FX Weekly Update

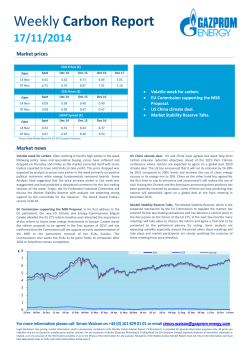

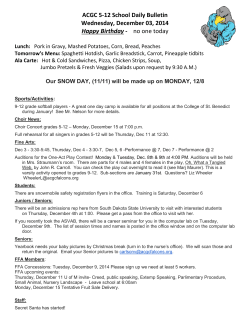

December 15, 2014 FX Weekly Update Contacts : Marc Maeder Utku Eroglu Oguz Sanli Tel : +41 (0)22 909 18 32 e-mail [email protected] Currency Pair EUR/USD USD/CHF EUR/CHF GBP/USD EUR/GBP USD/JPY EUR/JPY USD/TRY EUR/TRY USD/ZAR EUR/SEK EUR/NOK EUR/DKK GOLD SILVER Current Price 1.2423 0.9668 1.2010 1.5696 0.7915 118.58 147.32 2.3177 2.8801 11.5795 9.3840 9.1528 7.4374 1'210.89 16.87 Week Close 1.2462 0.9638 1.2011 1.5716 0.7928 118.75 147.99 2.2985 2.8652 11.5916 9.4090 9.1528 7.4389 1'222.59 17.03 % Change -0.31 0.31 -0.01 -0.13 -0.17 -0.14 -0.45 0.83 0.52 -0.10 -0.27 0.00 -0.02 -0.97 -0.95 Month Close 1.2452 0.9653 1.2022 1.5645 0.7958 118.63 147.72 2.2201 2.7645 11.0629 9.2762 8.7549 7.4405 1'167.38 15.45 % Change -0.23 0.16 -0.09 0.32 -0.54 -0.04 -0.27 4.21 4.01 4.46 1.15 4.35 -0.04 3.59 8.43 Year Close 1.3743 0.8929 1.2274 1.6557 0.8302 105.31 144.73 2.1482 2.9529 10.4926 8.8482 8.3436 7.4600 1'201.64 19.47 % Change -10.63 7.64 -2.20 -5.49 -4.89 11.19 1.76 7.31 -2.53 9.39 5.71 8.84 -0.30 0.76 -15.39 200d Moving Avg 1.3256 0.9161 1.2127 1.6514 0.8025 105.82 140.01 2.1731 2.8789 10.7939 9.1383 8.3168 7.4539 1'267.33 18.92 100d Moving Avg 1.2809 0.9431 1.2072 1.6178 0.7917 109.58 140.18 2.2179 2.8403 10.9906 9.2140 8.3728 7.4459 1'233.40 17.81 Period Nov Nov Dec Dec Dec Dec Dec Dec Nov Nov Dec Dec Nov Nov Dec Survey 0.60% 79.30% --50.2 52.5 51.8 50.6 0.00% 1.20% 6.5 20 1030K 1050K -- Prior -0.10% 78.90% 48.4 47.9 49.5 52.1 51.1 50.1 0.10% 1.30% 3.3 11.5 1009K 1080K 54.8 Importance Oct Nov Nov Nov Dec.17 Dec Dec Dec Nov Dec.13 Dec.06 5.90% 0.30% -0.10% 1.50% 0-0.25% 105.5 110.8 100.5 0.30% --- 6.00% -0.00% 1.70% 0-0.25% 104.7 110 99.7 0.80% 294K 2514K Weekly Comment EURGBP It’s been almost 6 months that EURGBP is stuck between 0.7800-0.8000 flat range. The pair seems totally directionless in the last 2 weeks. Even though we saw sharp moves within the day, mostly because of ECB and BoE officials’ bearish remarks, the pattern in the big picture hasn’t changed much. We see that upside is limited with 0.8025 (200day average) and downside is supported by 0.7830, 0.7800 and 0.7766, respectively. However, higher lows at the bottom of the daily chart is noteworthy, which is a bullish sign for the pair. We don’t expect the flat range bounds to be broken towards year-end unless something new comes out from either ECB or BoE. USDTRY As we are getting closer to the year end, investors have started to lose their risk appetite, which was the case in December 20013 as well. USD/EM has been trading uncomfortably lately and printing new highs every passing day. The lira, which is one of the best performers among EM currencies against the dollar this year, also got hit by the year-end flow. USDTRY broke crucial 2.3000 level as of this morning. Technically, the pair is in overbought territory but the momentum is still strong and it’s just a matter of time that we may see fresh highs. The liquidity will be a more serious issue in the following days. 2.3000 and 2.2810 are the supports below. On the upside we have all-time-high 2.3900 which was seen in January. Buying on dips may be the most appropriate strategy to pursue at the moment. Key Events Date 12/15/2014 15:15 12/15/2014 15:15 12/16/2014 09:00 12/16/2014 09:00 12/16/2014 09:30 12/16/2014 09:30 12/16/2014 10:00 12/16/2014 10:00 12/16/2014 10:30 12/16/2014 10:30 12/16/2014 11:00 12/16/2014 11:00 12/16/2014 14:30 12/16/2014 14:30 12/16/2014 15:45 12/17/2014 10:30 12/17/2014 10:30 12/17/2014 11:00 12/17/2014 14:30 12/17/2014 14:30 12/17/2014 20:00 12/18/2014 10:00 12/18/2014 10:00 12/18/2014 10:00 12/18/2014 10:30 12/18/2014 14:30 12/18/2014 14:30 Country US US FR FR GE GE EC EC UK UK GE GE US US US UK UK EC US US US GE GE GE UK US US Event Industrial Production MoM Capacity Utilization Markit France Manufacturing PMI Markit France Services PMI Markit/BME Germany Manufacturing PMI Markit Germany Services PMI Markit Eurozone Services PMI Markit Eurozone Manufacturing PMI CPI MoM CPI YoY ZEW Survey Current Situation ZEW Survey Expectations Housing Starts Building Permits Markit US Manufacturing PMI Bank of England Minutes ILO Unemployment Rate 3Mths CPI YoY CPI MoM CPI YoY FOMC Rate Decision IFO Business Climate IFO Current Assessment IFO Expectations Retail Sales Incl. Auto MoM Initial Jobless Claims Continuing Claims This document is for distribution to professional or institutional clients or counterparties only and is not intended for distribution to or use by, retail customers or any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where the distribution, publication, availability or use of such document would be contrary to law or regulation. This publication is for information only and does not constitute a contractual document, an offer, or a solicitation of an offer, to buy or sell any investment or other financial product. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Any opinion is valid only as of the date of this publication and may be changed at any time without prior warning. Past performance is not an indication of future results. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. BCP disclaims liability for any and all forms of loss or damage arising out of the use of them. All investments involve risks, particularly the risk of fluctuations in value and returns but not only. In addition, foreign currencies are exposed to risk of depreciation regarding the reference currency of the investor. Therefore, the recipient of this document has to consult with his own legal, financial and/or tax adviser before any investment in order to carefully consider the compatibility of the information with his personal situation in terms of financial risks, legal, regulatory and tax consequences. This document may not be reproduced or distributed, either in part or in full, without the prior authorisation of BCP. © 2014 Banque de Commerce et de Placements SA. All rights reserved

© Copyright 2026