THE WEEKLY BOTTOM LINE

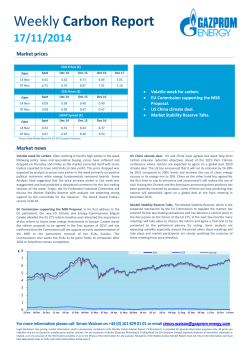

THE WEEKLY BOTTOM LINE TD Economics January 9, 2015 HIGHLIGHTS OF THE WEEK United States • It was a choppy week for global markets. Oil continued its slide alongside equities before stabilizing midweek, as deflation across the euro zone heightened expectations for ECB sovereign bond buying. A patient Fed and a bullish EIA report also supported sentiment. • Equities rallied strongly on Thursday, but the party was short lived as doubts over the ECB’s QE resolve resurfaced. • A rally on a relatively constructive U.S. employment report failed to be sustained. The U.S. labor market added 252 thousand jobs, with revisions adding another 50 thousand. The jobless rate fell to 5.6% aided by a labor force decline. Wage growth turned negative for the month, with the weakness in the figures keeping the Fed patient. Canada • Falling energy prices contributed to a notable decline in exports in November. And the sharp drop in export values is only the beginning of weaker revenues to come. This will soften incomes markedly, putting renewed strain on the government coffers of energy-rich provinces and the federal government. • Housing starts also showed pronounced weakness in December, rounding out the weakest Q4 print since 2009. Leading the descent in Q4 were the Prairie Provinces, notably Alberta. • In contrast, the December employment data was weak but full of good news stories. However, employment growth in the resource sector of Alberta and Newfoundland and Labrador has shown significant strain in the latter half of 2014. THIS WEEK IN THE MARKETS Week 52-Week 52-Week Current* Ago High Low Stock Market Indexes S&P500 2,062 2,058 2,091 1,742 S&P/TSXComp. 14,458 14,754 15,658 13,486 DAX 9,827 9,765 10,087 8,572 FTSE100 6,546 6,548 6,878 6,183 Nikkei 17,198 17,451 17,936 13,910 Fixed Income Yields U.S.10-yrTreasury 2.01 2.11 2.97 1.94 Canada10-yrBond 1.70 1.74 2.69 1.64 Germany10-yrBund 0.52 0.50 1.92 0.45 UK10-yrGilt 1.64 1.72 2.98 1.56 Japan10-yrBond 0.28 0.33 0.70 0.28 Foreign Exchange Cross Rates C$(USDperCAD) 0.84 0.85 0.94 0.84 Euro(USDperEUR) 1.18 1.20 1.39 1.18 Pound(USDperGBP) 1.51 1.53 1.72 1.51 Yen(JPYperUSD) 119.5 120.5 121.5 101.0 Commodity Spot Prices** CrudeOil($US/bbl) 48.8 52.7 107.6 47.9 NaturalGas($US/MMBtu) 2.91 2.99 7.92 2.75 Copper($US/met.tonne) 6175.8 6321.0 7403.5 6175.8 Gold($US/troyoz.) 1213.7 1189.2 1383.1 1140.7 *asof9:10amonFriday**Oil-WTI,Cushing,Nat.Gas-HenryHub, LA(Thursdaycloseprice),Copper-LMEGradeA,Gold-LondonGold Bullion;Source:Bloomberg. www.td.com/economics WEEKLY MOVES Weekly % change except (*) which denotes change in index S&P 500 Dax FT 100 Nikkei 225 US 10Y T-Note USD:EUR USD:JPY USD:GBP USD:CAD USD:MXN Gold WTI Brent VIX* -12.0 -7.0 -2.0 3.0 Note: Data as of Jan. 9, 12:30 PM ET. Change from end of business on Jan. 2. Sources: Bloomberg, TD Economics GLOBAL OFFICIAL POLICY RATE TARGETS CurrentTarget 0-0.25% FederalReserve(FedFundsRate) 1.00% BankofCanada(OvernightRate) 0.05% EuropeanCentralBank(RefiRate) 0.50% BankofEngland(RepoRate) 0.10% BankofJapan(OvernightRate) Source:CentralBanks,HaverAnalytics @CraigA_TD TD Economics | www.td.com/economics U.S. – ECB GETS A “D” IN PRICE STABILITY, WHILE FED LOOKING PATIENT The first full week of 2015 has been a choppy one for global markets. The slump in oil continued, after stabilizing midweek on a bullish inventory report in the U.S. Semblance of stability in the oil market helped arrest a slide in equity markets, with additional support from increased likelihood of ECB sovereign bond buying and a patient Fed. Equity indices were on a tear on Thursday but the mood soured on Friday, despite a relatively constructive U.S. employment report, as doubts over the ECB’s resolve resurfaced. While the D-word was not