7a*ei8 - Moneycontrol

INTERNATIONAL TRAVEL HOUSE LIMITED

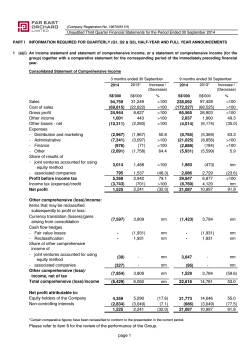

Part I : Statement of Unaudited Financial Results for the Quarter and Nine months ended 31st December, 2014

Particulars

3 months

ended

31.12.2014

(Unaudited

({. in Lacs)

Preceding

3 Months

ended

30.09.2014

(Unaudited)

Corresponding

3 months ended

31.12.2013

(Unaudited)

9 Months

ended

31-12.2411

(Unaudited)

9 months

ended

3t.12.2013

{Unauctited

Twelve Months

ended

31.03.?014

(Audited)

INCOME FROM OPERATIONS

a) lncome from Operations

b) Other Operating lncorne

4,418.10

101.05

4,519.15

(1)

(2)

(3)

TOTAL INCOME FROM OPERATIONS (1+2)

3,893.99

345.76

4.239.75

4,161.43

12,979.80

122.21

440.43

4,283.64

13,420.23

1,024.09

1,190.08

534.52

2,962.48

3,746.80

1,589.60

12,272.49

428.96

16,550.53

12.701.05

17,171 .09

620.56

EXPENSES

a) Employee Benefits Expense

b) Car Hire Charges

c) Serviee Charges

d) Depreciation and Amortisation Expense (Note vii)

e) Other Expenses

TOTAL EXPENSES

(4)

4,051,35

PROFIT FROM OPERATTONS tsEFORE OTHER TNCOME AND FTNANCE COSTS (3 - 4)

(5)

467.80

384.34

522.15

OTHER INCOME

(6)

69.87

108.53

80.81

176.67

272.78

473.s4

PROFIT FROM ORDINARY ACTIVITIES BEFORE FINANCE coSTS (5 + 6i

(7)

537.67

492"87

602.96

2,015.00

1,908.29

2,609.49

FINANCE COST$

(8)

0-03

0.38

0_49

0.94

1-28

1.55

(s)

537.64

492.49

602.47

2,014.06

TAX EXPENSE

(10)

178.28

143.33

194-27

661.34

582.19

797.19

NET PROFTT FOR THE PERTOD (9 - 10)

(11)

359.36

349.16

408.20

1,352.72

1,324.82

1,810.75

PAID UP EQUIry SHARE CAPITAL

(Equity Shares of T 10/- each)

(12)

799.45

799.45

799.45

799.45

799-45

799.45

RESERVES EXCLUDING REVALUATION RESERVES

(13)

EARNINGS PER SHARE (of t10/- each) (Not annualised):

- Basic and Diluted ( {.)

(14)

PROFTT FROM ORDTNARYACT|VITIES BEFORE TAX

987"29

1,362.16

540.86

224.23

929.04

1,193.02

500.43

243.14

989.78

936.81

F - 8)

(17.88)

1,030.69

3,761.49

3,855.41

1

,391 .19

1,581.90

742.14

2,767.87

11,065.54

1,838.33

1,635.51

404.77

2,878-25

1

2,742.15

3,422.19

1,907.01

3.747.21

4,786.51

1,866.28

988.53

3,647.01

15,035.54

2,135.55

'2,607.94

12,365.13

4.50

4.37

3 months

ended

31.12-2014

Gorresponding

3 months ended

31.12.2013

5.1

1

16.92

16.57

22.65

months

Twelve Months

PART ll : Select information for the Quarter and Nine months ended 31st Decernber. 2014

Particulars

A. Particularc of Sharcholding

1. PUBLIC SHAREHOLDING

- Number of Shares

- Percentage of Shareholding

2.

B.

PROMOTERS AND PROMOTER GROUP SHAREHOLDING

a) Pledged/Encumbered

b) Non-encumbered

- Number of Shares

- Percentage of shares (as a o/o of the total

shareholding of promoter and promoter groupi

- Percentage of shares (as a % of the total share

capital of the Cornpany)

9 Months

ended

31.12.2014

ended

31-12.2013

ended

31.03.2014

30,62,599

30,62,599

30,62,599

30,62,599

30,62,599

38.31

38.31

38.31

38.31

38.31

38.31

Nit

Nir

Nil

Nit

Nit

49,31,901

49,31,901

100

100

100

61.69

61.69

61.69

ot.og

61.69

61.69

ruit

ruit

ruit

Nit

Pu6uanttotheenactmentofthecompaniesAct,2ol3(theAct)thecompanyhas,efiecliveApdll,2Ol4reviffidtheestimatedusefullivesotitsfxedassets

vii-

in ac@rdane with the provisions of Schedule ll ofthe Act. Accordingly, the comlany has ac@urited for rcduciion in depreciation charge foiquarter

and nine mon(hs ended

Deember 31 , 2014 is Rs. 40.68 las and Rs. 144.91 la6 reEpectively in lheso Esults and Rs. 61.71 la6 (nel of detef,ed tax) in GseNes in tems of tEnsitional prcvisions

ofthe said Schedule ll.

