Optional headline can go here across a few lines.

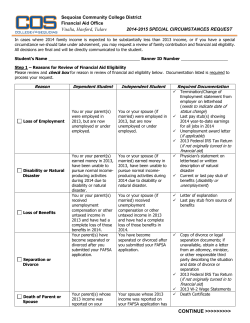

2015 New Hire Enrollment Guide Optional headline can go here across a few lines. What’s Inside What You Need to Know . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Medical and Prescription Drug Coverage . . . . . . . . . . . . . . . 4 Health Care Reform and the Individual Mandate . . . . . . . . . 8 Eligibility: Who You Can Cover on Your Cargill Benefits . . . 8 Cool Tools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 More Benefit Choices Dental Coverage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Vision Coverage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Flexible Spending Accounts (FSAs) . . . . . . . . . . . . . . . 13 Life Insurance and Disability Coverage . . . . . . . . . . . . 13 Retirement Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 2015 Wellness Incentives . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 How to Enroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 Vendor Contact Information . . . . . . . . . . . . . . . . . . . . . . . . . 21 Not sure who to call? Call Patient Care for questions about health care benefits: Call HR Direct Dial for questions about other benefits: • Medical Plans •Enrollment • Health Savings Account (HSA) • Dependent Verification • Health Reimbursement Account (HRA) • Life Insurance • Prescription Drugs/Pharmacy Benefit • Accidental Death and Dismemberment • Wellness Programs •Disability • Dental Plan • Accident and Sickness • Vision Plan • Business Travel Accident Insurance • Flexible Spending Accounts • Adoption Assistance o Health Care Spending Account (HCSA) • Tuition Reimbursement Program o Dependent Care Spending Account (DCSA) Patient Care 1-877-344-7474 for English 1-800-381-5834 for Spanish Monday through Friday, 7 a.m. – 8 p.m. CST Saturday, 8 a.m. – 1 p.m. CST 2 | 2015 New Hire Enrollment Guide HR Direct Dial 1-877-366-9696 for English and Spanish Monday through Friday, 8 a.m. – 5 p.m. CST What you need to know Cargill values the contributions you make to help the company achieve its business goals. As part of the total compensation package Cargill offers you, the company has a comprehensive benefits program that allows you to choose the benefits that best fit your needs. We also care about the health of you and your family. Therefore, we have created programs to support you in understanding and improving your health. Benefits Information Resources You have numerous resources and tools available to help you learn about and manage your benefits. These include: Cargill’s New Hire information website, cargill.com/mybenefits • Get information about your benefits program; • Read tips on how to choose a medical plan; and • Find out how the medical plans differ. Patient Care Health Care Advocacy Service, 1-877-344-7474 • Discuss benefit options and how the plans work; • Obtain help with the claim payment process and assistance with resolving any issues that may exist; and • Compare the cost and quality of physicians and facilities for health care procedures and tests. Blue Cross and Blue Shield’s website, bluecrossmn.com/cargill • Locate network providers; • Review preventive care guidelines and wellness resources; and • Access tools to help you get the best care at the best price including Ways to Save Alerts, Cost Look-Up Tool, Savings Dashboard and Healthcare University. Cargill’s My Well Being website, mywellbeing.cargill.com • Review the steps to earn wellness incentives; • Learn about programs on managing your weight, quitting smoking, etc.; • Get reimbursed for completing weight loss and tobacco cessation programs; • Read health newsletters and tips; and • Much more! RedBrick Health, redbrickhealth.com/login, 1-866-322-1719 • Learn about and participate in wellness incentives; and • Access Health Assessment, healthy activities, track your wellness points, and more. 2015 New Hire Enrollment Guide | 3 How the medical plans work All Cargill medical plans include preventive care covered at 100% by the company when you use an in-network provider. Other eligible medical expenses you pay count toward an annual deductible, which you must meet before the plan starts paying a percentage of covered costs. Under the HSA and HRA plans, you may use money from your Cargill-funded account to cover your share of these costs. This graphic provides a big-picture look at how it all fits together (in-network coverage only): You can use your HRA or HSA money to help pay for eligible expenses. In-network preventive care › FREE FOR YOU. Plan pays 100% of covered charges. (Call Patient Care at 1-877-344-7474 if you have questions on preventive coverage.) Deductible › You pay 100% of eligible expenses (nonpreventive care) until you satisfy the deductible. Coinsurance › After you meet the deductible, you and Cargill share expenses through coinsurance. › Once your eligible expenses reach the outof-pocket maximum, the plan pays 100% of eligible expenses for the remainder of the year. Out-of-pocket maximum Monthly Medical Employee Contributions HRA Plan Rate Tier HSA Plan Primary Plan Standard Rate After Incentives* Standard Rate After Incentives* Standard Rate After Incentives* 1 Employee only $152 $77 $131 $56 $92 $17 2 Employee and spouse $295 $195 $241 $141 $190 $90 3 Employee with 1 or 2 children $232 $157 $188 $113 $136 $61 4 Employee with 3 or more children $262 $187 $209 $134 $162 $87 5 Family with 1 or 2 children $361 $261 $288 $188 $209 $109 6 Family with 3 or more children $390 $290 $324 $224 $261 $161 *This table demonstrates your effective rate assuming you earn the full incentive for the year. The effective rate is determined by dividing the total available incentive by 12 and subtracting that amount from the monthly rate. Note that the wellness incentive is a taxable payment made quarterly. The effective rates do not take into account the tax impact of the incentive payments. 