a surprise, reports that deflation has reared its ugly head across the euro zone in December grabbed headlines. The fact that the decline was larger than expected, with prices down 0.2% year-over-year, coupled with below consensus PMI reports increased the pressure on the ECB to act aggressively to try to reflate the economy. The negative reading was largely caused by the precipitous decline in oil during the month, with core CPI gauge ticking up from 0.7% to 0.8% in December. But, this is unlikely to provide much comfort at the ECB, with inflation clearly too low given its target of just below 2%. The fear of a persistent deflationary trend, which could become selfsustaining if prices continue to fall for a prolonged period, looks likely to spur the ECB to act as early as January 22nd. According to unofficial reports, the ECB Governing Council was on Wednesday briefed on a study by staff outlining, among other options, a scenario to buy €500 billion worth of sovereign bonds. Markets were underwhelmed by the figure, with European bourses giving up some earlier gains. External risks and a subdued inflationary environment are also top of mind for the FOMC as they contemplate when to begin raising rates. In particular, the Committee is trying to assess the potential impact from sluggish global growth, falling oil prices, and a lofty dollar on an otherwise buoyant U.S. economy. According to the minutes from their December meeting round, Fed officials remain concerned about global growth, but are tacitly expecting that the relevant authorities will move to shore up growth. Moreover, they generally believe that more aggressive stimulative monetary policies abroad, which are resulting in a higher dollar and pressuring exports and inflation, should be offset as global growth improves. Lastly, the FOMC generally continued to see slowing domestic inflation as transitory, arguing that the slump at the pump should be a big boost for the economy, with strong domestic demand supporting prices. So far the data appears to be corroborating these viewpoints. Results of ISM surveys pointed to a slowdown at January 9, 2015 WAGES FALL SHARPLY IN DECEMBER, BUT DECLINE LIKELY TRANSITORY 1.0 Avg. hourly earnings, prod. & nonsupervisory emp. (m/m % chng.) 0.5 0.0 -0.5 Total private Retail trade -1.0 -1.5 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Bureau of Labor Statistics year end. But, much of the decline was related to prices, and in the case of manufacturing, export orders. Still, activity continued to expand at a solid pace, with forward looking indicators remaining healthy. U.S. vehicle sales also remained healthy, nearing 17 million in December. Last, but certainly not least, payroll employment expanded by a consensus beating 252 thousand in December, and together with a 50 thousand upward revision, capped the best year of growth since 1999. Unemployment dropped according to most measures of underutilization, with the headline rate down 0.2 percentage points to 5.6%. However, the improvement was largely related to more people leaving the labor force. Further souring the report was the notable lack of wage growth. Average hourly wages actually declined 0.2% during the month, falling 0.3% for nonsupervisory employees (largest decline since August 1983), while November’s 0.4% gain was halved following the revisions. While disappointing, we are willing to apply the adage that a month does not a trend make. December pay figures can be highly skewed by seasonal hiring in retail and e-commerce distribution. The mining sector also saw large declines as it finds itself under pressure to cut costs. But, given the increasingly tightening labor market and the breadth of employment gains, it is hard to imagine that wages will fail to increase in the coming months. As