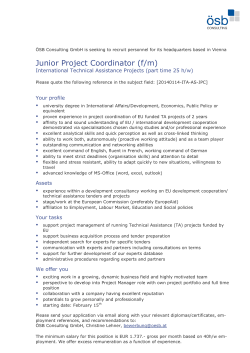

private sector as - orangeprojects.lt

New Commission Strategy on the Role of the

Private Sector in Development

Seminar “PRIVATE SECTOR’S INVOLVEMENT INTO DEVELOPMENT COOPERATION”

Gediminas’ Hall, Ministry of Foreign Affairs of the Republic of Lithuania

Vilnius, 13 November 2014

Mr Roberto Ridolfi, Director for Sustainable Growth and Development,

DG Development and Cooperation – EuropeAid, European Commission

New

Commission

Strategy on the

Role of the

Private Sector in

Development

Table of contents

1

2

3

4

PRIVATE SECTOR COMMUNICATION

PRIVATE SECTOR ENGAGEMENT

JOINT

ACP-EU

COOPERATION

FRAMEWORK and EU REGIONAL

BLENDING FACILITIES

AGRICULTURE

OPPORTUNITIES

AND

ENERGY

2

Why a Communication on the role of the private sector

in development?

The new EU development vision ('Agenda for Change') calls for making the

private sector a partner in development cooperation. The Communication

formulates in more operational terms how this can be achieved.

The EU committed at the Busan High-Level Forum on Aid Effectiveness

to more effective public-private collaboration for development. The

Communication follows up on this commitment.

The last Communication on the private sector dates back to 2003. The new

Communication updates our private sector development strategy in light

of a changing world.

The private sector plays a central role in many areas of EU development

cooperation. The Communication provides a strategic framework for

mainstreaming private sector development and engagement across sectors.

Interactions between donors and the private sector have intensified and

became more complex. The new Communication defines principles and

criteria to guide the EU’s engagement with the private sector.

3

Purpose and objectives of the Communication

Update the EU strategy for private sector development support

in developing countries;

Identify ways to working closer with the private sector in

development cooperation as announced in the 'Agenda for Change',

and confirmed in the Busan outcome document;

Using the private sector as “delivery channel” for development

in sectors such as energy, agriculture and infrastructure;

Propose a framework dialogue and joint action with business to

harness the private sector as a driving force in achieving inclusive

and sustainable growth;

Elaborate on the role of the private sector in the post-2015

framework, and in the transformation towards a green economy.

4

Structure of the Communication

5

New

Commission

Strategy on the

Role of the

Private Sector in

Development

Table of contents

1

2

3

4

PRIVATE SECTOR COMMUNICATION

PRIVATE SECTOR ENGAGEMENT

JOINT

ACP-EU

COOPERATION

FRAMEWORK and EU REGIONAL

BLENDING FACILITIES

AGRICULTURE

OPPORTUNITIES

AND

ENERGY

6

Private sector Engagement (PSE)

Finding a common language…

Implementation

partner

Civil Society

Organisations

Multistakeholder

alliances

Donors,

Public Sector

Watchdog of industry

Providing expertise

on local situation

Private

Companies

7

CONVERGENCE OF

ACTORS interests

8

Strategic areas of Private Sector Engagement in

agriculture

• 1 – Responsible Investment/Land Governance. Strengthening

investment frameworks, public policies. Examples: VGGT, rai.

• 2 – Risk Management. Reducing price and yield risks. Risks are

highest at production stage when values are low. Increased

production and access to finance. Examples: PARM, GIIF, FARMAF.

• 3 – Agriculture Equity Funds. Risk sharing instruments.

Guarantee schemes, interest rate subsidies. Example: AAF-TAF.

• 4 – Market Access/Value Chain Development. 'Traditional'

PSD: PEP, EDES, BTSF, STDF.

9

New

Commission

Strategy on the

Role of the

Private Sector in

Development

Table of contents

1

2

3

4

PRIVATE SECTOR COMMUNICATION

PRIVATE SECTOR ENGAGEMENT

JOINT

ACP-EU

COOPERATION

FRAMEWORK and EU REGIONAL

BLENDING FACILITIES

AGRICULTURE

OPPORTUNITIES

AND

ENERGY

10

Joint ACP-EU cooperation framework for

PSD support: provisions on Intra-ACP

The framework is articulated around 4 Pillars:

To support business-friendly national and regional policies.

To strengthen production capacities by providing micro-level support to

the private sector and supporting key intermediary organisations.

To improve access to responsible and sustainable micro-finance services.

