New Georgia Regulations Clarify Sales Tax Rules for Restaurants

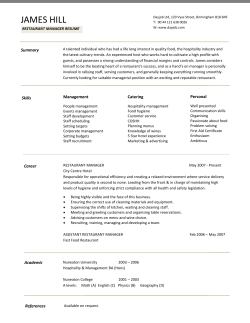

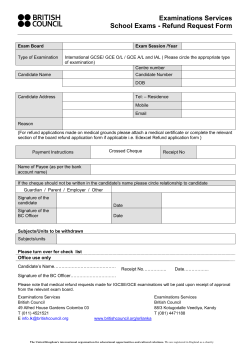

New Georgia Regulations Clarify Sales Tax Rules for Restaurants. Refunds May Be Available! The Georgia Department of Revenue has issued a new regulation that clarifies the sales and use tax rules for restaurants and other establishments that sell prepared food. This new regulation, Rule 560-12-2-.115, is highly relevant to taxpayers in the food and beverage industry, as it enumerates taxable and tax-exempt items and provides concrete examples explaining how the sale of food and purchases by restaurants are to be taxed in the State of Georgia. The Department has clarified that several purchases by restaurants are exempt from sales tax, including the following: a. Food packaging - single-use, disposable packaging containing food that is provided to the customer b. Items for sale – food ingredients or components of meals that will be resold by the restaurant c. Single-use items provided with meals – disposable items made available to customers as a component part of a meal, including straws, stirrers, napkins, disposable silverware, toothpicks, tray liners, and wet-naps d. Food items provided with meals sold – this includes condiments and other items available to customers without a separate charge such as bottled condiments left on tables, condiment packets, and complementary bread or chips. Further, the Department has also identified certain items often overlooked by restaurants that are subject to sales and use tax, including the following: a. Mandatory gratuities – whether negotiated in advance of a meal, unilaterally added by the seller, or mandatory under certain conditions (such as when a defined percentage is added for parties of a certain size when not conspicuously stated that the amount may be removed). b. Items used or consumed by the restaurant – this includes the cost of complimentary meals provided to customers or employees, restaurant décor, serving utensils, flatware, linens, placemats, and single-use items that are not a component of a meal sold to a customer. c. Other service charges – any other charges by a restaurant that are necessary to complete a taxable sale including delivery fees and bartender service. Taxpayers who have previously paid tax on purchases of items that the Regulation clarifies as exempt may request a refund of sales tax erroneously paid within the past three years. Potential for Sales & Use Tax Refunds Taxpayers who have previously paid tax on purchases of items that the Regulation clarifies as exempt may request a refund of the sales tax erroneously paid within the past three years. To determine whether tax was paid, restaurants and franchisees should examine past invoices from food service vendors to determine whether tax was assessed on exempt items. The assessed sales tax would be present as a separate line-item on the invoice. If sales tax on exempt items is discovered, the taxpayer may either pull the related invoices they have on file or request this information and all related invoices from the past three years from that vendor. For more information on our services, contact: In order to request a refund, a taxpayer must follow the standard procedures under OCGA §48-2-35.1: 1. The restaurant should first request the refund from its vendors by providing a written request as well as a completed Form ST-5 Exemption Certificate. The vendor may either request the refund directly on behalf of the restaurant or can provide the restaurant with a completed Form ST-12A Refund Waiver. 2. If the restaurant receives a completed Form ST-12A Refund Waiver from the Tommy Lee Partner-in-Charge of Retail, vendor, the restaurant may apply directly for a refund with the Department of Franchising & Hospitality Revenue. This may be done by filing a Form ST-12 Refund Request and attaching [email protected] the Form ST-12A as completed by the vendor. 770-353-71709 3. If the vendor does not want to issue a refund to the restaurant directly or does not provide a Form ST-12A within 90 days, the restaurant may file a refund claim directly with the state by completing the Form ST-12 Refund Request and including a Form ST-12B Purchaser’s Affidavit instead. Requests for refunds may take up to a year for the state to process and the taxpayer is often required to provide supporting documentation, including invoices, to the Department of Revenue. Jeff Glickman Partner-in-Charge of State and Local Tax services Habif, Arogeti & Wynne has experience in obtaining refunds and can assist restaurateurs and franchisees with the process of computing and requesting refunds [email protected] 770-353-4791 of the overpaid sales tax. For further information, please contact Tommy Lee, Partner-in-Charge of the Retail, Franchising & Hospitality group at Habif, Arogeti & Wynne at [email protected] or Jeff Glickman, Partner-in-Charge of State and Local Tax services, at [email protected]. Any tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or under any state or local tax law or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. Please do not hesitate to contact us if you have any questions regarding this matter. www.hawcpa.com

© Copyright 2026