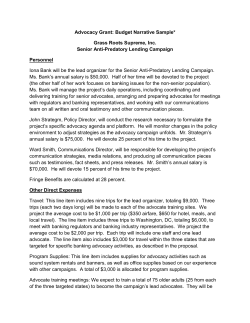

HOW WE DO BUSINESS — THE REPORT