Tax Facts Brochure - rebel Financial LLC

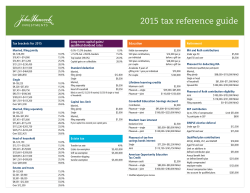

2015 Tax Facts At-A-Glance Tax Facts At-A-Glance 2014 Income Taxes 2015 Married Filing Jointly: Over But Not Over Married Filing Jointly: The Tax is Of the Amount Over Over But Not Over The Tax is Of the Amount Over $0 $18,150 $0 + 10% $0 $0 $18,450 $0 + 10% $0 18,150 73,800 1,815 + 15% 18,150 18,451 74,900 1,845 + 15% 18,450 73,800 148,850 10,162.50 + 25% 73,800 74,901 151,200 10,312.50 + 25% 74,900 148,850 226,850 28,925 + 28% 148,850 151,201 230,450 29,387.50 + 28% 151,200 226,850 405,100 50,765 + 33% 226,850 230,451 411,500 51,577.50 + 33% 230,450 405,100 457,600 109,587.50 + 35% 405,100 405,100 464,850 111,324 + 35% 411,500 457,600 And Over 127,962.50 + 39.6% 457,600 464,850 And Over 129,996.50 + 39.6% 464,850 Over But Not Over The Tax is Of the Amount Over Over But Not Over The Tax is Of the Amount Over $0 $9,075 $0 + 10% $0 $0 $9,225 $0 + 10% $0 Single: Single: 9,075 36,900 907.50 + 15% 9,075 9,225 37,450 922.50 + 15% 9,225 36,900 89,350 5,081.25 + 25% 36,900 37,451 90,750 5,156.25 + 25% 37,450 89,350 186,350 18,193.75 + 28% 89,350 90,751 189,300 18,481.25 + 28% 90,750 186,350 405,100 45,353.75 + 33% 186,350 189,301 411,500 46,075.25 + 33% 189,300 405,100 406,750 117,541.25 + 35% 405,100 411,501 413,200 119,401.25 + 35% 411,500 406,750 And Over 118,118.75 + 39.6% 406,750 413,200 And Over 119,996.25 + 39.6% 413,200 Over But Not Over The Tax is Of the Amount Over $0 $2,500 $0 + 10% 2,500 5,800 5,800 8,900 Estates and Trusts: Estates and Trusts: Over But Not Over The Tax is Of the Amount Over $0 $0 $2,500 $0 + 10% $0 375 + 25% 2,500 2,500 5,900 375 + 25% 2,500 1,200 + 28% 5,800 5,900 9,050 1,225 + 28% 5,900 8,900 12,150 2,068 + 33% 8,900 9,050 12,300 2,107 + 33% 9,050 12,150 And Over 3,140.50 + 39.6% 12,150 12,300 And Over 3,179.50 + 39.6% 12,300 AMT Brackets Tax Rate 2014 Single Head of Household Married Filing Jointly or Surviving Spouse Married Filing Separately 26% $ 0 - 182,500 $ 0 - 182,500 $ 0 - 182,500 $ 0 - 91,250 28% Over $ 182,500 Over $ 182,500 Over $ 182,500 Over $ 91,250 Amount $ 52,800 AMT Exemptions Phaseout1 $ 52,800 $ 117,300 - 328,500 $ 117,300 - 328,500 $ 82,100 $ 41,050 $ 156,500 - 484,900 $ 78,250 - 242,450 AMT Brackets Tax Rate 2015 Single Head of Household Married Filing Jointly or Surviving Spouse Married Filing Separately 26% $ 0 - 185,400 $ 0 - 185,400 $ 0 - 185,400 $ 0 - 92,700 28% Over $ 185,400 Over $ 185,400 Over $ 185,400 Over $ 92,700 AMT Exemptions Amount $ 53,600 $ 53,600 $ 83,400 $ 41,700 Phaseout1 $119,200 - 333,600 $119,200 - 333,600 $ 158,900 - 492,500 $ 79,450 - 264,350 The AMT income ranges over which the exemption phases out and only a partial exemption is available. The exemption is completely phased out if AMT income exceeds the top of the applicable range. Note: Consult your tax advisor for AMT rates and exemptions for children subject to the “kiddie tax”. 1 2 rF Tax Facts At-A-Glance Standard Deductions Married Filing Jointly 2014 2015 $ 12,400 $ 12,600 Single 6,200 6,300 Additional (Age 65/older or blind): Married 1,200 1,200 1,550 1,550 Unmarried and not surviving spouse Itemized Deductions 2014 2015 Income Over Applicable Amount Triggers Itemized Deduction Limitation* Married Filing Jointly Single $ 305,050 $ 309,900 254,200 258,250 *Itemized deduction reduced by the lesser of (a) 3% of the adjusted gross income above the applicable amount, or (b) 80% of the amount of the itemized deductions otherwise allowable for the taxable year. Personal Exemptions Personal Exemption Phase-Out Range for 2014 2015 $ 3,950 $ 4,000 Married Filing Jointly 305,050 - 427,550 309,900 - 432,400 Single 254,200 - 376,700 258,250 - 380,750 Regular Tax vs. AMT: What’s deductible? Expense Regular Tax State & local income tax • AMT