KITEX GARMENTS LTD

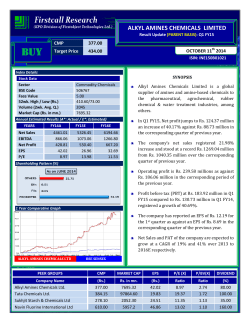

KITEX GARMENTS LTD Result Update (PARENT BASIS): Q3 FY15 BUY CMP 557.70 Target Price 635.00 JANUARY 17th 2015 ISIN: INE602G01020 Index Details SYNOPSIS Stock Data Sector BSE Code Face Value 52wk. High / Low (Rs.) Volume (2wk. Avg.) Market Cap (Rs. in mn.) Other Apparels & Accessories 521248 1.00 601.75/80.90 43000 26490.75 Annual Estimated Results (A*: Actual / E*: Estimated) YEARS Net Sales EBITDA Net Profit EPS P/E FY14A 4422.10 1084.82 573.69 12.08 46.18 FY15E 4922.55 1654.63 811.17 17.08 32.66 FY16E 5513.25 1818.75 873.15 18.38 30.34 Shareholding Pattern (%) Kitex Garments Limited engages in the manufacture, export, and sale of garments in India and internationally. During Q3 FY15, net profit jumps to Rs. 231.31 mn against Rs. 113.22 mn in Q3 FY14, an increase of 104.30%. Revenue for the quarter rose by 22.78% to Rs. 1220.98 mn from Rs. 994.46 mn, when compared with the prior year period. During the quarter, EBIDTA is Rs. 470.16 mn as against Rs. 222.58 mn in the corresponding period of the previous year, grew by 111.23%. During Q3 FY15, Profit Before Tax (PBT) grew by 104.62% to Rs. 351.85 mn from Rs. 171.95 mn in Q3 FY14. EPS of the company stood at Rs. 4.87 a share during the quarter, registering 104.30% increase over previous year period. Kitex Garments Ltd has opened a merchandising Company in the name of Kitex USA LLC with 50% investment at Delaware, USA. 1 Year Comparative Graph ICRA have upgraded the long term rating for Rs. 167 crores bank facilities of the company from ICRA A minus to ICRA A Plus and that of short term rating from ICRA A two plus to ICRA A one. KITEX GARMENTS LTD S&P BSE SENSEX Net Sales and PAT of the company are expected to grow at a CAGR of 20% and 44% over 2013 to 2016E respectively. PEER GROUPS CMP MARKET CAP EPS P/E (X) P/BV(X) DIVIDEND Company Name (Rs.) Rs. in mn. (Rs.) Ratio Ratio (%) 557.70 441.70 270.85 375.00 26490.75 3688.30 70074.30 7288.50 12.08 30.04 15.46 8.03 46.18 14.70 17.55 46.70 15.21 2.96 2.66 4.14 100.00 75.00 23.50 45.00 Kitex Garments Ltd Sarla Performance Fibers Ltd Arvind Ltd Zodiac Clothing Company Ltd QUARTERLY HIGHLIGHTS (PARENT BASIS) Results Updates- Q3 FY15, Months Dec-14 Dec-13 % Change Net Sales 1220.98 994.46 22.78 PAT 231.31 113.22 104.30 EPS 4.87 2.38 104.30 470.16 222.58 111.23 EBITDA The company’s net profit jumps to Rs. 231.31 million against Rs. 113.22 million in the corresponding quarter ending of previous year, an increase of 104.30%. Revenue for the quarter rose by 22.78% to Rs. 1220.98 million from Rs. 994.46 million, when compared with the prior year period. Reported earnings per share of the company stood at Rs. 4.87 a share during the quarter, registering 104.30% increase over previous year period. Profit before interest, depreciation and tax is Rs. 470.16 million as against Rs. 222.58 million in the corresponding period of the previous year. Break up of Expenditure Break up of Expenditure Cost of Material Consumed Employee Benefit Expenses Depreciation & Amortization Expense Other Expenses Rs. in Mn Q3 FY15 Q3 FY14 % Change 518.45 519.42 0% 190.04 145.10 31% 52.80 25.08 111% 153.52 126.94 21% Segment Revenue Latest Updates • Kitex Garments Ltd has opened a merchandising Company in the name of Kitex USA LLC with 50% investment at Delaware, USA. • ICRA Limited, the credit rating agency, have upgraded the long term rating for Rs. 167 crores bank facilities of the company from ICRA A minus to ICRA A Plus and that of short term rating from ICRA A two plus to ICRA A one with a comment that the outlook on the long term rating is stable. COMPANY PROFILE Kitex Garments Limited is based in Kochi, India. Kitex Garments Ltd. was incorporated in 1992. It made its public issue in the year 1995. It is promoted by Boby M Jacob, Kitex Exports Ltd, Sabu M Jacob and Somy Varghese. Kitex Garments Limited is in the business of manufacturing and exporting garments. The Company manufactures different types of garments, such as hosiers, shirts, pants, jackets, innerwear and outerwear. The company also exports infant and children’s wear, and jackets to the United States. The company is supplying Toddler wear/Kids wear to 5 of the worlds top 