Quarterly Report - Fourth Quarter North Carolina

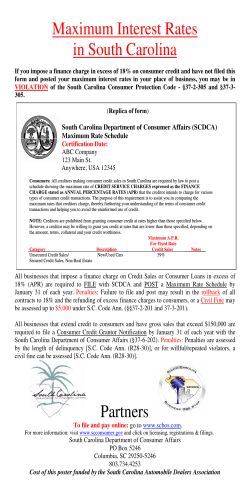

Q u a r t e r ly r e p o r t f o r Carolina Alliance Bank S h a r e h o l d e r s & C u s to m e r s North Carolina Edition December 2014 Left: 117th Annual Asheville Chamber of Commerce Meeting Right: Park Ridge Health Wellness on Wheels Bus Our staff wishes you a Merry Christmas, Happy Holidays & a Prosperous 2015! A TRUE Community Bank Board of Directors of Carolina Alliance Bank. We just don’t say we’re a community bank … we live it. Carolina Alliance bank Board of Directors “At Carolina Alliance our commitment to community means working together with community groups and Terry L. Cash, Chairman nonprofits to strengthen the communities in which we are located,” said John Poole, Carolina Alliance Chief W. Louis Bissette, Jr., Vice Chairman Throughout the year, non-profits, agencies, organizations and schools across Upstate South Carolina and Western North Carolina receive valuable services and leadership as donated by the dedicated staff and Carl R. Bartlett Executive Officer. During 2014 the Carolina Alliance staff pulled Earnings Report Released Carolina Alliance recently reported to its shareholders its third quarter 2014 financial results. Net income available to common shareholders of $5.6 million, or $1.43 per diluted common share, was reported for the nine months ended September 30, 2014, compared to net income available to common shareholders of $0.7 million, or $0.26 per diluted common share, for the nine months ended September 30, 2013. This $4.9 million increase in earnings was largely attributable to the impact of merger-related accounting, particularly the non-operating net bargain purchase gain of $4.3 million related to mark-to(continued, page 4) T. Alexander Evins Marsha H. Gibbs together to raise funds and awareness for many George M. Groome organizations such as, but not limited to, the John D. Kimberly, President United Way of the Piedmont, the United Way Samuel H. Maw, Jr. of Asheville & Buncombe County, the March Susan H. McClinton of Dimes, the Blue Ridge Humane Society, the D. Byrd Miller III Anderson Arts Center and the Oconee Memorial John S. Poole, Chief Executive Officer Hospital Foundation. W. Allen Rogers II “I am so proud of what our team has accom- R. Lamar Simpson, Chief Financial Officer, Chief Operating Officer plished this year,” said John Kimberly, Carolina L. Terrell Sovey Alliance President. “And I also have to thank our W. Lewis White, Sr. caring customers for their generosity by making a purchase or donating their time and/or products.” This next year promises to be just as exciting. (continued, page 3) 1 2 3 Community & Staff News Macy’s Thanksgiving Day Parade 1) Our Hendersonville office recently participated in the Henderson 6) Asheville Branch Supervisor Rebecca Pressley’s son Josh Pressley County Chamber’s Business Expo. Branch Manager Lisa Parham and had an eventful Thanksgiving. As a freshman member of Western Client Services Representative Amanda Arnold manned the bank’s Carolina University’s band, where he is a drummer, Josh marched in booth for the event. the Macy’s Day Parade. 2) Both our Asheville and Hendersonville offices participated in a The band led the legendary holiday parade and was part of the pa- food drive for the Manna Food Bank. Shown is staff from our Ashe- rade’s television broadcast. ville office including, Client Services Representatives Jamie Johnson And, taking the band to New York City was bank customer Young and Matt Whitworth and Asheville Branch Supervisor Rebecca Transportation. It took Young Transportation 10 buses for the 500 Pressley. band members and four buses for parents, family and friends. 3) Staff from Asheville and Hendersonville dressed in shades of pink Hearts & Hammers for Pink Wednesday on Oct. 15. This day helps to recognize Breast Cancer Awareness Month, which is October. 4) Our Asheville office recently collected unwrapped toys to benefit the Eblen-Kimmel Charities St. Nicholas Project Toy Drive. Here’s a look at the collection box in early December along with Vice President Commercial Banking Officer Steve Jennings. 7) All of our North Carolina offices are excited to be a co-sponsor of Habitat for Humanity’s Hearts & Hammers House. All staff have committed to be part of this project and as a show of their dedication, recently signed two 2 x 4 boards to be incorporated in the house. In November, Senior Vice President Professional Banker and Mortgage Officer Kelly Davis, Credit Analyst Scott Nesbit and Vice 5) Kelly Davis, Senior Vice President Professional Banker and Mort- President Retail Banking Officer Leslie Pruitt attended a wall-raising gage Officer in Asheville, helped make yummy buttermilk pumpkin celebration at the house. We so are proud to be sponsoring this pies (72 in all!) for the Thanksgiving meal at Haywood Street Con- house; be sure to look for more information about this community gregation Church in Asheville. event. 