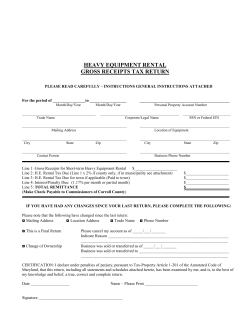

Gross Receipts Tax Computation Worksheet

General Information and Instructions 2014 Gross Receipts Tax Computation Worksheets Purpose of the Worksheets Use the 2014 Gross Receipts Tax Computation Worksheets to determine your 2014 San Francisco Gross Receipts Tax liability before applying any credits or the Central Market Street Limit. These worksheets may NOT be filed with the Office of the Treasurer and Tax Collector as an official Gross Receipts Tax return. The official 2014 Payroll Expense Tax and Gross Receipts Tax return will be available online through the Office of the Treasurer and Tax Collector’s website in early 2015. For 2014 quarterly installment payments, please note that tax installment penalties and interest shall not apply if the sum of your 2014 Gross Receipts Tax and Payroll Expense Tax quarterly installment payments for any quarter is at least 26 percent of the sum of your Payroll Expense Tax and Gross Receipts Tax liability for 2013, but you may choose to use these worksheets to compute your 2014 San Francisco Gross Receipts Tax quarterly installment payments. Complete the flow chart questions in the Worksheet Guide on page 3 of the instructions prior to completing the worksheet(s). The questions in the flow chart determine the applicable worksheet(s) to complete to compute your 2014 Gross Receipts Tax liability before any credits or the Central Market Street Limit. This worksheet flow chart is intended to identify the numerous taxpayers that are eligible to use the simplified worksheets (Worksheet-EZ, EZR and EZL). Follow the instructions in the order below: 1. Worksheet Guide – The flow chart questions in the Worksheet Guide on page 3 should be completed prior to completing the worksheet(s). 2. Gross Receipts Tax Computation Worksheet – EZ, EZR and EZL If the Worksheet Guide directs you to Worksheet-EZ, Worksheet-EZR or Worksheet-EZL, you are eligible to compute your Gross Receipts Tax liability using one of these simplified worksheets. If you qualify to use any of these simplified worksheets, you do not need to complete any of Gross Receipts Tax Computation Worksheet-Sections A, B, or C. 3. Gross Receipts Tax Computation Worksheet - Sections A, B, and C – If you are not eligible to use Worksheet-EZ, EZR, or EZL, complete Gross Receipts Tax Computation Worksheet-Section A-1, A-2, A-3, or A-4 separately for each of your business activities conducted during 2014, as appropriate. These sections will determine your San Francisco gross receipts for each of your business activities. Depending on the type of business activities you conduct, your gross receipts may be subject to various allocation/apportionment methodologies. Each of Sections A-1, A-2, A-3, and A-4 reflects a different allocation/apportionment methodology. Once you have determined your San Francisco gross receipts by completing the applicable Section As for each of Rev. 6/30/14 Instructions - 1 4. your business activities in 2014, use both Sections B and C to compute your Gross Receipts Tax liability before any credits or the Central Market Street Limit. Period Covered Use the 2014 Gross Receipts Tax Computation Worksheets for computing your Gross Receipts Tax liability for tax year 2014 only. If you cease business during 2014, you may use the worksheets to assist in determining your Gross Receipts Tax liability for your short tax year. However, the worksheet(s) should not be filed as a return. A copy of the 2014 Payroll Expense Tax and Gross Receipts Tax Short Period Return can be found at: http://www.sftreasurer.org/Modules/ShowDocument.aspx?documentid=646. Combined Groups Beginning with tax year 2014, all persons and their related entities (as defined under San Francisco Business and Tax Regulations Code Section 952.5) must file Gross Receipts Tax returns on a combined basis, including the gross receipts and allocation/apportionment factors of all related entities. Therefore, the 2014 Gross Receipts Tax Computation Worksheets must be completed on a combined basis to determine your 2014 Gross Receipts Tax. Each member of a combined group required to file a Payroll Expense Tax or Gross Receipts Tax return in San Francisco (and that is not a key filer itself) must authorize a key filer to file the Gross Receipts Tax and Payroll Expense Tax return on its behalf. Business Activities and Tax Rates For tax year 2014, tax rates are 10% of the maximum rates approved by the voters. This rate adjustment has already been taken into account on the worksheets. As you will see in the worksheets, different tax rates apply to different business