Purchasing Card Overview

State of Nevada: Purchase Card Overview – Agency intro April 17, 2014 Agenda ▪ Introductions ▪ Bank of America Overview ▪ Individual rebate program ▪ Each Dept will receive their rebate ▪ How they pay their bills will only impact their Dept rebate ▪ What we expect from you ▪ You are Purchasing’s ongoing POC for issues ▪ Identifying POCs for implementation to work with the Bank ▪ Oversight of Dept payment timeliness ▪ Adding and deleting PCA/TCAs ▪ Transition and Implementation ▪ 2 Collecting old cards and distributing new cards ▪ Transition and Implementation, cont. ▪ Contacted by Pamela Stalling to schedule construction of each agency’s P-card and T-card program ▪ What information the agencies will need to have for the program set up ▪ Transaction Management ▪ ▪ ▪ Online Application in Works Approval levels determined by agency Data import into ADVANTAGE for payment ▪ Payment Terms ▪ ▪ Options from Bank and determined by the Dept Err on side of caution, it can be changed to a quicker payment requirement at a later date to drive rebate ▪ Questions and Answers Introductions - Bank of America Merrill Lynch Offering a dedicated, Nevada focused team… CLIENT TEAM Greg Titus SVP, Senior Client Manager 775-325-9015 [email protected] Jeff Moore SVP, Senior Treasury Solutions Officer 702-498-4404 [email protected] …backed by strong, committed resources EXTENDED TEAM - CARD Holly Campbell VP, Senior Card Account Manager 602-448-3044 [email protected] Leadership Extended Team Client Team State of Nevada 3 Michael Bell Treasury Services Sr. Advisor Dedicated Card Servicing 888.715.1000 ext 21651 [email protected] Beverly Drury SVP, Senior Product Sales Specialist 503-795-6478 [email protected] Implementation Pam Stallings VP, Public Sector Business Leader 303-617-9171 [email protected] Nevada Consortium Overview Nevada Consortium Public Sector Group Overview BENEFITS 1 2 Membership provides dedicated support staff, a forum for peer-to-peer networking, and the ability to earn additional rebate basis points. STRONG OUTLOOK The NVCPSG, introduced in 2006 has continued to see year over year volume and membership growth. REVENUE SHARING 3 4 The NVCPSG volume has more than tripled since 2006. 5 GROWTH The 2012-13 fiscal year spend of $55 million resulted in over $575,000 in revenue sharing back to qualifying members. Current Members NVCPSG Member Agency • Carson City School District • City of Carson City • City of North Las Vegas • • • • • • • • • • • • • • • • • 6 City of Reno City of Sparks Clark County Clark County School District Clark County Water Reclamation - (CCWR) Douglas County Incline Village General Improvement District Las Vegas Metro Police Lyon County LVCVA NSHE – UNR Nye County RSCVA State if Nevada *** Storey County Truckee River Flood Management Authority Washoe County Product Purchase Purchase Purchase, ePayables Purchase Purchase ePayables ePayables Purchase Purchase Purchase Purchase, Travel Purchase Purchase, Travel ePayables Purchase Purchase Purchase, Travel Purchase Purchase Purchase, ePayables Nevada Consortium Contract Overview • NV Consortium Contract • • • In March, State of NV linked to NV Consortium Contract for Card Services Approved by State Board of Examiners NV Consortium Benefits • Total Annual NV Consortium Volume drives revenue sharing potential • Annual Rebate eligibility requirements include • • 7 Calculation period = Fiscal year - July – June On-time payments in full to maintain eligibility Nevada 2014 Rebate Grid NVCPSG Cycle days Standard Transaction Multiplier Table Grace days Excludes Large Ticket Annual USD Card Volume Tiers $500,000 $9,999,999 $10,000,000 $14,999,999 $15,000,000 $19,999,999 $20,000,000 $24,999,999 $25,000,000 $29,999,999 $30,000,000 $34,999,999 $35,000,000 $39,999,999 $40,000,000 $44,999,999 $45,000,000 $49,999,999 $50,000,000 $64,999,999 $65,000,000 $79,999,999 $80,000,000 $94,999,999 $95,000,000 $109,999,999 $110,000,000 $124,999,999 $125,000,000 $139,999,999 $140,000,000 $154,999,999 $155,000,000 $174,999,999 $175,000,000 $199,999,999 $200,000,000 $224,999,999 $225,000,000 $249,999,999 $250,000,000 $274,999,999 $275,000,000 $299,999,999 $300,000,000 + Large Ticket Interchange Multiplier