Caucus Newsletter 1-22-2015

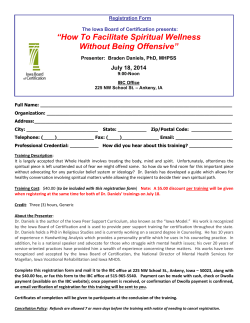

Thursday, January 22, 2015 www.IowaHouseRepublicans.com House Republican Talking Points 2015-16 House Republican Budget Principles House Republicans are committed to these principles to produce a balanced and sustainable state budget: We will spend less than the state collects; We will not use one-time money to fund on-going needs; We will not balance the budget by intentionally underfunding programs; and We will return unused tax dollars to Iowa’s taxpayers. Governor Branstad’s Budget Proposal The Governor’s Budget spends $7.3410 billion in FY 2016, an increase of $346.7 million over FY 2015 or 4.95 percent. Branstad’s FY 2016 proposal spends more money than the Revenue Estimating Conference’s December ongoing revenue estimate of $7.1946 billion. The gap between ongoing revenue and the Governor’s budget is approximately $146.4 million. For FY 2017, the Governor is proposing a General Fund budget of $7.5252 billion. This would be an increase of $184.2 million or 2.50 percent. percent, and Medicaid grew by 11.7 percent. 55 percent of the Governor’s FY 2016 budget proposal is targeted to education. Inside this issue: Appropriations 2 Agriculture 3 Commerce 4 Economic Growth 5 Education 6 Environmental Protection 10 Human Resources 10 Judiciary 11 Labor 11 Natural Resources 11 Public Safety 12 State Government 12 Transportation 13 Veterans Affairs 13 Ways and Means 14 School Funding State Aid to Schools over the last four years (FY 11-15) has increased $421 million or 16.6%. If Education Reform dollars are included that number jumps to $471 million or 18.6%. If the Governor’s plan for FY 16 is included that number jumps to $554 million or 21.9%. That is a tremendous investment in our K -12 schools over the last 4 years especially considering statewide enrollment has been relatively flat. According to the Department of Education’s Allocation Summary documents, Iowa will spend $10,231 per student in FY 15. That means in classroom of 20, Iowa spends just over $200,000. If we adopted the 6% increase in supplemental state aid for education pushed by Democrats in FY 16, the state would spend 104.4% of on-going revenue. If the Legislature approved the 6% increase in supplemental state aid for education pushed by Democrats, revenue growth in FY 16 would need to be about Each of the past four years, the budget 8.63%. Add the FY 2016 funding for the passed by the Legislature has spent less Education Reform package, and revenue than what the Governor proposed. The growth would need to be 9.54%. Over FY 2016 budget will continue this trend. the last 20 years, revenue growth has averaged 3.27%. 90 percent of Iowa’s budget goes to three areas - School aid ($2.9 billion), Or, if 6% Supplemental State Aid is apwages and benefits for state employees proved, $316.7 million would need to be ($2.1 billion), and Medicaid ($1.6 billion). cut to balance spending with on-going revenue. That’s like not funding both the Over the past decade, state revenue has University of Iowa and the University of grown by 4.1 percent annually, state (Continued on page 2) spending on K-12 education grew by 4.2 Page 2 House Republican Newsletter (Continued from page 1) Northern Iowa or shifting the cost of Iowa’s mental health system to property taxpayers. Statistics that show Iowa is in 35th place nationally in regards to per-pupil spending are questionable. Notably that ranking comes from the NEA and its inherent union biases. The US Dept. of Education’s National Center for Educational Statistics shows Iowa in 28th place. The result of increasing state spending to unsustainable levels and spending onetime money for ongoing expenses mixed with an economic collapse caused education funding in this state to take a $530 million loss in one single year (FY 2010). The state is still recovering from that loss. That recovery is only possible if we spend less than we collect. If you use the 35th in the nation ranking of per-pupil spending and the dollars associated with it, Iowa taxpayers would need to back over $767 million in additional spending this year to the national average. Iowans would face a 20.55% income tax increase to support this level of spending. If Iowa wanted to be in the top 10 in per pupil spending, Iowa taxpayers would need to pony up over $2.8 BILLION in additional spending. Iowans would face a 76.82% income tax increase to support this level of spending. According to a Friedman Foundation for Educational Choice study in 2013, 66% of Iowans do not think per-pupil spending is too low and 65% believe the public school system is either good or excellent. Governor Branstad increases Supplemental State Aid by 1.25% or $50 million and provides the second installment of $50 million for the teacher leadership component of the 2013 Education reform law. Appropriations AEA funding is once again be reduced by $15 million. This increase of $84.8 million raises State school aid funding to $3.0086 billion. Among the other K-12 education increases provided by the Governor in FY 2016 are $10 million for the High Need Schools program, a $1.5 million increase for the Reading Research Center, $1.0 for the Iowa Reading Corps, and $200,000 for bullying prevention. priation for Medicaid in FY 2015. Medicaid is the second biggest program in state government, and without major reform it will continue take funding away from other priorities like schools. Medicaid was 9% of the state budget in FY 2000. Today it is over 20%. While many are focused on targeting more money to schools, Medicaid is a looming issue that cannot be ignored. Over the past ten years, state revenue has grown by an averFor community colleges, the Governor inage of 4.1%. School aid during this time creases community college general aid grew at 4.2% annually. While Medicaid funding by 1.75 percent had an annual growth rate of 11.7%. The or $3.522 million. For Iowa’s private colleg- growth of Medicaid is crowding out other es, the Governor increases funding for the areas of the budget within the debate for Tuition Grant program by $4 million. This additional resources. is an 8.26% increase over the FY 2015 level. The tuition grant for students at forSOTU profit colleges are increased by $200,000 or 10.1 percent. Excerpts from the Wall Street Journal’s 1Depending on the calculations you are using Iowa is spending about $10,231 per pupil. The continued emphasis on this dollar amount further cements the focus on inputs rather than outputs. The true evaluation of K-12 performance is outputs. Or in other words, the academic performance of our students. In the