Thinking Outside the Cap, December 2014

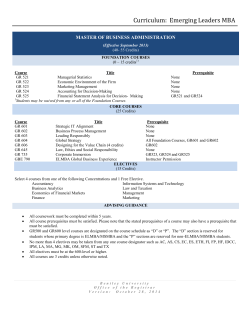

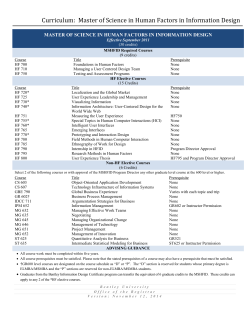

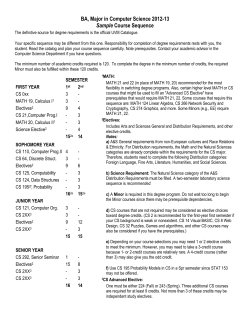

CaliforniaCarbon.info Bi-Monthlies December 2014 Thinking Outside the Cap CONTENTS SENTIMENT METER Page 1 • Sentiment Meter • Dashboard Page 2 • Offset Price Spreads • ARBOC Issuances Pages 3-4 • Protocol Statistics – Early Action Pages 5-6 • Protocol Statistics Compliance Page 7 • Project Type Statistics - Forestry Page 8 • Project Type Statistics - ODS Page 9 • Project Type Statistics - Livestock Page 10 • Project Type Statistics - Mine Methane ARB records hundredth early action project listing Origin Climate project achieves first compliance ARBOCs, CCO3s Over 1 million ARBOCs issued to ten Clean Harbors projects Alpental Energy Partners becomes fourth entity to earn livestock ARBOCs Third mine methane project listed under early action ARB moves towards rice cultivation adoption, forestry protocol update Ecosystem Marketplace release forest carbon market report for 2014 Disney-backed Oaxaca project is first pilot under CAR’s Mexico Forest Protocol ACR calls for stakeholder comments on registry standard, wetlands restoration methodology ISU-Environmental, Parhelion Underwriting launch ‘Platinum CCO’ ARB proceeds with Clean Harbors invalidation, but spares ECC project California cap and trade facing up to Clean Harbors exit For more details on these headlines, please proceed to page 12 Page 11 • Project Developer Statistics Page 12 • Verifier Statistics Page 13 • Major Headlines Page 14 • Soundbites: Selections from Exclusive Interviews Page 15 • Back Matter © CaliforniaCarbon.info DASHBOARD Number of ARBOCs issued: 13,799,927 Number of ARBOC-3s generated: 110,681 Next issuance date: Wed, December 24th, 12pm PT *Please refer to pages 2 to 10 for more detailed breakdowns of offset issuances and trends Broker-traded Golden CCO bid-ask mean: $10.55 Broker-traded CCO-8 bid-ask mean: $8.99 *Please refer to page 2 for more pricing information [email protected] 1 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 OFFSET PRICE SPREADS CCA-Golden CCO Spreads (aggregated broker prices) $15.50 $15.00 $14.50 $14.00 $13.50 $13.00 $12.50 $12.00 $11.50 $11.00 $10.50 $10.00 $9.50 Visit http://californiacarbon.info/cca/ for the latest pricing information 28.1% 30.0% 25.0% 17.7% 19.5% 19.9% 17.5% 16.8% 17.0% 16.8% 15.7% 14.5% Spread (%) 20.0% CCA OTC Benchmark 15.0% 10.0% Golden CCO OTC V2013 5.0% 0.0% 1st Jul 2013 1st Oct 2013 2nd Jan 2014 3rd Mar 2014 1st May 2014 1st Jul 2014 1st Sep 2014 1st Oct 2014 3rd Nov 2014 1st Dec 2014 Golden CCO-CCO Spreads (aggregated broker prices – CCO8 where source applies 8/3 differentiation) $12.00 $1.38 $11.50 $11.00 $1.57 $1.49 $1.61 $1.50 $1.50 $1.23 $0.96 $10.50 $0.88 Spread $1.25 $1.02 $1.00 $1.75 $1.00 $10.00 $0.75 $9.50 $0.50 $9.00 $0.25 $8.50 Golden CCO OTC V2013 CCO OTC V2013 $0.00 1st Jul 2013 1st Oct 2013 2nd Jan 2014 3rd Mar 2014 1st May 2014 1st Jul 2014 1st Sep 2014 1st Oct 2014 3rd Nov 2014 1st Dec 2014 RECENT ARBOC ISSUANCES* Breakdown by issuance date Breakdown by project type 51,834 17,993 24,643 166,918 Nov 12 303,939 112,378 1,081,493 Dec 9 153,904 1,200,000 1,000,000 800,000 600,000 400,000 Livestock 200,000 ODS 129,838 142,826 0 Forestry 9,198 109,653 Nov 25 1,309,50 6 Breakdown by project developer ARBOC-3 issuance No. of credits: 30,069 (2 reporting periods) Name of project: Brook View Dairy (CAR419 – now also CAR1036) Project developer: Origin Climate Project type: Livestock ARBOC-8 issuance date: July 22, 2014 Previous verifiers: SES/Analytical Environmental Services Other credits: 15,672 CRTs (5,672 retired); 12,988 compliance ARBOC-8s 803,733 166,918 EOS Climate Diversified Pure Chem Wabashco Alpental Energy Partners Camco International Finite Carbon A-GAS Americas Environmental Credit Corp Origin Climate *Covers the period Oct 15 - Dec 15. For a more detailed breakdown of credit issuances, please refer to pages 4 and 6. © CaliforniaCarbon.info [email protected] 2 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROTOCOL STATISTICS EARLY ACTION EAOCs converted to ARBOCs: 8,559,806 (615,035 buffered) *EAOCs listed for conversion: 17,883,175 (1,275,784 buffered) *EAOCs from all projects listed for conversion: 18,206,546 (1,297,837 buffered) 606,656, 7% 2,848,442, 33% 5,104,708, 60% **Reporting periods converted: 150 **Reporting periods listed with ARB: 315 Number of projects listed with ARB: 95 Forestry Number of registered projects not listed with ARB: 21 *EAOCs from registered projects not listed with ARB: 1,828,956 Eligible projects listed without unretired EAOCs: 47 EAOCs listed for conversion 673,340, 4% 1,086,777, 6% ODS Livestock Mine Methane *Totals adjusted to reflect credits subject to prior retirement and therefore ineligible for the ARB early action program **Reporting periods may be broken down and severally listed by the OPO, OPD, and/or APD. Non-material reporting periods (i.e. 0 credits) are excluded from this calculation. 