10 companies like Mother care, Fruit of the Loom, Toys R Us, Kids R Us, Carters, Gerber, Jockey. FINANCIAL HIGHLIGHT (PARENT BASIS) (A*- Actual, E* -Estimations & Rs. In Millions) Balance Sheet as at March 31, 2013 -2016E FY13A FY14A FY15E FY16E 47.50 47.50 47.50 47.50 1176.08 1694.19 2505.36 3181.80 1223.58 1741.69 2552.86 3229.30 Long term Borrowings 25.20 289.14 315.16 334.07 Deferred Tax Liabilities 161.50 216.06 231.18 242.74 Long term Provisions 25.31 23.32 26.12 28.47 212.01 528.52 572.47 605.28 Short term Borrowings 892.65 905.12 1194.76 1314.23 Trade Payables 228.90 244.17 288.12 322.70 Other Current Liabilities 197.46 304.59 341.14 368.43 Short Term Provisions 195.13 313.37 451.25 523.45 3. Sub Total - Current Liabilities 1514.14 1767.25 2275.27 2528.81 Total Liabilities (1+2+3) 2949.73 4037.46 5400.60 6363.40 1168.37 1809.11 2134.75 2433.61 Intangible Assets 4.10 2.95 3.30 3.60 Capital work-in-progress 22.82 6.67 7.60 8.36 a) Sub Total - Fixed Assets 1195.29 1818.73 2145.66 2445.58 b) Non-current investments 0.04 0.04 0.06 0.07 c) Long Term loans and advances 98.99 28.01 35.29 42.35 d) Other non-current assets 6.95 17.33 21.14 24.74 1301.27 1864.11 2202.15 2512.74 Inventories 458.62 108.00 138.24 160.36 Trade receivables 506.29 530.64 589.01 642.02 Cash and Bank Balances 411.84 1036.08 1793.69 2152.37 Short-terms loans & advances 217.15 342.10 513.15 718.41 Other current assets 54.56 156.53 164.36 177.51 2. Sub Total - Current Assets 1648.46 2173.35 3198.45 3850.66 Total Assets (1+2) 2949.73 4037.46 5400.60 6363.40 SOURCES OF FUNDS Shareholder's Funds Share Capital Reserves and Surplus 1. Sub Total - Net worth Non Current Liabilities 2. Sub Total - Non Current Liabilities Current Liabilities APPLICATION OF FUNDS Non-Current Assets Fixed Assets Tangible Assets 1. Sub Total - Non Current Assets Current Assets Annual Profit & Loss Statement for the period of 2013 to 2016E Value(Rs.in.mn) FY13A FY14A FY15E FY16E 15m 3169.83 12m 4422.10 12m 4922.55 12m 5513.25 Other Income 40.25 133.44 181.45 192.34 Total Income 3210.08 4555.54 5104.00 5705.59 Expenditure -2568.75 -3470.72 -3449.36 -3886.84 Operating Profit 641.33 1084.82 1654.63 1818.75 Interest -114.72 -106.16 -218.17 -244.35 Gross profit 526.61 978.66 1436.46 1574.39 Depreciation -86.21 -96.80 -213.08 -251.43 Profit Before Tax 440.40 881.86 1223.38 1322.96 Tax -146.64 -308.17 -412.21 -449.81 Net Profit 293.76 573.69 811.17 873.15 Equity capital 47.50 47.50 47.50 47.50 1176.08 1694.19 2505.36 3181.80 Face value 1.00 1.00 1.00 1.00 EPS 6.18 12.08 17.08 18.38 Description Net Sales Reserves Quarterly Profit & Loss Statement for the period of 30th June, 2014 to 31st Mar, 2015E Value(Rs.in.mn) 30-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15E 3m 3m 3m 3m 1027.62 1282.03 1220.98 1391.92 Other income 24.34 52.62 50.97 53.52 Total Income 1051.96 1334.65 1271.95 1445.44 Expenditure -755.57 -945.50 -801.79 -946.50 Operating profit 296.39 389.15 470.16 498.93 Interest -35.57 -41.10 -65.51 -75.99 Gross profit 260.82 348.05 404.65 422.94 Depreciation -50.44 -51.76 -52.80 -58.08 Profit Before Tax 210.38 296.29 351.85 364.86 Tax -65.99 -103.09 -120.54 -122.59 Net Profit 144.39 193.20 231.31 242.27 Equity capital 47.50 47.50 47.50 47.50 Face value 1.00 1.00 1.00 1.00 EPS 3.04 4.07 4.87 5.10 Description Net sales Ratio Analysis Particulars FY13A FY14A FY15E FY16E 6.18 12.08 17.08 18.38 EBITDA Margin (%) 20.23% 24.53% 33.61% 32.99% PBT Margin (%) 13.89% 19.94% 24.85% 24.00% PAT Margin (%) 9.27% 12.97% 16.48% 15.84% P/E Ratio (x) 90.18 46.18 32.66 30.34 ROE (%) 24.01% 32.94% 31.77% 27.04% ROCE (%) 33.97% 40.25% 45.97% 42.44% Debt Equity Ratio 0.75 0.69 0.59 0.51 EV/EBITDA (x) 42.09 24.57 15.84 14.29 Book Value (Rs.) 25.76 36.67 53.74 67.99 P/BV 21.65 15.21 10.38 8.20 EPS (Rs.) Charts OUTLOOK AND CONCLUSION At the current market price of Rs.557.70, the stock P/E ratio is at 32.66 x FY15E and 30.34 x FY16E respectively. Earning per share (EPS) of the company for the earnings for FY15E and FY16E is seen at Rs.17.08 and Rs.18.38 respectively. Net Sales and PAT of the company are expected to grow at a CAGR of 20% and 44% over 2013 to 2016E respectively. On the basis of EV/EBITDA, the stock trades at 15.84 x for