end, whether you agree with a program’s purpose or not, programs are supposed to help people, not bureaucracies. The focus on inputs is a focus on bureaucracies. Medicaid To address the continual growth in Medicaid, the Governor is proposing major reforms. He expands the use of managed care in Medicaid and other cost containment initiatives, lowering state expenditures by $70.2 million in FY 2016. The Governor funds the rebasing of Medicaid rates for hospitals, nursing homes, and home health agencies. The Governor is not recommending a supplemental appro- 21-15 editorial on the SOTU. “Mr. Obama’s income-redistribution themes are familiar, though they are amusingly detached from the reality of the largest GOP majority in Congress since 1949.” “The President has suddenly discovered that middle-class incomes have plunged on his watch, and he’s demanding that Congress address this with more of the same policies that have done so much to reduce middle-class incomes.” “Mr. Obama has spent six years trying to redistribute income, but all he’s done is make the income gap between rich and poor wider.” “Imagine if George W. Bush had proposed a $320 billion tax-rate cut in his 2007 State of the Union, following his rout in the 2006 midterm. He would have been hooted out of the chamber, followed by days of wondering if he’d wigged out.” (Contact Brad Trow at 1-3471) Appropriations Committee to Place Focus on Output, not Inputs during 2015 With the directive from the Speaker to find ways for state government to do less but do its core functions better, the House Appropriations Committee begins a new approach to budgetary oversight this session. tions all programs and agencies are exThe first steps in this new focus started with pected to answer prior to being funded in the opening of budget subcommittee meet- FY 2016. These questions switch the focus ings last week. Each of the House subcom- of the subcommittees to what these investmittees began submitting a series of ques(Continued on page 3) Page 3 House Republican Newsletter (Continued from page 2) ments are achieving in terms of results. The questions break down into three different categories: Program performance, program efficiency, and program duplication. The program performance questions focus on performance outcomes. They are: Do you have defined outcomes or measurements for your program(s)? What are they and are these measures listed somewhere so the public can see them? What data is available to show Iowans that your program(s) are an effective investment of taxpayer dollars? Where can Iowans find this data? Can you provide the committee with performance data for your programs over the last 5 or 10 years? These questions are intended to provide lawmakers and taxpayers with real data on performance, and to identify those areas in government were measures are not illustrative of the work being performed or nonexistent. The second group, focused on program efficiency, is intended to find ways that programs and agencies can perform their assigned tasks in a more budget-conscious manner. These questions are: Have you examined what other states are doing to improve performance and reduce costs? Can you share with the committee what other states are doing? Which of these ideas are you considering for implementation here in Iowa? Are there websites or organizations we could go to obtain more information on what other states’ programs are doing to provide more efficient services? Do you have an email address or a comment section on your website where Iowans can suggest improvements to your program or agency? The duplication category of questions is intended to try and illuminate those areas where multiple agencies or programs are performing the same or similar function. The questions in this category are: Are there any other programs that are providing the same or similar services? Is there a reason why we need more than one program providing the same or similar service? Have you had any discussions with the other agencies or programs to find ways to maximize the use of the taxpayer’s dollars? Are there any laws or administrative rules that would limit your ability to work with the other programs or departments? Are there any laws or administrative rules that could be changed to make your program or agency work better? The questions allow the subcommittees to make a thorough evaluation of each program to determine if it is achieving the goals set for it with the investment of state money. While many seem focused simply on the input of state dollars, House Republicans are intent to shine the light on what really matters - the output of the investment of state dollars. The second phase of the new approach began on Wednesday, as the House Appropriations Committee holding intensive sessions on the major issues driving growth in the state budget. The Department of Human Services made a presentation to the full committee concerning the Medicaid program, its growth in recent years, and what can be done to control the program. Next Monday, the Committee will be questioning the Board of Regents about a variety of issues related to higher education policy in the state. A number of questions will likely be asked of the Board and the university presidents concerning the Board’s proposal to change how state funding is allocated amongst Iowa, Iowa State, and UNI. Another area of focus will be the Board’s efficiency study, the proposed tuition freeze, and other issues specific to the individual schools. Worker Initiative and specific issues identified by the budget subcommittees. Why start with Medicaid? Iowa’s Medicaid program has grown significantly over the past two decades. When Representative Heaton became chair of the House Human Services budget subcommittee in 1999, there were 205,000 Iowans on Medicaid and 502,000 kids in Iowa’s public schools. The Medicaid budget passed that year - after two days of debate on the House floor - spent $420 million and accounted for just 9 percent of the FY 2000 General Fund budget. The federal Medicaid match rate was 63.06 percent. Today 405,000 Iowans are on the Medicaid program, while 479,000 kids attend Iowa schools. The Medicaid budget for FY 2015 will spend nearly $1.6 billion dollars on Iowa’s share of the program, with a federal match rate of just 56.14 percent. Medicaid now takes over 20 percent of the state budget. According to the Legislative Services Agency, the drop in the federal match rate since 2010 has resulted in Iowa having to contribute 266 million more in state dollars to fund Medicaid. And the federal share of Iowa’s Medicaid program is expected to drop again next