6,429,632, 36% 9,693,426, 54% Conversion of EAOCs to ARBOCs 5,000,000 4,348,247 4,500,000 4,000,000 ARBOCs generated 4,119,09512,026,476 3,864,239 12,000,000 9,895,956 3,500,000 3,000,000 14,000,000 9,629,562 9,166,640 9,745,331 9,323,369 3,439,953 8,212,486 10,000,000 8,000,000 2,500,000 2,000,000 1,630,246 1,500,000 1,309,433 3,864,239 6,000,000 1,758,595 1,295,673 945,201 829,432 900,930 1,000,000 1,059,397 637,435 2,000,000 305,105 500,000 0 0 Q1 2013 4,000,000 0 0 Q2 2013 Q3 2013 Q4 2013 Listed for Conversion Q1 2014 Q2 2014 Converted to ARBOCs Q3 2014 Backlog Q4 2014* *Q4 2014 – to date Conversion of early action reporting periods 120 100 240 206 100 80 194 188 182 165 160 160 60 60 120 50 100 41 40 29 24 30 25 31 20 0 200 172 0 Q1 2013 18 9 4 0 80 28 16 40 0 Q2 2013 Q3 2013 Q4 2013 Listed for Conversion © CaliforniaCarbon.info Q1 2014 Q2 2014 Converted to ARBOCs [email protected] Q3 2014 Backlog Q4 2014* *Q4 2014 – to date 3 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROTOCOL STATISTICS EARLY ACTION Listed EAOCs by year of project activity* 2,400,000 2,100,000 1,800,000 1,500,000 1,200,000 900,000 600,000 300,000 0 Through 2006 2007 2008 2009 Forestry 2010 ODS 2011 Livestock 2012 2013 2014 Mine Methane *Year of project activity defined as year in which stipulated reporting periods conclude. Hence many 2013 periods may remain unlisted, and many 2014 ones uncompleted. Early action ARBOCs by time of issuance 1,800,000 1,500,000 1,200,000 900,000 600,000 300,000 0 Q3 2013 Q4 2013 Q1 2014 Forestry Q2 2014 ODS Q3 2014 Q4 2014 Livestock Early action issuances in the last 2 months Issue Date Project ID Project Name Listing Entity Verifiers* Type Credits Issued Buffer Credits No. of RPs Time Taken** 12 Nov CAR645 The Forestland Group Champion Property Finite Carbon Environmental Services/SCS Global Services Forestry 166,928 32,109 4 63 25 Nov ACR184 EOS ACR 2013 EOS Climate NSF-ISR/First Environment ODS 249,025 - 2 370 25 Nov CAR477 Fair Oaks Dairy Farm Cyclus Camco Int’l DNV/SES Livestock 9,198 - 1 TBC 25 Nov CAR604 EOS-JA-09-01 EOS Climate NSF-ISR/SES ODS 11,940 - 1 398 25 Nov CAR781 Pure Chem Domestic ODS #2 Diversified PC Ruby Canyon/SES ODS 27,437 - 1 277 25 Nov CAR784 ECC-ODS-PA-001 Environmental Credit Corp TUV SUD/SES ODS 109,653 - 1 284 25 Nov CAR804 EOS-CAR 2011 Domestic EOS Climate NSF-ISR/SCS Global Services ODS 312,137 - 3 342 25 Nov CAR805 Pure Chem Domestic ODS #3 Diversified PC Ruby Canyon/SES ODS 55,730 - 1 279 25 Nov CAR833 Pure Chem Domestic ODS #5 Diversified PC Ruby Canyon/SES ODS 70,737 - 1 270 25 Nov CAR990 EOS 2013 Domestic EOS Climate NSF-ISR/SES ODS 41,061 - 1 239 * Registry issuance and desk review verifiers for early action projects © CaliforniaCarbon.info **Number of days from desk review submission to ARBOC issuance [email protected] 4 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROTOCOL STATISTICS COMPLIANCE ARBOCs generated: 5,240,121 (620,234 buffered) Reporting periods credited: 25 Projects credited: 25 85,819 Projects listed under compliance protocols: 99 Projects holding ROCs: 34 ROCs generated: 7,948,968 (1,010,694 buffered) ROCs generated (including present ARBOCs) 2,310,665 5,552,484 Av. time from ROC issuance to ARBOC issuance: 77 days Av. time from ROC to ARBOC issuance, for projects without resubmissions and/or Clean Harbors projects: 58 days No. of projects asked by ARB to resubmit documents: 8 Av. issuance time after resubmission of documents: 17 days Early action transitions to compliance protocol ARBOCs may no longer be generated under the early action mechanism for project activities occurring from Jan 1, 2015, onwards. Projects must re-list under an ARB compliance protocol. These diagrams reflect the number of projects that have re-listed, versus (i) the number of projects that have not, and (ii) the number of new projects listing directly under the compliance route. Early action ARBOCs generated 85,819 Forestry 1,775,374 3,378,928 ODS Livestock Mine Methane 17 26 3 6 11 0 25 16 1 Forestry Livestock 1 27 Projects listed 31 Early-actionturned-compliance 40 Mine Methane Compliance Unconverted ROCs ID Project Name Developer Type Verifier ROCs Issued Buffer ACR173 Round Valley Indian Tribes Forest Carbon Partners Forestry SCS Global Services 529,451 12 Nov 74,653 ACR192 Brookgreen Gardens IFM Green Assets Forestry Environmental Services 201,425 2 Oct 38,754 ACR199 CT Lakes Finite Carbon Forestry Environmental Services 1,442,576 9 Jul 276,975 ACR206 2014-P4 EOS Climate ODS NSF-ISR 71,825 19 Nov - CAR1011 RemTec 2013-1 A-Gas Americas ODS Ruby Canyon 93,055 22 May - CAR1026 EOS ARB 2014-2 EOS Climate ODS NSF International 33,214 20 Nov - CAR1029 ECC ODS Destruction 11-2013 Environmental Credit Corp ODS SES, Inc. 113,438 5 Dec - CAR1047 DPC Domestic ODS Destruction Project #17 Diversified Pure Chem ODS Ruby Canyon 30,587 15 Dec - CAR1051 RemTec 2013-4 A-Gas Americas ODS Ruby Canyon 191,960 10 Dec - © CaliforniaCarbon.info [email protected] 5 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROTOCOL STATISTICS COMPLIANCE *Time taken for ARBOC issuance (days) 450 401 400 365 366 361 350 312 300 250 219 186 200 155 150 *This graph tracks the time required to secure issuance of ARBOCs after the end of a reporting period, based on the year in which the reporting period ended. The downward trend may suggest greater familiarity with documentation and related processes, or simply that the slower issuances haven’t happened yet. Note that the ODS figure for 2014 has been inflated by the issuance slowdown that resulted from the Clean Harbors invalidation investigation. 100 50 0 2012 H1 2013 Forestry H2 2013 ODS 2014 Livestock Project Developer Comparison Project Developer Av. Time from End of RP to ARBOC Issuance (days) No. of Projects Forestry Forestry ODS A-GAS Americas Livestock ODS 191 Livestock 1 Alpental Energy Partners 469 Blue Source 1 352 1 Diversified Pure Chem 168 Edward Miller Trust 3 359 1 *Environmental Credit Corp 305 2 *EOS Climate 199 8 Forest Carbon Partners 370 2 Origin Climate 349 Wabashco 3 120 3 * ODS - averages may be misrepresentative by inclusion of Clean Harbors projects and/or ones completed prior to ARB commencing offset issuances. Compliance issuances in the last 2 months Issue Date Project ID Project Name Listing Entity Verifier Type Credits Issued Buffer Credits No. of RPs Time Taken** 12 Nov ACR221 Wabashco Clean Sweep 3 Wabashco Ruby Canyon ODS 112,378 - 1 133 12 Nov CAR997 Blue Mountain Biogas Alpental Energy Partners First Environment Livestock 24,643 - 1 469 25 Nov ACR195 EOS ARB ODS 2014-1 EOS Climate NSF-ISR ODS 122,080 - 1 238* 25 Nov CAR1021 EOS ARB ODS 2013-8 EOS Climate NSF-ISR ODS 67,490 - 1 284* 25 Nov CAR1033 Sunny Knoll Farms Origin Climate Agri-Waste Technology ODS 5,005 - 1 390 9 Dec CAR1036 Brook View Dairy Origin Climate Ruby Canyon ODS 12,988 - 1 312 9 Dec CAR1072 A-GAS RemTec 2014-1 A-GAS Americas SES, Inc. ODS 129,838 - 1 191 * Issuances to Clean Harbors projects were held up during the invalidation investigation © CaliforniaCarbon.info **Number of days from reporting period completion to ARBOC issuance [email protected] 6 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROJECT TYPE STATISTICS US FORESTRY Early Action (buffer values in parentheses) EAOCs converted to ARBOCs: 2,848,442 (615,035) *EAOCs listed for conversion: 9,693,426 (1,275,784) *Unretired EAOCs from all projects listed for conversion: 9,803,209 (1,297,837) Registered projects not listed with ARB: 6 EAOCs from registered projects not listed with ARB: 316,651 Eligible projects listed without EAOCs: 19 Reporting periods converted: 36 Reporting periods listed with ARB: 128 Number of projects listed with ARB: 23 *May be lower than previously-reported totals after the adjustment for credits retired for other purposes and ineligible for ARB compliance 0 Rips Redwoods 0 Bascom Pacific Unretired credits from all projects listed for conversion 210,225 224,159 0 Green Assets EA credits listed for conversion 220,108 220,108 63,135 Nature Conservancy EA credits converted to ARBOCs 117,441 117,441 285,687 285,687 0 Pacific Forest Trust 446,244 446,244 0 Yurok Tribe 1,245,840 