here - Napia

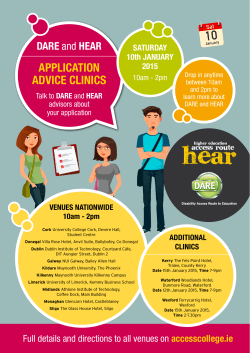

BULLETIN N a t i o n a l As s o c i a t i o n o f P u b l i c I n s u r a n c e Ad j u s t e r s PRESIDENT’S MESSAGE Karl L. Denison, CPPA, GoodmanGable-Gould Co./ Adjusters International Did you know that over the past year NAPIA presented programs that qualified for 33 continuing education (CE) credits in 17 states? No other national or regional organization offered as many credits for public adjusters, nor were their courses approved by as many state departments of insurance. Another example of NAPIA leading the way with public adjuster education is the Florida 5-Hour Law & Ethics Update course to be presented during the January 15-17, 2015 Mid-Year Meeting at Loews Portofino Hotel in Orlando, Florida. As of this past October, Florida licensed adjusters whose CE compliance period concluded at month’s end or later are required to complete a 5-Hour Law & Ethics Update course in each two-year license compliance period. The content of this course is highly regulated and specifically described by Florida’s Department of Financial Services. NAPIA will be one of the first to present this course exclusively for public insurance adjusters. In addition to meeting the needs of Florida PA licensees, the program has been submitted to 17 more states for approval. As of this writing the course has been approved for 5 CE credits in Colorado, Florida, Iowa, Georgia, Massachusetts, North Carolina, Pennsylvania, Tennessee, Texas, Utah and Virginia. Looking ahead to 2015 there will be more opportunities for NAPIA members and other public insurance adjusters to meet continuing education requirements for licensing in their various states. In addition to the upcoming MidYear Meeting, up to 6 CE credits will be awarded for attending FPCC West on March 26 in Marina del Rey, California. As many as 7 CE credits are planned for the June 10-13, 2015 Annual Meeting in Colorado Springs, Colorado. Attendees of the October 19-21, 2015 First Party Claims Conference in Warwick, Rhode Island can earn up to 15 CE credits. The final education program to be held next year is the December 10-12, 2015 Mid-Year Meeting in Scottsdale, Arizona. I encourage you to add these association sponsored events to your calendar. Keep in mind that the education sessions at NAPIA conferences and seminars are tailored to the public insurance adjusting profession. They offer a learning experience that can’t be matched by online courses or generic seminars that often include subjects unrelated to what you do. The contacts made and the networking that occurs at our events is also very valuable. I hope to see you next month at the NAPIA Mid-Year Meeting where we can all benefit from another first-rate education program. Fall 2014 ALL AGREE – FPCC 2014 WAS A BIG SUCCESS! “Wonderful program!,” “Great attendance/networking,” “Very well run conference,” and “A lot of instruction in a small amount of time,” were just a few of the favorable comments submitted by attendees surveyed after the October 20-22, 2014 First Party Claims Conference at the Crowne Plaza Hotel in Warwick, Rhode Island. FPCC Keynote Speaker Senator Alfonse D’Amato (c) is flanked by NAPIA President Karl Denison (l) and NAPIA’s NAIC Liaison Greg Serio (r) Judging from a first timer’s observation, “This was my first year and I found all sessions informative – learned much and great networking opportunity,” as well as another from a past attendee, “Better than last year – great speakers,” the conference is providing the instruction, continuing education (CE) credits and networking for first party property insurance claims professionals it was established to do. Continued on page 2 FPCC from page 1 The conference schedule was streamlined this year by providing education during two breakfasts and a luncheon. This resulted in shorter days with the same amount of CE credits. The difference was noted as one attendee said “Glad classes are done by 3:00 pm.” Conference sponsors and exhibitors benefited from the well positioned conference layout that prompted attendees to pause by displays between classes and during receptions. Looking ahead, the FPCC Planning Committee asked attendees for their thoughts on the location (Warwick/Providence, RI), hotel (Crowne Plaza), time of year (October) and overall schedule. Over 91% said they were happy with the location; greater than 98% were satisfied with the hotel; more than 90% liked having the conference in October, and all were pleased with the schedule. FUTURE MEETINGS SITES & DATES Mid-Year Meeting Loews Portofino Hotel at Universal Orlando, FL January 15-17, 2015 FPCC West Marina del Rey Hotel Marina del Rey, CA March 26, 2015 Annual Meeting The Broadmoor Colorado Springs, CO June 10-13, 2015 First Party Claims Conference Crowne Plaza Hotel Warwick, RI October 19-21, 2015 Mid-Year Meeting Westin Kierland Resort & Spa Scottsdale, AZ December 10-12, 2015 Annual Meeting Montage Laguna Beach, CA June 15-18, 2016 Mid-Year Meeting The Breakers Palm Beach, FL December 8-10, 2016 SERIO CALLS FOR EXPANSION OF CIVIL AUTHORITY INSURANCE COVERAGES Tony D’Amico leads FPCC course on business income & expense Plans are now underway for FPCC 2015. Speakers, sponsors and exhibitors are encouraged to sign up early to take advantage of choice topics, sponsorships and exhibit space. For details about the October 19-21, 2015 conference contact FPCC at 703-4332520 or [email protected]. Also visit www.firstpartyclaims.com. Page 2 Former New York Superintendent of Insurance Greg Serio called on insurers to greatly expand the civil authority coverage provided for in commercial insurance policies. Superintendent Serio made his comments during a presentation on the topic of civil authority insurance coverages at the 2014 First Party Claims Conference held in Warwick, RI. Civil authority insurance is that Continued on page 3 OFFICERS PRESIDENT Karl L. Denison, CPPA FIRST VICE PRESIDENT R. Scott deLuise, SPPA SECOND VICE PRESIDENT Diane Swerling, SPPA THIRD VICE PRESIDENT Jeff Gould, CPA FOURTH VICE PRESIDENT Damon Faunce TREASURER Greg Raab SECRETARY Jeff O’Connor, SPPA DIRECTORS Ray Altieri, Jr., CPPA Matthew Blumkin Kim Cary, CPPA Pat Cuccaro Art Jansen, SPPA Robert Joslin, CPPA Jodie Papa Ron Reitz, SPPA Anita Taff Judith Vickers, SPPA Ed Williamson David Young, SPPA COUNSEL Brian Goodman, Esq. One South Street, Suite 2600 Baltimore, MD 21202 P 410- 752-6030 F 410- 539-1269 [email protected] www.kramonandgraham.com EXECUTIVE DIRECTOR David Barrack 21165 Whitfield Place, #105 Potomac Falls, VA 20165 P 703-433-9217 F 703-433-0369 [email protected] www.napia.com STAFF Richelle Kelly Director of Membership & Events Enid Palazzolo Director of Accounting Services MANAGEMENT FIRM Barrack Association Management Potomac Falls, VA COVERAGES from page 2 NEW & PENDING MEMBERS component of a commercial insurance policy, usually within business interruption coverage, that protects businesses that have been disrupted by an order or action of a government agency. “Whereas civil authority was once a limited coverage pertinent in cases of individual losses, it has taken on a far greater import as emergency orders, wide scale evacuations, and more proactive and preventive emergency management have become the norm during times of disasters,” Serio said. “Coverages are sorely lagging behind the changing times, and their impacts upon the nation’s businesses. “If the industry is unwilling to take on this obligation to policyholders and insurance consumers, then I would expect insurance regulators and state legislators to take up the mantle.” NAPIA welcomes the following new and pending Public Adjuster member firms as well as new Affiliate member individuals: Serio also advocated to his listeners that they become more proactively engaged with governmental agencies, including emergency managers, to make certain that government orders issued before, during or after disasters like hurricanes, earthquakes and tornadoes, or terrorist events, reflect the terms and provisions of civil authority insurance contracts to assure that businesses will be covered for losses incurred as a result of those orders. “Oftentimes,” Serio said, “the orders are missing critical pieces of information that render civil authority policies useless.” NEW PUBLIC ADJUSTING FIRMS Claim Shield Public Adjusters Ft. Worth, TX (R) Roy Young (IC) John Long Gavnat and Associates Burnsville, MN (R) Jim Pierce Mid-West Public Adjusting, LLC Columbia, MO (R) Eric Baker (IC) Cindy Greene (IC) William Cox Miller Public Adjusters, LLC Appleton, WI (R) David Miller (R) Russell Thomas PENDING PUBLIC ADJUSTING FIRMS Crown Adjusting LLC Oakland, CA (R) Robert Crown D.B. Solomon Public Adjusters Fair Oaks, CA (R) Daniel Solomon (IC) Steven Solomon G.F. Gallo & Associates Cranston, RI (R) Gary Gallo Maine Public Adjusting, LLC Hamden, ME (R) Roland Francis NEW AFFILIATE MEMBERS NAPIA TO PRESENT 2014 PERSON OF THE YEAR AWARD AT MID-YEAR MEETING Gregory V. Serio, a partner in the New York City-based consulting firm Park Strategies, LLC, has been named NAPIA’s 2014 Person of the Year. Robert Green, Esq. Robert D. Green & Associates Houston, TX Clinton Scott, Esq. Gilbert Russell McWherter Scott & Bobbitt PLC Jackson, TN DONATE TO NAPIA CHARITABLE FUNDS Named after William Goodman, the first president and founding father of NAPIA, the Will Goodman Foundation was created to serve as a resource for education and training of public insurance adjusters. The Paul Cordish Memorial Foundation was established in memory of NAPIA Executive Director and Counsel Paul L. Cordish, Esq. Each year the Foundation funds an award for students at the University of Maryland School of Law who successfully compete in a writing competition on a topic focusing on public insurance adjusting. Contributions made to either fund in the name of a loved one or colleague will be acknowledged with a letter to the deceased’s family. Donations are tax deductible and are restricted for use as noted above. Checks are payable to the Will Goodman Foundation or the Paul Cordish Memorial Foundation and can be mailed to: NAPIA 21165 Whitfield Place, #105 Potomac Falls, VA 20165 To make a donation by credit card, contact NAPIA at 703433-9217 or [email protected]. SIGN UP FOR YOUR SPPA DESIGNATION! Do you