Filing Your Tax Forms After Selling Your Restricted Stock

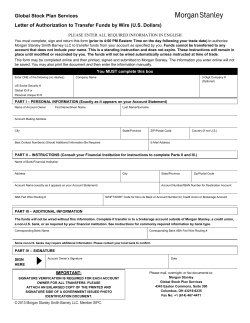

Filing Your Tax Forms After Selling Your Restricted Stock Morgan Stanley has prepared the following information to assist you in understanding the tax consequences involved when selling vested shares from a restricted stock award. Included are sample forms and an explanation of the information for reporting the sale of these shares on your individual income tax return for 2014. Please retain all forms sent to you by Morgan Stanley to use when preparing your tax return. Morgan Stanley and its affiliates do not provide tax or legal advice. You should therefore seek tax advice based on your particular circumstances from an independent tax advisor of your choosing. Where do I get the information I need? Q. WHAT INFORMATION DO I NEED TO FILE MY TAX RETURN? A. The following pages describe the information you will need when you prepare your 2014 individual income tax return (Form 1040). Assemble the following forms when you are ready to prepare your tax return: • Morgan Stanley’s Exercise Confirmation Form or Year-End Exercise Summary Statement. • W-2, Wage and Tax Statement from your employer. • Morgan Stanley’s IRS Form 1099-B. • IRS Form 8949: Sales and other Dispositions of Capital Assets. • IRS Form Schedule D: Capital Gains and Losses. Forms How to Obtain Questions? Release Confirmation OR Year-End Transaction History Statement Morgan Stanley mails this to your home at the time of your original release and sale. Morgan Stanley will also post this to your stock plan account online. Call Morgan Stanley’s Tax Reporting Service Center, toll-free 877-772-1099 or 801-617-7467. Form 1099-B Morgan Stanley sends this to you by February 15th* of the year following that in which the sale occurs. Morgan Stanley will also post this to your stock plan account online Call Morgan Stanley’s Tax Reporting Service Center, toll-free 877-772-1099 or 801-617-7467. Form W-2 Your company will send this to you. Call your company’s payroll department. IRS Form 8949 Visit your local IRS office or call 800-TAXFORM. You may also obtain this form via the Internet at www.irs.gov. Call your local IRS office or consult your tax advisor. Schedule D (Form 1040) Visit your local Internal Revenue Service (IRS) tax office or call 800-TAX FORM. You may also obtain this form via the Internet at www.irs.gov. Call your local IRS office or consult your tax advisor. FILING YOUR TAX FORMS Exhibit 1: Release Confirm (For Illustrative Purposes Only) ABC COMPANY e l p REVIEW THE EXAMPLE The following example reflects a salary w $45,000, a vest of 200 shares m a s of hypothetical ABC Company stock and a sale of the stock. The exhibits will show you where you can find the information you need to prepare your 2009 individual tax return. This example 2014 assumes you have not elected to file an 83(b) election. a e l p $50,250.00 m a s 2014 Step 1 YOUR COMPENSATION INCOME FROM THE VESTING OF YOUR RESTRICTED STOCK AWARD At the time your restricted stock award vests, the full fair market value will be taxed as compensation income. The fair market value is the value of the stock on the day of vesting, multiplied by the number of shares or units. 2 b 2014 MORGAN STANLEY | 2014 c The example above is hypothetical and does not necessarily reflect the results (including transaction costs and withholding) of an actual vesting event. You may instead receive a companyprovided confirmation when shares vest, depending on your company’s preferences. Exhibit 2: Form W-2 Wage And Tax Statement (For Illustrative Purposes Only) Exhibit 1 shows the release confirmation from Morgan Stanley, which will show the amount subject to taxation a and the applicable withholding at the time of vest b . Your company will include the taxable amount of gain as compensation income on your Form W-2 in the year of the vesting event, shown in Exhibit 2. This amount will be added to any other income reported by your company to the IRS, as seen in c on the following page. In this example, the salary of $45,000 has been added to the $5,250 gain from the vested c ompany stock. If you paid in order to receive the initial award, the amount would be subtracted from the gain in Exhibit 1 and the wages in Form W-2. Any taxes withheld at the time of vesting would be included as part of your year-end withholding amounts. FILING YOUR TAX FORMS Exhibit 3: Irs Form 8949 Sales And Other Dispositions Of Capital Assets (For Illustrative Purposes Only) e l p Step 2 2014 CAPITAL GAINS AND/OR LOSSES Calculate your capital gains and/or losses using the appropriate IRS forms. All capital transactions are reported on Form 8949 Sales and Other Dispositions of Capital Assets (Exhibit 3); the subtotals from this form are then carried over to Schedule D (Exhibit 4), where gain or loss is calculated in aggregate. 