activities, as defined under the 2012 North American Industry Classification System (“NAICS”) code. Moreover, within each business activity your rate increases marginally for higher amounts of gross receipts. For example, a taxpayer with $1.5 million of gross receipts from a single business activity will pay one rate on its first $1 million of gross receipts and a second (higher) rate on its second $500,000 of gross receipts. Appendix A to these worksheets provides useful information about business activities, including descriptions of the activities, the NAICS codes corresponding to each activity, the tax rate categories applicable to each activity, and the method(s) used for attributing gross receipts from each activity to San Francisco. For additional information on NAICS codes, go to: http://www.census.gov/eos/naics/2012NAICS/2012_Definition_File.pdf . Administrative Office Tax If you are required to pay the Administrative Office Tax pursuant to San Francisco Business and Tax Regulations Code Section 953.8 (which applies to taxpayers and their related entities who, among other things, have more than 1,000 employees in the United States as of December 31, 2013, and reported, or will report, more than $1,000,000,000 of gross receipts on their federal income tax return(s) for 2013), do not use these 2014 Gross Receipts Tax Computation Worksheets. Refer to the 2014 Payroll Expense Tax and Gross Receipts Tax return and its instruction booklet (which will be available in early 2015) for instructions on determining whether you are required to pay the Administrative Office Tax, and on the computation of the Administrative Office Tax. Rev. 6/30/14 Instructions - 2 Payroll Expense Tax The 2014 Gross Receipts Tax imposed under Article 12-A-1 is in addition to the Payroll Expense Tax imposed under Article 12-A. If you are not exempt from the Gross Receipts Tax or Payroll Expense Tax, you must pay both taxes. If you are exempt from either the Gross Receipts Tax or Payroll Expense Tax, but not both, you must pay the tax from which you are not exempt. Use the 2014 Gross Receipts Tax Computation Worksheets to determine your Gross Receipts Tax liability for 2014 before any credits or the Central Market Street Limit, and refer to the 2014 Payroll Expense Tax and Gross Receipts Tax return and its instruction booklet (which will be available in early 2015) for instructions regarding the computation of your 2014 Payroll Expense Tax liability, any credits, and the Central Market Street Limit, if applicable. For more detailed information with respect to the computation of your Gross Receipts Tax, please refer to San Francisco Business & Tax Regulations Code, Article 12-A-1 (sections 950 et. seq.), or visit www.sfbiztax.org. Rev. 6/30/14 Instructions - 3 Gross Receipts Tax Computation Worksheet Guide Determine the applicable Gross Receipts Tax Computation Worksheet(s) to complete by answering the questions below with respect to tax year 2014: Question 1: Are you a lessor of residential real estate? YES NO Question 2: Do you have more than $1,000,000 in gross receipts (excluding any gross receipts from leasing residential real property)? Use Worksheet-EZL for your gross receipts from leasing residential real estate. Proceed to Question 2 for any other gross receipts. NO STOP ZERO TAX DUE YES Question 3: Did you have related entities during any portion of the year? NO Question 4: Did you receive any amount from the sale of real property or financial instruments, investment receipts, royalties, licensing fees, OR distributions from one or more pass through entities? YES YES NO Question 5: Did you make payments to construction subcontractors while doing business in the construction industry? YES NO Question 6: Are you applying for a “Payroll Expense Tax Exclusion Credit” or the “Central Market Street Limit?” Use Gross Receipts Tax WorksheetSections A, B, & C YES NO Question 7: Are all your business locations in San Francisco, AND all your gross receipts derived from business activities in San Francisco, AND more than 80% of your gross receipts derived from business activities in a single tax rate category (see Appendix A)? NO YES Question 8: Did you have gross receipts derived from real estate or rental and leasing services? YES Use WorksheetEZR NO Use Worksheet- EZ Rev. 6/30/14 Instructions - 4 2014 EZ Worksheet – (DO NOT FILE) Gross Receipts Tax Computation Worksheet – EZ Use this worksheet only as directed by the Worksheet Guide. Office of the Treasurer & Tax Collector Complete the lines below for your 2014 business activities. 