4 | 2015 New Hire Enrollment Guide Comparing your medical plan options Whether you’re young and healthy, someone who has the pediatrician on speed dial, or a single dad with three growing kids, it’s important to have coverage that helps keep you healthy with access to 100% coverage for in-network preventive care and helps cover the cost of health care services if, or when, you need them. HRA Plan HSA Plan Primary Plan Monthly contributions Highest Medium Lowest Deductible Lowest Medium Highest Network coverage In- and out-of-network coverage available In- and out-of-network coverage available In-network coverage ONLY* Account Cargill funds an account you can use to pay for eligible medical expenses (including meeting your deductible) Cargill funds an account you can use to pay for eligible health care expenses (medical, prescription drugs, dental and vision); you can make pre-tax contributions to the account as well N/A Carry forward You can carry the balance forward every year you’re enrolled in the plan; if you leave Cargill or do not enroll in Cargill HRA coverage, you forfeit any remaining amount in your account Your account carries forward every year and you keep the account regardless of whether you leave Cargill or enroll in other Cargill coverage N/A * Except for emergency services. Is an HSA your path to a more secure retirement? Did you know an HSA can help you reach your retirement savings goals? Sure, you can use it now to pay for eligible health care expenses tax free, but you can also save your contributions (including Cargill contributions) and roll them over from year to year until you accumulate a significant balance to use for medical expenses in retirement. And remember, you take your HSA with you if you leave Cargill. Not only does money go into your account tax free, but you never pay taxes on it or the earnings, as long as you use it for IRS-eligible medical expenses. 2015 New Hire Enrollment Guide | 5 Here’s a closer look at how your 2015 medical plan options compare: Cargill offers three medical plan options so you can choose the one that fits your budget and best meets the needs of you and your family. 2015 Medical Plan Options In-Network Benefits Tier HRA Plan HSA Plan Primary Plan* Highest employee contribution Medium employee contribution Lowest employee contribution 1 $1,200 $1,800 $2,500 2, 3 or 4 $1,800 $2,700 $3,700 5 or 6 $2,400 $3,600 $5,000 Monthly Contribution Deductible Amount you pay before the plan pays coinsurance Note: The HRA and HSA plan deductibles are offset by Cargill’s contribution to your account (see below) Cargill’s Contribution to Your Account Pays for a portion of your deductible 1 $500 $750 2, 3 or 4 $750 $1,100 $1,000 $1,500 Plan pays 80% You pay 20% Plan pays 80% You pay 20% Plan pays 70% You pay 30% Plan pays 100% Plan pays 100% Plan pays 100% 1 $3,500 $3,800 $6,000 2, 3 or 4 $5,200 $5,700 $9,000 5 or 6 $7,000 $7,600 $12,000 5 or 6 Coinsurance Percent the plan and you pay after your deductible (in network) Preventive Care (in network) Out-of-Pocket Maximum The most you will pay in a year for eligible expenses, including your coinsurance, deductible and any prescription copays Once you reach your out-of-pocket maximum, you pay 0% and Cargill pays 100% (in-network) Prescription Drug Coverage You pay 25% after deductible with the following limits: Retail (31-day supply) Generic: $10 min/$25 max copay Preferred brand: $20 min/$60 max copay Non-preferred brand: $50 min/$100 max copay Mail Order (90-day supply) Out-of-Network Coverage*** $0 (no account) Generic: $20 min/$50 max copay Preferred brand: $40 min/$120 max copay Non-preferred brand: $100 min/$200 max Plan pays 60% You pay 40% You pay 30% after deductible You pay 20% after deductible (certain approved maintenance drugs are not subject to the deductible)** Plan covers maintenance drugs only if received through mail order Plan pays 60% You pay 40% In-network coverage only (except for emergency services) *Differences in covered benefits for the Primary plan include, but are not limited to: no infertility coverage, and Blue Distinction Centers must be used to obtain coverage for certain procedures. Review your Summary Plan Description or contact Patient Care at 1-877-344-7474. **Certain approved drugs are not subject to the deductible. A complete list of these drugs can be found on the on the Cargill Connects’ HR Center under Health & Wellness > Research Benefits > How Do Prescriptions Work. ***Out-of-network coverage also has higher deductibles and out-of-pocket maximums. 6 | 2015 New Hire Enrollment Guide What You Need To Know About the HSA If you enroll in the HSA Plan, you will be asked to agree to the terms of the HSA before an account can be opened in your name. When you enroll on HR Direct, you will be prompted to accept the terms, and if you do, your HSA will be opened automatically. If you do not agree to open your account within a timely manner, you will forfeit all contributions to the account from Cargill. Here’s a quick list of things you should know before enrolling: • Cargill contributes money to your account on a prorated, per-pay-period basis. For example, an employee enrolled in employee-only coverage with semi-monthly pay periods will have $31.25 contributed to the HSA each pay period he or she is enrolled in the plan ($750 if enrolled 24 pay periods). • The IRS limits the amount that can be contributed to an HSA each year. The IRS limits for 2015 are: $3,350 for employee-only, and $6,650 for employee + spouse, employee + child(ren) and employee plus family. Both your contributions and Cargill contributions count toward the IRS limit. • If you cover a domestic partner (DP) and/or DP children, you will receive the “Employee only” contribution amount from Cargill and be able to contribute up to the “Employee only” amount to the Health Savings