year. “Medicaid now takes over 20 percent of the state budget” At a time when many are discussing how the state can get more money to our schools, a looming issue is being ignored. Statistics from LSA show that over the past ten years, state revenue grew by an annual rate of 4.1 percent. School aid during this Next Wednesday, the Department of Adtime grew 4.2 percent annually. And Mediministrative Services has been invited to caid had annual growth of 11.7 percent. If appear and discuss the significant growth in the state cannot find ways to slow the cost of state employee health insurance. In growth, very soon Medicaid will be the first, future weeks expected topics will include and possibly only, program to get additional reviewing the initial results of the Skilled funding in future budgets. Agriculture (Contact Lew Olson at 1-3096) Des Moines Waterworks Authorizes Legal Action Against Three Rural Counties On January 8, 2015, the Des Moines Water Northwest Counties (Buena Vista, Calhoun Works commissioners voted to authorize a and Sac) alleging that the counties have legal suit against county boards in three been negligent in controlling pollutants dis- charges into the Raccoon River. The Raccoon provides the bulk of the water source for the Des Moines Water works. The wa- Page 4 House Republican Newsletter Two Water Quality Focused Projects for New, Innovative Conservation Program On Wednesday, January 14, 2015 the Iowa Department of Agriculture and Land Stewardship (IDALS) issued a press release announcing that more than 100 high-impact projects across all 50 states, including Iowa, will receive more than $370 million as part of the new Regional Conservation Partnership Program (RCPP). The RCPP’s historic focus on public-private partnership enables private companies, local communities and other nongovernment partners a way to invest in efforts to keep our land resilient and water clean, and promote tremendous economic growth in agriculture, construction, tourism and outdoor recreation, and other industries. The details of the Iowa Targeted Demonstration Watersheds Partnership Project award were announced late Wednesday, January 14, 2015. That event officially unveiled that Iowa will receive $3.5 million through RCPP. With the funding, IDALS and its 20 project partners, will be able to increase available resources through existing demonstration projects in key watersheds, conduct farmer-to-farmer outreach and assist farmers in implementing conservation practices. quality, water quantity and soil health in the Cedar River Watershed. Additionally aspects of the southern tier of Iowa counties will be a part of the Regional Grassland Bird and Grazing Land EnThis year’s RCPP projects will engage hun- hancement Initiative with the Lead Partner dreds of partners with wide-ranging interof the Missouri Department of Conservation ests, including communities, conservation (MDC) with the goal of this project is to districts, agribusiness, non-government create and implement management strateorganizations, for- and non-profit organiza- gies that integrate habitat needs of grasstions, state and federal agencies and Tribal land-dependent birds on grazing lands, governments. In addition to USDA funds, maintain the tall grass prairie ecosystem, partners will contribute an estimated $400 and enroll high quality grasslands into conmillion, more than doubling USDA’s invest- tracts. The project will target at-risk bird ment. species habitat on pastures and agricultural lands, enhance water and soil quality, and USDA will also provide $2 million to Cedar improve plant productivity limited by undeRapids for an RCPP project. The Middle sirable invasive plant species. Cedar Partnership Project will focus on NRCS is providing $5 million for this project working with local conservation partners, through RCPP and MDC and other partfarmers and landowners to install best ners are providing $10 million. Parts of management practices such as cover Nebraska, Kansas and Iowa are also incrops, nutrient management, wetlands and cluded in this project. saturated buffers to help improve water Commerce (Contact Dane Schumann at 1-3626) Cities Working On Cab Rules Last spring, the Iowa City Police Department spent hundreds of man hours finding the drivers of one taxi company during a sexual assault investigation involving one of the company’s drivers. The city’s police chief said no accurate directory existed for the company owner to provide the police with a list of its drivers. The incident has forced Iowa City’s city council to take a fresh look at its taxi regulations. City officials have been considering rules that would update current regulations for traditional cabs, but they would also propose regulations on services like Uber--a San Francisco-based startup that uses a smartphone app for customers to request a ride from a driver. While Uber experiences mixed receptions at city council meetings across the country, Iowa City’s rewrite of its cab rules was perfectly timed with Uber’s entrance into the market. The city council is working with Uber as it considers its new rules. The company also began operating in Des Moines in September with little notice to city officials, and it started in Cedar Rapids last month. Its experience in Cedar Rapids has been less confrontational than it has been in Des Moines, where city council members postponed action on a new ordinance that Uber officials called the most restrictive in the country. It would have required drivers to receive an Iowa chauffeur license, submit to quarterly vehicle inspections and apply for a local certificate to operate in the city. The proposal also would have mandated the company prove it undertook an extensive background check, which Uber already does, and require drivers to carry a commercial insurance policy with coverage of at least $750,000. Many cities have long used a medallion system to limit the number of operating taxis, requiring drivers to own or rent a medallion to pick up haling passengers. Since Uber picks up people haling them from their smartphone app, they sidestep the medallion requirement. But they have, nevertheless, impacted their value in two ways by luring passengers away from drivers with often-cheaper fares and attracting drivers to switch company’s. Medallion owners often lease their expensive right to operate a taxi to drivers that often can’t afford a medallion, but the same driver can drive their own car for Uber and pay no medallion lease fee. These trends have decimated the medallion market in major cities, perhaps no more so than in Philadelphia and Chicago. Philadelphia’s taxi