1. Input total taxable gross receipts here. 2A. If line 1 is more than $1,000,000, input $1,000,000 here. Otherwise, input $0. 2B. Multiply line 2A by tax bracket A of your tax rate category. 3A. If line 1 is between $1,000,001 and $2,500,000, subtract $1,000,000 from line 1 and enter the difference. Otherwise, input $0. 3B. If line 1 is more than $2,500,000, input $1,500,000. Otherwise, input $0. 3C. Multiply the greater of line 3A or 3B by tax bracket B of your tax rate category. 4A. If line 1 is between $2,500,001 and $25,000,000, subtract $2,500,000 from line 1 and enter the difference. Otherwise, input $0. 4B. If line 1 is more than $25,000,000, input $22,500,000. Otherwise, input $0. 4C. Multiply the greater of line 4A or 4B by tax bracket C of your tax rate category. 5A. If line 1 is more than $25,000,000, subtract $25,000,000 from line 1 and enter the difference. 5B. Multiply line 5A by tax bracket D of your tax rate category. 6. Total Gross Receipts Tax (sum lines 2B, 3C, 4C, and 5B) Stop: This is your Gross Receipts Tax. EZL Rev. 6/30/14 2014 Worksheet – EZR (DO NOT FILE) Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – EZR Use this worksheet only as directed by the Worksheet Guide. Complete the lines below for your 2014 business activities. 1. Input total taxable gross receipts here. 2A. If line 1 is $1,000,000 or less, input $0 here. 2B. If line 1 is between 1,000,001 and $5,000,000, input line 1 here. 2C. Multiply line 2B by 0.0285%. 3A. If line 1 is more than $5,000,000, input $5,000,000. Otherwise, input $0. 3B. Multiply line 3A by 0.0285%. 4A. If line 1 is more than $5,000,000, subtract $5,000,000 from line 1 and enter the difference. Otherwise, input $0. 4B. Multiply line 4A by 0.03%. 5. Total Gross Receipts Tax (sum lines 2C, 3B, and 4B) Stop: This is your Gross Receipts Tax. EZL Rev. 6/30/14 2014 Worksheet – EZL (DO NOT FILE) Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – EZL (Lessors of Residential Real Estate) Use this worksheet only as directed by the Worksheet Guide. COMPLETE WORKSHEET-EZL SEPARATELY FOR EACH INDIVIDUAKL BUILDING IN WHICH YOU LEASE RESIDENTIAL REAL ESTATE.* EACH INDIVIDUAL BUILDING IN WHICH YOU LEASE FEWER THAN FOUR RESIDENTIAL UNITS IS EXEMPT FROM PAYING THE GROSS RECEIPTS TAX WITH RESPECT TO THOSE UNITS. For each individual building in which you lease four or more residential units, input your total gross receipts from those units on line 1 below, less any deductions for rent controlled property. (see instructions) Complete the lines below for your 2014 business activities. 1. Input total taxable gross receipts here (see instructions for rent-controlled property deduction). 2A. If line 1 is $1,000,000 or less, input $0 here. 2B. If line 1 is between 1,000,001 and $5,000,000, input line 1 here. 2C. Multiply line 2B by 0.0285%. 3A. If line 1 is more than $5,000,000, input $5,000,000. Otherwise, input $0. 3B. Multiply line 3A by 0.0285%. 4A. If line 1 is more than $5,000,000, subtract $5,000,000 from line 1 and enter the difference. Otherwise, input $0. 4B. Multiply line 4A by 0.03%. 5. Total Gross Receipts Tax (sum lines 2C, 3B, and 4B) Stop: This is your Gross Receipts Tax. * For the purposes of the Business Registration Fee, Payroll Expense Tax, and Gross Receipts Tax, a lessor of residential real estate is treated as a separate person with respect to each individual building in which it leases residential real estate units, defied as real property where the primary use of or right to use the property is for the purpose of dwelling, sleeping or lodging other than as part of the business activity of accommodations in the Code. EZL Rev. 6/30/14 A-1 Section (DO NOT FILE) 2014 Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – Section A-1 Use this worksheet only as directed by the Worksheet Guide. Complete a separate worksheet for each of the business activities listed below: Retail TradeWholesale Trade Manufacturing Transportation and Warehousing Information Food Services Biotechnology Clean Technology Utilities Circle the business activity above for which you are calculating gross receipts. (Circle one only, please use a separate worksheet for each business activity) For the business activity indicated above only, enter the gross receipts. If you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending on the election you made that governs your California Franchise Tax Board filing for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part A – Gross Receipts Before Exclusions Total San Francisco A1. Sales, including but not limited to revenues received from services provided, from the lease or rental of equipment, and from dealings in