To increase access to finance for SMEs and catalyse private investments

through blending operations.

National, regional and intra-ACP actions must be strongly interlinked:

To establish a platform for lesson-sharing, dissemination of good practices

and dialogue with the private sector across the ACP regions.

11

Blending

Using grants strategically to unlock additional public

and private financing to meet development challenges

LEVERAGE

12

13

NIF: € 789 million from ENPI & € 78 million

from Member States, 2007 – 2013

FINANCIAL

CONTRIBUTIONS

From the EU budget and

Member States into the

blending facilities

ITF: € 638 million from the EU (including

SE4ALL) and € 161 million from Member

States

LAIF: € 197 million, 2009 - 2013

IFCA: € 85 million, 2011 - 2013

CIF: € 70 million, 2012-2013

AIF: € 60 million, 2011 - 2013

IFP: € 10 million, 2012-2013

14

€1.6 BILLION

LEVERAGED

RESOURCES

42

Since 2007 in ITF, NIF,

LAIF, IFCA, AIF

Until end 2013

At least €15 billion are provided by

eligible public finance institutions

15

Sectors

covered

Figures since 2007

16

BLENDING

FACILITIES –

EXPERIENCE

OF PPPs

• 12 PPP projects have been

financed by EU blending facilities

• 10 in Africa (9 ITF, 1 NIF)

• 1 Latin America

• 1 Caribbean

• Strong emphasis on renewable

energy

• 7 in Energy (most renewable)

• 3 ICT (undersea cables)

• 2 Transport (ports)

17

UNLOCKING

PRIVATE

INVESTMENT

With the facilities the

needed tools are in place

Currently the blending facilities mainly support

public investment projects. However, they

also provide the means to catalyse private

investments – particularly by using more

innovative financial instruments such as risk

capital and guarantees.

• Risk capital can help address the lack of

equity

capital

in

some

countries,

particularly for new sectors such as

renewable energy (e.g. GEEREF fund)

• Guarantees are particularly useful in more

liquid markets where the perceived risk of

certain activities is high among local

investors or banks (e.g. SME Guarantee

Facility)

18

New

Commission

Strategy on the

Role of the

Private Sector in

Development

Table of contents

1

2

3

4

PRIVATE SECTOR COMMUNICATION

PRIVATE SECTOR ENGAGEMENT

JOINT

ACP-EU

COOPERATION

FRAMEWORK and EU REGIONAL

BLENDING FACILITIES

AGRICULTURE

OPPORTUNITIES

AND

ENERGY

19

Our plans for the Agriculture sector:

The EU has undertaken high level political commitments

1.

Support partner countries in reducing the number of stunted

children by 7 million by 2025

2.

Build resilience

management

3.

Agriculture for growth & job creation, enhancing private

sector activities and agribusiness

4.

Promote a sustainable agriculture through its sustainable

intensification & linking farmers to markets

and

enhance

crisis

prevention

&

20

Result of evidence based programing:

Countries with Food Security focal sector 2014-2020

Moldavie

Georgie

Kyrghyzstan

Uzbekistan

Tajikistan

Azerbaijan

Mauritanie

Cuba

Pakistan

Haïti

Suriname

Guatemala

Honduras

Nicaragua

Colombia

Burkina Faso

Sénégal

Afghanistan

Mali

Gambie

Guinée Bissau

Sierra Leone

Libéria

Côte d'Ivoire

Niger

Yémen

Erythrée

Djibouti

Laos

Népal

Nigeria

RCA

RDC

Cameroun

Myanmar

Bhutan

Ethiopie

Somalie

Benin

Sao Tomé & P.

Ghana

Tchad

Ouganda

Kenya

Burundi

Cambodge

Bangladesh

Sri Lanka

Tanzanie

Rwanda

Timor Oriental

Angola

Madagascar

Zambie

Namibie

Malawi

Mozambique

Swaziland

Zimbabwe

Total for the FNS/SA Sector: €8bn

(80%geographic, 20% thematic)

NIP approved

NIP expected

Fidji

Vanuatu

CFS Principles for Responsible Investment in

Agriculture and Food Systems

Agreement formally endorsed mid-October in Committee on

world Food Security plenary meeting, Rome

CFS coordinated the RAI process

Voluntary and legally non-binding principles (international

soft law).

12 page document contains a set of principles to promote

investments in agriculture that contribute to food security

and nutrition.

It also sets out the roles and responsibilities of all involved

in agricultural investment.