Property tax • Mortgage interest • Interest on home equity debt not used to improve your principal residence • Investment interest • Investment expenses • Professional fees • Unreimbursed employee business expenses • Medical expenses • • Charitable contributions • • • • 3 Capital Gains Tax Rate on gains for assets held: 2014 2015 More than 12 months More than 12 months 15% income tax bracket or below 0% 0% 25%, 28%, 33%, 35% income tax bracket 15% 15% 39.6% income tax bracket 20% 20% Kiddie Tax 2014 2015 $ 1,000 $ 1,050 Next 1,000 1,050 Child’s Rate Amounts Over 2,000 2,000 Parent’s Rate (under age 18 with unearned income) First 2014 Pease Limitations on Itemized Deductions No Tax 2015 Personal Exemption Phaseout Filing Status Income Filing Status Phaseout Begin Phaseout Complete Single $258,250 Single $258,250 $380,750 Married Filing Jointly 309,900 Married Filing Jointly 309,900 432,400 Head of Household 284,050 Head of Household 284,050 406,550 2014 & 2015 FICA Rates Self-Employed Emp loyee 12.4% 6.2% HI (Medicare) 2.9% 1.45% Additional Medicare Tax* 0.9% 0.9% OASDI (Social Security) *The additional Medicare tax applies to wages and self-employment income above the following thresholds: 4 Tax Bracket rF Tax Facts At-A-Glance Filing Status Wages or Self-Employment income above the threshold MFJ >$250,000 MFS >$125,000 Others >$200,000 Affordable Care Act (ACA) Credit Assistance over the “Applicable Amount” of premium paid by insured: Household Income as a percentage of the Poverty Line: Single Less than 200% $600 At least 200% but less than 300% 1,500 At least 300% but less than 400% 2,500 *The tax payer is responsible for the excess tax credit that was granted prematurely if their AGI ends up being higher than they projected when selecting coverage. Social Security 2014 2015 66 years, 6 months 66 years, 6 months 72.5% 72.5% $ 117,000 $ 118,500 2014 2015 $15,480 $15,720 Year of Full Retirement Age 41,400 41,880 After Full Retirement no limit no limit Full Retirement Age* Portion of Benefit Paid at Age 62* Income subject to social security tax (OASDI) *Assumes born in 1957 Maximum Earnings Before Social Security Benefits Are Reduced Before Full Retirement Age (lose $1 for every $2 of earnings) Base Amount of Modified AGI Causing Social Security Benefits to be Taxable 50% taxable 85% taxable Married/Filling Jointly $32,000 $44,000 Single 25,000 34,000 5 Qualified Plans 2014 Maximum elective deferral to retirement plans (e.g., 401(k), 403(b), & 457) 2015 $ 17,500 $ 18,000 401(k), 403(b), 457 age 50+ catch-up contribution 5,500 6,000 Maximum IRA contribution 5,500 5,500 IRA age 50+ catch-up contribution 1,000 1,000 12,000 12,500 2,500 3,000 550 600 260,000 265,000 52,000 53,000 Highly compensated employee compensation amount 115,000 120,000 Annual retirement benefit limit under defined benefit plan (not to exceed 100% of compensation) 210,000 215,000 Definition of key employee in a top-heavy plan 170,000 170,000 Maximum elective deferral to SIMPLE plan SIMPLE IRA age 50+ catch-up contribution limit SEP minimum compensation amount Annual includable compensation limit Defined contribution plan annual addition limit IRAs 2014 2015 Phase-Out Range for Deductible Contributions to Traditional IRAs Married Filing Jointly Both spouses as participants in qualified plan $ 96,000 - 116,000 $ 98,000 - 118,000 181,000 - 191,000 183,000 - 193,000 60,000 - 70,000 61,000 - 71,000 Married Filing Jointly 181,000 - 191,000 183,000 - 193,000 Single 114,000 - 129,000 116,000 - 131,000 One spouse as participant in qualified plan Single Phase-Out Range for Contributions to Roth IRAs $1000 Retirement Savings Credit 2015: RMD Factor Table 6 Credit Rate Single Married Filing Joint Head of HH 50% $18,250 $36,500 $27,375 Age Factor Age Factor 70 27.4 87 13.4 71 26.5 88 12.7 