property, if such amount has not been accounted for in A2 through A9 A2. Rent received from real property A3. Royalties received A4. Interest, dividends, and other amounts received from the ownership or sale of financial instruments A5. Licensing and related fees received A6. Commissions A7. Amounts distributed from business entities A8. All taxes and government imposed fees received A9. Other amounts that constitute gross income for federal income tax purposes, if not included above A10. Sum of A1 through A9 For the business activity indicated above only, enter the following amounts received for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part B – Exclusions from Gross Receipts Total San Francisco B1. Any amount(s) included in Part A that that were received from related entities, if applicable B2. Interest, dividends, and other amounts received from the ownership or sale of financial instruments that are exclusively derived from the investment of capital B3. Allocations of income, gain, and distributions (including returns on capital) received from a passthrough entity solely because of an investment in that entity B4. Distributed share of the gross receipts of a pass-through entity that is also subject to the San Francisco Gross Receipts Tax B5. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B6. Excludable taxes B7. Other amounts excludable by law, if reported in A1 to A9, and if not included in B1 to B6 B8. Sum of B1 through B7 C1. Subtract B8 from A10 D1. Payroll D2. Divide D1 San Francisco by D1 Total D3. Multiply D2 by C1 Total D4. Multiply D3 by 50% D5. Multiply C1 San Francisco by 50% D6. Sum D4 and D5 D7. Payments subject to the Gross Receipts Tax made to subcontractors registered in San Francisco, if any. E1. Transfer D6. These are the gross receipts attributable to San Francisco for this business activity. EZL Rev. 6/30/14 2014 A-2 Section (DO NOT FILE) Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – Section A-2 Use this worksheet only as directed by the Worksheet Guide. Complete a separate worksheet for each of the business activities listed below: Arts, Entertainment, and Recreation Education and Health Services Administrative and Support Services Certain Services Financial Services Insurance Professional, Scientific, and Technical Services Any Business Activity Not Listed Circle the business activity above for which you are calculating gross receipts. (Circle one only, please use a separate worksheet for each business activity) For the business activity indicated above only, enter the gross receipts. If you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending on the election you made that governs your California Franchise Tax Board filing for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part A – Gross Receipts Before Exclusions Total San Francisco A1. Sales, including but not limited to revenues received from services provided, from the lease or rental of equipment, and from dealings in property, if such amount has not been accounted for in A2 through A9 A2. Rent received from real property A3. Royalties received A4. Interest, dividends, and other amounts received from the ownership or sale of financial instruments A5. Licensing and related fees received A6. Commissions A7. Amounts distributed from business entities A8. All taxes and government imposed fees received A9. Other amounts that constitute gross income for federal income tax purposes, if not included above A10. Sum of A1 through A9 For the business activity indicated above only, enter the following amounts received for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part B – Exclusions from Gross Receipts Total San Francisco B1. Any amount(s) included in Part A that that were received from related entities, if applicable B2. Interest, dividends, and other amounts received from the ownership or sale of financial instruments that are exclusively derived from the investment of capital B3. Allocations of income, gain, and distributions (including returns on capital) received from a passthrough entity solely because of an investment in that entity B4. Distributed share of the gross receipts of a pass-through entity that is also subject to the San Francisco Gross Receipts Tax B5. