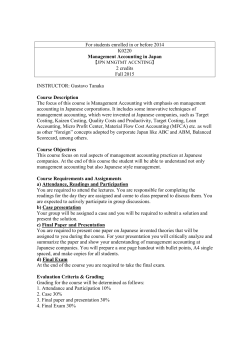

ACCT 321 - Kenya Methodist University

KENYA METHODIST UNIVERSITY ODLM ASSIGNMENT GUIDELINE FROM ACCOUNTING, FINANCE AND INVESTMENT DEPARTMENT 1st TRIMESTER 2015 1. The Odlm assignment must be completed and submitted to the ODLM office (KeMU Hub) before 5th March 2015. 2. Late assignments will NOT be received. 3. Student who will not have submitted the assignments (for the department) by the due date will be required to BOOK for a sit-in CAT with the departments Administrative Officer by 12th March 2015. 4. APA format is expected - plagiarism is illegal 5. Attached is the assignment and the course outline ACCT 321 ,MANAGERIAL ACCOUNTING ODLM ASSISNMENT QUESTION ONE a) Discuss the Role of the Management Accountant in the Management Process ( 10marks) b) Highlight and discuss the Decision Making Process (5Marks) c) QUESTION Two d) Basic analysis ltd produces and sells one product only, the BBT, the standard cost for one unit being as follows: e) Sh. f) Direct material A- 10 kg at Sh.20 per kg 200 g) Direct material B- 5 litres at Sh.6 per litre 30 h) Direct wages- 5hrs at Sh.6 per hour 30 i) Fixed production overhead 50 j) Total standard cost 310 k) l) The fixed overhead included in the standard cost is based on an expected monthly output of 900 units m) During April Year 1 the actual results were as follows. n) o) p) Production 800 units q) Material A 7,800 kgs used, costing Sh.159, 900 r) Material B 4,300 units used costing Sh.23, 650 s) Direct wages 4,200 hrs worked for Sh.24,150 t) Fixed production overhead Sh.47,000 u) v) Required w) Calculate price and usage variances for each material x) Calculate labour rate and efficiency variances y) Calculate fixed production overhead expenditure and volume variances (6 Marks) (7 Marks) (7 Marks) ACCT 321: MANAGERIAL ACCOUNTING COURSE OUTLINE COURSE OBJECTIVE This course is intended to introduce the students to the management’s use of accounting information for purposes of planning and control of an organization’s business activities. Fundamental accounting techniques of planning and control will be discussed. Prerequisite: Cost Accounting (ACCT 219) COURSE CONTENT Topic 1 Topic 2 The Nature and Purpose of Management Accounting Introduction to management accounting Accounting as an information system Management use of accounting information Financial accounting vs. Management accounting Cost objectives and classifications Cost Estimation Accounts classification methods Industrial engineering methods High-Low Approach Week 1 Week 2 Topic 3 Topic 4 Topic 5 Topic 6 Topic 7 Scatter graph approach Linear Regression analysis Cost – Volume Profit Analysis and Profit Planning Break – even analysis Graphical analysis of break-even Sensitivity Analysis Critical review of CVP model Importance of profit planning CAT 1 Product Costing Methods Variable costing system Absorption costing system Activity based costing Effects of the costing methods on income Budgeting Introduction to budgeting Objectives of budgets Types of budgets and their features Budget construction CAT 2 Decision – Making and Performance Evaluation Relevant costs for decision making Pricing and other non-routine decisions Cost - benefit analysis Importance of performance evaluation Variance Analysis Standard costs and flexible budgets Basic variance analysis Investigating variances REVISION Week 3 Week 4 Week 5-6 Week 7-8 Week 9 Week 10 Week 11 Week 12 COURSE METHODOLOGY AND EVALUATION The course will be covered mainly through lectures, class discussions and problem-solving sessions. Students will be evaluated as follows: Assignments/Tests Final Examination 30% 70% 100% COURSE TEXT BOOKS 1. Drury C: Management and Cost Accounting, Book power Publishing, current Edition 2. Horngren C.T and Foster, C; Cost Accounting – A Managerial Emphasis, 8th Edition 3. Horngren, C.T and Sunder G. L: Introduction to Management Accounting, Prentice- Hall, 7th Edition.

© Copyright 2026