it stands, we still expect the Fed to move later this year, however, the notable lack of wage and inflation pressures should make the FOMC increasingly more patient with the timing and speed of any rate hikes. Michael Dolega, Senior Economist 416-983-0500 2 TD Economics | www.td.com/economics CANADA - THE ENERGY RICH AND THE REST OF US Falling oil prices continue to dominate the headlines. The price of a barrel of West Texas Intermediate (WTI) has now closed below US$50 per barrel for 3 consecutive days and hovered around US$48 at the time of writing. Beyond the per barrel price of oil, the commentary on the economic impacts of lower oil prices is ubiquitous. However, this week provided our first glimpse into how falling oil prices are spilling over into the real economy, and the picture isn’t pretty. First, exports fell off a cliff in November (-3.5%), suffering the largest dollar decline since the Japanese earthquake and tsunami of February 2011 grounded global trade to a halt. Driving this were plummeting energy exports (-7.8%) – the sixth consecutive monthly decline. Falling crude oil and bitumen exports were the primary culprit (-9.9%). As export prices fell even more steeply than volumes, this is expected to weigh on both personal and corporate incomes in Canada in Q4. Weaker income growth will be particularly relevant to the energy-producing provinces in 2015 (Chart 1). As a result, government revenues can also be expected to come in lower than was anticipated in the most recent official fiscal forecasts, although many levels of government have communicated their recognition that the wave is coming. At the federal level, we expect the fiscal planning environment to remain challenging in 2015, with the $1.6 billion surplus projected for fiscal 2015-16 at significant risk. December housing starts (181K) also had their weakest showing since last winter’s deep freeze kept construction activity to a minimum. For the quarter as a whole (188K), CHART 1: WEAKER NOMINAL GDP GROWTH EXPECTED IN 2015 DUE TO LOWER OIL PRICES %growth,nominalGDP,2015 6 5 4 3 2 1 0 -1 -2 December2014Forecast -3 September2014Forecast -4 -5 CAN NL PE NS NB QC Sources:TDEconomics, StatisticsCanada. January 9, 2015 ON MB SK AB BC CHART 2: EMPLOYMENT GROWTH SOFTENING IN THE RESOURCE SECTOR OF ENERGY PRODUCERS Y/Y%Chg. 40 Alberta NewfoundlandandLabrador 30 20 10 0 -10 -20 Jan2013 Apr2013 Jul2013 Oct2013 Jan2014 Apr2014 Jul2014 Oct2014 Source:StatisticsCanada. the last quarter of 2014 was the weakest Q4 print since 2009. Looking regionally, the trend is clearly tilted toward a softening in the Prairie Provinces (Alberta, Saskatchewan, and Manitoba), where housing starts fell 4.1K to 39K in Q4. Meanwhile, employment pulled back for the second consecutive month in December (-4.3K), although the release was chalked full of silver linings. First, the economy created 53.5K full-time jobs in December, for the fourth consecutive monthly increase. Further, the rise in the number of employees (+11K) was only modestly offset by the decline in the number of self-employed (-15K). Additionally, the goods-producing sector expanded for the fifth consecutive month (+22K). Lastly, while the overall participation rate continues to decline (falling 0.1 percentage points to 65.9%), the youth participation rate (65.2%) is 2 percentage points above its post-recession trough reached in February 2014 (see Young and Restless: A Look at the State of Youth Employment in Canada). However, even in the labour market there appear to be some dark clouds on the horizon for energy-producing provinces. Looking at Alberta and Newfoundland and Labrador, the two provinces where the energy sector makes up the largest share of their economies (between 20% and 25% of total output), year-over-year employment growth