authority recently auctioned medallions at $475,000. It didn’t sell any, but it’ll try again at $350,000. When Chicago announced an auction of 50 medallions at $360,000 a piece in the fall of 2013, nobody showed up. Page 5 House Republican Newsletter Economic Growth (Contact Dane Schumann at 1-3626) IEDA Board Makes Awards The Iowa Economic Development Authority awarded tax benefits and financial awards to four companies last week at its monthly board meeting. The awards are structured to spur job growth and business expansion: Alter Trading Corporation, a Davenport company that’s one of the largest metal recycling companies in the U.S., won approval of tax incentives through the HighQuality Jobs Program to help the company finance its $5.9 million expansion. The expansion should create 13 jobs. Federal-Mogul Ignition of Southfield, Michigan is an automotive component manufacturer. The company won $100,000 in direct financial assistance to help its $925,000 Barilla, an Italian-based food company, expansion project in Burlington. won tax benefits through the High-Quality Jobs Program to help the company add production lines at its Ames facility. Cambrex Charles City Inc., an Active Pharmaceutical Ingredients (API) manufacturer, was awarded tax benefits through the HighQuality Jobs Program to create 32 jobs at $14.93 per hour as it builds a facility with 45,000 square feet of warehousing space. Education Contact Jason Chapman at 1-3015) Per Pupil Amount Breakdown There are a number of per pupil spending amounts being tossed around in various talking points used by legislators, lobbyists and the media. Below is a breakdown of where those numbers come from and what they mean. the State Cost Per Pupil (SCPP), which for FY15 (2014/2015 school year) is $6,366. This number grows annually when the legThe backbone of school funding is the islature sets the growth percentage, known School Funding Formula which forms the as Supplemental State Aid (SSA, previousbasis for state aid to districts. It’s based on ly Allowable Growth). $6,366 State Cost Per Pupil Fiscal Year (school year) Percent Growth State Cost Per Pupil FY12 (11/12) 0% $5883 FY13 (12/13) 2% $6001 FY14 (13/14) 2% + 2% one-time $6121 FY15 (14/15) 4% $6366 This SCPP is a mixture of state aid and property taxes. There’s a uniform levy of $5.40 per / $1,000 property value in the district, then the state aid fills the pot up to 87.5% of the SCPP. The remaining 12.5%, called the Additional Levy, is entirely property taxes. A new effort started in FY14 is called the Property Tax Replacement Payment and it involves the state paying for any increase in the 12.5% portion of the funding formula thus saving Iowans money due to higher property taxes. as the National Center for Education Statistics and the National Education Association, pick and choose what funds they use to determine a per pupil amount is up to those entities. $10,000 Per Pupil Total Allocation The Governor has been using $10,900 per But the SCPP per pupil isn’t all a district receives. Other numbers being used are amounts over $10,000. How entities, such (Continued on page 6) Page 6 House Republican Newsletter (Continued from page 5) pupil in his comments early this session. This is presumably a number that includes some of his FY16 proposals, which include an additional $85 million on school aid this upcoming year. A reliable measure to use in Iowa comes from the Department of Education in the the past 5 years. form of Allocation Summary documents, which are “comprehensive listings of state, federal and local dollars for each school “It has grown just shy of district.” According to this document, the FY15 (2014/2015 school year) per pupil $1,000 per pupil over the amount when taking into account all state, local, and federal tax dollars is $10,231. It past 5 years” has grown just shy of $1,000 per pupil over Statewide Per Pupil Amount This $10,231 consists of 32 different fund: Regular Program Budget Adjustment Instructional Support Income Surtax Instructional Support Property Tax Education Improvement FY12 FY13 FY14 FY15 $9191 $9381 $9554 $9892 $10,231 Modified Supplemental State Aid— Dropout Management Levy Supplemental Weighting Special Education Instruction Teacher Salary Supplement Professional Development Supplement Early Intervention Supplement Preschool FY11 Regular PPEL Voted PPEL—Income Surtax Voted PPEL—Property Tax PERL FY 14 Modified Supplemental Amount FY 13 Modified Supplemental Amount for Special Ed Deficit Educator Mentoring & Induction Title I Title 1 Migrant Title 1 Neglected Title 1 Delinquent Title II Part A Title III English Language Acquisition 21st Century Learning Centers Title VI FY 14 Small Rural Schools Achievement Program (REAP) FY 14 Rural Low Income Schools (RLIS) Program IDEA Part B Carl D. Perkins (Italics are federal funds) Page 7 House Republican Newsletter Second Round of Schools Chosen for Teacher Leadership Program The Teacher Leadership Compensation (TLC) system entered the next phase of its implementation in December when 126 districts were chosen to start implementing the program, with 76 joining next school year and 50 joining the following school year. They will join the 39 districts already implementing the program this current school year. There is still time for the remaining districts to apply for year four. vision and goals for what they plan to accomplish. They also had to address “musthaves,” such as setting a minimum teacher The legislation created a four-year process salary of $33,500, improved entry into the to develop a statewide teacher leadership profession, including mentoring for new and compensation system, with the goal of teachers, and a rigorous selection process all school districts participating by the 2016- for leadership roles. The next step for 17 school year. The new system allows school districts is selecting their teacher teachers to work in greater collaboration leaders. with colleagues and learn from each other The program has been popular since the instead of operating largely in isolation in Districts selected will receive about $309 legislature passed it in 2013: their classrooms. per pupil next school year to implement their teacher leadership systems. The annu Passed the legislature in the Spring of The grantees were selected based on the al cost statewide is nearly $50 million in 2013 with overwhelming bipartisan recommendations of the 19-member Com- fiscal year 2015, growing to about $150 support. Year 1 (2013/14): Every school district mission on Teacher Leadership and Com- million annually by the third year. pensation, created in legislation as part of in