72 25.6 89 12.0 20% 19,750 39,500 29,625 73 24.7 90 11.4 10% 30,500 61,000 45,750 74 23.8 90 10.8 0% 30,500+ 61,000+ 45,750+ 75 22.9 92 10.2 76 22.0 93 9.6 77 21.2 94 9.1 78 20.3 95 8.6 79 19.5 96 8.1 80 18.7 97 7.6 81 17.9 98 7.1 82 17.1 99 6.7 83 16.3 100 6.3 84 15.5 101 5.9 85 14.8 102 5.5 86 14.1 103 5.2 rF Tax Facts At-A-Glance *For example: If you were single, your AGI was $25,000, and you contributed $2,000 into your 401k then the government would give you a $200 tax credit. That’s a 10% match on top of what your employer might have given you! Maximum Qualified Long-Term-Care Insurance Premiums Eligible for Deduction Age 40 or less >40.<50 >50.<60 >60.<70 Over 70 2015 $380 $710 $1,430 $3,800 $4,750 2014 370 700 1,400 3,720 4,660 Qualified LTC contract per diem limit: $330. Federal Estate and Gift Tax Year Top Estate Tax Rate Estate Tax Exemption Applicable Credit Gift Tax Lifetime Exemption Gift Tax Applicable Credit Amount Top Gift Tax Rate 2014 40% 5.34 million 2,081,800 5.34 million 2,081,800 40% 2015 40% 5.43 million 2,117,800 5.43 million 2,117,800 40% States With Separate Estate Tax CT, DC, DE, HI, IL, MA, MD, ME, MN, NJ, NY, OR, RI, VT, WA States With Inheritance Tax IA, KY, MD, NE, NJ, PA, TN Community Property States AK*, AZ, CA, ID, LA, NM, NV, TX, WA, WI *Opt-in community property state Gift Tax 2015 Annual Gift Tax Exclusion: Individual donor may gift $14,000 per donee Individual may gift to non-U.S. Citizen spouse $147,000 Generation-Skipping Transfer Tax Exemption: $5,430,000 Education Incentives 2014 2015 $ 160,000 - 180,000 $ 160,000 - 180,000 80,000 - 90,000 80,000 - 90,000 108,000 - 128,000 110,000 - 130,000 54,000 - 64,000 55,000 - 65,000 113,950 -143,950 115,750 -145,750 76,000 - 91,000 77,200 - 92,200 Maximum contribution of $2,000 Maximum contribution of $2,000 190,000 - 220,000 190,000 - 220,000 95,000 - 110,000 95,000 - 110,000 Phase-Out for American Opportunity Credit/Hope Scholarship Credit Married Filing Jointly Others Phase-Outs for Lifetime Learning Credits Married Filing Jointly Others Phase-Outs for Exclusion of U.S. Savings Bond Income Married Filing Jointly Others Phase-Outs for Coverdell Education Savings Accounts Married Filing Jointly Others Miscellaneous Plan Limits: Benefit Description 2014 Plan Limit 2015 Plan Limit Health FSA Maximum $2,500 $2,550 Dependent Care Assistance Program 5,000 5,000 HSA Maximum Annual Contribution Limit (Single/MFJ) 3,300/6,550 3,350/$6,650 HSA Catch-up Contribution Limit 1,000 1,000 HDHP Minimum Annual Deductible (Single/MFJ) 1,250/2,500 1,300/2,600 HDHP Maximum Out-of-Pocket (Single/MFJ) 6,350/12,700 6,450/12,900 7 rebel Financial LLC 540 Officenter Place, Suite 286 Gahanna, OH 43230 Phone: 614-441-9605 Fax: 614-441-4150 rebelfinancialllc.com 2015 Tax Facts At-A-Glance This document is for informational use only. Nothing in this publication is intended to constitute legal, tax, or investment advice. There is no guarantee that any claims made will come to pass. The information contained herein has been obtained from sources believed to be reliable, but rebel Financial LLC does not warrant the accuracy of the information. Consult a financial, tax or legal professional for specific information related to your own situation. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission, or by any state securities authority. Additional information about rebel Financial LLC is available on in our Form ADV Part II, which is available at anytime at www.rebelfinancialllc.com. This document provides information about the qualification and business practices of rebel Financial LLC. If you have any questions about the contents of this brochure, please contact us at (614) 441-9605, or by email at [email protected]. © 2014 rebel Financial LLC rebelfinancialllc.com

© Copyright 2026