Table Qualified Transactions Annual Volume 8 $0 Cycle Days Grace Days + (1 BPS = 0.01% or 0.0001 or 60 BPS = 0.60% or 0.0060) 7 3 14 3 14 7 30 3 30 7 REBATE BASIS POINTS 120 118 123 121 133 131 136 134 139 137 142 140 145 143 148 146 151 149 30 14 30 20 30 25 114 117 127 130 133 136 139 142 145 110 113 123 126 129 132 135 138 141 107 110 120 123 126 129 132 135 138 127 130 140 143 146 149 152 155 158 125 128 138 141 144 147 150 153 156 123 126 136 139 142 145 148 151 154 160 158 156 153 151 147 143 140 162 164 166 168 170 172 174 176 177 178 179 180 181 160 162 164 166 168 170 172 174 175 176 177 178 179 158 160 162 164 166 168 170 172 173 174 175 176 177 155 157 159 161 163 165 167 169 170 171 172 173 174 153 155 157 159 161 163 165 167 168 169 170 171 172 149 151 153 155 157 159 161 163 164 165 166 167 168 145 147 149 151 153 155 157 159 160 161 162 163 164 142 144 146 148 150 152 154 156 157 158 159 160 161 7 3 14 3 14 7 30 14 30 20 30 25 70 69 68 63 62 60 30 30 3 7 REBATE BASIS POINTS 67 65 Nevada 2014 Rebate Grid NVCPSG Cycle days 7 14 14 30 30 30 30 30 Standard Transaction Multiplier Table Grace days 3 3 7 3 7 14 20 25 Excludes Large Ticket REBATE BASIS POINTS Annual USD Card Volume Tiers $50,000,000 $64,999,999 160 158 156 153 151 147 143 140 Large Ticket Interchange Multiplier Table Cycle Days 7 14 14 30 30 30 30 30 Qualified Transactions Grace Days 3 3 7 3 7 14 20 25 63 62 60 REBATE BASIS POINTS Annual Volume $0 + (1 BPS = 0.01% or 0.0001 or 60 BPS = 0.60% or 0.0060) 9 70 69 68 67 65 Rebate Calculation criteria (1.) Volume (standard) Tier = $50,000,000 - $64,999,999 ● 3. Cycle/Grace – (Speed of Pay) ● 2. Your (standard transaction) program volume ● 4. (Large Ticket vol) cycle/grace – (if applicable) Vol $500,000 Cycle / grace 30 / 25 30 / 14 BPS 1.40% 1.47% Vol $1,000,000 Cycle / grace 30 / 25 30 / 14 BPS 1.40% 1.47% (1 BPS = 0.01% or 0.0001 or 60 BPS = 0.60% or 0.0060) 10 Rebate $7,000.00 $7,350.00 Rebate $ 14,000 $ 14,700 Works - Card Management Platform Works: All-inclusive Program Management A solution that meets all of the State’s requirements ... and offers even more. Seamless integration into your business processes Easy to navigate with minimum clicks to: o Define accounting codes and cost allocations o Manage roles and access o Administer cards and profiles o Control spending and access at multiple levels o Create customized reports o Enable simplified cardholder reconciliation o Provides robust audit and control functionality Convenient spend control profiles apply to multiple cards o Saves time o Increases control 99.96% system availability We can meet all of your required technical elements. Let us demonstrate. 12 Purchase Card Implementation Streamlined Agency Implementation implementation ▪ Builds reporting platform and hierarchies to support reporting, data integration ▪ Provides training to program administrators ▪ Effective resource coordination from a single source ▪ Proven timely project delivery ▪ Updates throughout to track progress and ensure satisfaction 14 servicing ▪ Cardholder/company-level support ▪ Local card, language support in local time zone ▪ Coordinated by a team you know and trust ▪ Specialists assist with operational questions ▪ Technical resources to complement your current team ▪ Company-level servicing provides in-region support; key point of contact for the program administrator; and assists with card program management relationship ▪ Global & regional account managers share: − Best practices − Overall growth strategies and program optimization ▪ Acts as a point of escalation ▪ Develops an approach to address specific client challenges ▪ Identifies and improves processes ▪ Provides a roadmap for reengineering ▪ Performs process reviews Four phases of a successful implementation define ▪ Define project goals, team roles & responsibilities ▪ Agree on program scope: phases, timeline for card issuance, data integration and project completion ▪ Execute the documentation required ▪ Finalize the project statement and issue project plan 15 design ▪ Collect the data needed to configure your program, to support your automation, control and spend processes objectives ▪ Review existing policies, procedures for card use ▪ Prepare the communication plan ▪ Data integration file specification deliver ▪ Verify the solution supports the operational processes to achieve the project goals ▪ Complete systems configuration ▪ Build the data integration file and set-up connectivity ▪ System training ▪ Deploy the solution and issue cards review ▪ Post go-live monitoring & validation ▪ Initiate the transition to “business as usual” sustaining operations ▪ The Account Servicing team takes over ▪ Post-implementation review Program Optimization and Marketing Program Optimization Maximize your Card Usage Are you getting the most benefit from your Card program? Do you have the ability to move additional approved spending from check to Card? • Is my agency utilizing the Card in all departments? • Are all departments using Card whenever possible? • Is the Card being used for travel related expenses? • Is my agency including in bids that Card is the preferred form of payment? • Question PO’s for low dollar purchases 17 Individual Program Optimization and Consulting Opportunity Consultative analysis & planning Supplier target & enrollment services Provides benchmark and best practice information Identifies and helps you prioritize suppliers who accept card payments at the amounts you need to pay Identifies opportunities, benefits of expanding your card program Develops a tactical card expansion plan to help you achieve your financial goals Provides periodic reviews 18 Engages our Merchant Services group to discuss enrollment opportunities for suppliers who do not accept card payments Enables key suppliers to accept card payments Program Marketing How do you increase key Agency participation? • As primary state bank for over 25 years we know all key agencies • We will meet directly with agencies to outline the benefits of program participation • We can personalize Works demonstrations to address individual Agency issues • Regularly scheduled member user group meetings to promote ongoing peer networking and gain industry knowledge • This has been key to the success of the Nevada Consortium • No other bank offers this level of marketing support! 19 A Track Record of Growth Nevada Consortium Oregon Consortium $60,000,000 $140,000,000 $50,000,000 $120,000,000 $40,000,000 $100,000,000 $80,000,000 $30,000,000 $60,000,000 $20,000,000 $40,000,000 $10,000,000 $20,000,000 $- $2007 2008 2009 2010 2011 2012 2013 2007 Washington Public Sector Group 2008 2009 2010 2011 2012 Idaho Consortium $300,000,000 $50,000,000 $250,000,000 $40,000,000 $200,000,000 $30,000,000 $150,000,000 $20,000,000 $100,000,000 $10,000,000 $50,000,000 $- 20 $0 2007 2008 2009 2010 2011 2012 2013 2012 2013 2013 Benefit Summary ▪ Better Fraud Control ▪ Improved fraud monitoring ▪ Improve process efficiencies ▪ Integration with accounting system ▪ Decrease operational expenses ▪ Increase revenue without increase spending ▪ Shift of existing spending ▪ Strong support network through agency & local government peers 21 Appendix Works® ▪ One of the most innovative web-based travel and purchasing card solutions available ▪ Data can easily be integrated into ERP systems Works® ▪ Tools to make card the payment method of choice: – Real-time card controls – Funds pre-approval process – Declining balance card issuance – Merchant Category Code (MCC) restrictions and transaction limits to purchasing authority – Card issuance or suspension – Add or close cards in real-time ▪ Simplifies management reporting – Online, on-demand, configurable reporting – Spend by vendor reports ▪ Accommodates unique cardholder, manager, auditor, accountant and administrator permissions ▪ Existing HR data feeds for account, addition, deletion, and maintenance ▪ Level III purchasing and travel data 23 Real-time manipulation of credit availability Easy integration into your ERP system Online hierarchy management Card maintenance and Active Card Controls Pre-approval and postapproval workflows Spend monitoring for encumbered funds and discretionary/ incremental funds Works: Differentiators Active Card ControlTM ▪ Flexibility to make onetime purchases for optimized control ▪ Increase/decrease funds on card, disable cards in real-time ▪ Enforce corporate and individual spending