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B6. Excludable taxes B7. Other amounts excludable by law, if reported in A1 to A9, and if not included in B1 to B6 B8. Sum of B1 through B7 C1. Subtract B8 from A10 D1. Payroll D2. Divide D1 San Francisco by D1 Total D3. Multiply D2 by C1 Total E1. Transfer D3. These are the Gross Receipts attributable to San Francisco for this business activity. Section A-2 Rev. 6/30/14 A-3 2014 Section (DO NOT FILE) Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – Section A-3 Use this worksheet only as directed by the Worksheet Guide. Complete a separate worksheet for each of the business activities listed below: Accommodations Real Estate and Rental and Leasing Services Circle the business activity above for which you are calculating gross receipts. (Circle one only, please use a separate worksheet for each business activity) For the business activity indicated above only, enter the gross receipts. If you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending on the election you made that governs your California Franchise Tax Board filing for this tax year. Part A – Gross Receipts Before Exclusions San Francisco A1. Sales, including but not limited to revenues received from services provided, from the lease or rental of equipment, and from dealings in property, if such amount has not been accounted for in A2 through A9 A2. Rent received from real property A3. Royalties received A4. Interest, dividends, and other amounts received from the ownership or sale of financial instruments A5. Licensing and related fees received A6. Commissions A7. Amounts distributed from business entities A8. All taxes and government imposed fees received A9. Other amounts that constitute gross income for federal income tax purposes, if not included above A10. Sum of A1 through A9 For the business activity indicated above only, enter the following amounts received for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part B – Exclusions from Gross Receipts San Francisco B1. Any amount(s) included in Part A that that were received from related entities, if applicable B2. Interest, dividends, and other amounts received from the ownership or sale of financial instruments that are exclusively derived from the investment of capital B3. Allocations of income, gain, and distributions (including returns on capital) received from a pass-through entity solely because of an investment in that entity B4. Distributed share of the gross receipts of a pass-through entity that is also subject to the San Francisco Gross Receipts Tax B5. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B6. Excludable taxes B7. Other amounts excludable by law, if reported in A1 to A9, and if not included in B1 to B6 B8. Sum of B1 through B7 C1. Subtract B8 from A10 E1. Transfer C1. These are the Gross Receipts attributable to San Francisco for this business activity. Section A-3 Rev. 6/30/14 A-4 2014 Section (DO NOT FILE) Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – Section A-4 Use this worksheet only as directed by the Worksheet Guide. Only use this worksheet if you are reporting gross receipts in the business activity of CONSTRUCTION. For the business activity indicated above only, enter the gross receipts. If you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending on the election you made that governs your California Franchise Tax Board filing for this tax year. Part A – Gross Receipts Before Exclusions Total San Francisco A1. Sales, including but not limited to revenues received from services provided, from the lease or rental of equipment, and from dealings in property, if such amount has not been accounted for in A2 through A9 A2. Rent received from real property A3. Royalties received A4. Interest, dividends, and other amounts received from the ownership or sale of financial instruments A5. Licensing and related fees received A6. Commissions A7. Amounts distributed from business entities A8. All taxes and government imposed fees received A9. Other amounts that constitute gross income for federal income tax purposes, if not included above A10. Sum of A1 through A9 For the business activity indicated above only, enter the following amounts received for this tax year. Enter the amounts only once, even if they qualify in more than one line. Part B – Exclusions from Gross Receipts Total San Francisco B1. Any amount(s) included in Part A that that were received from related entities, if applicable B2. Interest, dividends, and other amounts received from the ownership or sale of financial instruments that are exclusively derived from the investment of capital B3. Allocations of income, gain, and distributions (including returns on capital) received from a pass-through entity solely because of an investment in that entity B4. Distributed share of the gross receipts of a pass-through entity that is also subject to the San Francisco Gross Receipts Tax B5. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B6. Excludable taxes B7. Other amounts excludable by law, if reported in A1 to A9, and if not included in B1 to B6 B8. Sum of B1 through B7 C1. Subtract B8 from A10 D1. Payroll D2. Divide D1 San Francisco by D1 Total D3. Multiply D2 by C1 Total D4. Multiply D3 by 50% D5. Multiply C1 San Francisco by 50% D6. Sum D4 and D5 D7. Payments made to subcontractors possessing a valid San Francisco business registration certificate during the tax year, if any, as long as the amounts were included in C1 San Francisco. E1. Subtract D7 from D6. These are the Gross Receipts attributable to San Francisco for this business activity. Section A-4 Rev. 6/30/14 B Section (DO NOT FILE) 2014 Office of the Treasurer & Tax Collector Gross Receipts Tax Computation Worksheet – Section B Use this worksheet only as directed by the Worksheet Guide. Input amount from line E1 of Section A for each business activity below. Worksheet Code Business Activity Section Section 1 A-1 §953.1 Retail Trade 2 A-1 §953.1 Wholesale Trade 3 A-2 §953.1 Certain Services 4 Subtotal (sum of lines 1 to 3) 5 A-1 §953.2 Manufacturing 6 A-1 §953.2 Transportation and Warehousing 7 A-1 §953.2 Information 8 A-1 §953.2 Food Services 9 A-1 §953.2 Biotechnology 10 A-1 §953.2 Clean Technology 11 Subtotal (sum of lines 5 to 10) 12 A-3 §953.3 Accommodations 13 A-1 §953.3 Utilities 14 A-2 §953.3 Arts, Entertainment, and Recreation 15 Subtotal (sum of lines 12 to 14) 16 A-2 §953.4 Education and Health Services 17 A-2 §953.4 Administrative and Support Services 18 A-2 §953.4 Activity Not Listed Above 19 Subtotal (sum of lines 16 to 18) 20 A-4 §953.5 Construction 21 Subtotal (line 20) 22 A-2 §953.6 Financial Services 23 A-2 §953.6 Insurance 24 A-2 §953.6 Professional, Scientific, and Technical Services 25 Subtotal (sum of lines 22 to 24) 26 A-3 §953.7 Real Estate, Rental, and Leasing Services 27 Subtotal (Iine 26) 28 Total San Francisco Gross Receipts (sum of lines 4, 11, 15, 19, 21, 25 and 27) Amount If line 28 is $1,000,000 or less for the entire tax year, you are exempt from the Gross Receipts Tax in 2014 and you do not need to complete Worksheet – Section C. However, you must still file a Gross Receipts Tax return if line 28 is $500,000 or more for the entire tax year. If line 28 is more than $1,000,000, transfer amounts to Worksheet – Section C, Column A “Gross Receipts” as follows: If any of lines 4, 11, 15, 19, 21, 25, or 27 constitutes more than 80 percent of the total San Francisco gross receipts listed on line 28, transfer line 28 to the row in Worksheet – Section C, Column A “Gross Receipts” that corresponds to the Code section that generated more than 80 percent of the gross receipts. If none of lines 4, 11, 15, 19, 21, 25, or 27 constitutes more than 80 percent of the total San Francisco gross receipts listed on line 28, transfer lines 4, 11, 15, 19, 21, 25, and 27 to the corresponding row in Worksheet – Section C, Column A “Gross Receipts.” Rev. 6/30/14 Section B Section C Gross Receipts Tax Computation Worksheet – Section C Use this worksheet only as directed by the Worksheet Guide. Use the instructions on the following pages to fill in the cells in Table 1 below. Each cell is referenced by the column label and the row label. For instance, cell “A1” refers to the Gross Receipts for column A, row 1. A Gross Receipts B Lower Bound C Upper Bound Tax Brackets 953.1 – 953.6 1 I Tier I Tax $0 to $1,000,000 II Tier II Tax $1,000,001 to $2,500,000 III Tier III Tax $2,500,001 to $25,000,000 IV Tier IV Tax Over $25,000,000 x 0.0075% = x 0.0100% = x 0.0135% = x 0.0160% = x 0.0125% = x 0.0205% = x 0.0370% = x 0.0475% = x 0.0300% = x 0.0325% = x 0.0325% = x 0.0400% = x 0.0525% = x 0.0550% = x 0.0600% = x 0.0650% = x 0.0300% = x 0.0350% = x 0.0400% = x 0.0450% = x 0.0400% = x 0.0460% = x 0.0510% = x 0.0560% = 0 953.1 2 953.2 3 953.3 4 953.4 5 953.5 6 953.6 Tax Brackets 953.7 $0 to $1,000,000 x 0.0285% = 7 $1,000,001 to $2,500,000 x 0.0285% = $2,500,001 to $25,000,000 Over $25,000,000 x 0.0300% = x 0.0300% = 953.7 8 9 Subtotal (Sum row 1 thru 7) Gross Receipts Tax (Sum of cells from line 8) Calculation Instructions 1) 2) 3) After filling in the table per the instructions, multiply each cell in Column Tier I, Tier II, Tier III, and Tier IV by its corresponding tax rate in Column Tier I Tax, Tier II Tax, Tier III Tax, and Tier IV Tax. Sum Column Tier I Tax, Tier II Tax, Tier III Tax, and Tier IV Tax in the respective Subtotal row, line 8. Sum all amounts from Subtotal row, line 8, in Gross Receipts Tax and input in line 9. This is your Gross Receipts Tax before any credits or the Central Market Limit. NOTE: The tax year 2014 tax rate adjustment factor has already been applied. 