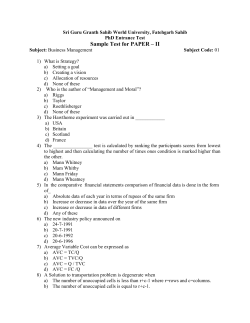

Cost Chapter 20: Microeconomics Concepts

Cost Chapter 20 McGraw-Hill/Irwin Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved. Learning Objectives After this chapter you should be able to: 1. 2. 3. 4. 5. 6. 7. 8. Define and analyze fixed costs, variable costs, and total cost. Discuss and measure marginal cost. Distinguish between the short run and the long run. Define and calculate average fixed, variable, and total cost. Graph and analyze the AFC, AVC, ATC, and MC curves. Analyze the production function and its relationship to the law of diminishing returns. List the factors contributing to economies and diseconomies of scale. Explain the difference between the shut-down and go-outof-business decisions. 20-2 Costs Sales – Costs = Profit or Total Revenue - Total Cost = Profit or – Total Revenue (TR) Total Cost (TC) Profit (the bottom line) 20-3 Fixed Costs (FC) Fixed costs stay the same no matter how much output changes. • • • • Examples: rent, insurance, salaries, property taxes, and interest payments. Even when a firm’s output is zero, it incurs the same fixed cost. Sometimes called “sunk cost” because once you have obligated yourself to pay them, that money has been sunk into your firm. The trick is to spread these (fixed) costs over as much output as possible. In other words, to spread your overhead over a large output. 20-4 Variable Costs (VC) Variable costs vary with output. • • • • As output goes up, VC goes up. As output goes down, VC goes down. Examples: wages, fuel, raw materials, electricity, and shipping. Sometimes a cost may be part fixed and part variable. The electricity used by production is a variable cost because it will go up or down with production. Even if your output fell to zero, you would still have to pay something on your electric bill. 20-5 Total Cost (TC) Total cost is the sum of fixed and variable costs. TC = FC + VC 20-6 Hypothetical Cost Schedule Let’s first try graphing these 3 costs curves. 20-7 Hypothetical Cost Schedule (continued) FC + VC = TC 20-8 Marginal Cost (MC) MC is the cost of producing one additional unit of output. MC = change in TC ÷ change in Q Output FC 0 $500 VC $ TC MC 0 $500 $ - 1 200 700 200 2 300 800 100 3 450 950 150 4 650 1,150 200 5 950 1,450 300 6 1,500 2,000 550 20-9 Marginal Cost (MC) MC is the cost of producing one additional unit of output. At an output of zero, VC is always zero Output FC 0 $500 VC MC 0 $500 $ - 200 700 200 300 800 100 450 950 150 4 650 1,150 200 5 950 1,450 300 6 1,500 2,000 550 1 2 3 At an output of zero, FC is equal to TC $ TC 20-10 The Short Run (SR) As long as there are any fixed costs, we are in the short run. • The present time is always the short run. The short run is the length of time it takes all fixed costs to become variable costs. • In other words, the length of time it takes to eliminate all fixed costs. A steel firm might need 10 years to pay off such fixed costs as interest and rent. Even a grocery store would need a few weeks or months to sublet the store and discharge its other obligations. 20-11 The Long Run (LR) The long run is the time at which all costs become variable costs. • Never exists except in theory…you never rally reach the long run. You will never have a situation in which all your costs are variable. This would mean no rent, no insurance, no guaranteed salaries, no depreciation, etc. As you proceed through the short run, you are forced to make decisions that will push the long run farther into the future. 