%

4.0%

59.7%

-0.09%

57.36

60.93

-6%

201

144

13.19

1.88

102

41

13.21

1.88

97.8%

252.7%

n.a

n.a

Significant Crossings (by Transaction Value)

Quantity

Price

T/O (Rs. Mn)

JKH

165,353

252.00

42

LLUB

56,112

390.00

22

COMB

127,091

170.00

22

Source: Colombo Stock Exchange & Bloomberg

Daily Review | 16 December 2014

Sector Performance

Chem & Pharma, -1.28%

Footwear & Textiles, 2.57%

Healthcare, -1.17%

ASPI 0.09%

Diversified, -0.67%

Manufacturing, -0.23%

Hotels & Travel, -0.22%

Land & Property, 0.61%

Trading, 0.86%

Motors, 0.84%

IT, 0.72%

Corporate Announcements

None for 16th December 2014.

Source: Colombo Stock Exchange & Bloomberg

Daily Review | 16 December 2014

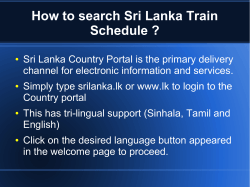

Net Foreign Flows

Net Foreign Sales (15th Dec - 16th Dec)

Net Foreign Purchases (15th Dec - 16th Dec)

DISTILLERIES

CEYLON TOBACCO

Volume Change ('000s)

RENUKA HOLDINGS[X.0000]

Volume Change ('000s)

SLT

LAUGFS GAS[X.0000]

LAUGFS GAS

TEXTURED JERSEY

ACL

COM.CREDIT

TOKYO…

THE FINANCE CO.

COMMERCIAL BANK

CHEVRON

TOKYO CEMENT

RENUKA AGRI

HEMAS HOLDINGS

AMANA BANK

JKH

*BROWNS INVSTMNTS

-

84

168

252

336

420

(200) (160) (120) (80) (40)

-

*Volume change of Browns Investments 2.00mn shares between 15th Dec -16th Dec not displayed

Companynot displayed

Foreign Holding (%)

15/12/14

15/12/14

Net Change

Value*

(LKR. Mn)

Company

Foreign Holding (%)

15/12/14

15/12/14

CHEVRON

32.7%

32.7%

Net Change

Value*

(LKR. Mn)

(56,112)

(21.9)

JKH

52.8%

52.8%

406,542

101.6

HEMAS HOLDINGS

21.0%

21.0%

331,598

24.5

BROWNS INVSTMNTS

1.0%

1.1%

(2,000,000)

(3.6)

1.5%

1.5%

(42,000)

(3.2)

COMMERCIAL BANK

38.3%

38.3%

137,959

23.5

ACL

CEYLON TOBACCO

96.7%

96.7%

18,050

18.3

DISTILLERIES

24.4%

24.4%

(6,500)

(1.4)

not

displayed

TOKYO

CEMENT

31.4%

31.3%

192,899

12.3

LAUGFS GAS

0.5%

0.5%

(31,400)

(1.3)

TOKYO CEMENT[X.0000]

23.4%

23.3%

105,575

4.9

THE FINANCE CO.

0.4%

0.5%

(54,000)

(1.2)

COM.CREDIT

19.1%

19.1%

50,048

2.3

AMANA BANK

57.1%

57.1%

(165,000)

(0.8)

45.0%

45.0%

(14,400)

(0.7)

not displayed.

SAMPATH

17.9%

17.9%

9,499

2.2

SLT

COMMERCIALBANK[X.0000]

21.1%

21.1%

14,000

1.7

LANKA WALLTILE

0.8%

0.8%

(5,000)

(0.5)

1.2

RENUKA AGRI

13.7%

13.7%

(60,893)

(0.3)

NAT. DEV. BANK

42.2%

42.2%

*Value based on VWA price and not on actual traded price

5,000

*Value based on VWA price and not on actual traded price

Source: Colombo Stock Exchange

Daily Review | 16 December 2014

Corporate & Macro Developments

Corporate News |

THE FINANCE COMPANY

Macro-Economic & Other News |

TFC.N

SRI LANKA LAUNCHES USD 50MN PRIVATE EQUITY FUND

The Central Bank approved a long term concessionary loan facility from the

Sri Lanka Deposit Insurance and Liquidity Support Fund in order to support

the liquidity requirements of TFC. The move is the 2nd phase of restructuring

for the Group.

New York based Zephyr Management and NDB Bank Group launched

‘Emerald Sri Lanka Fund’, a USD 50Mn private equity fund, which provides

financing to small and medium enterprises in Sri Lanka. The fund will invest

in small and mid-sized businesses seeking growth.

Source: Central Bank of Sri Lanka_ www.cbsl.gov.lk

Source: Lanka Business Online_www.lankabusinessonline.com

Daily Review | 16 December 2014

Disclaimer

Distributed in Sri Lanka and abroad by Acuity Stockbrokers (Private) Limited (ASB) and its authorized representatives. ASB is fully

owned by Acuity Partners (Pvt) Ltd (APL) and APL is a joint venture of DFCC Bank and Hatton National Bank PLC.

The Information contained herein has been compiled from sources that ASB (“The Research Institution”) believes to be reliable but

none of the Research Institution holds itself responsible for its completeness or accuracy. It is not an offer to sell or a solicitation of an

offer to buy any securities. The Research Institution and its affiliates and its officers and employees may or may not have a position in

or with respect to the securities mentioned herein.

The Research Institution and its affiliates may from time to time have consulting relationship with any company, which is being

reported upon. This may involve the Research Institution providing significant corporate finance services or acting as the company’s

official or sponsoring broker.

All opinions and estimates included in this report constitute judgment as of this date of the Research Institution and are subject to

change or amendment without notice. The Research Institution has the copyright for this report and the views herein cannot be

reproduced and/or distributed in any form without the explicit (written or otherwise) permission from Research Institution.

Daily Review | 16 December 2014

Research Team |

Sales Team |

Chethana Ellepola

(+94) 112 206 256

[email protected]

Deva Ellepola

(+94) 112 206 220/221

[email protected]

Anjula Nawarathna

(+94) 112 206 255

[email protected]

Prashan Fernando

(+94) 112 206 222

[email protected]

Anouk Weerasinghe

(+94) 112 206 254

[email protected]

Kapila Pathirage

(+94) 112 206 227/228

[email protected]

Nilruk Soysa

(+94) 112 206 255

[email protected]

Naren Godamunne

(+94) 112 206 225

[email protected]

Roshan Noah

(+94) 112 306 237/257

[email protected]

Arjuna Dasanayake

(+94) 112 206 235

[email protected]

Amarasena Liyanage

(+94) 112 206 231

[email protected]

Susil Fernando

(+94) 112 206 234

[email protected]

Navin Dullewe

(+94) 112 206 230

[email protected]

Chathura Siyambalapitiya

(+94) 112 206 232

[email protected]

S. Vasanthakumar

(+94) 112 206 250/251

[email protected]

Dhammika Wanniarachchi

(+94) 112 206 229

[email protected]

Shivane Wijayaratnam

(+94) 112 206 236

[email protected]

Sameera Rajawatte

(+94) 112 206 279

[email protected]

Dilanjan Perera

(+94) 112 206 278

[email protected]

Rukshan De Mel

(+94) 112 206 268

[email protected]

Kumar Dias Desinghe

(+94) 814 474 443

[email protected]

Prasanna Semasinghe

(+94) 814 474 443

[email protected]

© Copyright 2026