Iowa (all 346) applied for the planthe system. Each year of implementation The last round of applications will open later ning grants. adds about 1/3 of Iowa’s PK-12 students, this year, allowing all remaining districts to Year 2 (2014/15): 39 districts entered meaning next school year about 2/3’s of apply to join in. While the program is opthe TLC program (146 applied) Iowa’s kids will be benefiting from the protional, the hope is that all districts will be Year 3 (2015/16): 76 districts will enter gram. participating by the 2016/17 school year. the TLC program (170 applied) Year 4 (2016/17): 50 already chosen Districts that applied to start teacher leader- The selected districts are: from the 170 applicants in year three. ship systems next fall were required to set a Page 8 House Republican Newsletter 2015-16 Albia Alden (in collaboration with Iowa Falls) Ames Andrew Ankeny Atlantic Audubon Baxter Boone CAL Cardinal Carlisle Carroll Center Point-Urbana Central Decatur Central DeWitt (Clinton) Central Lyon Chariton Clay Central-Everly Clear Creek-Amana Clinton College Collins-Maxwell Dallas Center-Grimes Davis County Decorah Des Moines Eastern Allamakee Emmetsburg Fairfield Fort Dodge Glenwood Hampton-Dumont Hinton Indianola Iowa City Iowa Falls (in collaboration with Alden) Iowa Valley Lewis Central Maquoketa Valley MFL MarMac MOC-Floyd Valley Monticello Nevada New London Nodaway Valley North Cedar North Fayette North Linn North Scott Northeast Okoboji Oskaloosa Pleasant Valley Red Oak Solon Spencer Springville Stratford Tri-County Union United Urbandale Vinton-Shellsburg Wapello Waukee Waverly-Shell Rock Wayne West Branch West Delaware County West Monona Williamsburg Wilton Winfield-Mt. Union 2016-17 Adair-Casey (in collaboration with Guthrie Center) Adel-DeSoto-Minburn Alburnett Aplington-Parkersburg Bennett CAM Camanche Cedar Falls Centerville Central City Charter Oak-Ute (in collaboration with Maple Valley-Anthon Oto and Schleswig) Clarke Clayton Ridge Danville Denver Durant East Sac County Edgewood-Colesburg George-Little Rock Grinnell-Newburg Guthrie Center (in collaboration with AdairCasey) Highland Independence Keota Knoxville Lawton-Bronson Lenox Lisbon Lone Tree Maple Valley-Anthon Oto (in collaboration with Charter Oak-Ute and Schleswig) Marion Mason City Midland Mid-Prairie Moravia (in collaboration with Seymour) North Mahaska Ogden Pekin Rudd-Rockford-Marble Rock Schleswig (in collaboration with Charter Oak-Ute and Maple Valley-Anthon Oto) Seymour (in collaboration with Moravia) Sheldon Sumner-Fredericksburg Tipton Tripoli Van Buren Wapsie Valley Washington West Hancock West Liberty West Lyon Stability and Growth in Education Funding From 2002 to 2012, education funding in Iowa was a tumultuous period. This is evidenced by numerous across the board cuts – which affected education and every other area of the budget – and moves by the legislature to underfund the state’s responsibility in the school funding formula. Over that decade it happened no less than 6 times with the capstone being the 2010 10% across-the-board cut. If a picture is worth a thousand words, then this graph is worth $530 million dollars. Page 9 House Republican Newsletter The result of increasing state spending to unsustainable levels and spending onetime money for ongoing expenses mixed with an economic collapse caused education funding in this state to take a $530 million loss in one single year. The state is still trying to recover from that loss. This is an example that the House looks to as we form our budgeting principles. while at the same time providing unprecedented growth to school funding. It was on this foundation that House Republicans and Governor Branstad begin their work in 2011 of stabilizing not only education funding but the entire budget, Here’s the resulting picture of Republican efforts over the past 5 years Budget Year School Year Growth Percentage State Aid Increase FY 2012 11/12 0% Allowable Growth * $178 million FY 2013 12/13 2% Supplemental State Aid (SSA) $30 million FY 2014 13/14 2% SSA + 2% one-time payment $65 million + $57 million FY 2015 14/15 4% Supplemental State Aid $148 million Total $421 million + $57 million (* 0% growth was a $178 million increase in state funds because the school aid formula had been purposely underfunded by over $156 million the previous year by the legislature) ver $450 million new state dollars have been appropriated to Iowa’s schools since Republicans gained control of the House and the Governor’s office. Some of these years have seen more growth than at any point in Iowa’s history. The Funding is just part of the picture 215, was where the real change happened. In addition to providing unprecedented growth in the school funding formula, the legislature also passed a bipartisan education reform package two years in a row. 2013’s education reform bill, House File On top of the $450 million new dollars provided to schools over the past 4 years, HF 215 appropriated an additional $150 million ($50 million incrementally over 3 years) and created a new teacher leadership and Page 10 House Republican Newsletter States around the country will be watching Iowa and following our lead into a new sup- House Republicans made a campaign compensation system that will fundamenport system for teachers that will do much promise that they would get the budget tally change how teachers cooperate and for student success in the future. under control and end bad budgeting pracgrow in their profession. tices and out of control spending. They vowed to not spend more than the state The big picture This isn’t just money into the system for the takes in. They vowed to not spend onesake of more money. It’s potentially revolu- House Republicans are the products of this time money on on-going expenses. And tionary change in a system that doesn’t state’s education system, through Iowa’s they are adhering to those principles year change often. The new TLC program went public elementary schools, private schools, after year, providing stability while at the live this year in 39 school districts with the home school families, community colleges, same time providing unprecedented growth goal of being statewide in 2 more years, private colleges, and the state universities. in education. making Iowa the first state in the nation to The state spends nearly 60% of its dollars provide a state-wide teacher leadership on education in this state proving that edusystem and adequately fund it for success. cation is our top priority. (Continued from page 9) Environmental Protection (Contact Lew Olson at 1-3096) Derelict Building Grant Applications