6/30/14 Section C - Page | 13 Section C Cell B1 Instructions Input zero (0) B2 Input A1 B3 Input sum of A1 through A2 B4 Input sum of A1 through A3 B5 Input sum of A1 through A4 B6 Input sum of A1 through A5 B7 Input sum of A1 through A6 C1 Input A1 C2 Input sum of A1 through A2 C3 Input sum of A1 through A3 C4 Input sum of A1 through A4 C5 Input sum of A1 through A5 C6 Input sum of A1 through A6 C7 Input sum of A1 through A7 6/30/14 Section C - Page | 14 Section C Cell Instructions I-1 a) b) c) a) b) c) a) b) c) a) b) c) a) b) c) a) b) c) a) b) c) I-2 I-3 I-4 I-5 I-6 I-7 If A1 is zero, input zero If A1 is between zero and $1,000,000, input A1 If A1 is greater than $1,000,000, input $1,000,000 If A2 is zero, input zero If B2 is greater than $1,000,000, input zero If B2 is between zero and $1,000,000, input the lesser of A2, and $1,000,000 minus B2 If A3 is zero, input zero If B3 is greater than $1,000,000, input zero If B3 is between zero and $1,000,000, input the lesser of A3, and $1,000,000 minus B3 If A4 is zero, input zero If B4 is greater than $1,000,000, input zero If B4 is between zero and $1,000,000, input the lesser of A4, and $1,000,000 minus B4 If A5 is zero, input zero If B5 is greater than $1,000,000, input zero If B5 is between zero and $1,000,000, input the lesser of A5, and $1,000,000 minus B5 If A6 is zero, input zero If B6 is greater than $1,000,000, input zero If B6 is between zero and $1,000,000, input the lesser of A6, and $1,000,000 minus B6 If A7 is zero, input zero If B7 is greater than $1,000,000, input zero If B7 is between zero and $1,000,000, input the lesser of A7, and $1,000,000 minus B7 6/30/14 Section C - Page | 15 Section C Cell Instructions II-1 a) b) c) a) b) c) d) e) II-2 II-3 a) b) c) d) e) II-4 a) b) c) d) e) II-5 a) b) c) d) e) II-6 a) b) c) d) e) II-7 a) b) c) d) e) If C1 is less than or equal to $1,000,000, input zero If C1 is between $1,000,001 and $2,500,000, input the result of A1 minus $1,000,000 If C1 is greater than $2,500,000, input $1,500,000 If C2 is less than or equal to $1,000,000, input zero If B2 is greater than $2,500,000, input zero If B2 is between $1,000,001 and $2,500,000, input the lesser of A2, and $2,500,000 minus B2 If B2 is less than or equal to $1,000,000 AND if C2 is greater than $2,500,000, input $1,500,000 If B2 is less than or equal to $1,000,000 AND if C2 is between $1,000,000 and $2,500,000, subtract $1,000,000 from C2 If C3 is less than or equal to $1,000,000, input zero If B3 is greater than $2,500,000, input zero If B3 is between $1,000,001 and $2,500,000, input the lesser of A3, and $2,500,000 minus B3 If B3 is less than or equal to $1,000,000 AND if C3 is greater than $2,500,000, input $1,500,000 If B3 is less than or equal to $1,000,000 AND if C3 is between $1,000,000 and $2,500,000, subtract $1,000,000 from C3 If C4 is less than or equal to $1,000,000, input zero If B4 is greater than $2,500,000, input zero If B4 is between $1,000,001 and $2,500,000, input the lesser of A4, and $2,500,000 minus B4 If B4 is less than or equal to $1,000,000 AND if C4 is greater than $2,500,000, input $1,500,000 If B4 is less than or equal to $1,000,000 AND if C4 is between $1,000,000 and $2,500,000, subtract $1,000,000 from C4 If C5 is less than or equal to $1,000,000, input zero If B5 is greater than $2,500,000, input zero If B5 is between $1,000,001 and $2,500,000, input the lesser of A5, and $2,500,000 minus B5 If B5 is less than or equal to $1,000,000 AND if C5 is greater than $2,500,000, input $1,500,000 If B5 is less than or equal to $1,000,000 AND if C5 is between $1,000,000 and $2,500,000, subtract $1,000,000 from C5 If C6 is less than or equal to $1,000,000, input zero If B6 is greater than $2,500,000, input zero If B6 is between $1,000,001 and $2,500,000, input the lesser of A6, and $2,500,000 minus B6 If B6 is less than or equal to $1,000,000 AND if C6 is greater than $2,500,000, input $1,500,000 If B6 is less than or equal to $1,000,000 AND if C6 is between $1,000,000 and $2,500,000, subtract $1,000,000 from C6 If C7 is less than or equal to $1,000,000, input zero If B7 is greater than $5,000,000, input zero If B7 is between $1,000,001 and $5,000,000, input the lesser of A7, and $5,000,000 minus B7 If B7 is less than or equal to $1,000,000 AND if C7 is greater than $5,000,000, input $4,000,000 If B7 is less than or equal to $1,000,000 AND if C7 is between $1,000,000 and $5,000,000, subtract $1,000,000 from C7 6/30/14 Section C - Page | 16 Section C Cell Instructions III-1 a) b) c) a) b) c) d) e) III-2 III-3 a) b) c) d) e) III-4 