Account. This is because, in accordance with federal law, DPs are not eligible to use the funds from the HSA. This does not apply if you are covering your own children in addition to a DP and/or the DP’s children. • If you are age 55 or older, you can make an additional “catch-up contribution” of up to $1,000 beyond the annual limit. • You may use your HSA funds to pay for qualified health-care expenses for you, your spouse and any dependents you claim on your federal tax return. Go online to cargill.com/mybenefits to view a list of eligible expenses. Note: Unless your covered dependent also meets the IRS definition of a “qualifying child” or “qualifying relative” (i.e., lives with you for more than half the year and provides less than half of his/her own support), funds from your HSA used for his/her eligible medical expenses may be subject to regular income tax plus a 20% penalty tax. • Once your account balance reaches $1,500, you can choose to invest the money in your account in the investment funds offered through the account. Note: While non-tax dependents are eligible to be covered under the HSA Plan, you cannot cover medical expenses from the HSA for dependents you do not claim on your taxes, including non-tax DPs and non-tax dependents age 19-26. ConnectYourCare App Enrolled in the HSA Plan, the health care spending account (HCSA) or the dependent care spending account (DCSA)? Check your accounts wherever you are! ConnectYourCare, account administrator for all of the above, has designed a secure, interactive mobile application for iPhones and Androids called “CYC Mobile.” Use it to view account information, call customer service or take a photo of your receipt with your mobile device and upload it directly to the system. Simply download the free application from the iPhone App Store or the Android Market, and you will have the following features at your fingertips: • View account balance, account alerts and transaction history. • View all claims, your claims that require action and claims details. • Submit a new claim. 2015 New Hire Enrollment Guide | 7 Covering your dependents Prevention is key – and free! You care about your dependents, and so do we. When you enroll, you may choose to cover yourself and your eligible dependents under the Cargill plans. Generally, eligible dependents If you think annual checkups are just include: for kids, think again. Just as we trust a • Children, stepchildren, children of your domestic partner and foster children to age 26 mechanic to tune up our cars and check (for life insurance, children between 19 and 25 must be full-time students in order to be the oil to prevent costly breakdowns later, eligible for coverage) an annual physical with your primary • Disabled adult children age 26 or older care doctor can help find problems early, •Spouse leading to better treatment options and • Domestic partner better outcomes for your health. For IMPORTANT: If you are adding a dependent, you will be asked to provide documentation to support the eligibility of that dependent through the Mercer verification process. For more information, including detailed definitions and exceptions, visit cargill.com/mybenefits. example, early detection of cancer can literally save your life. Typical preventive care includes an office visit, basic biometrics (height, weight, Special note for HSA plan participants with dependents blood pressure, blood test) that provide a snapshot of your overall health and The IRS allows you to use your HSA to pay qualified expenses for yourself, and for dependents who meet the IRS definition of “dependent” on your tax return. Take this into account when choosing your medical plan for 2015 and/or if you are using an HSA to pay expenses during the year. Talk to your tax advisor for guidance. appropriate cancer screenings. Even if you complete a screening onsite through Cargill’s wellness program, you should go over your results with your physician, who can review them in the context of your overall health history. 8 | 2015 New Hire Enrollment Guide Under health care reform, individuals are required to have health care coverage or pay a tax penalty. If you and your dependents choose coverage through Cargill or a qualified plan elsewhere, you won’t be subject to the individual penalty. There are some exceptions and exemptions from the penalty. For more information, contact Patient Care at 1-877-344-7474. Does your spouse have access to other coverage? If your spouse is eligible for medical coverage through another employer (whether they have elected coverage or not) and you choose to cover him or her under a Cargill medical plan, you will pay a fee of $900 per year on a pre-tax basis (domestic partner fee is post-tax, in accordance with IRS regulations). See cargill.com/mybenefits for more information. Questions? Call Patient Care at 1-877-344-7474 (Spanish: 1-800-381-5834). 2015 New Hire Enrollment Guide | 9 Cool tools Giving you resources to make your life easier and help you get the most value from your benefits. Smart ways to save. The costs of health care services and prescriptions can vary greatly by location, facility or provider. And, paying more doesn’t always mean better quality. The following tools and resources can help you get great-quality health care and save time and money at the same time. What’s not to like? Cost Look-Up is here today! Want to start saving today? If you’re a BCBS medical plan member, go to bluecrossmn.com/cargill any time and sign in (or create an account) to try the Cost Look-Up Tool, part of the provider finder tool, or to check the cost of services like an MRI, specific procedures or surgery. Get informed before you schedule your next appointment so you can compare costs, understand your options and select the provider, facility or service that meets your needs and budget. Ways to Save Alerts Savings Dashboard Ever wish you