1,245,840 1,128,277 1,326,888 1,326,888 Coastal Ridges 688,505 Finite Carbon 1,406,838 1,406,838 570,049 Blue Source 1,598,495 1,694,344 398,476 Conservation Fund 0 500,000 2,835,660 2,835,660 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 No. of Credits Compliance (buffer values in parentheses) ARBOCs generated: 3,378,928 (620,234) Reporting periods credited: 4 Projects credited: 4 Others 0 0 The Conservation Fund 0 0 Green Assets 0 Heartwood Forestland Fund 0 0 Projects listed under compliance protocol: 31 (6 ex-early action) Projects registered: 7 ROCs generated: 5,552,484 (1,010,694) Average time from ROC issuance to ARBOC issuance: 50 days Average time from end of reporting period to ARBOC issuance: 363 days 7 Projects credited with ARBOCs Projects registered Projects listed under compliance protocol 1 1 1 Edward Miller Trust 1 1 Blue Source 1 1 2 2 2 2 Forest Carbon Partners Sierra Pacific 0 0 Finite Carbon 0 0 3 4 5 1 1 7 2 3 4 5 6 7 8 No. of Projects © CaliforniaCarbon.info [email protected] 7 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROJECT TYPE STATISTICS OZONE DEPLETING SUBSTANCES Early Action Registered projects not listed with ARB: 0 EAOCs from registered projects not listed with ARB: 0 Eligible projects listed without EAOCs: 5 EAOCs converted to ARBOCs: 5,104,708 *EAOCs listed for conversion: 6,429,632 *Unretired EAOCs from all projects listed for conversion: 6,429,662 Reporting periods converted: 61 Reporting periods listed with ARB: 79 Number of projects listed with ARB: 32 *May be lower than previously-reported totals after the adjustment for credits retired for other purposes and ineligible for ARB compliance Camco International 54,497 54,497 54,497 EA credits converted to ARBOCs Vitol 52,500 65,010 65,010 Unretired credits from all projects listed for conversion 0 Honeywell International EA credits listed for conversion *Diversified Pure Chem includes Pure Chem Separation, and A-GAS Americas includes Reclamation Technologies and Coolgas, Inc. 128,072 128,072 133,718 133,718 133,718 Wilshire Stanford 661,345 689,296 689,296 Environmental Credit Corp 800,629 998,617 998,617 *A-GAS Americas 728,302 *Diversified Pure Chem 1,059,017 1,059,017 2,673,717 EOS Climate 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,301,405 3,301,435 3,000,000 3,500,000 No. of Credits Compliance Projects listed under compliance protocol: 40 Projects registered: 23 ROCs generated: 2,310,665 Average time from ROC issuance to ARBOC issuance: 71 days Average time from end of reporting period to ARBOC issuance: 191 days ARBOCs generated: 1,775,374 Reporting periods credited: 17 Projects credited: 17 Refrigerant Exchange Corp 0 0 RapRec Refrigerants 0 0 Projects credited with ARBOCs Projects registered Projects listed under compliance protocol 1 2 *Diversified Pure Chem includes Pure Chem Separation, and A-GAS Americas includes Reclamation Technologies and Coolgas, Inc. 3 3 Wabashco 2 Environmental Credit Corp 1 *A-GAS Americas 4 3 4 3 6 3 *Diversified Pure Chem 4 7 8 EOS Climate 0 2 4 6 8 10 10 16 12 14 16 No. of Projects © CaliforniaCarbon.info [email protected] 8 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROJECT TYPE STATISTICS LIVESTOCK Early Action Registered projects not listed with ARB: 11 EAOCs from registered projects not listed with ARB: 131,597 Eligible projects listed without EAOCs: 22 EAOCs converted to ARBOCs: 606,656 *EAOCs listed for conversion: 1,086,777 *Unretired EAOCs from all projects listed for conversion: 1,300,335 Reporting periods converted: 53 Reporting periods listed with ARB: 98 Number of projects listed with ARB: 37 *May be lower than previously-reported totals after the adjustment for credits retired for other purposes and ineligible for ARB compliance 0 Holsum Dairies 0 Vitol 35,041 35,041 0 Grotegut Dairy Unretired credits from all projects listed for conversion 33,420 33,420 0 Dairy Dreams EA credits listed for conversion 24,746 24,746 0 ClimeCo Corporation EA credits converted to ARBOCs 11,241 12,444 26,984 38,663 105,716 121,015 121,015 Environmental Credit Corp 69,334 Origin Climate 189,975 209,377 431,606 Camco International 0 100,000 200,000 300,000 400,000 644,355 500,000 600,000 700,000 825,629 800,000 900,000 No. of Credits Compliance Projects listed under compliance protocol: 27 (11 ex-early action) Projects registered: 4 ROCs generated: 85,819 Average time from ROC