a) b) c) d) e) III-5 a) b) c) d) e) III-6 a) b) c) d) e) III-7 a) b) c) d) e) If C1 is less than or equal to $2,500,000, input zero If C1 is between $2,500,001 and $25,000,000, subtract $2,500,000 from A1 If C1 is greater than $25,000,000, input $22,500,000 If C2 is less than or equal to $2,500,000, input zero If B2 is greater than $25,000,000, input zero If B2 is between $2,500,001 and $25,000,000, input the lesser of A2, and $25,000,000 minus B2 If B2 is less than or equal to $2,500,000 AND if C2 is greater than $25,000,000, input $22,500,000 If B2 is less than or equal to $2,500,000 AND if C2 is between $2,500,000 and $25,000,000, subtract $2,500,000 from C2 If C3 is less than or equal to $2,500,000, input zero If B3 is greater than $25,000,000, input zero If B3 is between $2,500,001 and $25,000,000, input the lesser of A3, and $25,000,000 minus B3 If B3 is less than or equal to $2,500,000 AND if C3 is greater than $25,000,000, input $22,500,000 If B3 is less than or equal to $2,500,000 AND if C3 is between $2,500,000 and $25,000,000, subtract $2,500,000 from C3 If C4 is less than or equal to $2,500,000, input zero If B4 is greater than $25,000,000, input zero If B4 is between $2,500,001 and $25,000,000, input the lesser of A4, and $25,000,000 minus B4 If B4 is less than or equal to $2,500,000 AND if C4 is greater than $25,000,000, input $22,500,000 If B4 is less than or equal to $2,500,000 AND if C4 is between $2,500,000 and $25,000,000, subtract $2,500,000 from C4 If C5 is less than or equal to $2,500,000, input zero If B5 is greater than $25,000,000, input zero If B5 is between $2,500,001 and $25,000,000, input the lesser of A5, and $25,000,000 minus B5 If B5 is less than or equal to $2,500,000 AND if C5 is greater than $25,000,000, input $22,500,000 If B5 is less than or equal to $2,500,000 AND if C5 is between $2,500,000 and $25,000,000, subtract $2,500,000 from C5 If C6 is less than or equal to $2,500,000, input zero If B6 is greater than $25,000,000, input zero If B6 is between $2,500,001 and $25,000,000, input the lesser of A6, and $25,000,000 minus B6 If B6 is less than or equal to $2,500,000 AND if C6 is greater than $25,000,000, input $22,500,000 If B6 is less than or equal to $2,500,000 AND if C6 is between $2,500,000 and $25,000,000, subtract $2,500,000 from C6 If C7 is less than or equal to $5,000,000, input zero If B7 is greater than $25,000,000, input zero If B7 is between $5,000,001 and $25,000,000, input the lesser of A7, and $25,000,000 minus B7 If B7 is less than or equal to $5,000,000 AND if C7 is greater than $25,000,000, input $22,500,000 If B7 is less than or equal to $5,000,000 AND if C7 is between $5,000,000 and $25,000,000, subtract $5,000,000 from C7 6/30/14 Section C - Page | 17 Section C Cell Instructions IV-1 a) b) a) b) c) a) b) c) a) b) c) a) b) c) a) b) c) a) b) c) IV-2 IV-3 IV-4 IV-5 IV-6 IV-7 If C1 is less than or equal to $25,000,000, input zero If A1 is greater than $25,000,000, subtract $25,000,000 from A1 If C2 is less than or equal to $25,000,000, input zero If B2 is greater than $25,000,000, input A2 If B2 is less than or equal to $25,000,000 AND C2 is greater than $25,000,000, subtract $25,000,000 from C2 If C3 is less than or equal to $25,000,000, input zero If B3 is greater than $25,000,000, input A3 If B3 is less than or equal to $25,000,000 AND C3 is greater than $25,000,000, subtract $25,000,000 from C3 If C4 is less than or equal to $25,000,000, input zero If B4 is greater than $25,000,000, input A4 If B4 is less than or equal to $25,000,000 AND C4 is greater than $25,000,000, subtract $25,000,000 from C4 If C5 is less than or equal to $25,000,000, input zero If B5 is greater than $25,000,000, input A5 If B5 is less than or equal to $25,000,000 AND C5 is greater than $25,000,000, subtract $25,000,000 from C5 If C6 is less than or equal to $25,000,000, input zero If B6 is greater than $25,000,000, input A6 If B6 is less than or equal to $25,000,000 AND C6 is greater than $25,000,000, subtract $25,000,000 from C6 If C7 is less than or equal to $25,000,000, input zero If B7 is greater than $25,000,000, input A7 If B7 is less than or equal to $25,000,000 AND C7 is greater than $25,000,000, subtract $25,000,000 from C7 4) Multiply each cell in Column Tier I, Tier II, Tier III, and Tier IV by its corresponding tax rate in Column Tier I Tax, Tier II Tax, Tier III Tax, and Tier IV Tax. 5) Sum Column Tier I Tax, Tier II Tax, Tier III Tax, and Tier IV Tax in the respective Subtotal row, line 8. 6) Sum all amounts from Subtotal row, line 8, in Gross Receipts Tax, line 9. 6/30/14 Section C - Page | 18

© Copyright 2026