Due On Thursday, January 15, 2015, the Iowa Department of Natural Resources (DNR) published it weekly electronic newsletter ‘EcoNewsWire” which contained an article in which the state agency noted that small rural communities looking for assistance to help renovate or deconstruct abandoned commercial and public structures can apply for funding through the Derelict Building Grant Program. Applications for the next round of funding are due at 4 p.m. central time on February 27, 2015. and alleviates the environmental concern these buildings can pose. Financial assistance includes asbestos removal, building deconstruction and renovation, and other inspections and environmental site assessments. Glidden, Hedrick, Imogene, Osceola, Protivin, and the East Greene Consolidated School District were 2014 grantees that completed their projects. The projects combined diverted an average of 83 percent of waste from the landfill. In total, more than 5,664 tons of construction and Funding is awarded annually on a competi- demolition materials (wood, brick, concrete, tive basis. A committee from the Iowa metal, etc.) were diverted from area landDNR, Iowa Society of Solid Waste Operafills, providing a savings exceeding tions, Iowa Recycling Association, Iowa $150,000 for the projects completed in Economic Development Authority and 2014. One grant recipient, the City of GlidKeep Iowa Beautiful selects the projects for den, promotes healthy activities through its This program was instigated by legislative funding. More information about the grant Live Healthy teams, but unfortunately resiaction by the Iowa General Assembly in its program, application forms, and resources dents had to travel out of town to find placcurrent form in 2011 and seeks to help are available at www.iowadnr.gov/ es for exercise and recreation. Based on rural communities with populations of 5,000 Environment/LandStewardship/ local input, the city renovated an abanor less to deconstruct or renovate abanWasteManagement/ doned building in its downtown corridor doned commercial and public structures DerelictBuildingProgram.aspx. with funding assistance from the Derelict and annually allocates $400,000 of state Building Grant Program into a health and solid waste tonnage fees revenues for this Last year (2014), 13 deconstruction/ wellness center that features an indoor purpose. The Derelict Building Grant Pro- renovation projects were completed. The walking track, weight rooms, shower faciligram emphasizes reuse and recycling of cities of Buffalo, Early, Marcus, Slater and ties, and an exercise classroom. building items, helps improve street apZearing carried over from the previous pearance and commercial development, grant round, while the cities of Bridgewater, Human Resources (Contact Carrie Malone at 5-2063) Federal Able Act will Aid Individuals with Disabilities The Achieving a Better Life Experience Act, or ABLE Act, was signed into law in December. This law will allow people with disabilities to save money without losing government benefits. bilities couldn’t save money they made at work if they made more than $700 a month. To be eligible, people must have a condition that occurred before they turned 26. Now, people with disabilities can open an Individuals can only have one ABLE acaccount where they save up to 100,000 count. There is a $14,000 annual deposit without jeopardizing their eligibility for Socap. Backers of the ABLE Act hope that Before this law was in place, to qualify for cial Security and Medicaid. This account the program will support people with disaservices people could only save $2,000 in will let them put money aside for long-term bilities living independently in their commuassets and earn $700 per month. Advoexpenses that Medicaid and SSI do not nity. Individual states will now be tasked cates argued that this was a huge disincen- cover, like housing, education, and transwith addressing the regulation of these tive to being employed. People with disaportation. accounts before they can be utilized. Page 11 House Republican Newsletter Judiciary (Contact Amanda Freel at 1-5230) Iowans Face IRS Scams With tax season approaching, scam artists are trying to take advantage of hardworking, honest Iowans, by posing as Government Officials. The Iowa Attorney General’s Office is reporting an increase in the number of complaints their office is receiving. It is important to remember that the IRS will never make calls demanding immediate payment over the phone. However, if a person wants to ensure they don’t have an outstanding payment due, they are advised to call the IRS directly at 1-800-829-1040. Many Iowans have reported calls from sup- Additionally, if you receive a phone call posed IRS agents or local authorities defrom a person claiming to be with a Govmanding payment for some outstanding ernment agency and you doubt their affiliadebt. These scam artists will use threats to tion, call the government agency back at convince the victim to either provide a cred- the number listed on their website to enit or debit card number, or a pre-paid debit sure you are talking with an official. card number. Often times the person answering the phone will be threatened with The Attorney General offers the following arrest if they don’t pay the debt immediate- advice for Iowans: ly. If you have received one of these calls, hang up. If you have been taken advantage of by one of these scams, report this to law enforcement immediately. Those who haven’t lost money, but received any of these phone calls, are urged to report the call to the U.S. Federal Trade Commission (FTC) www.ftccomplaintassistant.gov. Iowans can also report imposter IRS agents to the U.S. Treasury Inspector General for Taxpayer Administration http://www.treasury.gov/ tigta Labor (Contact Colin Tadlock at 1-3440) Iowa Metro Area Unemployment Rates Below National Average All but one of Iowa’s metro regions falls spectively. Coming in with the highest rate below the national unemployment rate, is the Quad City metro area (6.0%), which according to the latest Department of Labor shares cities in Illinois. report. While the national unemployment rate sits at 5.6%, most of Iowa’s metros are currently under 5%, with several hovering “most of Iowa’s metros between 2.5-3.5%. The average unemare currently under 5%” ployment rate for all of Iowa’s metro areas is tied for the 7th lowest nationally. The Ames metro area currently boasts the lowest unemployment with a rate of just 2.5%. Following Ames is the Iowa City (2.6%) and Dubuque metros (3.5%) re- Iowa’s overall unemployment rate currently stands at 4.3%, which is tied for 10th best