issuance to ARBOC issuance: 126 days Average time from end of reporting period to ARBOC issuance: 379 days ARBOCs generated: 85,819 Reporting periods credited: 4 Projects credited: 4 0 Others 0 8 0 Alpental Energy Partners Projects credited with ARBOCs 1 1 Projects registered 0 NativeEnergy Projects listed under compliance protocol 0 2 0 CSE Operating 0 2 0 Roeslein Missouri 0 4 0 Environmental Credit Corp 0 4 3 Origin Climate 3 0 1 2 3 6 4 5 6 7 8 9 No. of Projects © CaliforniaCarbon.info [email protected] 9 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROJECT TYPE STATISTICS MINE METHANE Early Action Registered projects not listed with ARB: 4 EAOCs from registered projects not listed with ARB: 1,380,709 Eligible projects listed without EAOCs: 1 EAOCs converted to ARBOCs: 0 *EAOCs listed for conversion: 673,340 *Unretired EAOCs from all projects listed for conversion: 673,340 Reporting periods converted: 0 Reporting periods listed with ARB: 10 Number of projects listed with ARB: 3 *May be lower than previously-reported totals after the adjustment for credits retired for other purposes and ineligible for ARB compliance 0 Biothermica EA credits converted to ARBOCs EA credits listed for conversion 80,766 80,766 0 Verdeo Sindicatum 197,511 197,511 0 Solvay Chemicals 395,063 395,063 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 No. of Credits Eligible registry projects Project ID Project Name Listing Entity Verifier* Unretired Credits CAR891 Elk Creek Methane Destruction & Utilization Vessels Coal Gas First Environment 107,445 CAR979 Pinnacle Gob Methane Incineration Project Pinnacle Mining Company - - VCS013 Coal Mine Methane Capture and Use Project at the North Antelope Rochelle Mining Complex Peabody Natural Gas/ Blue Source First Environment 1,122,724 VCS613 North Antelope Rochelle Porcupine Project Camco International DNV 135,000 VCS648 Tower Abandoned Mine Methane Utilisation Project Oso Oil & Gas NSF-ISR 15,540 Compliance ARBOCs generated: 0 Reporting periods credited: 0 Projects credited: 0 0 0 Verdeo Sindicatum Projects listed under compliance protocol: 1 Projects registered: 0 ROCs generated: 0 Average time from ROC issuance to ARBOC issuance: N.A. Average time from end of reporting period to ARBOC issuance: N.A. Projects credited with ARBOCs Projects registered Projects listed under compliance protocol 1 0 © CaliforniaCarbon.info No. of Projects [email protected] 1 10 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 PROJECT DEVELOPER STATISTICS CREDIT ISSUANCES ARBOCs earned Project Developer Reporting periods credited with ARBOCs Early Action Compliance Total EOS Climate 2,673,717 738,345 3,412,062 Blue Source 570,049 2,163,951 2,734,000 Environmental Credit Corp 767,061 561,744 1,328,805 Coastal Ridges 1,128,277 0 1,128,277 Forest Carbon Partners 0 943,833 943,833 A-GAS Americas 800,629 0 930,467 Diversified Pure Chem 728,302 94,425 822,727 Finite Carbon 688,505 0 688,505 Project Developer Early Action Compliance Total EOS Climate 33 8 41 Environmental Credit Corp 29 2 31 Camco International 27 0 27 Diversified Pure Chem 11 3 14 Finite Carbon 12 0 12 A-GAS Americas 10 1 11 Coastal Ridges 9 0 9 Origin Climate 5 3 8 Yearly credit totals 1,500,000 This graph charts the number of ARBOCs that have been generated by project activities occurring in different years. The year used is the year in which the reporting period ended. 1,250,000 1,000,000 EOS Climate Environmental Credit Corp 750,000 Camco International Diversified Pure Chem 500,000 Blue Source Finite Carbon 250,000 Coastal Ridges Conservation Fund 0 Through 2009 2010 2011 2012 2013-14 A-GAS Americas ACTIVE PROJECTS Active ARB (including early action) Active registry (ARB-eligible) Forest ODS Livestock Total Project Developer Forest ODS Livestock Total EOS Climate 0 14 0 14 Camco International 0 1 16 17 Camco International 0 1 12 13 Diversified Pure Chem 0 17 0 17 Diversified Pure Chem 0 13 0 13 0 5 11 16 Environmental Credit Corp Environmental Credit Corp 0 4 8 12 EOS Climate 0 16 0 16 A-GAS Americas 0 6 0 6 A-GAS Americas 0 9 0 9 Origin Climate 0 0 6 6 Origin Climate 0 0 8 8 Project Developer © CaliforniaCarbon.info [email protected] 11 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 VERIFIER STATISTICS *Verification activities NON-FORESTRY REPORTING PERIODS Verifier Early Action Desk Review Compliance Early Action Desk Review Compliance Total