had a savvy friend who understood the ins and outs When it comes to your health, it pays to be in the driver’s seat. of health care and could help you get the Your personalized Savings Dashboard gets you there. Sort of like best deals? Now you have one – right in “driver’s education” for your medical plan, this tool analyzes how your pocket. As a Cargill BCBS medical plan you use your benefits and provides personalized suggestions to member, you can sign up to receive a text or help steer you toward savings. email when there is a chance for you to save You’ll see the real cost money on a service or prescription you’re already using. The alert system automatically reviews any recurring claims you had the prior month(s) to see if the same services can be found nearby for less. Alerts may show you the amount you can save by considering: • Lower-cost pharmacies • Facility alternatives, such as choosing an imaging center rather than a hospital for an MRI (MRI costs can vary as much as 600% from provider to provider) • Provider alternatives that are near you • Drug alternatives to discuss with your doctor Let Ways to Save Alerts shop for you. Sign in to your account at bluecrossmn.com/cargill to sign up and pick your preferences or call Patient Care at 1-877-344-7474 and they can help you sign up. Messages will start arriving when you have an opportunity to save. 10 | 2015 New Hire Enrollment Guide of services and how they vary – often greatly – between different providers and facilities. Learn where to fill your prescription for less, and find a clinic that charges a lower price for the same quality of services you’re receiving elsewhere. Savings Dashboard integrates your Ways to Save Alerts. Sign in to bluecrossmn.com/cargill to get behind the wheel and start saving. Teladoc® brings the doctor to you! Who wants to drive to an appointment when you’re not feeling well, and then sit in the waiting room with other sick people while you wait your turn? Teladoc is an easy, convenient and affordable alternative to an office, urgent care or emergency room (ER) visit. You can talk to a board-certified, licensed doctor by phone or online video chat (where available*), any time, day or night, to get help for yourself or your covered dependents. Simply call or log in to request a consultation, and you’ll get connected with a physician who is licensed in your state. They can diagnose and even prescribe medication for non-emergency issues like: • Ear/sinus infections Healthcare University Watch videos and play games to learn more about your health care benefits and earn wellness incentive points. Healthcare University offers videos, quizzes and games you can play any time, •Bronchitis •Allergies • Colds and flu • Urinary tract infection • Respiratory infection • Strep throat • And more anywhere, even on your mobile phone or tablet. This free feature With your permission, Teladoc can share your consultation record makes it easier than ever to learn how to get the most value from with your primary doctor. your medical benefits. School is in session – go to bluecrossmn. Teladoc is available to Cargill Blue Cross and Blue Shield com/cargill to get started. Healthcare University is available in (BCBS) salaried medical plan participants. The service costs addition to the tools available through RedBrick Health. $40 per consultation, which applies toward your deductible and out-of-pocket maximum. Your use of Teladoc is completely confidential. If you enroll in a Cargill medical plan for 2015, you’ll receive more information from Teladoc. *Teladoc is not available in Idaho, and Teladoc’s video consultations are not available in Iowa, Louisiana, Missouri, Ohio and Texas. 2015 New Hire Enrollment Guide | 11 Your other benefit options Dental Vision The health of your teeth can affect how often you smile, how you Do you, your spouse or kids wear glasses or contacts? If so, the feel and even what you eat. Cargill’s dental plan through Delta Vision Service Plan (VSP) could be a good fit for you. Coverage Dental helps you keep your mouth healthy by covering the following includes vision care products and services, such as: care (up to a $1,500 annual maximum): • Eye exams (every year) • Preventive care (exams, cleanings and X-rays) – covered at • Frames (every two years) 100% in network • Lenses (every year) • Basic services (fillings, extractions) – covered at 80% • Contact lenses – every year in lieu of glasses (lenses and • Major services (crowns, bridges, dentures, implants) – covered at 50%. frames) Each time you need vision care, you decide whether to use a If you or a dependent is considering braces, the plan also covers VSP in‑network provider (including many national chains) or an orthodontia (50%, up to a separate lifetime in-network maximum of out-of-network provider. You save money if you go through the $2,000/person). VSP network for your services and supplies. To find a participating You may visit any provider you choose, but you’ll save money when provider near you, visit vsp.com/go/cargill and click on “Find a VSP you use an in-network provider. To find out whether your provider is in one of the Delta Dental networks, go to deltadentalmn.org/cargill doctor.” For more detail about your covered benefits under the plan, visit cargill.com/mybenefits. and click “Dentist Search” or call 1-800-587-6975. For more detail Monthly Vision Employee Contributions about your covered benefits under the plan, visit cargill.com/mybenefits. Rate Tier Monthly Dental Employee Contributions Rate Tier Monthly Rate 1 Employee only $11 2 Employee and spouse $27 3 Employee with 1 or 2 children $25 4 Employee with 3 or more children $27 5 Family with 1 or 2 children $41 6 Family with 3 or more children $45 12 | 2015 New Hire Enrollment Guide Monthly Rate 1 Employee only $7.00 2 Employee and spouse $13.70 3 Employee with 1 or 2 children $14.90 4 Employee