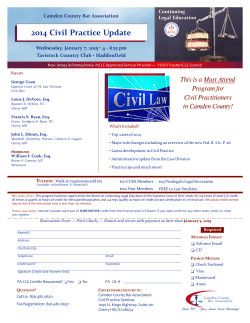

COVER NL 09_06.qxd - Nassau County Bar Association