Dep.ecialionchargefortheprecedingquarterendedSeptember30,2014andninemonthsendedDe@mber31,2014

isnetofpriorperiodimpaclamountingtoRs.l45.12Lacs

(nd of td Rs.74 72 Lacs), on a@oud of Evision in residual value of fixed assets, since lhe date oflheir installation. The residual vd@ as detemined

is withi; the limit sp4fied

in the Companies Ac1. 2013.

viii. This slalement is as per Ciause 41 oflhe Listing AgEemenl_

LimiEd Revbw

:he !m(ed Revifl. as requircd

ReForl

d€s

under Clause 41 ofth€ Listing Agreemenl has been completed and the related Report foryarded to the Stock Exchanges. This

nol have any impad on the above 'Resu[s and Notes' for the Quarter ended 31st Decmber, 2O'14 which neds to be explained.

t"t":t

Reg *e-e.: Off;:e,

Traver -c;s€ T-2 Osrnnunity Centre, Sheikh Sarai,

Pnas+.' *iar l,e^ f i-i3'17 india

Dde: '3'l^ -a^uarr 2315

P ace \,9,t 1,8,.

ilrt

r/

"t:"lrorthe

Board

\

7a*ei8

Jehangirlal

49,31,901

100

Notes i

i. The unaudited Financial R€sulls rere reviffid by the Audit Committee snd apprcved at the meeting ot ihe Board of Directo6 of the Company

held on 1gth January, 2015.

Figures for the previous periods aE rrclasEifieU Baranged egrcuped, wheEvernffissry, to mspond with the curent pedod's classification/

disclosure.

The Company does not have any Ex@ptional or Extraordinary item to Eporl forlhe above periods.

The Company opefates only in one segment i.e. Tcvel Rel.ted Seryices,.

v- The Company being in the seryice industry, lhe infomation as regards slock in tEde, @rssmplion of Ew materiats and purchase of tEded goods is not appli€bte.

vi

49,31,901

100

ended 31.12.2014

I

I

I

Nit

49,31,901

100

ffis

Pending at the beginning of the quarter

Received during the quarter

Disposed off during the quarter

Remaining unresolved at the end of the quarter

I

30,62,599

49,31,901

lnvestorComplaints

Preceding

3 Months

encled

30.09.20r4

enaoiali

Managing Director

tt

Fdh

Sdndip Datta

Chief Financial Ofiicer

5.R. BnrtrBot

* AssocrATES LLP

Chartered Accountants

Golf View Corporate Toyrer-B

Sector-42, Sector Road

Gurgaon'722 002, Haryana, lnoia

Tel ' +91 724 464 4000

Fax : +91 124 464 4050

Limited Review Report

Independent Auditors' Review Report to

The Board of Directors

fnternational Travel House Limited

1.

we have reviewed the accompanying statement of unaudited financial results of International

Travel House

Limited ('the Company'), for the quarter and nine months ended December 31,2014 (the ,.Statemenf,),

being submitted by the Company pursuant to the requirement of Clause 4l of the Listing

Agreement, except

frI tl9 disclosures regarding 'Public Shareholding' and 'Promoter and promoter c1o,r!

si,u..holding,

which have been traced from disclosures made by the management and have not

been revierved by us. This

statement is the respon:jpil{y of the company's management and has been approved

b1, the Board of

Directors. Our responsibility is to issue a repo.t on the StJtement based on our

review.

2.

We conducted our review in accordance with the Standard on Review Engagements (SRE)

ll10.

Revierv

of

hterim Financial Inforrnation Performed by the Independent Auditor of tf,JEntity issu.a

ly the lnstirute of

Chartered Accountants of India. This standard ."quir"s that we plan and p"rio*

the ier1eri to obtain

moderate assurance as to whether the Statement is free of material misstatement.

A rel'ieu. is limited

primarily to inquiries of company personnel and analytical procedures applied to financial

data

and thus

provides less assurance than an audit. We have not performed an audit and

accordingly, u,e do not express

an audit opinion.

J.

Based on our review conducted as above, nothing has come to our attention that

causes us to believe that

the accompanying Statement of unaudited financial results prepared in accordance

with recognition and

measurement principles laid down in [Accounting Standard 25 Interim Financial

Reporting specified under

the Companies Act, 1956 (which are deemed tobe applicable as per section

133 ;f the-companies Act.

2013, read with rule 7 of the Companies (Accounts) nules, z0t+)l and other

recognised accountin*q

practices and policies has not disclosed the information required to be iisclosed

in terms of Clause 4l of the

Listing Agreement including the manner in which it is io be disclosed, or that it contains

an\. material

misstatement

For S.R. BATLIBOI & ASSOCIATES LLp

ICAI Firm registration number: l0l049W

Chartered Accountants

per Yogesh Midha

Parhrer

Membership No.: 94941

Place: Gurgaon

Date: January 19,2015

S.R. Batliboi & Associates LLP, a Lrmried Liability Partnersnio rvith Ll-P Identity No. AAB-4295

Regd. Office:22, Camac Street, Block'C',3rd Frcc. Kotkata-700 016

© Copyright 2026