with 3 or more children $14.90 5 Family with 1 or 2 children $21.50 6 Family with 3 or more children $21.50 Flexible Spending Accounts Life Insurance Health care and dependent care costs can really add up. Flexible Cargill provides Basic Life insurance coverage at no cost to you, spending accounts (FSAs) allow you to set aside money to pay with the option to buy additional coverage for yourself, and/or for some of these expenses. If eligible, you set aside the money coverage for your spouse and dependent children. pre-tax which means that you do not pay tax on the amounts you Optional coverage is administered by The Standard Insurance elect to contribute. Health Care Spending Account (HCSA)*: You may contribute Company and includes: • Employee: additional life insurance equal to one to five times up to $2,500 to your account and can use the money to reimburse your salary. In the future, you can only enroll or increase your yourself for eligible medical expenses not covered by your medical, coverage during a life event or by one times your salary during dental or vision plans for yourself, your spouse or anyone who open enrollment. qualifies as a dependent on your federal tax return – even if you don’t cover them on your Cargill benefits. If you are enrolled in the HSA plan, your HCSA may be used for dental and vision expenses • Spouse: up to $250,000 in $25,000 increments. In the future, you can only enroll or increase your coverage during a life event or by $25,000 during Open Enrollment. only. • Dependent Children: up to $10,000 in $2,000 increments. Dependent Care Spending Account (DCSA): Contribute up to For details, visit cargill.com/mybenefits. $5,000 annually to help yourself pay for employment-related day care expenses for eligible dependents. An eligible dependent is Monthly Additional Life Employee and Spouse Contributions someone you claim as a dependent on your federal income tax return, and includes children under age 13 who live in your home, as well as a spouse or dependent of any age (including parent) Non-tobacco Rate (per $1,000 of coverage) Tobacco Rate (per $1,000 of coverage) who lives with you and is physically or mentally incapable of self- Age Employee Spouse Employee Spouse support. Under age 25 $0.056 $0.056 $0.067 $0.067 25-29 $0.067 $0.067 $0.078 $0.078 30-34 $0.090 $0.090 $0.101 $0.101 35-39 $0.101 $0.101 $0.112 $0.123 40-44 $0.112 $0.168 $0.134 $0.213 45-49 $0.168 $0.280 $0.235 $0.358 50-54 $0.258 $0.414 $0.370 $0.538 55-59 $0.482 $0.638 $0.538 $0.829 60-64 $0.739 $0.974 $1.165 $1.747 65-69 $1.422 $1.467 $1.434 $1.870 70-74 $2.307 $2.778 $2.330 $3.304 For more information, including restrictions, instructions for 75-79 $2.509 $3.461 $2.811 $3.886 reimbursement and a complete list of covered expenses, go to 80-84 $3.763 $5.253 $4.144 $5.768 85 and older $6.160 $8.669 $6.597 $9.240 This account reimburses you for dependent care expenses that allow you to work or attend school full time; it does NOT reimburse you for dependent health care expenses. Plan carefully! Each of these accounts is separate – you can’t move money between them. The DCSA has a “use-it-or-lose-it” restriction that requires you to forfeit any money remaining in your account at the end of the year. The HCSA allows you to roll over up to $500, as long as you re-enroll in the HCSA for the next year. Any money over $500 remaining in your account will be forfeited. cargill.com/mybenefits. *Note: You also cannot cover medical expenses for DPs under the health care spending account. Dependent Child Additional Life is $.08/$1,000 of coverage (regardless of the number of children covered). Dependent care limit for Highly Compensated Employees (HCEs) Due to IRS requirements, HCEs – employees making $115,000 or more annually for 2014 – will be limited to a $1,000 Dependent Care Spending Account (DCSA) contribution in 2015. 2015 New Hire Enrollment Guide | 13 Accidental Death & Disability (AD&D) Salary Continuation If you or your spouse were disabled or killed in an accident, Salary continuation is for qualifying absences due to a physical AD&D coverage would provide financial support to you or your disease, injury, pregnancy or mental disorder lasting longer than beneficiaries. If eligible, you can purchase voluntary AD&D seven calendar days up to 26 weeks. You are automatically coverage through The Standard Insurance Company for yourself enrolled in this company-paid benefit. The amount of salary and your spouse in the following amounts: continuation you are eligible to receive is based on your length of • For yourself: $25,000 to $500,000 in $5,000 increments. service. For more on salary continuation coverage, see the Salaried • For your spouse: $25,000 to $250,000 in $5,000 increments. Employee Handbook, available on Cargill Connects’ HR Center (click on Human Resources > North America > United States). You must purchase voluntary AD&D coverage for yourself in level cannot be greater than your coverage amount. See Detailed Benefits Information is Available in your SPD cargill.com/mybenefits for rates and other information. Access Summary Plan Descriptions (SPDs) for your elected order to purchase it for your spouse, and your spouse’s coverage Long-term Disability benefits plans at hrdirect.cargill.com, then click on Self Service > Benefits > Benefits Summary. If you do not have intranet access, Did you know that 25% of the U.S. population will have an illness you may request a paper copy of an SPD by contacting HR Direct or injury during their lifetime that requires multiple months of time Dial at 1-877-366-9696. off? That’s why Cargill provides those with salaried benefits financial protection if they are disabled and unable to work for six months or more. Long-term disability coverage pays two-thirds of your annual salary if you are totally disabled as defined by the plan. Core coverage is company paid, up to a