FY15E and 14.29 x for FY16E. Price to Book Value of the stock is expected to be at 10.38 x and 8.20 x respectively for FY15E and FY16E. Despite stiff competition from other countries, international buyers show preference to company’s product for its quality and timely delivery and hence Company will achieve better working results in the coming years. Major Internatioal buyers like KOHLS and THE CHILDRENS PLACE have shown interest in the company’s products by placing large orders. Kitex Garments Ltd has opened a merchandising Company in the name of Kitex USA LLC with 50% investment at Delaware, USA. Company also plans to take the performance to the next level by modernization, installing high tech and time saving machinery and supportive systems, improving quality of work by employee training, and by Research and Development in major areas pertaining to the industry in which the company is in business. We expect that the company surplus scenario is likely to continue for the next two to three years, will keep its growth story in the coming quarters also. Hence, we recommend ‘BUY’ for ‘Kitex Garments Ltd’ with a target price of Rs. 635.00 for medium to long term investment. INDUSTRY OVERVIEW The Indian textile industry plays a vital role in the economy of the country by contributing to GDP, generating employment and earning foreign exchange. Opportunities and Threats The big business houses in the USA and Europe manufacturing and dealing in textiles and garments depend upon India, China and the neighbouring countries, due to availability of the raw materials and skilled labour at lower prices in these countries, to get the required output at the lowest possible cost. However the company perceives threats by way of competition from the neighbouring countries like China, Pakistan and Sri Lanka. Although the competition is hectic company has an edge over others with quality and timely execution of orders. The more transit time due to geographical position and adverse movement of foreign exchange rate of the Rupee are major concerns for the growth of the industry. The appreciation of Rupee against US Dollar, a trend noted during the last quarter of the year may effect the company’s profitability in both short and long term. China, Europe, Japan along with the U.S. (the four largest economies in the world) will largely determine the direction of the global economy through the rest of this year and into 2015. The good news is that the advanced economies overall will perform more strongly and contribute more to global growth in 2014. Outlook The company is taking all efforts to improve the quality and productivity to get more orders at competitive rates. Due to the own processing plant the company is able to quote better rates and maintain high quality & productivity in the finished goods manufactured. Barring unforeseen circumstances the company is confident of achieving better results in the current year. The key risks for the global economy include China and other emerging markets and the situation in the Middle East and North Africa. The developing nations of Asia are expected to experience a higher rate of growth next year, provided China remains in the 7.0% to 7.5% growth range. Disclaimer: This document is prepared by our research analysts and it does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable but we do not represent that it is accurate or complete and it should not be relied on as such. Firstcall Research or any of its affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Firstcall Research and/ or its affiliates and/or employees will not be liable for the recipients’ investment decision based on this document. Firstcall India Equity Research: Email – [email protected] C.V.S.L.Kameswari U. Janaki Rao B. Anil Kumar M. Vinayak Rao G. Amarender Pharma & Diversified Capital Goods Auto, IT & FMCG Diversified Diversified Firstcall Research Provides Industry Research on all the Sectors and Equity Research on Major Companies forming part of Listed and Unlisted Segments For Further Details Contact: Tel.: 022-2527 2510/2527 6077 / 25276089 Telefax: 022-25276089 040-20000235 /20000233 E-mail: [email protected] www.firstcallresearch.com

© Copyright 2026