19th Dec 2014 - Lanka Securities (Pvt)

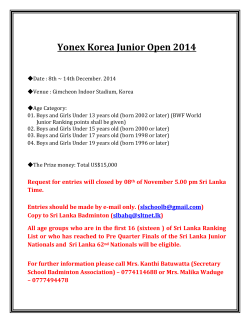

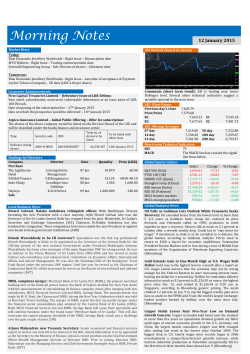

udithgpseall14 21gpgppivg Morning Notes 19 December 2014 Market Diary ASI Outlook (based on charts) Today: Central Finance Company - Dividend payment date (LKR 0.85 per share) Alliance Finance Company – Debenture Issue – Opening for subscription Monday: Chevron Lubricants Lanka – Dividend payment date (LKR 5.50 per share) Corporate Announcements John Keells Holdings – Project funding obtained by Waterfront Properties: Waterfront Properties (Pvt) Ltd, a subsidiary controlled by the company, has entered into a USD 445mn syndicated project development facility with Standard Chartered Bank. Sampath Bank – Debenture Issue: The debentures of the above bank will be listed on 19th December 2014. Debenture Type Security ID ISIN Number 5 Year Fixed Rate Debentures (8.25%) payable annually SAMP-BD-14/12/19C2271-8.25 LK0090D22713 5 Year Fixed Rate Debentures (8.10%) payable bi-annually SAMP-BD-14/12/19C2273-8.10 LK0090D22739 PCHH Holdings – Extension of Mandatory offer made by Adam Investments: AINV has decided to extend the given offer period for mandatory offer. This is due to the delay of PCHH to forward views, comments and advice of the board of directors PCHH on the offer and the independent advisor’s report, by the board of directors of the offeree. Therefore the offer period will be extended for a further period of 5 market days from 18th December 2014. Accordingly please be informed that the offer will be kept open till 4.30pm on 26th December 2014 for acceptance. Siyapatha Finance – Debenture Issue: Company has received applications for over LKR 500mn for the debenture issue and accordingly the initial issue has been oversubscribed. Siyapatha Finance Limited has informed the registrars that they will be exercising the oversubscription option and the issue closed on 18th December 2014 as per the prospectus. Orient Finance – Debenture Issue: Company has received applications for over LKR 1bn for the debenture issue and accordingly the issue has been oversubscribed. Therefore, the issue closed on 18 th December 2014 as per the prospectus. Abans – Debenture Issue: Company has received applications for over LKR 2bn for the debenture issue and accordingly the issue has been oversubscribed. Therefore, the issue closed on 18 th December 2014 as per the prospectus. Asian Alliance Insurance – Segregation of general insurance business: AAIC has obtained all requisite approvals for the segregation of its general insurance business from its life insurance business. (Refer attachment for more details). Dealings by Directors Company Purchase Lion Brewery Director Date Carson Cumberbatch 17 Dec Quantity 599,737 Price (LKR) 605.00 Sale Local Business News Ceramic and Glass Council wants price of Furnace Oil reduced: Sri Lanka Ceramic and Glass Council appeals to Government asking a price reduction in furnace oil due to international price reduction of crude oil, the Council said in a media release. The council said the industry was heavily dependent on all three energy sources -electricity, furnace oil and LPG. “The future for the Ceramics and Glass industry in Sri Lanka is greatly dependent on energy,” said Mahendra Jayasekara, President of the Sri Lanka Ceramic and Glass Council. “On the supply side, Sri Lanka does not have the oil and natural gas deposits at its disposal as some of its Asian competitors such as Indonesia, India and Malaysia. Thus we are dependent on imports to meet most of our energy needs,” he said. Jayasekara said the high energy costs over 30 the past few years especially the sharp furnace oil price increases, which took place between April 2011 to Feb 2012 (From Rs.40/- to Rs.90/- per liter) had affected the industry adversely. “Although Petrol, Diesel and LPG prices were reduced recently Furnace Oil prices remain unchanged,” he said. “The Ceramic and Glass Industry has reached a point where the negative effects are seen in the form of loss of orders and the industry is being saddled with excess capacities. (LBO) Comments (short term trend): ASI is trading near lower Bollinger level. Several other technical indicators suggest a possible uptrend in the near term. ASI - Pivot Points Previous day’s close Pivot Point R1 R2 ASI - Moving Averages 07 day 14 day 21 day 7,230.52 7,219.75 7,242.73 7,254.95 7,231.15 7,239.42 7,248.00 S1 S2 7,207.53 7,184.55 50 day 100 day 200 day 7,298.13 7,174.24 6,701.03 Short-term Technical Indicators RSI 46 MACD The MACD line has crossed the signal line from above. Global Equity Indices S&P 500 (USA) FTSE 100 (UK) NIKKEI 225 (Japan) Shanghai Comp (China) BSE Sensex (India) KSE All (Pakistan) MSCI