7 2 | CAB: Community And Banking 5 4 6 A TRUE Community Bank, continued from page 1 Our North Carolina offices are co-sponsoring the Hearts & Hammers House Habitat for Humanity House. The house was started in November and will be completed in April. In addition to a donation, bank staff will be onsite building the house. In Spartanburg, the popular BBQ Luncheon, which is always a sell-out, returns in the spring and promises to be bigger and better than ever. Plus the yearly Good Friday Bake Sale is always full of delicious homemade goodies prepared by our staff. Proceeds from both the BBQ Luncheon and Bake Sale benefit the March of Dimes. As you can see, we like being part of our respective communities; it’s who we are. We use our Facebook page—Carolina Alliance Bank—and twitter account—CABankNews—to document many of our activities. Be sure and “like” us and follow us so you can see what all we do. Top Row: Seneca Customer Appreciation Barbecue; Spartanburg Area Chamber of Commerce Annual Meeting; Golf for the Animals Tournament for the Blue Ridge Humane Society. Bottom Row: Anderson Ribbon Cutting/Donation to the Anderson Arts Center; Spartanburg March of Dimes. CAB: Community And Banking | 3 Third Quarter Results, continued from page 1 market adjustments to the Forest Commercial Bank (“Forest Commercial”) balance sheet as of the merger date of April 5, 2014. Partially offsetting this gain were expenses of approximately $0.6 million, which include merger costs and start-up costs associated with the bank’s recently opened branches in Seneca and Anderson, South Carolina. “We are very pleased with our results to date. We believe the combination of Carolina Alliance, Forest Commercial, and Dave McBride Leasing has created a solid foundation for growth,” said Chairman of the Board of Directors Terry Cash. “We fully intend to build on this new foundation to enhance our future performance.” Gross loans and leases increased by $145.1 million to $323.3 million on September 30, 2014 from $178.2 million on September 30, 2013. Of the increase, $123.5 million is attributable to Forest Commercial loans added as of the merger date. Total assets increased by $172.1 million to $416.5 million at September 30, 2014 from $244.4 million at September 30, 2013. Forest Commercial’s assets totaled $156.6 million as of the merger date. Total deposits increased to $345.5 million on September 30, 2014 from $202.3 million on September 30, 2013, an increase of $143.2 million. Forest Commercial’s deposits totaled $128.1 million as of the merger date. “The excitement that has occurred through- Protect Your Mobile Device When Banking out 2014 at Carolina Alliance has certainly continued through the third quarter,” said John Poole, Carolina Alliance Chief Executive Officer. “The board of directors and senior staff are working hard on strategic planning efforts at several levels to ensure that the bank remains a solid performer in the future.” “We are focused on the unified and customer-oriented delivery of products and services across the recently combined operations,” said John Kimberly, Carolina Alliance President. “While our team continues to work on improving systems and processes every day, we are extremely pleased with our progress to date.” Total shareholders’ equity on September 30, 2014 was $51.6 million, or 12.4% of total assets. Book value per common share was $10.22 as of September 30, 2014. The bank’s capital levels continue to exceed the levels required by regulatory standards to be classified as “well capitalized,” which is the highest of the five regulator-defined capital categories used to describe an institution’s capital strength. For a copy of the letter to shareholders reporting in further detail our third quarter 2014 financial results, please see “Shareholder Communications” under the “About Us” tab located on our website at www. carolinaalliancebank.com. Non-performing assets as a percentage of total assets at September 30, 2014 increased from a year prior, in part due to real estate acquired in settlement of loans of $0.7 million absorbed in the merger. Non-performing assets were $3.1 million at September 30, 2014, or 0.74% of total assets, as compared to $1.7 million, or 0.69% of total assets, at September 30, 2013. At September 30, 2014, the allowance for loan losses stood at $3.3 million, which is 1.03% of gross loans. Loans charged off for the nine months ended September 30, 2014 totaled $0.7 million, which represents 0.21% of gross loans. Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, we can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by us or any person that the future events, plans, or expectations contemplated by us will be achieved. All subsequent written and oral forward-looking statements concerning us or any person acting on our behalf is expressly qualified in its entirety by the cautionary statements above. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, to reflect circumstances or events that occur after the date the forward-looking statements are made. Your mobile device provides convenient access to your email, bank and social media accounts. Unfortunately, it can potentially provide the same convenient access for criminals. Carolina Alliance recommends following these tips to keep your information— and your money—safe. • Use the passcode lock on your smartphone and other devices. • Log out completely when you finish a mobile banking session. • Protect your phone from viruses and malicious software, or malware. • Avoid storing sensitive information on your mobile device. • Let Carolina Alliance know if you change your number or lose your mobile device. • Be aware of shoulder surfers. • Wipe your mobile device before you donate, sell or trade it. • Be wary of ads (not from your security provider) claiming that your device is infected. • Watch out for public Wi-Fi. Try disabling the Wi-Fi and switching to your mobile network. Report any suspected fraud to Carolina Alliance immediately. 