THE DAILY MARKET REPORT - Gold Coast Fund Management

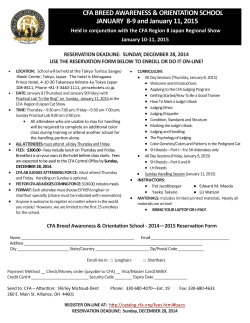

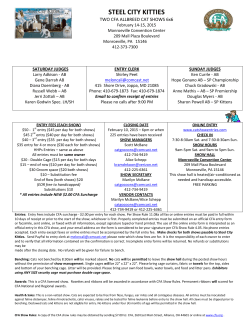

T THE DAILY MARKET REPORT January 16, 2015 Chamber of Commerce and Industry calls on businesses to unite IMF bailout programme will cushion Cedi more Gov’t doesn’t owe GHc1billion pension money – SSNIT SEC Clears Republic Bank Of Concert Party Allegations The Cedi appreciates to the Pound,Euro and CFA Chamber of Commerce and Industry calls on businesses to unite The Western Regional Chairman of the Ghana Chamber of Commerce and Industry, Mr. Issa Ouedraogo, has reiterated the need for the business community to work together in harnessing the numerous emerging business opportunities in the Region.We must remember that job creation; wealth creation; economic empowerment; and nation building are all led by business communities and the private sector and that is why it is so important that we come together as a business community and make the best use of the enormous emerging opportunities around us,” he said in a statement.Mr. Ouedraogo appealed to the business community to join the Chamber and help it grow in order to promote and protect local business interests and bring positive change and improvement to the Region that has so much potential. He said the Sekondi/Takoradi chapter of the Chamber would embark on programmes aimed at making the business community efficient, effective and profitable THE DAILY Daily Market Outlook Treasury Securities Rates Current Yield Previous Yield % % Security Change (%) 91 Day 182 Day 1yr Note 25.83% 26.38% 22.50% 25.84% 26.41% 22.50% -0.02% -0.10% 0.00% 2yr Fixed Note 23.00% 23.00% 0.00% MARKET REPORT IMF bailout programme will cushion Cedi more Currency Buying Selling Midrate USDGHS 3.2179 3.2211 3.2195 GBPGHS 4.8800 4.8941 4.88705 EURGHS 3.7450 3.7480 3.7465 An Economic Analyst with Databank has expressed optimism that an anticipated programme from the International Monetary Fund (IMF) will help cushion the Ghana Cedi against fluctuations on the currency market.Courage Martey told Starr Business that the implementation of the three-year IMF programme which is still being negotiated between the Bretton Wood Institution and the Government of Ghana will help stabilise the Cedi against the major international currencies of trade such as the Dollar.Last year the Cedi was reported by Bloomberg as the world’s worst-performing currency.Its value consistently fell by about 40 percent by the third quarter of the 2014.The trend caused the Government to roll out some forex control measures to rein in the fall and infuse confidence in the economy. GHSXOF 175.02 175.15 175.09 Gov’t doesn’t owe GHc1 billion pension money – SSNIT Currency Gold Coast Fund Management Cedi Index Previous Level Current Level Change Year to Date 303.31 302.20 -1.11 -1.17% Interest Rates & Inflation BOG Policy Rate 21.00% Ghana Interbank interest Rate 23.91% Inflation (CPI) for November(2014) Inflation target for 2015 17.00% (11.5+/-2)% Commodities (Prices as at 9:00 GMT) Current Previous Change Commodities Price Price (%) Oil Brent Crude (USD/bbl) 48.52 47.45 2.26% ▲ Gold (USD/t oz) 1,260.20 1,228.40 2.59% Cocoa (USD/MT) 2,977.00 2,992.00 -0.50% ▲ ▼ Coffee (USD/lb) 176.65 179.85 -1.78% ▼ Sugar (USD/lb) 15.35 14.97 2.54% ▲ Credits: Bloomberg Reuters Graphic/GBN Joy Business News Gold Coast Fund Management Ltd Research The Social Security and National Insurance Trust (SSNIT) has denied reports that government has failed to pay contributions of public sector workers under the Tier-1 scheme.An operational performance report of SSNIT between September 2013 to September 2014 secured by Joy News revealed that government has defaulted in the payment of almost 1 billion Ghana cedis.The Accountant General was said to be in "arrears of 15 months of unpaid contributions," the report indicated.What this meant was that within the 15 months, government collected SSNIT contributions from workers, especially in the public and civil service and yet failed to remit same to SSNIT. But Director General of the state pension trust, Ernest Thompson told Joy Business government has issued bonds to clear these debts. SEC Clears Republic Bank Of Concert Party Allegations Republic Bank Limited (RBL) has expressed its satisfaction, having been cleared by the Securities and Exchange Commission (SEC) of recently made concert party allegations.Mr. Robert Le Hunte, Director of African Operations of Republic Bank, said “We are pleased with the results of the investigations published by the SEC in the January 12, 2015, issue of the Daily Graphic. It states, categorically, that “the Commission did not find a concert party relationship between Yellow Tide and Republic Bank with the intent of cooperating to consolidate control of HFC Bank”.This confirms Republic Bank’s commitment to abide by the laws, rules and regulations that govern the territories in which they operate. The Cedi appreciates to the Pound,Euro and CFA The local currency on the interbank market saw the Pound, Euro and CFA, appreciate to the Cedi. But recorded a decline to the American Dollar.The Cedi lost 0.135 Pesewas to the Dollar to register a YTD depreciation of 0.61 percent. It however gained 0.585 Pesewas and 4.585 Pesewas to the Pound and Euro to peg a YTD appreciation of 1.77 percent and 3.83 percent respectively. The CFA lost 2.12 to the Cedi to measure its YTD at 3.99 percent.The GC Cedi Index which measures the accumulated average performance of the Cedi against its major trading partners measured its YTD depreciation to -1.17 percent.On the interbank market today, the Dollar now trades at GHS 3.2179 and GHS 3.2211. The Pound exchanges for GHS 4.8880 and GHS 4.8941 and the Euro buys and sells at GHS 3.7450and GHS 3.7480. The CFA bids CFA 175.02 and CFA 175.15.This is the performance of the Cedi today on the interbank market. Disclaimer: This is published solely for informational purposes. All expressions of opinion are subject to change without notice. The information is obtained from internal and external sources which Gold Coast Fund Management (GC) considers reliable but GC has not independently verified such information and GC does not guarantee that it is accurate or complete.

© Copyright 2026