maximum annual salary of $75,000. You can choose to buy additional coverage for your base salary that is greater than $75,000, up to a maximum annual salary of $240,000. If you decide to enroll outside of your new hire enrollment, evidence of insurability will be required. The monthly cost for buy-up coverage is $0.649 per $100 of monthly salary. For more information, visit cargill.com/mybenefits. Don’t forget to name a beneficiary. A beneficiary is someone who will receive your life insurance benefits if you die. Your beneficiary designation applies to any Basic, Additional Life, Voluntary AD&D and Business Travel Accident (if applicable) elections you have on file. This means you should have a beneficiary on file even if you don’t elect any additional life or AD&D coverage. If you die, your spouse or domestic partner will need to provide your marriage certificate or a signed affidavit of domestic partnership in order to receive the benefit. 14 | 2015 New Hire Enrollment Guide Retirement Benefits A 401(k) enrollment kit will be mailed to your home by Vanguard within three weeks of your hire date. You can enroll in 401(k) at any time during the year. At Cargill we value your future and, therefore, we encourage and support you to save and plan for it. Cargill 401(k) and Employee Stock Ownership Plan (ESOP) Cargill’s 401(k) plan is a portable retirement account administered by Vanguard. You can contribute up to 50 percent of your pay on a pre-tax basis, after-tax (Roth) basis or a combination of both. You will be automatically enrolled at 3 percent in the 401(k) plan if you do not enroll within one year. Cargill matches 100 percent on the first 3 percent you contribute, then 50 percent on the next 2 percent. You are eligible to participate in the 401(k) plan immediately following your hire date. The quarterly match is in Cargill ESOP stock. You are eligible to receive matching contributions beginning with your first paycheck following one year of service. The match is immediately 100 percent vested. Employee Retirement Account (ERA) Cargill funds this portable retirement account, which provides an annual contribution of 2.5–7 percent of your eligible pay, depending on your age and years of service (see the table). You are immediately eligible for the ERA and are vested after three years of service. You control where the money is invested from a selection of funds. If you do not make an election, Cargill’s contribution will automatically be invested in the Vanguard Target Retirement Fund that most closely matches the year in which you will reach age 65. To make your investment elections, call Vanguard at 1-800-523-1188. ERA Contribution Schedule Years of Service Age 0-4 5-9 10-14 15-19 20-24 25-29 30-34 35-39 40+ Less than 30 2.5% 2.5% 2.5% 30-34 2.5% 2.5% 2.5% 2.5% 35-39 3% 3% 3% 3% 3% 40-44 3% 3% 3% 3% 4% 4% 45-49 3% 3% 3% 4% 4% 5% 5% 50-54 4% 5% 5% 5% 6% 6% 6% 6% 55-59 5% 5% 6% 6% 7% 7% 7% 7% 7% 60-64 6% 6% 6% 7% 7% 7% 7% 7% 7% 65 + 7% 7% 7% 7% 7% 7% 7% 7% 7% 2015 New Hire Enrollment Guide | 15 Wellness – what you should know We offer wellness incentives because we care about you and your family. We also want to help manage your costs and ours. When we work together towards better health, the cost of our health care will grow at a slower rate. Wellness incentives are designed to thank you—and reward you— for taking steps to improve the quality of your life and the overall health of our organization. Earn up to $1,200 in wellness incentives!* Taking care of ourselves is not easy, and at times it can seem like work. Think of the maintenance a car requires: oil changes, rotating tires, brake inspections. Similarly, your health requires maintenance. Knowing your numbers (cholesterol, Body Mass Index (BMI) and blood pressure) can help ensure your body is running smoothly. Cargill’s wellness program is here to help you keep your health on track and earn some extra cash while doing so! How to earn your 2015 wellness incentives At Cargill, we are committed to providing you and your family with the resources to help you get healthy and/or stay healthy. You can take steps to earn incentives each quarter, October through September: Quarter 1 October - December 2014 Quarter 2 January - March 2015 Quarter 3 April - June 2015 Quarter 4 July - September 2015 There are two types of incentives, both of which translate to real dollars for you: 1. Direct Dollar Incentives: Money you can make by completing certain steps (including being tobacco free) and achieving healthy biometric results. 2. RedBrick Health Points: If you and/or your spouse do not meet the healthy biometric goals, you may make up the missing points (and receive associated dollars) by completing certain healthy activities. You both also have the opportunity to qualify for the first quarter’s wellness incentive by earning 60 points each by the end of 2014.* *Please note: The amount you can earn is prorated based on your hire date. 16 | 2015 New Hire Enrollment Guide Here are the activities you can complete for dollars and/or points in each quarter: QUARTER 1 OCT - DEC 2014 QUARTER 2 JAN - MARCH 2015 Be tobacco free Biometric screening Health assessment Healthy activities QUARTER 3 APRIL - JUNE 2015 QUARTER 4 JULY - SEPT 2015 Healthy biometric results OR healthy activities alternative if you did not achieve healthy biometric results We respect your privacy. Your personal health information is personal and we treat it as such. The health assessment and biometric screening results are completely confidential. Enter the amounts as you earn them Activity How to earn your incentives — step by step Deadline Reward Be tobacco free Attest that you and your covered family members have not smoked or used tobacco in the last 12 months or have completed a tobacco cessation program within the last 12 months. Complete this step during enrollment. $50 per quarter (Q1-Q4 - total $200) Combined reward for both you and spouse Health assessment (HA) Complete the online, confidential HA that helps you understand your health – where you’re doing well and opportunities for improvement – at redbrickhealth.com or by calling RedBrick Health. ASAP You must complete this “gateway” step to qualify for any healthy activity points. You: $50 Spouse: $50 Healthy activities Q1 Complete 60 points worth of RedBrick healthy activities. For a complete list of activities, go to mywellbeing.cargill.com or call RedBrick Health. Q1 December 31, 2014 You: $125 for 60 points Spouse: $50 for 60 points Biometric screening Q2-4 Complete a biometric screening onsite (you) or with your doctor (you/your spouse). Q2 March 31, 2015* You: $150; Spouse: $50 Q3 June 30, 2015* OR Q4 September 30, 2015* You: $75; Spouse: $25 Q2 March 31, 2015 You: $125 each quarter Q2-Q4 = total $375 Spouse: $50 each quarter Q2-Q4 - total $175 Q2 March 31, 2015 Q3 June 30, 2015 Q4 September 30, 2015 You: $125 each quarter you earn 60 points; possible total $375 Spouse: $50 each quarter you earn 60 points; possible total $150 Healthy biometric Achieve healthy results for ALL biometric measures: results (BMI, blood You’re done! You automatically earn your 60 healthy pressure, cholesterol) activity points for quarters 2-4. To view the healthy ranges, access mywellbeing.cargill.com or call RedBrick Health. OR Healthy activities Alternative: If you do not achieve healthy results in all measures, complete RedBrick healthy activities each quarter to earn any remaining points needed to earn 60 healthy activity points. Incentives * Deadlines listed are the date Provant (the administrator of our biometric screenings) receives the form from you doctor, not when the screening was completed. 2015 New Hire Enrollment Guide | 17 It’s easy to get started You can take the first step toward your wellness incentive by completing the tobacco-free certification when you enroll for your 2015 benefits. This is found under the medical section when you enroll online. Then, to complete your health assessment, log on to redbrickhealth.com any time after October 1. If you’re not registered, simply go to the site and click “Register now,” then follow the prompts to complete your registration. Remember: Taking the health Get your spouse in on the action. assessment is the first step in earning wellness incentive dollars. If you do not complete the health assessment, you will not be able to earn points toward your You will earn wellness incentives when healthy activities incentives. your covered spouse completes wellness Once you register with RedBrick Health, log in at your convenience for additional information and healthy activities you can complete to earn points and maximize your wellness incentive. Questions? Call RedBrick Health at 1-866-322-1719. activities too. So why not work together toward a healthier future? Did you know? Numerous studies show that when you partner with someone to Why we care about wellness eat healthier and participate together in When potential problems are caught early, they can be treated more effectively, typically with less expensive treatments and better health outcomes. This protects your health, reduces emotional and financial stress on you and your family and saves money – for you and for Cargill. healthy activities, you are more likely to be successful and keep it up as a longterm habit than if you go it alone. So find a partner—maybe it’s your spouse! Struggling with completing the wellness requirements? Your reward payout When you complete healthy activities and achieve points to earn wellness incentives, you will receive each quarter’s incentive in your paycheck according to the following schedule: Cargill is committed to helping you achieve your best health. Rewards for participating in a wellness program are available to all For tasks/activities completed in… You will receive payment in… employees. If you think you are unable to Quarter 1 October – December 2014 February 2015 meet a requirement for a reward under this Quarter 2 January – March 2015 May 2015 Quarter 3 April – June 2015 August 2015 by different means. Contact RedBrick Quarter 4 July – September 2015 November 2015 Health and they will work with you (and, if Note: You and your spouse (if applicable) must be enrolled in a Cargill medical plan to be eligible for the wellness incentive. You also must be actively working at the time the incentive is paid to be eligible to receive it. Reminder: You will not be able to access healthy activities on the Red Brick Health website until you complete the health assessment. 18 | 2015 New Hire Enrollment Guide wellness program, you might qualify for an opportunity to earn the same reward you wish, with your doctor) to determine alternative ways for you to earn your rewards. Biometric screening points Increase Your Odds of Getting Future Incentives – Complete This Year’s Biometric Screening To motivate you to stay actively engaged in your health and to help you achieve your goals and maintain your health over time, Cargill wellness incentives focus not only on activities but also on your results. For example, you will earn an incentive for achieving certain biometric standards. If you don’t meet the standards, you can earn an incentive for making specific improvements in your results year-over-year. That’s why it’s important you complete a biometric screening in 2015. Those results will form the baseline for measuring your future progress. In other words, without a 2015 screening, you won’t have anything to measure against in 2016, and you will only be able to earn an incentive for meeting the standards vs. making improvements from one year to the next. Here is an overview of biometric measures and what you need to accomplish to earn points. Healthy Ranges Who Points Per Quarter BMI (18.5 – 27.5) You and/or your covered spouse 