frontier markets MSCI emerging markets Index 2,061.23 6,466.00 17,540.12 3,077.12 27,126.57 30,827.45 569.23 935.12 Change +48.34 +129.52 +330.07 +19.60 +416.44 +160.31 +6.63 +16.97 % Change +2.40 +2.04 +1.92 +0.64 +1.56 +0.52 +1.18 +1.85 Global Business News Oil Rebounds From 5-Year Low as Market Most Volatile Since 2011: Oil rebounded from the lowest closing price since May 2009 amid the highest trading volatility in more than three years as Saudi Arabia’s oil minister said he’s optimistic about global demand in the future. West Texas Intermediate climbed as much as 2.6 percent in New York, trimming a fourth weekly drop. A measure of expected futures movements and a gauge of options value was at the highest level since October 2011, data compiled by Bloomberg show. Saudi Arabia and OPEC would find it “difficult, if not impossible” to give up market share by cutting supply, according to Oil Minister Ali Al-Naimi. (Bloomberg) Gold Set to Halt Two-Week Advance as Fed Boosts Dollar, Stocks: Gold headed for the first weekly decline in three as the Federal Reserve moved closer to raising borrowing costs amid a slump in energy prices. Bullion for immediate delivery traded at $1,196.31 an ounce at 8:41 a.m. in Singapore from $1,198.57 yesterday and is 2.2 percent lower this week, according to Bloomberg generic pricing. The metal slid to a two-week low of $1,183.89 on Dec. 17 after the U.S. central bank dropped a pledge to hold rates low for a considerable time while promising to be patient. Gold retreated as a rally in global equities and the dollar damped demand for an alternative investment. (Bloomberg) Wheat Prices Jump to Highest Since May as Russia Slows Shipments: As the ruble’s collapse increases domestic costs for bread, Russia is taking steps to stem its grain shipments and sending wheat prices in Chicago to the highest since May. The nation is slowing down shipments by denying certificates that grain sellers and buyers need after sanitary inspections, a grainexport lobby said yesterday. The country’s “main goal is to replenish the domestic market,” Deputy Prime Minister Arkady Dvorkovich’s spokeswoman, Aliya Samigullina, said by phone from Moscow today. Morning Notes Local Business News SLCTIP eyes over US$ 1B Chinese Investments: The Sri Lanka China Trade and Investment Promotion Chamber (SLTIP) announced upcoming Chinese investments into Sri Lanka in view of achieving over US$ 1 billion worth of investments into Sri Lanka in 2015. Some of the investments include an investment of US$ 200 million for the construction of luxury and semi luxury apartments in Rajagiriya, US$ 500 million into a hotel project in Wattala, a US$ 20 million investment for the production of saline and a US$ 500 million investment for the production of building materials. “Our plan is to aggressively work to hit the US$1 billion in 2015 and the forthcoming FTA signing will generate new exports. A setback would be not acquiring proper market research but chambers such as us could fulfill these requirements of studying the demands that economies such as China requires,” SLCTIP Director General, Mohan Perera said. “By mid-2015, we might receive approval to export tropical fruit such as plantains, pineapple and papaw. Another potential is canned king coconut juice,” Aluvihare acknowledged. (DN) 19 December 2014 Global Business News Cheap oil can benefit Asia says ADB: The growth outlook for developing Asia remains steady, even though momentum slowed in the second half of 2014, but the declining oil prices represent a golden opportunity for many beneficial reforms, the Asian Development Bank (ADB) says in a new report. In a supplement to its Asian Development Outlook 2014 Update, ADB forecasts Gross Domestic Product (GDP) growth for the region of 6.1% in 2014, down from 6.2% expected in September, and 6.2% in 2015, down from 6.4%. Developing Asia, comprising the 45 ADB developing member countries, grew 6.1% in 2013. Growth projections for Central Asia, East Asia, and Southeast Asia are revised downward. There is no change for South Asia. (DFT) Industrial Asphalts unveils full range of colour anti-corrosive paints: History is being made by Industrial Asphalts (Ceylon) PLC by introducing, for the first time in Sri Lanka, the full range of colour anti-corrosive paints. Up to now anti-corrosive paints were available only in four basic colours. Britex, the protective coatings range from Industrial Asphalts (Ceylon) PLC – IAC – has launched a full range of coloured anti-corrosive paints for the Sri Lankan market. This pioneering move is a result of the new restructuring being carried out at IAC. The company’s newly-established product development team had carried out