SES 42 76 6 0 0 0 124 SCS Global Services 0 11 1 45 20 11 88 Ruby Canyon Engineering 45 10 29 0 0 0 84 Environmental Services 0 0 0 38 17 12 67 NSF-ISR 50 0 11 0 0 0 61 First Environment 37 11 5 0 0 0 53 DNV 6 0 0 31 0 3 40 Rainforest Alliance 0 0 0 19 0 0 19 Agri-Waste Technology 11 0 1 0 0 0 12 ENVIRON International Corp 0 8 0 0 0 0 8 TUV SUD 4 0 0 0 0 0 4 LRQA 4 0 0 0 0 0 4 Analytical Environmental 0 3 0 0 0 0 3 SCS Engineers 0 0 2 0 0 0 2 Conestoga-Rovers 0 0 1 0 0 0 1 FORESTRY REPORTING PERIODS *This table takes into account all early action reporting periods which have been listed with ARB for conversion, and all compliance projects which have appointed verifiers. Appointments for compliance projects (recent) Compliance projects listed without verifiers ID Developer Project Type Verifier ID Developer Project Type List Date CAR1065 California Bioenergy Livestock Ruby Canyon ACR200 Edward Miller Trust Forestry 23 Dec 2013 CAR1095 Coastal Forestlands Forestry SCS Global Services ACR209 Finite Carbon Forestry 5 Nov 2014 ACR213 EOS Climate ODS 30 May 2014 ACR214 EOS Climate ODS 30 May 2014 ACR225 Wabashco ODS 25 Nov 2014 ACR226 Verdeo Sindicatum Mine Methane 16 Dec 2014 CAR1006 Fruit Growers Supply Forestry 30 Jul 2013 CAR1060 EOS Climate ODS 20 Mar 2014 CAR1070 Yurok Tribe Forestry 18 Aug 2014 CAR1074 EOS Climate ODS 7 Jan 2014 CAR1075 EOS Climate ODS 24 Jul 2014 CAR1080 Origin Climate Livestock 17 Sep 2014 CAR1081 Roeslein Missouri Livestock 26 Sep 2014 CAR1082 Whole Energy Fuels Corp Livestock 28 Jul 2014 CAR1083 Roeslein Missouri Livestock 24 Jul 2014 CAR1092 Sierra Pacific Forestry 6 Aug 2014 CAR1093 A-GAS Americas ODS 3 Sep 2014 Eligible EAOCs not listed for ARBOC conversion 57,317 51,585 68,060 141,564 95,849 107,445 1,122,724 251,666 258,012 316,304 Peabody Natural Gas The Nature Conservancy Vessels Coal Gas Holsum Dairies Origin Climate © CaliforniaCarbon.info Camco International Solvay Chemicals Blue Source City of Arcata Others (<25k) [email protected] 12 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 HEADLINES ARB proceeds with Clean Harbors invalidation, but spares ECC project (Nov 14) Over 1 million ARBOCs issued to ten Clean Harbors projects (Nov 26) As in October’s preliminary determination, ARB deems the Clean Harbors destruction facility to have been in regulatory breach of its RCRA permit, and has invalidated ARBOCs awarded to project activities operational during the breach. While ECC’s project was spared, EOS Climate’s EOS-CAR 2012 Domestic has seen 88,955 ARBOCs nulled. (Read full article) With the Clean Harbors invalidation investigation having been concluded, issuances of ARBOCs to ODS projects that used the facility have resumed, with ARB awarding over 1 million of them to ten separate early action or compliance projects. Issuances had been delayed for a full six months during the investigation. (Read full article) California cap and trade facing up to Clean Harbors exit (Nov 23) Clean Harbors, a destruction facility in Arkansas which has supported project activities worth 5.4 million ARBOCs (and over 7 million including precompliance credits), has indicated in the wake of the ARB invalidation investigation that it is not willing to bear the substantial risks involved in continued participation in the California offset program. (Read full article) ISU-Environmental, Parhelion Underwriting launch ‘Platinum CCO’ (Nov 2) ISU Environmental Brokers and Parhelion Underwriting are teaming up to offer the ‘Platinum CCO’ to players in the California cap-and-trade offset market. The ‘Platinum CCO’ transfers the risk of invalidation onto an A 15-rated insurance company. (Read full article) Alpental Energy Partners becomes fourth entity to earn livestock ARBOCs (Nov 12) Alpental Energy Partners, a private equity-backed developer of alternative energy projects, has been awarded 24,643 ARBOCs for emission reductions at the Blue Mountain Biogas project in Utah. Three other developers had previous earned livestock ARBOCs – Camco International Group, Environmental Credit Corp, and Origin Climate. (Read full article) Origin Climate project achieves first compliance ARBOCs, CCO3s (Dec 10) Origin Climate’s Brook View Dairy project (CAR419/ CAR1036) has on the same day been awarded its first ARBOCs since transitioning to the ARB compliance livestock protocol and seen the conversion of its early action CCO-8s to