View/Download - Voya Investment Management

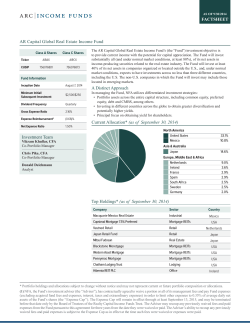

Real Estate Q4 2014 Voya Real Estate Fund Investment Objective Voya Real Estate Fund Performance (%) as of 12/31/14 The Fund seeks total return consisting of long-term capital appreciation and current income. Class I Shares Average Annual Total Returns (Performance may vary for other share classes) Portfolio Management Team At Net Asset Value MSCI US REIT Index Voya Investments, LLC, Investment Adviser CBRE Clarion Securities, LLC, Sub-Adviser T. Ritson Ferguson, CFA, Portfolio Manager Joseph P. Smith, CFA, Portfolio Manager Class A Class C Class I Class R Class R6 Class W YTD 29.77 30.38 1 Year 29.77 30.38 3 Years 15.27 16.31 5 Years 10 Years 16.53 8.86 17.05 8.31 Expense Ratio Gross 0.91% Net 0.91% The Adviser has contractually agreed to limit expenses of the Fund. This expense limitation agreement excludes interest, taxes, brokerage, and extraordinary expenses and may be subject to possible recoupment. Please see the Fund's prospectus for more information. The expense limits will continue through at least October 1, 2015. The Fund is operating under the contractual expense limits. Fund Facts NASDAQ Symbol CLARX CRCRX CRARX CRWRX VREQX IREWX QTR 13.98 14.34 Calendar Year Total Returns (%) CUSIP # 92913K652 92913K629 92913K595 92913K785 92913K587 92913K694 Inception Date 12/20/2002 01/17/2003 12/31/1996 08/05/2011 07/03/2014 12/17/2007 Class I Shares as of December 31 50 25 0 -25 Summary Total Net Assets ($ millions) Number of Holdings Distribution Payment Frequency Morningstar Category Fiscal Year End $1,506.4 53 Quarterly Real Estate March 31 Portfolio Statistics P/FFO Weighted Average Market Cap (millions) Standard Deviation Sharpe Ratio Alpha (3-yr) Beta (3-yr) R2 (3-yr) 18.30 $18,027 13.09 1.15 -0.65 0.98 99.41 Portfolio statistics are shown for Class I shares only. †Source: Sub-Adviser For definitions, see glossary of terms. Not FDIC Insured | May Lose Value | No Bank Guarantee I N V E S T M E N T M A N AG E M E N T voyainvestments.com -50 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Fund 12.61 36.34 -16.28 -34.89 30.00 27.83 9.76 15.61 2.09 29.77 Benchmark 12.13 35.92 -16.82 -37.97 28.61 28.48 8.69 17.77 2.47 30.38 The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. See above "Average Annual Total Returns %" for performance information current to the most recent month-end. Returns for the other share classes will vary due to different charges and expenses. Performance assumes reinvestment of distributions and does not account for taxes. SEC fund returns assume the reinvestment of dividends and capital gain distributions and include a sales charge. Net Asset Value fund returns assume the reinvestment of dividends and capital gain distributions. Total return for less than one year is not annualized. Results would have been less favorable if the sales charge were included. Real Estate Q4 2014 Voya Real Estate Fund Growth of $10,000 Investment Top Holdings* (%) Class I Shares (without Sales Charge) | 10-Year Period Ending 12/31/14 30,000 Ending Value $23,379 25,000 20,000 15,000 10,000 5,000 0 12/04 12/06 12/08 12/10 12/12 12/14 The performance quoted in the "Growth of $10,000 Investment" chart represents past performance. Performance shown is without sales charges; had sales charges been deducted, performance would have been less. Ending value includes reinvestment of distributions. CBRE Clarion Securities LLC (“CBRE Clarion”) CBRE Clarion Securities is the listed equity management arm of CBRE Investors and focuses on worldwide real estate equity securities management opportunities. Because of their access to the world’s largest real estate platform which encompasses both direct and indirect property markets in Europe, Asia-Pacific and the Americas, CBRE Clarion Securities provides a unique perspective on global real estate securities investing. Investment Risks: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. Risks of the REIT's are similar to those associated with direct ownership of Real Estate, such as changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and credit worthiness of the issuer. Concentration of investments in one or more real estate industries, may subject the Fund to greater volatility than a portfolio which is less concentrated. Other risks of the Fund include but are not limited to: Initial Public Offerings Risks; Convertible Securities Risks; Manager Risks; Market Trends Risks; Non-Diversification Risks; Other Investment Companies Risks; Price Volatility Risks; Rule 144A Securities Risks; Inability to Sell Securities Risks; and Securities Lending Risks. Investors should consult the Fund's Prospectus and Statement of Additional Information for a more detailed discussion of the Fund's risks. Glossary of Terms: Alpha Measures the difference between a fund's actual return and its level of risk as measured by beta. An alpha of 0.5 implies the fund performed 0.5% better than the market would predict. The figure is calculated on a three-year basis relative to the benchmark. Beta Measures the Fund's volatility relative to the overall market. A beta above 1 is more volatile than the overall market, while a beta below 1 is less volatile. Price/FFO The REIT equivalent of a security’s Price to Earnings ratio (P/E), is used to measure operating performance which encompasses a REIT’s net income, excluding gains or losses from sales of property, and adding back real estate depreciation. R2 The way in which a percentage of a portfolio's total returns represents the portfolio's beta measure. Sharpe Ratio A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. The higher the Sharpe Ratio, the better the fund's historical risk-adjusted performance. Standard Deviation A measure of the degree to which an individual probability value varies from the distribution mean. The higher the number, the greater the risk. Weighted Average Market Cap The value of a corporation as determined by the market price of its issued and outstanding common stock. An investor should consider the investment objectives, risks, charges and expenses of the Fund(s) carefully before investing. For a free copy of the Fund's prospectus, or summary prospectus, which contains this and other information, visit us at www.voyainvestments.com or call (800) 992-0180. Please read the prospectus carefully before investing. ©2015 Voya Investments Distributor, LLC, 230 Park Ave, New York, NY 10169 Individual Investors (800) 992-0180 FFS-REALESTATEI4 (0101-010115-ex043015) RETIR E M E NT | INV ES TM EN TS | I N S U R A N C E voyainvestments.com Simon Property Group Inc. Equity Residential Host Hotels & Resorts Inc. Health Care REIT Inc. ProLogis Inc. Vornado Realty Trust AvalonBay Communities Inc. General Growth Properties Inc. Public Storage Inc. Boston Properties Inc. 7.78 5.22 4.68 4.58 4.53 3.74 3.72 3.40 3.05 2.88 Excludes investments made with cash collateral received for securities on loan. Property Sector Breakdown* (%) Residential Office Buildings Retail: Enclosed Malls Healthcare Facilities Industrial Properties Residential: Hotels Retail: Community Shopping Centers Net Leased Properties Self Storage Property Technology Real Estate Fund Benchmark 18.24 16.38 16.17 13.41 15.07 14.41 12.23 15.45 8.92 6.70 8.53 8.04 7.99 8.93 6.15 4.67 0.60 8.88 5.83 1.97 Portfolio Composition* (%) Stocks Short Terms 99.06 0.94 *Portfolio holdings, sector weightings, and compositions are subject to change daily. Source: CBRE Clarion Securities.

© Copyright 2026