4 | CAB: Community And Banking Note: Certain statements in this news story contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future plans and expectations, and are thus prospective. Such forward-looking statements are subject to risks, uncertainties, and other factors, such as the businesses of Carolina Alliance Bank and Forest Commercial Bank may not be integrated successfully or such integration may take longer to accomplish than expected, the expected cost savings and any revenue synergies from the merger may not be fully realized within the expected timeframes, disruption from the merger may make it more difficult to maintain relationships with clients, associates, or suppliers, a continued downturn in the economy, competitive pressures among depository and other financial institutions, the rate of delinquencies and amounts of charge-offs, the level of allowance for loan loss, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, and changes in the U.S. legal and regulatory framework, including the effect of recent financial reform legislation on the banking industry, any of which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Customer Spotlight Stepp’s Hillcrest Orchard At Stepp’s Hillcrest Orchard there is plenty of apple goodness to go around. From orchard-farm tours, to the country store to finding and picking fresh apples, Stepp’s has it. For more than 40 years, four generations of the Stepp family of Hendersonville have been inviting guests to pick their own apples at the family’s 70-acre working farm and orchard. For many families, visiting Stepp’s family farm has become a yearly tradition. Others also have noticed - Stepp’s Hillcrest Orchard was highlighted as one of the Nation’s Best Apple Picking Spots in Destinations Travel Magazine in its October 2014 issue. The farm was one of only 12 pickyour-own orchards selected and the only one in North Carolina. There are lots of things going on at the farm besides apples. You also can pick your own grapes and pumpkins. Or, if you prefer, you can buy pre-picked apples, pumpkins and grapes. School and group tours also are available. And at the country store, Hillcrest Market, you can shop for apple goodies such as the popular apple butter, apple salsa, apple chipotle raspberry sauce, and other great yummy apple treats. Then, there are the 40 acres of orchard you can enjoy plus a picnic area. “We have been so blessed,” said owner Mike Stepp. “We want to provide a setting where families can come and enjoy themselves and have a good time.” Stepp’s Hillcrest Orchard 170 Stepp Orchard Drive, Hendersonville, NC 28792 (828) 685-9083 | www.SteppApples.com Facebook: Stepp’s Hillcrest Orchard CAB: Community And Banking | 5 NC Market Lenders Carolina Alliance has the best lenders you’ll find anywhere. This team of professionals understands our markets and will work with you for the best possible deal. Kelly Leonard Senior Vice President Commercial Banking Officer [email protected] (828) 398-2182 Steve Jennings Vice President Commercial Banking Officer [email protected] (828) 348-2282 Staff News Transfer Jamie Johnson Client Services Representative – Hendersonville [email protected] (828) 233-0584 Popmoney! Welcome! Kayla Revis Proof Operator – Spartanburg [email protected] (864) 208-2265 Here’s how is works: Sending Money eliminates the hassles of • To send money, login to your Carolina Alliance online banking account and look for Popmoney. • Send money to anyone using their email address or account information. •You will be notified when the transaction is completed. checks and cash. Now, Here are a few ways you can use Popmoney Have you used Popmoney? It’s a great personal payment service offered by Carolina Alliance that sending and receiving money is as easy as emailing and texting. You don’t need a new account to send or receive money. Just use your current bank/financial institution account. • • • • • Send money to your child at college Send a gift to family and friends Reimburse friends for that fun outing Pay your babysitter or your lawn care service Pay rent to your landlord or roommates For more information about Popmoney go to www.CarolinaAllianceBank.com or contact any of our bankers. carolinaallianceBank.com Advisory Boards South Carolina: Charles E. Atchison, Sr. Andrew M. Babb Vollie C. “Vic” Bailey III James D. Bearden III, MD Norman H. Chapman Caleb C. Fort North Carolina: Robert F. Burgin Thomas L. Cooper Andrea J. Corn Eugene W. Ellison F. Jerry Grant Oscar J. Honeycutt Thomas D. Hunter IV Adam L. Shealy William W. White, Jr. Thank you! I want to send a heartfelt thank you to everyone who has asked about me, sent cards and emails, sent flowers or meals and who have visited me these past few weeks. Your concern means more to me than I will ever be able to fully express. I am happy to report that my doctors tell me that I am making good progress and that I should be back in the office soon. I can’t wait to get there! Again, thanks to everyone. This information is also available at carolinaallianceBank.com. John Poole Chief Executive Officer Locations 200 South Church Street, Spartanburg, SC 29306 • Phone: (864) 208-BANK (2265) 1127 Hendersonville Road, Asheville, NC 28803 • Phone: (828) 255-5711 • ATM Onsite 115 Broadbent Way, Unit 8, Anderson, SC 29625 • Phone: (864) 965-7829 122 Cherokee Road, Suite 4, Charlotte, NC 28207 • Phone: (980) 321-5946 218 North Main Street, Hendersonville, NC 28792 • Phone: (828) 233-0900 • ATM Onsite 135 Eagles Nest Drive, Suite K, Seneca, SC 29678 • Phone: (864) 904-9993 125 Venture Boulevard, Suite A, Spartanburg, SC 29306, Phone: (864) 595-9000 • Leasing Office

© Copyright 2026