in the resource sector has been negative for much of the second half of 2014 (Chart 2). Going forward, soft employment growth is expected in energy-producing provinces in 2015 (see December 2014 Provincial Economic Forecast). Randall Bartlett, CFA, Senior Economist 416-944-5729 3 TD Economics | www.td.com/economics U.S.: UPCOMING KEY ECONOMIC RELEASES U.S. Retail Sales - December* Release Date: January 14, 2015 November Result: Total 0.7% M/M; Ex-autos 0.5% M/M TD Forecast: Total 0.1% M/M; Ex-autos 0.1% M/M Consensus: Total 0.1% M/M; Ex-autos 0.1% M/M Retail sales activity is expected to post its third consecutive monthly advance in December, with spending posting a relatively modest 0.1% m/m gain. Strong auto and electronics sales during the busy holiday season are expected to more than compensate for the huge slip in gasoline sales – which we expect to post a 2% m/m decline. Core spending activity (which excludes spending on autos, gas and building material, and is a useful gauge on the tone of real sales activity) should also improve; posting a 0.4% m/m advance following the 0.6% m/m rise the month before. Higher spending on food/beverage, general merchandise and other discretionary items are likely to be key sources of the gain in this month. Overall, we expect the tone of this report to be broadly encouraging, pointing to further upside momentum U.S. RETAIL AND FOOD SERVICES SALES 2.0 M/M%Chg. Total 1.0 0.5 0.0 -0.5 -1.0 Dec-13 Headline consumer prices are expected to post its second consecutive monthly fall in December, reflecting the continued decline in energy prices. During the month, we expect the headline index to post a 0.2% m/m decline, with the annual pace of inflation decelerating further to 0.8% y/y from 1.3% y/y the month before. Core consumer prices, however, should remain firm, posting a 0.1% m/m (0.113% at 3 decimal places) advance. Despite the increase, the annual pace of core inflation should remain unchanged at 1.7% m/m. The 3-month and 6-month annualized pace of inflation should slip further, underscoring the weakening in inflationary momentum. In the coming months, we expect the current disinflationary impulse to persist, with the annual inflation rate falling to a trough of 0.0% y/y by mid-2015. Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Source:U.S.DepartmentofCommerce/HaverAnalytics in household spending. In the coming months, we expect the positive thrust in spending to be sustained, providing a crucial underpinning for the US economic recovery. U.S. CPI - December* Release Date: January 16, 2015 November Result: Core 0.1% m/m, all-items -0.3% m/m TD Forecast: Core 0.1 m/m, all-items -0.2% m/m Consensus: Core 0.1% m/m, all-items -0.3%% m/m Excl.AutomotiveDealers 1.5 U.S. CONSUMER PRICE INDEX (CPI) 3.0 Y/Y%Chg. AllItems 2.5 AllItemsEx.FoodandEnergy 2.0 1.5 1.0 0.5 0.0 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Source:BureauofLaborStatistics/HaverAnalytics *Forecast by Rates and FX Strategy Group. For further information, contact TDRates&[email protected]. January 9, 2015 4 TD Economics | www.td.com/economics CANADA: UPCOMING KEY ECONOMIC RELEASES Canada Business Outlook Survey (Q4) – Future Sales* Release Date: January 12, 2015 Q3 Result: 35 TD Forecast: 23 Consensus: N/A The balance of opinion for future sales in the Bank of Canada’s Business Outlook Survey (BOS) is expected to fall to +23 in Q4 from a robust +35 reading last quarter. The origin of the anticipated dent to business confidence can be traced to the collapse in the price of oil. However, an equally pronounced decline in the value of the Canadian dollar and a strengthening US economy is expected to buttress sentiment in other industries and prevent a more outsized collapse in this indicator (though admittedly, the risk to our forecast