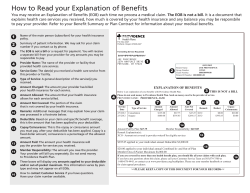

2014 Benefits Guide - Davis School District