in the country. Below are where the metro rates currently stand: Iowa Average – 3.9 Ames – 2.5 Cedar Rapids – 3.9 Des Moines – 3.8 Dubuque – 3.5 Iowa City – 2.6 Sioux City – 4.2 Waterloo – 4.5 Iowa metros that share borders with other states: Natural Resources (Contact Carrie Malone at 5-2063) Sustainable Urban Forestry Training and Assistance Grants Help Iowa Communities 10 Iowa communities were awarded grants through a U.S. Forest Service grant called Sustainable Urban Forestry Training and Assistance (SUFTA). This grant will help train interested citizens so that communities can complete a public tree inventory and prepare for possible invasive species, such as the emerald ash borer. The training is eight sessions long and it is administered by the DNR. The program includes training on technology, tree planting, data collection, and pest identification. The Iowa communities chosen to participate along with the first training dates and the contact information for the local coordinator are listed below: Atlantic, Feb 24; John Lund at 712-243 -4810 Fairfield, March 11; Scott Timm at 515- 291-2560 Grinnell, March 24; David Popp at 641- 236-2632 Marion, March 26; Mike Carolan at 641 -236-2632 Marshalltown, March 31; Terry Gray at 641-754-5715 Mason City, April 7; Bob Berggren at 641-421-3675 Muscatine, Feb 18; Richard Klimes at 563-263-0241 Oskaloosa, March 23; Dylan Mulfinger at 641-673-9431 Pleasant Hill, March 12; Heath Ellis at 515-208-5212 Storm Lake, Feb 27; Jim Patrick at 712 -732-8000 Page 12 House Republican Newsletter Public Safety (Contact Amanda Freel at 1-5230) Inquiry into Fort Madison Prison Construction Continues In his opening remarks to members of the House Speaker Kraig Paulsen tasked the Oversight Committee with investigating why the new prison in Fort Madison was still not open. This week Representatives will start their investigation into the problems that have plagued Fort Madison for the past year. line to move the inmates to the new prison. floor of the prison. Unlike other buildings, a window can’t be opened to help clear Multiple issues have kept the prison closed. smoke, so the ventilation system must be In late 2013, prison officials found major strong enough to remove smoke from the problems with the geothermal unit that was upper floor. Engineers, DOC officials and supposed to heat the cells. As constructed, the Fire Marshall are currently working to the geothermal system could not properly solve this problem, but as of now, there is heat the building. Contractors were called no timeline for a fix. back to the prison and retrofitting was done In 2005, two prisoners escaped the Iowa to ensure the pumps could spread heat House Republicans are looking in to these State Penitentiary (ISP) at Fort Madison. through the buildings. Currently, the heatmajor issues. On Thursday, the Justice After the escape, Department of Correcing and cooling systems are working. Systems Budget Subcommittee will meet tions (DOC) Officials and others met to with Director of Corrections, John Baldwin, evaluate the safety and security at prisons to discuss the prison construction and dethroughout the state. Many recommendalays. Members from both the House and “Multiple issues have tions were made, and in 2008 the General Senate plan to travel to Fort Madison on Assembly appropriated $130.7 million, from kept the prison closed” Friday to tour both the old and new prison. the Prison Bond Fund, to build a new prisMore meetings are expected to be schedon in Fort Madison. uled as the session continues. A ground breaking ceremony was held in the late summer of 2010 and the prison was expected to be completed in late 2012 or early 2013. As of today, the prison is unoccupied and there is no definite time The largest issue now facing the prison is the inability to clear smoke in case of a fire. As of now the Fire Marshall will not issue an occupancy permit because the ventilation system cannot clear smoke on the 2nd State Government The original Fort Madison Prison was built in 1839. The Iowa State Penitentiary holds approximately 934 inmates and employs 510 staff. (Contact Brittany Telk at 1-3452) Small, Independent and Traditional: The Explosion of Craft Breweries In Iowa, "Beer" means any liquid capable of being used for beverage purposes made by the fermentation of an infusion in potable water of barley, malt, and hops, with or without unmalted grains or decorticated and degerminated grains or made by the fermentation of or by distillation of the fermented products of fruit, fruit extracts, or other agricultural products, containing more than one-half of one percent of alcohol by volume but not more than five percent of alcohol by weight but not including mixed drinks or cocktails mixed on the premises (Iowa Code 123.3). While the term used to be a regular piece of the public’s vernacular, there is now another familiar term known as craft beer. The definition of this term stemming from the idea that the beer produced and consumed is not really manufactured, but crafted in smaller batches giving drinkers the ability to enjoy their alcoholic beverage in a personalized setting. The Brewer’s Association defines a craft brewer (or brewery) as someone who is small, independent and traditional –and these craft breweries have grown massively in popularity in the last couple of years. So where exactly did it come from? The evolution of these types of craft beer really starts in the BC years, but was revolutionized in the 1970’s. Some accredit this to the fact that the immigrant styles were losing their relevance as the typical lightcolored, low-caloried American lagers were the most popular in the country which essentially forced homebrewers to get creative should they desire something that tasted a little different. These homebreweries turned into bigger, yet still small by comparison to industry standards, breweries which improved in quality over the years. In the 1980’s, microbreweries took root and even without any industry support, managed to keep their foothold and grow it moving forward throughout the years, and by the mid90’s, the practice had increased its volume growth by 20%. Moving into the 2000’s up through today, the craft breweries have continued to push the popularity of such beverages through the use different and arguably higher quality brewing techniques, creative ingredients and craft beer enthusiasts. In fact, the number of craft brewers has gone from 8 back in the 1980s to over 2,800 as of 2013 –with that number growing still. “21st in the nation for craft beer” In Iowa, there are 40 craft breweries (plus those in the process of starting