CCO3s. Only one project had previously generated CCO-3s. (Read full article) ARB records hundredth early action project listing (Nov 9) While the number of unique registry offset projects that have listed reporting periods for credit conversion to ARBOCs stands at 94, the separate listing of projects with credits listed severally by various parties brought this number up to 100 at the end of October. (Read full article) Third mine methane project listed under early action (Dec 7) Solvay Chemicals' Green River Trona Mine Methane Destruction and Utilization Project (CAR629) in Wyoming has become the third mine methane project to be listed under the early action mechanism, and is the single early action project listing for November. Mine methane was approved as the fifth offset project type earlier this year. (Read full article) Disney-backed Oaxaca project is first pilot under CAR’s Mexico Forest Protocol (Nov 27, Read more) Ecosystem Marketplace release forest carbon market report for 2014 (Nov 27, Read more) ACR calls for stakeholder comments on registry standard, wetlands restoration methodology (Nov 22, Read more) For other offset-related news, please visit http://californiacarbon.info/offset-news/ For comprehensive coverage of the latest news from the cap-and-trade and complementary markets in California, always think of http://californiacarbon.info/ © CaliforniaCarbon.info [email protected] 13 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 SOUNDBITES: EXCLUSIVE INTERVIEWS John Savage, US Managing Director, Sindicatum “[Mine methane projects] have a lot of attractive characteristics […] For example, they involve permanent reductions, and hence aren’t subject to any kind of permanence risk, and they are also quite scalable.” “…we are pretty much focused on mine methane projects. We have a lot of mine methane projects to evaluate, so you can say our plate is full and we are not looking at other projects at the moment.” “The premium for Goldens will remain in place for now. People are going to look at what level of risk they are willing to accept, relative to what allowance prices are.” “…if the market can’t commit to a transaction after 2020, then you really have a fiveyear project life. Different investors might place different values on the post-2020 option than others, but that is the biggest challenge right now. If there is more clarity regarding what is going to happen post-2020, then it would bring a lot more capital into the market.” “We have a portfolio of projects that are either operational or in development; if we get them all up and running, I would say we could supply between 5 and 7 million through 2020.” © CaliforniaCarbon.info Chris Villiers, Parhelion Underwriting “…the owner of an insured ARBOC at the time of the invalidation will receive the market value of an equivalent issued ARBOC, up to a fixed limit that is agreed at the inception of the insurance […] We named it ‘Platinum’ to convey that an insured credit puts the owner very similar to the owner of a Golden CCO.” “We are prepared to insure CCO-8s, and even registry offset credits, assuming they will be converted to ARBOCs within six months and they do a second verification within a year. This means that project developers may insure credits before they are actually issued.” “[The invalidation risk] may be perceived as small but it is absolutely real […] the Platinum CCO [is] a useful and cost-effective way for organizations to manage invalidation risk, in particular ones that don’t have the balance sheet to play in the Golden CCO market.” “There is a perceived hassle in dealing with insurance products, in that you have to read the policy documents thoroughly and then do the paperwork. However when people start to go through this process I don’t think they will find it such a strain and will start to view the Platinum with confidence…” [email protected] Bill Flederbach, CEO, ClimeCo Corporation “…the larger participants […] have always desired a guaranteed CCO product, but now we may see a shift from all other buyers. We may also see the smaller entities […] opt out of the market entirely and purchase more CCAs.” “[The Clean Harbors investigation and outcome] is going to affect pricing at the developer, buyer, and perhaps even the verifier and project stages […] I think it will impact costs, especially on the guaranteed CCOs that we provide to our