2014 m a s Exhibit 4: Irs Form 1040 Schedule D Capital Gains And Losses (For Illustrative Purposes Only) e l p 2014 Complete appropriate Short-Term or Long-Term section. Check appropriate Box A, B or C, depending on what is provided within either Box 3 or Box 5 on your 1099-B. Sections b, c, d and e should be populated with the amounts from your 1099-B. Section g should include any compensation income associated with the transaction. The examples are hypothetical and does not reflect the results of an actual sale or transaction. m a s Part I corresponds with Part I of Form 8949. The totals from Form 8949 are to be carried over to Schedule D. Questions & Answers Q. WHAT IS A SECTION 83(B) ELECTION AND HOW DOES IT WORK? A Section 83(b) election is a special tax filing with the IRS that allows you to pay the ordinary income taxes due on your restricted stock award when it is granted, rather than when it vests. Despite the fact that taxes have been paid, the shares are still subject to forfeiture if the participant leaves the company. It A. 3 MORGAN STANLEY | 2014 must be filed within 30 days of receipt of the award, and if the shares are forfeited there is no deduction allowed for taxes that have been paid. Q. WHEN MY STOCK AWARD VESTS, come is equal to the fair market value of the stock at the time of vest multiplied by the number of shares vesting. The income you earned upon the vest is reported as part of the taxable compensation (wages) on Form W-2 in Box 1. WHAT IS THE AMOUNT OF MY COMPENSATION/INCOME AND Q. HOW CAN I DETERMINE MY CAPITAL WHERE IS IT REPORTED? GAIN OR LOSS ON SHARES SOLD? A. The amount of your compensation in- A. Please refer to Step 2 of this brochure. FILING YOUR TAX FORMS Exhibit 5: Sample Morgan Stanley Form 1099-B (For Illustrative Purposes Only) e l p Q. WHAT IS THE COST (TAX) BASIS OF SHARES I OBTAINED THROUGH A VESTING EVENT? m a s A. The term “cost basis” refers to the original value of an asset for tax purposes (usually the purchase price), adjusted for wash sales, stock splits, reinvested dividends and return of capital distributions. In the case of selling vested shares from a restricted stock award, it is the fair market value of your company’s stock at the time of vesting, multiplied by the number of units or awards. The cost basis is used to determine capital gain or loss when an asset is sold or disposed of. In accordance with reporting requirements, Morgan Stanley will track and report the adjusted cost basis of covered stock plan shares for the 2014 tax year. As shown on Exhibit 5, you can find d “Cost or other basis” on your 1099. Please note that the basis reporting requirement does not apply to noncovered securities. Although we are not required to report the cost basis for noncovered securities to the IRS, we will provide the cost basis on the Form 1099-B. Please refer to your sales confirm for the information when selling restricted stock shares. d The example above is hypothetical and does not reflect the results of an actual sale or transaction. Q. CAN I FILE A FORM 1040EZ OR FORM 1040A WITH A FORM 8949 AND A SCHEDULE D FOR A YEAR IN WHICH I SOLD STOCK? A. No. You are not permitted to file a Form 1040EZ or Form 1040A for a year in which you have sold any stock. Form 8949 and Schedule D must be attached to Form 1040. NOTE: The example shown in Exhibit 5 is based on one transaction. If you conducted multiple transactions in 2014, you must list each separately on Form 8949 and Schedule D. THE MORGAN STANLEY ADVANTAGE For nearly 80 years, Morgan Stanley has been a leader, innovator and resource for successful individuals and their families, as well as corporations, foundations and endowments. Our Financial Advisors work from an extensive knowledge base built on diverse skills, experience, training and professional interests. The Global Stock Plan Services unit of Morgan Stanley has over four decades of experience delivering advice and transaction support to stock plan administrators and participants. We are also a market leader in providing financial solutions to meet the specialized needs of executives, including #1 in 10b5-1 plans. *Source: Washington Service. Morgan Stanley ranked #1 in 10b5-1 market share from 2005 through 2013. Data from the period 2/1/2005 to 5/31/2009 reflects the formerly separate PDP businesses of the Global Wealth Management Group of Morgan Stanley & Co. LLC and the Smith Barney division of Citigroup Global Markets Inc. that now form Morgan Stanley Smith Barney LLC. This data also includes transactions from Morgan Stanley & Co. LLC. Information contained herein was obtained from sources believed reliable but the accuracy and completeness thereof cannot be guaranteed. Information contained herein is subject to change. Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for legal matters. © 2014 Morgan Stanley Smith Barney LLC. Member SIPC. CRC1044831 CS 8082431 12/14

© Copyright 2026