LMC Bulletin - Livestock and Meat Commission

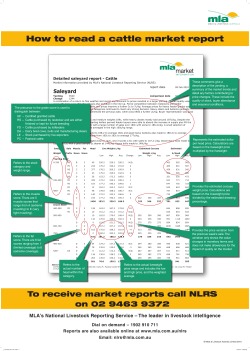

BULLETIN WEEKLY PUBLICATION OF THE LIVESTOCK AND MEAT COMMISSION FOR NORTHERN IRELAND BEEF TRADE ENDS YEAR ON A HIGH NOTE Issue No. 2350 Saturday 27 December 2014 F OLLOWING a very difficult first half of the year, with reduced farmgate prices and difficulties in trading conditions, the beef trade has improved significantly in recent months. Northern Ireland farmgate cattle prices have been on the rise throughout the autumn and winter of 2014 and the trade of signs show to continues improvement. Processors are now quoting 360p/kg across most of the Northern Ireland plants. However, there are reports that stronger prices are being paid to farmers, so producers are advised to shop around for deals. The trade across the British Isles was under pressure early in the year, but the trade in Great Britain started to recover in mid-July, with prices rising steadily into the autumn. By the first week of September, Northern Ireland R3 steer prices were 30p/kg lower than in GB levels. However, increased exports to GB and intense competition for cattle generated upward pressure on price with processors in Northern Ireland having increased quotes sharply in late September / early October by 20p/kg over the space of a fortnight. In the first week of December, processors increased quotes by a further 10p/kg. These developments in the trade mean that NI prices are now the second highest in the EU and one year on from the publication of LMC’s Price Differential Report, prices here are in some cases higher than English levels. In the week ending 20 December 2014 for example, NI R3 steer prices averaged 362p/kg. This was higher than prices across any English region, although Scottish prices remained the highest across the UK. The R3 heifer price in Northern Ireland was 361p/kg. Again this was higher than equivalent prices in England and Wales, but lower than Scottish prices. On average, O3 steer and heifer prices were higher than equivalent prices in England with Scottish prices the highest in the UK for these grades. plainer cows, the gap is even wider, with the price for P3 cows almost 40p/kg higher than GB levels. Prices for cull cows in NI are generally lower than in ROI, but higher than GB levels. NI farmgate cattle prices are now very high relative to the remainder of mainland Europe and are almost on a par with GB levels. By recent standards this is new territory for the NI industry, and probably reflects the increased emphasis placed on the UK identity post-horsemeat, a more responsive live export trade and relatively tight supplies in Northern Ireland. Producers will be hopeful that tight supplies across the British Isles in 2015 will continue to generate upward pressure on price. Developments in the UK retail sector can be critical to the performance of the NI red meat industry and the situation there is very fluid, with some key players losing market share to discounters. The response of the large multiples to this increased level of competition will have a bearing on the market in 2015. New opportunities may present themselves in 2015, with the potential for access to new export markets next Last week, GB prices were generally higher for U3 and R4 grade steers and heifers. However, in the case of R4 steers, NI prices were ahead of corresponding prices in Southern England and the Midlands and Wales, while remaining lower than equivalent prices in Scotland and Northern England. The prime cattle trade in ROI continues to lag well behind UK prices, but southern factories are paying more for cull cows. Last week, the O3 cow price in ROI was 247p/kg, about 9p/kg higher than the corresponding price in NI and 16p/kg higher than the average O3 cow price in GB. In the case of NI FACTORY QUOTES FOR CATTLE (P/KG DW) This Week 24/12/14 Next Week 29/12/14 U-3 360p 360p O+3 348p 348p R-3 P+3 Cows 354p - LAST WEEK'S DEADWEIGHT CATTLE PRICES (UK / ROI) W/E 20/12/2014 354p Steers 294-310p Including bonus where applicable O+3 & better 230-255p 230-255p Blues 120-130p 120-130p Steakers 140-170p Heifers 140-170p REPORTED COW PRICES NI - P/KG w/e Wgt 220Wgt <220kg 20/12/14 250kg P1 127.4 136.9 P2 148.4 172.7 P3 170.0 202.6 O3 140.0 229.0 O4 218.0 R3 While the outlook is generally positive, producers will naturally be cautious. The tough start to the year serves as a powerful reminder of the volatility in the beef trade and the likelihood is that volatility will continue to be a feature of the market in the coming years. Figure 1. Deadweight Cattle Prices for Selected Categories and Grades, in Northern Ireland, Great Britain and Republic of Ireland, Week Ending 20 December 2014 WEEKLY BEEF & LAMB MARKETS Prime year, which would help to sustain the current strong trade. The US market is a key target and UK or Irish access to the American market would have the potential to have a positive impact on the beef trade right across the British Isles. Young Bulls Wgt 250Wgt >280kg 280kg 149.0 160.6 190.4 209.0 210.9 222.6 235.2 239.1 237.0 243.5 297.5 263.1 U3 R3 R4 O3 Notes: Rep of Ireland Scotland 345.8 286.3 355.7 365.5 361.7 360.9 313.3 303.1 302.5 383.9 374.9 376.8 Northern Midlands Southern England & Wales England 366.7 358.3 372.8 334.3 368.5 356.8 356.7 326.3 372.4 362.3 368.3 355.7 376.1 363.8 365.3 340.1 358.6 353.5 340.2 313.8 321.8 330.2 352.4 363.6 361.2 357.8 344.7 352.3 353.8 346.4 321.9 328.7 323.0 312.1 311.0 298.0 303.1 296.1 280.0 - 373.7 381.8 376.6 377.6 356.3 374.6 369.6 364.8 322.6 336.4 359.0 371.9 359.4 362.0 338.4 357.0 337.4 330.0 299.3 314.9 342.8 376.0 359.7 359.8 329.6 351.7 358.1 338.8 308.1 316.2 338.6 370.8 353.8 355.2 329.5 342.2 361.6 345.3 332.9 331.7 O3 O4 P2 P3 238.5 243.1 195.1 219.2 247.0 248.5 218.6 238.0 237.9 239.5 177.9 198.1 233.7 234.3 196.1 216.6 230.1 232.0 167.6 192.9 218.0 222.4 164.6 193.0 AVG 5103 211.0 - - 6180 220.2 5632 210.6 5186 190.4 3804 188.9 (i) Prices are p/kg Sterling-ROI prices converted at 1 euro=79.09p Stg (ii) Shading indicates a lower price than the previous week. (iii) AVG is the average of all grades in the category, not just those listed FQAS Helpline If you have had a recent inspection and need help and advice to rectify any non-conformances, contact the FQAS helpline: 028 9263 3024 GB 368.6 355.1 353.0 AVG U3 R3 R4 O3 AVG U3 R3 O3 AVG Prime Cattle Price Reported Cows Northern Ireland 337.5 20802 230.6 232.8 174.9 199.5 203.1 Answerphone Service Factory Quotes & Mart Results Updated 5pm Daily Tel: 028 9263 3011 LAMB QUOTES (P/Kg DW) This Week 24/12/14 Next Week 29/12/14 Lambs 390>22kg 390>22kg REPORTED LAMB PRICES - P/KG W/E 29/11/14 W/E 06/12/14 W/E 13/12/14 NI Liveweight 354.0 353.6 360.4 NI Deadweight 373.8 377.4 382.5 ROI Deadweight 369.0 370.2 374.8 GB Deadweight 400.5 409.3 422.7 (P/KG DW) Please note that the reported sheep prices above are for week ending 13/12/14. Text Service Free Price Quotes sent to your mobile phone weekly Email - [email protected] Tel: 028 9263 3000

© Copyright 2026