is for firms to generally express more pessimism heading into the end of the year). Other pockets of interest from the survey will include investment intentions related to the commodity sector and relative measures of capacity. The evolution of inflation expectations are also quite topical and are expected to have ratcheted lower in tandem with the price of oil. BUSINESS OUTLOOK: FUTURE SALES SURVEY 40 Index 35 30 25 20 15 10 5 0 -5 -10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Source:BankofCanada *Forecast by Rates and FX Strategy Group. For further information, contact TDRates&[email protected]. January 9, 2015 5 TD Economics | www.td.com/economics RECENT KEY ECONOMIC INDICATORS: JANUARY 5-9, 2015 Release Date Economic Indicator/Event Jan05 Jan05 Jan05 Jan06 Jan06 Jan07 Jan07 Jan07 Jan08 Jan08 Jan08 Jan08 Jan08 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 DomesticVehicleSales TotalVehicleSales ISMNewYork FactoryOrders ISMNon-ManufacturingComposite MBAMortgageApplications ADPEmploymentChange TradeBalance ChallengerJobCuts InitialJoblessClaims ContinuingClaims BloombergConsumerComfort ConsumerCredit ChangeinNonfarmPayrolls ChangeinPrivatePayrolls ChangeinManufact.Payrolls UnemploymentRate AverageHourlyEarnings UnderemploymentRate LaborForceParticipationRate WholesaleInventories WholesaleTradeSales Jan05 Jan06 Jan06 Jan07 Jan07 Jan08 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 Jan09 BloombergNanosConfidence IndustrialProductPrice RawMaterialsPriceIndex InternationalMerchandiseTrade IveyPurchasingManagersIndexSA NewHousingPriceIndex HousingStarts BuildingPermits UnemploymentRate NetChangeinEmployment FullTimeEmploymentChange PartTimeEmploymentChange ParticipationRate Jan05 JN VehicleSales Jan05 GE ConsumberPriceIndex Jan07 GE UnemploymentRate Jan07 EC UnemploymentRate Jan07 EC CPIEstimate Jan07 EC CPICore Jan08 EC ProducerPriceIndex Jan08 EC EconomicConfidence Jan08 UK BOEAssetPurchaseTarget Jan08 UK BankofEnglandBankRate Jan09 JN LeadingIndexCI Jan09 GE TradeBalance Jan09 GE CurrentAccountBalance Jan09 FR TradeBalance Jan09 UK TradeBalance Source:Bloomberg,TDEconomics. January 9, 2015 United States Canada International Data for Period Units Current Prior Dec Dec Dec Nov Dec Jan02 Dec Nov Dec Jan03 Dec27 Jan04 Nov Dec Dec Dec Dec Dec Dec Dec Nov Nov USD,Mlns USD,Mlns Index M/M%Chg. Index W/W%Chg. Thsd USD,Blns Y/Y%Chg. Thsd Thsd Index USD,Blns Thsd Thsd Thsd % M/M%Chg. % % M/M%Chg. M/M%Chg. 13.46 16.80 70.8 -0.7 56.2 11.1 241 -39.0 6.6 294.0 2452 43.6 14.081 252.0 240 17.0 5.6 -0.2 11.2 62.7 0.8 -0.3 13.78 17.08 62.4 -0.7 59.3 -18.2 227 -42.2 -20.7 298.0 2351 42.7 15.969 353.0 345.0 29.0 5.8 0.2 11.4 62.9 0.6 0.0 Jan02 Nov Nov Nov Dec Nov Dec Nov Dec Dec Dec Dec Dec Index M/M%Chg. M/M%Chg. CAD,Blns Index M/M%Chg. Thsd M/M%Chg. % Thsd Thsd Thsd % 55.8 -0.4 -5.8 -0.64 55.4 0.1 180.6 -13.8 6.6 -4.3 53.5 -57.7 65.9 55.1 -0.6 -4.2 -0.33 56.9 0.1 193.2 2.1 6.6 -10.7 5.5 -16.3 66.0 Dec DecP Dec Nov Dec DecA Nov Dec Jan Jan08 NovP Nov Nov Nov Nov Y/Y%Chg. Y/Y%Chg. % % Y/Y%Chg. Y/Y%Chg. Y/Y%Chg. Index GBP,Blns % Index EUR,Blns EUR,Blns EUR,Mlns GBP,Mlns -8.8 0.2 6.5 11.5 -0.2 0.8 -1.6 100.7 375.0 0.5 103.8 17.9 18.6 -3236 -1406 -13.5 0.6 6.6 11.5 0.3 0.7 -1.3 100.7 375.0 0.5 104.5 22.1 22.5 -4268 -2246 R5 R5 R6 R5 R5 R5 R5 R6 R5 R6 R6 R5 R6 R6 R5 R6 R5 R6 R5 R6 6 TD Economics | www.td.com/economics UPCOMING ECONOMIC RELEASES AND EVENTS: JANUARY 12-16, 2015 Release Date Time* Jan12 Jan13 Jan13 Jan13 Jan13 Jan13 Jan14 Jan14 Jan14 Jan14 Jan14 Jan14 Jan14 Jan15 Jan15 Jan15 Jan15 Jan15 Jan15 Jan15 Jan16 Jan16 Jan16 Jan16 Jan16 Jan16 Jan16 Jan16 12:40 7:30 10:00 10:00 17:00 14:00 7:00 8:00 8:30 8:30 8:30 8:30 10:00 8:30 8:30 8:30 8:30 8:30 9:45 10:00 8:30 8:30 8:30 9:15 9:15 9:15 10:00 16:00 Fed's Lockhart Speaks on U.S. Economic