have your SPPA? The Senior Professional Public Adjuster (SPPA) designation program can provide the specific technical knowledge you need for effective claims handling, leading to beneficial results for you and your clients. For details about the public adjuster certification program log on to www.TheInstitutes.org/SPPA. Page 3 COUNSEL’S CORNER Brian S. Goodman, Esq. As we head into 2015, I am pleased to report that NAPIA continues to gain acceptance and recognition as the leading voice in the public adjusting profession throughout the country. In November, NAPIA Past President Ron Papa made a presentation to the newly formed Catastrophe Response Committee of the NAIC, a committee established in large part due to the outstanding efforts of our NAIC Liaison Greg Serio. The presentation focused on the pervasive problem of the Unauthorized Practice of Public Adjusting (UPPA). With the formation of this committee as well as the growing body of legal authority, we see that this is an issue that is now being recognized and acted upon in many states. Page 4 But we have to do more. We have to be ever vigilant in addressing this problem and bringing it to the attention of the insurance departments and state attorney general offices. As they say at airports these days “if you see something, say something.” This is an adage that applies to us as we witness both individuals and companies engaging in public adjusting without a license. many states have now enacted additional regulations on public adjuster contracts and conduct. It is vitally important that all NAPIA members be aware of these controls in a particular state, especially if you are handling a loss in a state in which you do not regularly practice. We want to be sure that our members adhere to various state by state regulations as we protect the insured. On another note, please remember that this is the time of year when legislatures are preparing to convene. NAPIA has efforts pending in a number of states; however, if you learn of a legislative issue impacting the public adjusting profession in your state, please let us know as soon as possible. Do not assume that all will simply work out if we do not at least have the opportunity to consider a particular issue. As I will detail in my presentation at the upcoming Mid-Year Meeting, Goodman speaks on ethics at FPCC Page 5 NAPIA MID-YEAR MEETING COMPLIES WITH NEW FLORIDA 5-HOUR CE REQUIREMENT The NAPIA Mid-Year Meeting takes place January 15-17, 2015 at Loews Portofino Bay Hotel Universal Orlando in Orlando, Florida. The education at this year’s winter convention is designed to help public adjusters comply with the new Florida fivehour law and ethics continuing education requirement now in effect. The two morning sessions provide insurance law updates, ethics and industry trends. Applications have also been filed with 17 other state DOIs for similar credit. Course instructors are Bob Freemon, Esq., Freemon & Miller, P.A. and Jim Greer, CPCU, AE21. The Mid-Year Meeting opens with the welcome reception at 6:30 pm on Thursday, January 15 and concludes at noon on Saturday, January 17. The 2014 NAPIA Person of the Year Award will be presented at Friday’s reception. This year’s recipient is NAPIA’s liaison to the NAIC, Greg Serio of Park Strategies, LLC. Meeting registration includes all education sessions, NAPIA business meeting (for members only), breakfasts, breaks and receptions. The non-member registration includes education sessions, breakfasts and breaks. Registered guests and children are welcome to attend the evening receptions as well as a separate breakfast on Friday morning. FAPIA, GAPIA and TAPIA members may register at the NAPIA member rate and attend all functions. Located at Universal Orlando® Resort, Loews Portofino Bay Hotel re-creates the charm of the seaside village of Portofino, Italy. Hotel guests enjoy exceptional dining, spa and health club, and other hotel benefits. It’s just a short walk to shopping, entertainment and further dining options at Universal CityWalk. Resort guests can also take advantage of early admission and express lines at the theme parks. Visit www.napia.com for more details. Keep in mind the deadline for early registration fees and group room rates is December 22, 2015. THANK YOU TO OUR MID-YEAR SPONSORS & EXHIBITORS! Continental Machinery, Inc. Frankel & Company Merlin Law Group, P.A. NAPIA ERRORS & OMISSIONS LIABILITY INSURANCE PLAN CAN SAVE YOU MONEY! This exclusive program, available through CNA, is a package policy providing flexibility and key benefits – all at a reduced rates Highlights include: ● Professional Liability ● Network Security & Privacy Liability ● Directors & Officers Liability ● Employment Practices Liability ● Fiduciary Liability ● Crime (employee theft) For more information and to receive an application, contact Frank Costa, CIC, CRM at: Frenkel & Company 601 Plaza 3, 6th Floor Harborside Financial Center Jersey City NJ, 07311 Phone: (201) 356-0075 Loews Portofino Bay Universal Orlando is modeled after Portofino, Italy (above) Page 6 PARTICIPANTS AT FPCC 2014 “ENGAGE – LEARN – NETWORK” Page 7 Page 8 Page 9 Page

© Copyright 2026