clients.” “We do not have more confidence in the process. Rather than the amount being invalidated, it is the method by which credits are invalidated that is worrying.” “I think California’s protocols and verifications are of really high integrity […and] the right to invalidate offset credits after such levels of scrutiny, is a part of the program that we have all been concerned about since the start…” “…when we did deals during the investigation we did not see any significant price escalation. I saw trends in certain deals […] in which Golden prices came down from where they historically were. I think they might since have returned up to where most counterparties are…” 14 Thinking Outside the Cap: A Bi-Monthly for the California Offset Program 19 December 2014 MERRY CHRISTMAS DISCLAIMER While Climate Connect, its data or content providers, the financial exchanges and each of their affiliates and business partners display information on the web site in good faith, no representation or warranty is given or shall be deemed given or implied by Climate Connect, its data or content providers, the financial exchanges and each of their affiliates and business partners to you or any other person as to the completeness, accuracy, sufficiency, currency, reliability or suitability of any such information, all which information is provided on an ‘as is’ basis, and all such representations warranties or conditions that may be implied by statute, general law or otherwise (whether as to title, non-infringement, merchantability, fitness for purpose or otherwise) are hereby excluded. Access full disclaimer statement METHODOLOGY Broker price data provided in this volume, and on the website(s) to which it is linked, observe a methodology which involves the aggregation of price sheets from several sources, and the averaging of price marks for each individual traded instrument. More detail on the method of calculation can be obtained through the link at the end of this paragraph. Data relating to the issuance and/or listing of offset credits and/or projects are obtained directly from the Air Resources Board website, or the databases of participating registries. The graphs through which offset and price information is presented are graphs which have been developed by CaliforniaCarbon.info. Access full methodology statement RIGHTS TO PUBLICATION CaliforniaCarbon.info is a trademark of Climate Connect Ltd. All articles and features for which the name of no external source is given may be assumed to be the full original work of Climate Connect Ltd and/or CaliforniaCarbon.info. Any republication or reprint of any portion of text contained in this document shall cite CaliforniaCarbon.info as the source, and furthermore provide a link to http://californiacarbon.info. Reproduction shall also not alter the meaning, express or implied, of the original text. If in doubt, please contact us at [email protected]. ABOUT CALIFORNIACARBON.INFO CaliforniaCarbon.info is your knowledge hub for the California cap-and-trade market. It is an online news, data, and analytics portal designed to empower high-stakes decision-making, both for policy-makers and for the market. Access to commentary on the latest developments concerning the program, to real-time trading data, to advanced modelling and analytics, and to themed periodicals such as this one, is available on a subscriber basis. CaliforniaCarbon.info has content and/or data partnerships with a large number of market participants, and has been a media partner to the Navigating the American Carbon World and Argus California Carbon Summit conferences in the past year. Visit CaliforniaCarbon.info ABOUT CLIMATE CONNECT LTD CaliforniaCarbon.info is operated by Climate Connect Ltd, an online media firm established in London in 2010. With headquarters in London and in New Delhi, Climate Connect’s dedicated editorial, research, forecasting, and IT solutions desks have a global reach that allows us to serve clients in four continents. Climate Connect’s distinguished board of advisors consists of high net-worth individuals in the Bay Area and in New Hampshire, who boast 40 years of cumulative experience in the climate change markets. Climate Connect also operates several other websites, including www.cleantechdeals.com and www.energyportal.in. Visit Climate Connect homepage © CaliforniaCarbon.info [email protected] 15

© Copyright 2026