policies by blocking specific Merchant Category Codes (MCCs) 24 Accounting support ▪ Ability to monitor spending towards projects or grants with spend monitor ▪ Map, configure GL segments or use GL assistant to enable cardholders to pick from a list of cost center codes ▪ Upload changes or additions to GL Segments or Valid combinations Pre-purchase approval ▪ Ability to move largedollar transactions to purchasing cards by using electronic prepurchase approval by management Credit refresh feature ▪ Ability to control when a cardholder’s credit line will refresh even with central payment option Comprehensive card program management Why Works? web-based solution ▪ 24x7 online access ▪ Permissions-based signon ▪ Intuitive, user-friendly navigation ▪ Works Resource Center – Individual account status – Central starting point for tasks – Alerts and updates ▪ No software installation or maintenance 25 self-service administration ▪ Request, activate and close cards online ▪ Modify card settings in real-time ▪ Enforce card controls at the point of purchase – MCC Group restrictions and limits – Transaction & credit limits ▪ Audit logging of card program changes and actions streamlined reconciliation ▪ Enables distributed or centralized tasks ▪ Automates and improves accuracy of allocation ▪ Hands-free reconciliation reduces manual activities to exception handling ▪ Supports post-purchase transaction details, reallocation and approval ▪ Offers transaction file export to financial application ▪ Improve reconciliation with transaction matching timely data & reporting ▪ Transaction data updated daily for immediate access to spending information ▪ Permissions-based online access to data and reports ▪ Visibility into individual or group spending activity ▪ Full transaction data export for further analysis Robust payment management capabilities Why Works? transaction workflow ▪ Facilitates user review and accountability ▪ Enables appropriate approvals and controls, both pre- / postpurchase ▪ Streamlines crossdepartmental data flow 26 business rule engine ▪ Enables policy enforcement at the time of request and the point of purchase ▪ Facilitates spending authority matrix ▪ Reduces process flow bottle-necks by automating certain decisions ▪ Applies policies to transaction types generating alerts dynamic credit management ▪ Offers flexible credit limit management – discretionary vs. preapproval ▪ Facilitates dynamic adjustment of individual credit limits for preapproved purchases ▪ Enables credit limit restoration based on user compliance hands-free reconciliation ▪ Automation reduces manual activities to exception-handling ▪ Enforces cardholder reconciliation activities via delayed restoration of funds feature Configurable reports options Why Works? Reporting made simple Select from 650+ data fields to create an endless variety of report templates Report categories Filter examples 650+ data fields Card Defined groups Purchase request Employees Fields include, but are not limited to: Audit Card numbers Allocation Spend Card profiles Cardholder Card status categories Card Card statement periods Transaction Card decline Card profile Card renewal date Cardholder spend limits 27 Exact Authorization Override Make specific purchases outside of normal card controls, while retaining strict controls over the card program. Value drives efficiencies and provide flexibility to Purchasing, Travel, Commercial, and One Card cardholders Before Exact Authorization Override After Exact Authorization Override In order to enable a purchase outside of standard card controls, the PA would move the card out of the existing profile to a specific profile and then schedule the card to move back to the last profile after a period of time EAO drives efficiencies for card clients by eliminating the need to move cards in and out of profiles, instead, enabling exception, one-off purchases by placing the card in an exact auth profile 28 Uploading receipt images Uploading receipts into Works: 1. Once enrolled in the program, a cardholder logs into Works. Simple Receipts can be attached directly from the desktop to the transaction, reimbursement*, or expense report. 