Outlook in Atlanta NFIBSmallBusinessOptimism Dec IBD/TIPPEconomicOptimism Jan JOLTSJobOpenings Nov Fed's Kocherlakota Speaks on Economic Outlook in New York MonthlyBudgetStatement Dec MBAMortgageApplications Jan09 Fed's Plosser Speaks on the Economy in Philadelphia RetailSalesAdvance Dec RetailSalesExAuto Dec RetailSalesExAutoandGas Dec ImportPriceIndex Dec BusinessInventories Nov EmpireManufacturing Jan PPIFinalDemand Dec PPIExFoodandEnergy Dec InitialJoblessClaims Jan10 ContinuingClaims Jan03 BloombergConsumerComfort Jan11 PhiladelphiaFedBusinessOutlook Jan ConsumerPriceIndex Dec CPIExFoodandEnergy Dec CPICoreIndexSA Dec CapacityUtilization Dec IndustrialProduction Dec Manufacturing(SIC)Production Dec UniversityofMichiganConfidence JanP TotalNetTICFlows Nov Jan12 Jan12 Jan12 Jan14 Jan14 Jan14 10:00 10:30 10:30 8:30 8:30 8:30 BloombergNanosConfidence BusinessOutlookFutureSales BoCSeniorLoanOfficerSurvey Teranet/NationalBankHPI Teranet/NationalBankHPIndex Teranet/NationalBankHPI Economic Indicator/Event United States Jan12 18:50 JN BoPCurrentAccountBalance Jan12 18:50 JN TradeBalanceBoPBasis Jan13 4:30 UK ConsumerPriceIndex Jan13 4:30 UK CPICore Jan13 4:30 UK RetailPriceIndex Jan14 2:45 FR CurrentAccountBalance Jan14 2:45 FR ConsumerPriceIndex Jan14 18:50 JN ProducerPriceIndex Jan14 19:30 AU UnemploymentRate Jan15 3:00 GE GrossDomesticProductNSA Jan15 5:00 EC TradeBalanceSA Jan16 5:00 EC ConsumerPriceIndex *EasternStandardTime;Source:Bloomberg,TDEconomics. January 9, 2015 Canada International Units Consensus Forecast Last Period Index Index Thsd 97.8 48.2 - 98.1 48.4 4834 USD,Blns W/W%Chg. 24.0 - 11.10 M/M%Chg. M/M%Chg. M/M%Chg. M/M%Chg. M/M%Chg. Index M/M%Chg. M/M%Chg. Thsd Thsd Index Index M/M%Chg. M/M%Chg. Index % M/M%Chg. M/M%Chg. Index USD,Blns 0.1 0.1 0.3 -2.9 0.2 5.0 -0.4 0.1 298.0 20.0 -0.3 0.1 80.0 0.0 0.2 94.1 - 0.7 0.5 0.6 -1.5 0.2 -3.6 -0.2 0.0 294.0 2452 43.6 24.3 -0.3 0.1 239.3 80.1 1.3 1.1 93.6 178.4 Jan09 Q4 Q4 Dec Dec Dec Index Index Index M/M%Chg. Index Y/Y%Chg. - 55.8 35.0 -10.3 -0.3 167.5 5.2 Nov Nov Dec Dec Dec Nov Dec Dec Dec 2014 Nov Dec Yen,Blns Yen,Blns Y/Y%Chg. Y/Y%Chg. Y/Y%Chg. EUR,Mlns Y/Y%Chg. Y/Y%Chg. % Y/Y%Chg. EUR,Blns M/M%Chg. 139.5 -734.0 0.7 1.3 1.6 0.0 2.1 6.3 1.5 20.0 -0.1 833.4 -766.6 1.0 1.2 2.0 -0.9 0.3 2.7 6.3 0.1 19.4 -0.2 Data for Period 7 TD Economics | www.td.com/economics CONTACTS AT TD ECONOMICS Craig Alexander Senior Vice President and Chief Economist [email protected] CANADIAN ECONOMIC ANALYSIS U.S. & INTERNATIONAL ECONOMIC ANALYSIS Derek Burleton, Vice President and Deputy Chief Economist [email protected] Randall Bartlett, Senior Economist [email protected] Beata Caranci, Vice President and Deputy Chief Economist [email protected] James Marple, Senior Economist [email protected] Sonya Gulati, Senior Economist [email protected] Michael Dolega, Senior Economist [email protected] Diana Petramala, Economist, Real Estate [email protected] Francis Fong, Senior Economist [email protected] Dina Ignjatovic, Economist, Autos, Commodities and Other Industries [email protected] Thomas Feltmate, Economist [email protected] Leslie Preston, Economist, Financial [email protected] Jonathan Bendiner, Economist, Regional [email protected] Brian DePratto, Economist, Environmental [email protected] ECONOMIC ANALYSTS Admir Kolaj [email protected] Diarra Sourang [email protected] Ksenia Bushmeneva, Economist [email protected] Andrew Labelle, Economist [email protected] Christos Ntantamis, Econometrician [email protected] TO REACH US Mailing Address 66 Wellington Street West 20th Floor, TD Bank Tower Toronto, Ontario M5K 1A2 [email protected] Nicole Fillier [email protected] January 9, 2015 8 TD Economics | www.td.com/economics This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. January 9, 2015 9

© Copyright 2026