22

10 Principles

1) Contribute to food security and nutrition

2) Contribute to sustainable, inclusive economic

development, poverty eradication

3) Foster gender equality and women’s empowerment

4) Engage and empower youth

5) Respect tenure of land, fisheries, forests and access to

water

23

10 Principles (cont.)

6) Conserve and sustainably manage natural resources,

increase resilience, and reduce disaster risks

7) Respect cultural heritage, traditional knowledge, support

diversity , innovation

8) Promote safe and healthy agriculture and food systems

9) Inclusive, transparent governance structures, processes,

grievance mechanisms

10) Assess and address impacts and promote accountability

24

EU Investment in agriculture in General

Approximately € 8.2 billion for period 2014-2020

Different instruments:

- National, Regional, Intra-ACP

- Global Public Goods and Challenges Programme, DCI

- Specific Initiatives on Horn of Africa (SHARE) and Sahel (AGIR)

New initiatives

G7 New alliance on Food Security and Nutrition

SUN – Scaling up Nutrition

Current specific opportunities for private sector

All ACP Commodities Programme (2014-2017, € 18 million).

AAF/TAF – African Agriculture Fund (2012-2016, EU TAF

contribution of € 10 million; Fund itself approx. € 150, multidonor).

PIP - Pesticides Initiative Programme (2010-2014, € 32.5 million).

GIIF – Global Index Insurance Facility (2009-2016), €24.5 million

Various programmes at national level. Mostly targeted at

smallholders, SMEs, inclusive business. EU Delegations are in the

lead. Examples: Uganda, Tanzania, Malawi, Papua New Guinea.

The African Agriculture Fund (AAF) and

the Technical Assistance Facility (TAF)

•

•

•

AAF•

•

• TAF

Who: A pool of European and African DFIs

What: Support private sector companies to enhance

and diversify food production and distribution in Africa.

How: By providing equity funding and strengthening

management and company structure

• The AAF has raised $243 million in investment. AAF is

managed by Phatisa.

What: provides technical assistance to agri and food related businesses

that receive investment through the AAF:

•

•

•

capacity building for SMEs invested in by the AAF through its SME Fund

improve linkages between smallholder outgrowers and the companies invested

in by the AAF and

enhance rural financing opportunities in areas where AAF invests

Funded primarily by EC, managed by IFAD and implemented by TechnoServe. It is

also co-sponsored by the Italian Development Corporation, UNIDO and AGRA.

• As of November 2013, 11 TA projects were approved with a value of

27

€975,000

Empowering Development - the EU Energy Policy

1. What? Creating an enabling environment

transparency, cost-recovery and reinvestment.

that

allows

Regulatory framework

Catalysing private sector investment

2. How?

-

Reforms: Technical Assistance Facility

Investments: Blending (regional blending facilities, GEREEF, EDFIs);

Rural Electrification: Calls for Proposals;

New Business Models for Rural Electrification;

Missing Link: Utilities.

28

for

Rural electrification project - example

Micro-Power Economy Tanzania Roll Out

Activities:

•

Electrification of households, businesses, public services and lighting;

•

Support the development of new businesses, particularly in

agriculture;

•

Transformation of the project into a sustainable and profitable Micro

Utility

Expected results: more than 81 000 people in rural Tanzania will

get access to reliable electricity mainly from renewable sources in

mini grids.

Implementing actors: private sector bodies and one University

EU grant: € 7,4 million

Total estimated cost of

the project: € 16 million

29

Rural electrification project - example

Rent-to-Own Solar Home Systems - Rwanda

Activities:

•

Rent-to-own finance scheme for solar home systems and inclusion of

mobile money

•

Distribution of business kits to support economic activities

Expected results: more than 49 000 households and 1 000 schools

in rural Rwanda will get access to reliable electricity through solar PV

systems.

Implementing actors: one private sector body and one public

authority

EU grant: € 6 million

Total estimated cost of the

project: € 22 million

30

http://ec.europa.eu/europeaid/where/latinamerica/regional-cooperation/laif/index_en.htm

http://ec.europa.eu/europeaid/where/neighbourhood/re

gional-cooperation/irc/investment_en.htm

USEFUL LINKS

http://www.eu-africa-infrastructure-tf.net/

http://ec.europa.eu/regional_policy/sources/

docgener/guides/ppp_en.pdf

http://ec.europa.eu/europeaid/what/economicsupport/private-sector/documents/psdcommunication-2014_en.pdf

More info

[email protected]

31

Thank you!

Sustainable Growth and Development Directorate

European Commission, DG DEVCO – EuropeAid

32

© Copyright 2026