their own breweries), ranking it 21st in the nation for craft beer, with a $329.4 million economic impact. Iowa craft breweries produced 29,417 barrels of craft beer in 2013. As for the rest of the country this same year, while overall beer sales were down 1.9%, craft beer sales had increased by 17.2% contrib(Continued on page 13) Page 13 House Republican Newsletter Light. Additionally, the brewers are more creative with their ingredients and are conuting $14.3 billion and an increase of 20% stantly looking for new ways and flavors to dollar in sales growth. And in 2012, the add to their existing stock which gives a craft brewing industry contributed $33.9 good change of pace to the domestic billion to the economy, with more than brands that are mass-produced. The fact 360,000 jobs either as brewers, servers that it is now being bottled more widely, and other staff at brewpubs. also helps in its growth and recognition. Finally, the craft beer community through So why are these craft breweries and beers social media has been instrumental in the growing so fast? To start, there is an immarketing process of this new beer type; possible amount of styles; from lagers to however, it is impossible to just pinpoint ales, with all of the subcategories of these one specific source to credit all of the popusame styles, there are far more craft beers larity. than the typical domestic beers like Bud (Continued from page 12) Transportation And craft breweries are only proving to be the beginning, with artisan and craft distilleries fastly emerging as a way to make craft liquor (i.e. vodka, gin, rum) as well as meaderies which specialize in producing different types of mead and honey wines. All of these alcoholic endeavors seemingly fueled by the desire to produce new and interesting flavors in a local setting. (Sources: The Brewer’s Association and CraftBeer.com) (Contact Brittany Telk at 1-3452) I-380 Commuter Study Last session, the Iowa Department of Transportation was charged with conducting a study to analyze the needs, costs and demand for a public transit service for the commute in the Interstate 380 corridor, between Cedar Rapids and Iowa City. The Office of Public Transit managed the study, and began the process with appointing an advisory group who consulted major employers in the area as well as public input surveys to assess a public need, which was clearly evident; over 90% felt improvements to the corridor were needed, while another 70% indicated they would use public transportation –either a public bus or ridesharing program, in the corridor. In order to address these needs, the Office of Public Transit discovered several options that could be used, in conjunction with existing programs such as: park and ride facilities, regional commuter travel information; transit priority measures; and, guaranteed ride home. Some of the options include: Public Interregional Express Bus Service: a bus service that would commute between downtown Cedar Rapids and downtown Iowa City, with few stops to ensure a shorter travel time Subscription Public Bus Service: a bus service that is more logical for specific locale or employer, and would look more like a vanpool with flexible operation to and from the workplace in the morning and evening. Public Vanpool Program: a vanpool program to cater to rural areas not directly on the corridor. This program would work with conjunction and expand existing vanpool services offered by the University of Iowa program. Public Carpool Program: the cheapest of all of the suggested program in the Veterans Affairs suggested package, which would consist of a formal carpool program that has been highly encouraged by employers and stakeholders. As for the next steps in this study, the Office of Public Transit must: find a lead agency to implement the program as well as a study implementation committee, find funding and financing option, create a plan for implementation and construct a phasing plan. The entire study and its findings can be read here. The document further details all of the proposed plans in addition to numerical supporting data, maps and other figures to outline of what the study consisted and where it plans to go. (Contact Kristi Kielhorn at 2-5290) Streamlined Licensing for Veteran’s Spouses There is little doubt that last year’s Home Base Iowa package provided incentives for veterans to come to Iowa and make it their home. These incentives were mostly geared toward veterans—but also included were some provisions for the spouses of veterans. One division of Home Base Iowa required Iowa’s licensing boards to grant expedited licenses to veterans and their spouses who already held professional licenses in other states. The boards were instructed to streamline the process and make it easier for veterans and their spouses coming into the state to get to work in their chosen field—often times in professions they had been doing for years. Because military families move often, licensing requirements in the various jurisdictions can prove cumbersome and time consuming. The Iowa Board of Educational Examiners is offering a three year “military exchange license” to veterans and their spouses. The license is offered at a reduced cost. This temporary license lets the veteran and their spouse continue teaching in Iowa for three years without having to do additional coursework or testing. A new report from the Board of Education Examiners indicates that five veterans and 19 spouses were issued these licenses last year. Data on the Home Base Iowa licensing provisions will keep coming in throughout the year as all boards were required by the bill to report to the legislature. More information on Home Base Iowa can be found at: http:// www.homebaseiowa.org/. Page 14 House Republican Newsletter Ways & Means (Contact Kristi Kielhorn at 2-5290) Tax on Social Security—Completely Phased Out Legislation passed in 2006 to phase out the state income tax on social security benefits has finally fully been fully implemented. Senate File 2408 (2006) phased out the tax over eight years and started out by exempting 32 percent of taxable social security benefits from state income tax for the first two years. That number than ratcheted up every year until reaching 100 percent in tax That is more than $240 million in taxpayer year 2014. savings in the last two years. According to the latest estimate by the Iowa Department of Revenue the impact of the phase out of income tax on social security impact was $106 million for fiscal year 2014 and $128 million for fiscal year 2015. “$240 million in taxpayer savings in the last two years”

© Copyright 2026