20-12 Another Cost Table: Find TC Output FC 0 $500 1 500 2 500 3 500 4 500 5 500 6 500 7 500 VC TC $0 $500 200 700 300 800 420 920 580 1,080 800 1,300 1200 1,700 1900 AFC AVC ATC MC 2,400 Recall TC = FC + VC 20-13 Average Cost: Now Adding AFC, AVC, and ATC Output FC 0 $500 1 500 2 500 3 500 4 500 5 500 6 500 7 500 VC $0 200 300 420 580 800 1200 TC $500 700 800 920 1,080 1,300 1,700 AFC $ 500 250 166.7 125 100 83.3 AVC $200 150 140 145 160 200 ATC $700 400 306.7 270 260 283.7 1900 2,400 71.4 271.4 342.9 MC Recall TC = FC + VC AFC = FC / Output AVC = VC / Output ATC = TC / Output 20-14 Average Cost: Finally Adding MC Output 0 1 2 3 4 5 6 7 FC $500 500 500 500 500 500 500 500 VC $0 200 300 420 580 800 1,200 1,900 TC $500 700 800 920 1,080 1,300 1,700 2,400 AFC $ 500 250 166.7 125 100 83.3 71.4 AVC $200 150 140 145 160 200 271.4 ATC $700 400 306.7 270 260 283.7 342.9 MC $200 100 120 160 220 400 700 MC is the cost of producing one additional unit of output. It is best to use the VC column to calculate the MC. If the TC column is used, you cannot calculate the MC for the first unit of output. 20-15 Graphing the AFC, AVC, ATC & MC curves Output 0 1 2 3 4 5 6 7 FC $500 500 500 500 500 500 500 500 VC $ 0 200 300 420 580 800 1,200 1,900 TC $500 700 800 920 1,080 1,300 1,700 2,400 AFC $ 0 500 250 167 125 100 83 71 AVC $ 0 200 150 140 145 160 200 271 ATC $ 0 700 400 307 270 260 283 343 MC $ 0 200 100 120 160 220 400 700 Much of microeconomic analysis involves: Filling in a table Drawing a graph Analyzing the graph 20-16 Graphing the AVC, ATC, and MC curves Output FC 0 $500 1 500 2 500 3 500 4 500 5 500 6 500 7 500 VC $ 0 200 300 420 580 800 1200 1900 TC $500 700 800 920 1080 1300 1700 2400 AFC $ 0 500 250 167 125 100 83 71 AVC $ 0 200 150 140 145 160 200 271 ATC $ 0 700 400 307 270 260 283 343 MC $ 0 200 100 120 160 220 400 700 Always do MC first! AVC and ATC are U-shaped MC intersects ATC and AVC at their minimum points. What is min. AVC? About $135 What is min. ATC? About $260 20-17 Further Discussion: You Try Finding Minimum AVC and ATC points Minimum AVC: $70 Minimum ATC: $166 20-18 Review The MC curve intersects the ATC and AVC at their minimum points. 20-19 The Production Function and the Law of Diminishing Returns Production function: relationship between the maximum amount a firm can produce and various quantities of inputs. Marginal output: the additional output produced by the last worker hired. Law of diminishing returns: as successive units of a variable resource (say, labor) are added to a fixed resource, beyond some point, the extra or marginal product attributable to each additional unit of the variable resource will decline. 20-20 Total Output and Marginal Output 20-21 Economies of Scale Economies of scale: the economies of mass production, which drive down ATC. • In general, we expect large firms to undersell small firms. Reasons are: • • • Evidenced by the declining part of the ATC curve Quantity discounts Economies of being established Spreading fixed cost Economies of scale enable a business to reduce its cost per unit as output expands. 20-22 Diseconomies of Scale Diseconomies of scale: the inefficiencies that become endemic in large firms. • In general, at some point, the larger firms get the more inefficient they become. Reasons are: • • Evidenced by the rising part of the ATC curve An expanding and growing bureaucracy A huge and growing corporate authority Diseconomies of scale increase inefficiencies and also increase cost per unit. 20-23 A Summing Up The overlapping forces of increasing returns and economies of scale drive down ATC. Eventually, the overlapping forces of diminishing returns and diseconomies of scale push ATC back up again. The U-shaped ATC is very important in economic analysis and in business strategy. • • • What size size plant do we build? How many workers do we hire? What is the output at which our firm would operate most efficiently? 