2. The cardholder selects the transaction, reimbursement request or expense folder which corresponds to a receipt image. 3. The accountholder clicks on the Single Action Menu (SAM), and selects “Manage Receipts”. 4. The user clicks “Add”, selects the receipt image to be uploaded, and clicks “OK”. Retrieving receipts: 1. A cardholder/manager logs into Works. 2. The cardholder/manager selects a transaction, expense report to view attached receipts. 3. The user clicks on the name of the image to view the image. 4. The user can then print and save PDF images on their computer. * * With deployment of Reimbursements project; expected in December 2013 Users can upload receipts from their desktop directly into Works. Receipts can be attached to the transaction, reimbursement* or expense folder. Additional receipts can be stored in the Receipt Store until needed. 29 Declining balance card features Value for business expenses Declining balance Common uses for events, projects, grants, etc. Funded with a single amount for a specific businessrelated purpose and time period. Funds are not restored with a payment or on a cycle date. Funds decline as purchases are made until the funds are spent (or the time period is passed). Used only by employees and only for business transactions. Detailed reporting on all transactions in Works. Need a fixed value card for personal use? For a fixed value card for a non-employee or for consumer-related purchase activity, our personal funds prepaid card solution is a perfect fit. 30 provides greater control and visibility in all card programs * Prepaid Card BofAML also offers business funds prepaid cards for employees with business expenses. Receive reporting on purchase and transaction activity by cardholders. Works Card Shuffler Value convert check payments to electronic payments ▪ Use purchasing cards for non-recurring, high-volume payments securely and efficiently ▪ Card number is only available to that vendor once payment is approved ▪ Using Works Active Card ControlTM, cards lay dormant with no available funds until they are funded for vendor payment by an organizations claims/warranty or eProcurement system ▪ Control card limit/expiration date of each payment ▪ Each card account number can correspond to one payment enabling ease of reconciliation Automated reconciliation 31 Convert additional spend to cards One-time payments to single vendors Generating purchase requests Card Shuffler Simple & Secure Automatic Manual Automatically generated purchase requests Manual purchase requests ▪ Shuffler selects a card account to be used for the payment when a purchase request is generated through ePayables. ▪ Account number is automatically assigned and available to be viewed through a secure method. ▪ Notify the vendor of the card account number. ▪ Using the patented Active Card Control™ technology, each card is funded with the exact amount to be paid. ▪ Select the shuffler as the payment method. ▪ Once Shuffler selects a card account, authorized users may run a configurable report or view the purchase request details to locate the selected full account number. ▪ Communicate the account number to the vendor. 32 Why MasterCard for Purchasing and Travel Card Programs MasterCard Information Advantage • • • • Manages a full range of global payments brands and related products Sets and enforces policies and rules Establishes standards and procedures for merchant acceptance and settlement MasterCard has a global data repository using a standardized global format, Visa does NOT Acceptance MasterCard Branded Cards Are Accepted Globally at Nearly 36 Million Locations Total MasterCard Acceptance Locations* (in Millions) Worldwide APMEA Europe United States Latin America Canada 35.9 10.6 10.1 9.2 5.0 1.0 • MasterCard has a material and quantifiable acceptance advantage over Visa in the US due to Visa’s lack of acceptance at Sam’s Club and Visa’s weaker acceptance in industries like utilities, education and healthcare • Purchase Card Level 3 Line Item detail from over 400,000 B2B suppliers* • Currently 3 out of the top 5 largest utilities accepts MasterCard and not Visa* • Southern California Edison (Los Angeles metro), Florida Power & Light (state of Florida) and Con Edison (New York metro) do not accept Visa * source: MasterCard Worldwide Q4, 2012 SEC report Notice to Recipient "Bank of America Merrill Lynch" is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation ("Investment Banking Affiliates"), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., both of which are registered as broker-dealers and members of FINRA and SIPC, and, in other jurisdictions, by locally registered entities. Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured * May Lose Value * Are Not Bank Guaranteed. This document is intended for information purposes only and does not constitute a binding commitment to enter into any type of transaction or business relationship as a consequence of any information contained herein. These materials have been prepared by one or more subsidiaries of Bank of America Corporation solely for the client or potential client to whom such materials are directly addressed and delivered (the “Company”) in connection with an actual or potential business relationship and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with us. We assume no obligation to update or otherwise revise these materials, which speak as of the date of this presentation (or another date, if so noted) and are subject to change without notice. Under no circumstances may a copy of this presentation be shown, copied, transmitted or otherwise given to any person other than your authorized representatives. Products and services that may be referenced in the accompanying materials may be provided through one or more affiliates of Bank of America, N.A. We are required to obtain, verify and record certain information that identifies our clients, which information includes the name and address of the client and other information that will allow us to identify the client in accordance with the USA Patriot Act (Title III of Pub. L. 107-56, as amended (signed into law October 26, 2001)) and such other laws, rules and regulations. We do not provide legal, compliance, tax or accounting advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by us to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. For more information, including terms and conditions that apply to the service(s), please contact your Bank of America Merrill Lynch representative. Investment Banking Affiliates are not banks. The securities and financial instruments sold, offered or recommended by Investment Banking Affiliates, including without limitation money market mutual funds, are not bank deposits, are not guaranteed by, and are not otherwise obligations of, any bank, thrift or other subsidiary of Bank of America Corporation (unless explicitly stated otherwise), and are not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency (unless explicitly stated otherwise). This document is intended for information purposes only and does not constitute investment advice or a recommendation or an offer or solicitation, and is not the basis for any contract to purchase or sell any security or other instrument, or for Investment Banking Affiliates or banking affiliates to enter into or arrange any type of transaction as a consequent of any information contained herein. With respect to investments in money market mutual funds, you should carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. Although money market mutual funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market mutual funds. The value of investments and the income derived from them may go down as well as up and you may not get back your original investment. The level of yield may be subject to fluctuation and is not guaranteed. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. We have adopted policies and guidelines designed to preserve the independence of our research analysts. These policies prohibit employees from offering research coverage, a favorable research rating or a specific price target or offering to change a research rating or price target as consideration for or an inducement to obtain business or other compensation. Copyright 2013 Bank of America Corporation. Bank of America N.A., Member FDIC, Equal Housing Lender. 36

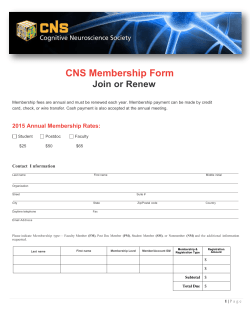

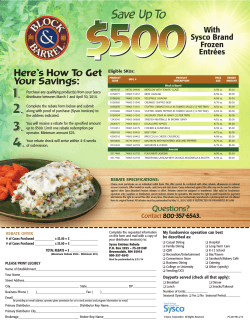

© Copyright 2026