20 Cholesterol (<200 or ratio of total cholesterol to HDL is less than 3:5:1) You and/or your covered spouse 20 Blood pressure (≤120/80 mmHg) You and/or your covered spouse 20 Note that points for biometric measures are per quarter, so if you earn 60 points for having biometric measures in the healthy range in the quarter in which you complete the screening, you won’t have to complete any additional healthy activities in the remaining quarters. However, we always challenge you to participate and lead by example. Take Advantage of Wellness Resources and Activities Visit RedBrickHealth.com/login and mywellbeing.cargill.com for valuable wellness resources, including: • Wellness incentive tracking and healthy activity points options (RedBrick Health) • Access to programs to help you quit smoking, manage your weight and get reimbursed for weight loss programs • Nutritional counseling and more! 2015 New Hire Enrollment Guide | 19 How to enroll You must enroll within 30 calendar days of hire. Your first day counts as day one. 1) Get informed. • Read this guide to decide the right options for you. • Log on to cargill.com/mybenefits for additional benefit details. 2) Enroll within 30 days of your hire date. • Log in to HR Direct from your work computer at hrdirect.cargill.com using your Directory Services (DS) ID and password.* Please note: You cannot enroll until you are entered into the system and have a DS ID, which may take one to two weeks. • Click on Self Service > Benefits > Benefits Enrollment. • Click on Select to begin your enrollment. • Click on Edit next to each benefit for which you’d like to enroll and follow the prompts to make your choices. Don’t forget to: • Indicate tobacco status for yourself and your covered family members (in the medical section on HR Direct). • Indicate whether or not your spouse is eligible for other employer-sponsored medical coverage (in the medical section on HR Direct). If you don’t cover your spouse or don’t have a spouse, select “Not Applicable.” • Select the coverage you want for your dependents when you add them. • Include beneficiaries for your life insurance. • Once all your choices have been entered and are final, click Continue, then Submit to complete your enrollment. You must follow this process to save, authorize and submit your choices to Cargill Benefits for processing. 3) Complete the dependent eligibility verification process for dependents you wish to add to coverage. If you are adding dependents to your medical, dental or vision plan, a verification packet will be mailed to your home within six to nine weeks of your enrollment. This packet will explain how to verify your dependents. If you do not provide the necessary documentation by the deadline, your dependents will be removed from coverage. *Please note: Employees hired between October and December, must enroll by calling HR Direct Dial. For life events during the year, such as a marriage, birth or adoption, you have 30 days to enroll (with the day of event counting as day 1). 20 | 2015 New Hire Enrollment Guide Vendor contact information Health care benefits Plan Vendor Contact Information Medical Blue Cross and Blue Shield • HRA Plan • HSA Plan • Primary Plan 1-866-870-0361 Teladoc 1-800-TELADOC (835-2362) bluecrossmn.com/cargill teladoc.com (where available) Prescription drug Express Scripts 1-800-349-3759 express-scripts.com Dental Delta Dental 1-800-587-6975 deltadentalmn.org/cargill Vision VSP 1-800-877-7195 vsp.com/go/cargill Health Savings Account (HSA) Health Care Spending Account (HCSA) ConnectYourCare 1-866-568-7558 connectyourcare.com Cargill IT Help Desk For help with Cargill password resets 1-844-227-7657 Financial protection benefits Life Insurance and Accidental Death The Standard Life Insurance Company and Dismemberment (AD&D) 1-855-839-9883 Accident and Sickness Benefits standard.com (employees with production benefits only) Long-Term Disability (employees with salaried benefits only) Salary Continuation HR Direct Dial (employees with salaried benefits only) 1-877-366-9696 Business Travel Accident Insurance Chubb Life (employees with salaried benefits only) For information, contact HR Direct Dial at 1-877-366-9696. 2015 New Hire Enrollment Guide | 21 Retirement benefits Plan Vendor Contact Information Cargill Partnership Plan (401(k) and The Vanguard Group Employee Stock Ownership Plan 1-800-523-1188 (ESOP)) vanguard.com Employee Retirement Account Wellness benefits Nutritional Counseling Tobacco Cessation Programs Blue Cross and Blue Shield 1-866-870-0361 bluecrossmn.com/cargill Healthy Start Prenatal Program Blue Cross and Blue Shield Call early in your pregnancy to be eligible 1-866-870-0361 for money from Cargill. [email protected] Health Assessment RedBrick Health Health Coaching 1-866-322-1719 redbrickhealth.com/login Weight Loss and Tobacco Cessation HR Direct Dial Reimbursement Programs 1-877-366-9696 mywellbeing.cargill.com Other benefits Employee Assistance Program (EAP) Bensinger, DuPoint & Associates (BDA) 1-888-247-2086 bdaeap.com (password: cargilleap) Dependent Care Spending Account ConnectYourCare (DCSA) 1-866-568-7558 connectyourcare.com Other important contacts Health Advocacy Service Patient Care English: 1-877-344-7474 Spanish: 1-800-381-5834 Dependent Verification Process Mercer 1-866-511-8427 Disclaimer: If there are any differences/discrepancies between the information in this guide and the information in the plan documents and/or summary plan descriptions (SPDs), the information in the plan documents/SPDs will control. For details on coverage, we recommend reviewing your SPD. 22 | 2015 New Hire Enrollment Guide 2015 New Hire Enrollment Guide | 23 www.cargill.com Global HR Operations-NA P.O. Box 5685 Minneapolis, MN 55440-5685 T 1-877-366-9696 F 952-984-0500 © 2014 Cargill, Incorporated. Printed in U.S.A. NHMEG-1014 New Hire Model Enrollment Guide

© Copyright 2026