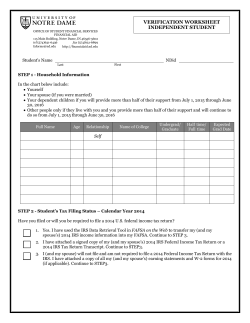

2014-15 Independent Verification Worksheet

2014-15 Independent Verification Worksheet Your application has been selected for review in a process called Verification. In this process, the information from your Free Application for Federal Student Aid (FAFSA) will be compared with you and your spouse’s answers to the questions below. If there are differences, our office may correct your FAFSA information. You must complete and sign this worksheet, attach all required documents, and submit to The Office of Student Financial Aid. _______________________________________________________________ Student’s Last Name First Name MI _______________________________ Furman University ID Number ________________________________________________________________ Address (include apartment number) Check here if new freshman ______________________________________________________________ City State Zip HOUSEHOLD INFORMATION Please list the people in your household. Include: Yourself, Your spouse, Your dependent children, Other people ONLY if they now live with you and receive more than half of their support from you (and your spouse) AND will continue to receive this support through June 30, 2015. The name of the college/university attended by household members who will be pursuing a degree at least halftime (usually 6 hours/semester) in 2014-15. Full Name of Family Member in Student’s Household Age Relationship to Student Name of College/University in 2014-15 Self Furman University Check here if family member is in graduate school (Master’s, PhD) CHILD SUPPORT PAID Please list the child support that you or spouse paid to another household because of separation, divorce or a legal requirement. Do not include child support paid for children listed on this form. Name of person who paid child support VERI15.pdf Name of adult to whom child support was paid Name of child for whom child support was paid Amount of child support paid in 2013 2/10/14 SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP)/FOOD STAMPS ION ASSISTANCE PROGRAM (SNAP) Did you, your spouse, or anyone listed in your household receive SNAP/food stamps (Supplemental Nutrition Assistance Program) in 2012 or 2013? Yes No ? INCOME VERIFICATION The easiest way to verify income is to use the IRS Data Retrieval Tool when completing or updating your FAFSA at www.fafsa.gov. If you did not use the IRS Data Retrieval Tool when completing or updating the FAFSA, you must provide an IRS Tax Return Transcript. Due to changes in federal regulations, schools can no longer accept photocopies of tax returns. To request an IRS Tax Return Transcript please visit www.irs.gov. Be sure to request a Tax Return Transcript, NOT an Account Transcript. If you or your spouse did not and will not file a 2013 federal tax return, please check the appropriate box below. Student (and Spouse) Income I (and my spouse) used the IRS Data Retrieval process when completing/updating the 2014-15 FAFSA. My 2013 Federal IRS Tax Return Transcript is attached. If I am married and my spouse filed separately, his/her 2013 Tax Return Transcript is attached. See Income Verification section above for important details. I (and my spouse) will not file and am (are) not required to file a 2013 federal tax return. I (and my spouse) was (were) not employed and had no income earned from work in 2013. Additional information may be requested to verify how you met your living expenses. I (and my spouse) will not file and am (are) not required to file a 2013 federal tax return. I (we) was (were) employed in 2013. Provide copies of all 2013 IRS W-2 forms issued to the student and spouse by all employers. Employer’s Name 2013 Amount Earned Was IRS W-2 Issued by Employer? CERTIFICATIONS AND SIGNATURES By signing this worksheet, I/we certify that all of the information reported is complete and correct. We also acknowledge that we have read and agree to comply with all verification policies as stated by the University. Student (Required) VERI15.pdf Date Spouse Date 2/10/14

© Copyright 2026