20-24 The Decision to Operate or Shut Down: The Short Run A firm has 2 options in the short run: operate or shut down. When TR > VC, operate. • • If it operates, it will produce the output that will yield the highest possible profits. If it is losing money, it will operate at that output at which losses are minimized. When TR < VC, shut down. • • • If the firm shuts down, output is zero. Shutting down does not mean zero total costs. The firm must still meet its fixed costs. Remember, at an output of zero, TC = FC. The firm can not go out of business until all fixed cost obligations are eliminated. 20-25 Summary Table: Let’s Try 3 Problems Problem #1: Operate or shut down in the short run? TC = FC + VC ($5 + $6) = $11 TR = $7 Loss = $4 TR ($7) > VC ($6), so operate to cover FC and then some. Note: Fixed costs are not relevant in the operate/shut down decision. 20-26 Summary Table: Let’s Try 3 Problems Problem #2: Operate or shut down in the short run? TC = FC + VC ($10 + $9) = $19 TR = $8 Loss = $11 TR ($8) < VC ($9), so shut down Note: Fixed costs are not relevant in the operate/shut down decision. 20-27 Summary Table: Let’s Try 3 Problems Problem #3: Operate or shut down in the short run? TC = FC + VC ($8 + $12) = $20 TR = $10 Loss = $10 TR ($10) < VC ($12), so shut down Note: Fixed costs are not relevant in the operate/shut down decision. 20-28 The Decision to Stay In or Go Out of Business: The Long Run In the long run, firms must decide to stay in business or go out of business. • • The firm will stay in business if the total revenue is greater than its total cost. The firm will go out of business if the total cost exceeds total revenue. Going out of business means that all fixed cost obligations are met. Does everybody who is losing money go out of business? • • Eventually (most sooner rather than later). There are always exceptions to the rule. 20-29 Deriving the Shut-Down and Break-Even Points The firm can make the same shut-down or operate decisions on the basis of price and average variable cost. Recall, a firm will shut down if VC > TR , or A firm will shut down if VC > P x Q Let’s divide both side of the above equation by Output: VC > Price x Output Output Output AVC AVC > Price < Price SHUT DOWN OPERATE 20-30 Deriving the Shut-Down and Break-Even Points The firm can make the same stay in business or go out of business decisions on the basis of price and average total cost. Recall, a firm will go out of business if TC > TR , or A firm will go out of business if TC > P x Q Let’s divide both side of the above equation by Output: TC > Price x Output Output Output ATC ATC > Price < Price GO OUT OF BUSINESS OPERATE 20-31 ATC, AVC and MC: Graphing These Business Decisions 20-32 Questions for Thought and Discussion Pretend you are the owner of a coffee house. What would be the difference between shutting down and going out of business? • • What are the fixed costs? What are the variable costs? Why does it take longer to go out of business than to shut down? 20-33 Varying Factory Capacities: Choosing Plant Size Each of these ATCs represents a different size factory, with a different optimum level of output represented by the minimum point on the ATC curve. 20-34 Varying Factory Capacities: Choosing Plant Size Answer: plant size 4 ATC1 has the lowest capacity while ATC5 has the highest. Which size factory would a firm choose to produce 400 units of output? 20-35 Varying Factory Capacities: Choosing Plant Size Changes in plant size are long run changes. In the long run, a firm could be virtually any size provided it has the requisite financing. 20-36 Current Issue: Wedding Hall or City Hall? Every wedding, big or small incurs fixed cost and variable cost. • • Fixed costs: flowers, photographer, the wedding hall, the gowns, the videographer, tux rentals, clergy. Variable costs: food and drinks; the number of guest will affect the size of the wedding hall. A relatively small wedding that cost $20,000 and might pull in gifts worth $10,000. A much larger wedding might cost $100,000 and might pull in gifts worth $50,000. Do you go for the large wedding or smaller one? 20-37

© Copyright 2026