a detailed study of the products available in the market to identify and meet the customers’ evolving requirements. (DFT) SL gets US$ 102M FDI for Colombo Port Project: 'Colombo Port City (CPC),' within the first year of signing agreements with the country's investment promotion agency, has invested US$ 102 million as at end October this year out of its US$ 1,300 million commitment to Sri Lanka. The project was on track according to the Board of Investment (BOI), and land reclamation was taking place. The BOI hopes that the project would help the country achieve its FDI goals set for the coming years, after failing to meet targets during the last two years. Investment Promotion Minister Abeywardena has already begun marketing CPC. He implored investors to explore new business vistas in the upcoming man-made island, in a bid to improve FDI to the county. China Communication Construction Company (CCCC) signed agreements with the BOI last year at the Commonwealth Heads of Government Meeting to invest US$ 1,300 million, to reclaim 233 hectares of land off Colombo. An eight year exemption on VTA, PAL, Excise Duty, CESS and NBT has been given to CCCC, on top of which an eight year tax break to China Harbour Engineering Corporation for profits and income generated in the building of the artificial island have also been given. (CFT) SriLankan Airlines' second A330-300 arrives: SriLankan Airlines, will take delivery of its second brand new A330-300 arriving at the Colombo International Airport today, flying from Toulouse, France. It joins the airlines' existing fleet of A320, A321, A330-200 and A340-300 aircraft. SriLankan will take delivery of a further five A330-300s."We have a reputation as a global leader in service, comfort, safety, reliability and punctuality; all of which are qualities reflected in selecting the A330," said Kapila Chandrasena, CEO of SriLankan Airlines. "This addition of the A330-300 to our family will enable us to drive our offering to new heights." (DN) Rupee, interest rates to be capped till polls day: Central Bank of Sri Lanka's (CBSL's) rejection of more than half the bids received at Wednesday's weekly Treasury (T) Bill primary auction is a sign that rates are once more looking up, sources told Ceylon FT. Though CBSL had up for reissue maturing T bills of Rs 12 billion, it accepted bids worth only Rs 5.5 billion, with the weighted average yield of the benchmark one year T bill increasing by one basis point (bp) to 5.99%, while that of the six months, which was the other tenure on offer, stagnating at 5.83%. Imports are driven by the prevalence of a low interest rate regime, complemented by the reduction in import taxes on a variety of items, not least vehicles. This is driving up demand. They said that the present situation was not dissimilar to what took place 4½ years ago, in the middle of 2010, when GoSL at that time too reduced vehicle taxes. "The problem is Sri Lanka is an import driven economy," a banker said. So, when the rupee is depreciated, everyone is affected. (CFT) Former SEC DG at DDFC: Deshodaya Development Finance Company Ltd. (DDFC) in its consolidation drive has appointed Channa de Silva as its Deputy Chairman, said a press release.He was also appointed as George Steuart Finance PLC Managing Director, subject to Central Bank of Sri Lanka (CBSL) approval.De Silva was the former Managing Director of Delmege Group, prior to taking responsibilities at DDFC. He was also the former Securities and Exchange Commission of Sri Lanka (SEC) Director General and also functioned as Board of Investments of Sri Lanka (BOI) Executive Director. De Silva has previously served as board director in many public sector organizations, including the Insurance Board of Sri Lanka (IBSL), the now defunct Public Enterprise Reform Commission (PERC), Construction Guarantee Fund, National Council for Economic Development, Sri Lanka Accounting and Auditing Standards Monitoring Board (SLAASMB) and CBSL's National Payment Gateway. (CFT) Lanka Securities Research The information contained in this report, researched and compiled for purposes of information do not purport to be complete description of the subject matter referred to herein. In preparing this report care has been exercised to collect information from sources which we believe to be reliable although we do not guarantee the accuracy and completeness thereof. Lanka Securities (Pvt) Ltd. and/or its affiliates and/or its directors, officers and employees shall not in any way be responsible or liable for loss or damage which any person or party may sustain or incur by relying on the contents of this report and acting directly or in directly in any manner whatsoever.

© Copyright 2026