Master Course Outline Cover Sheet

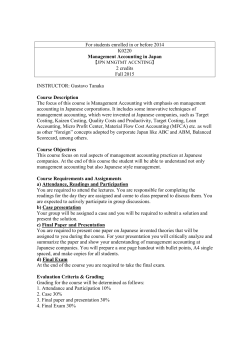

Master Course Outline Cover Sheet Analysis of accounting data as part of the managerial process of planning, decision-making and control. Concentrates on economic decision-making in enterprises. Includes computerized element. ACCT 120, ACCT& 202 or ACC 220 or permission (C, N); ACCT 120 or ACCT& 202 or ACC 220 or permission (5). sccc D College: NSCC X Date: 5/24/06 Submitted sscc D by: Patrick S. Bouker D SVI Phone #: 528-4520 Please check all boxes that are appropriate for this request: Add to inventory effective (Year/Quarter): Delete from inventory effective (Year/Quarter): Change to another CIP code: Change course title to: Change or Add to the AA Degree distribution table (See #4 below): X Other (specify): Course Outline Changes in following sections (see attached) Course Outcomes/Learning Objectives NSCC Gen Ed Outcomes Topical Outline and/or Major Divisions Course Requirements Methods of Assessment/Evaluation D D D D D Dept: ACC Course #: 230CIP Code: 52.0302 Institutional Intent: 21 Voc. Prep. Course Title: Fund Source: State X Contract Student (1) Is this course a requirement for a Workforce Education Program? (Intent 21) Yes X Program Code: 505 No (2) Is this course designed for Limited English Proficiency? Yes No X Academic Disadvantaged? Yes No X (3) Does this course contain a workplace training component? Yes No X (4) Which, if any, AA Degree requirement will this course satisfy? Q/SR - Quantitative Symbolic Reasoning Communication Visual, Literary and Performing Arts Individuals, Cultures and Societies Natural World Global Studies United States Cultures D D D D D D D D D D D D D Credits: 5 List Course Contact Hours: Lecture (1:1) 55 Lab (2:1) Work Site (3:1) Total Contact Hours: 55 D Is this course shared across the District? Yes X No If yes, have you received concurrence from the other colleges? Yes Contact N ame( s): No X D Curriculum Committee Approval: 1f/:f6 D te Origi SEA TILE COMMUNITY COLLEGE DISTRICT COURSE CODING APPROVAL FORM ~-ttu.rv ~ Vice President for Instruction 0/~O/C-G North Seattle Community College Business, Engineering & Information Technologies Division Course Outline Fall 2006 Division: Business, Engineering & Inform. Technologies Program/Dept: Type: Accounting CL - Computer Lab Fee Degree/Certificate Requirement: Yes Name of Degree/Certificate Requirement: Accounting AAS Computerized Accounting Cert. Paraprofessional Accounting Cert. Distribution Requirement for AAJAAS: Yes Transfer Status to 4-year institution: Yes If yes, please describe: Transfers to four year schools as an accounting course Course Contact Hours: 55 Lecture: 55 Lab: Course Description: Analysis of accounting data as part of the managerial process of planning, decision making and control. Concentrates on economic decision making in enterprises. Includes computerized element. Prerequisite: ACC 220 or instructors permission. Computer Lab Fee. Course Outcomes/Learning Objectives: 1. To learn how information is obtained, summarized and analyzed to help managers plan, organize, direct, and control their organizations. 2. To learn the terminology, concepts, principles, and environment of managerial accounting 3. To learn how managerial accounting information relates to external financial reporting 4. To learn how to use computers and software to produce internal accounting schedules and reports 5. To calculate upstream and downstream costs 6. To identify emerging trends in managerial accounting including Just-in-Time inventory, total quality management, activity based management, and value chain analysis NSCC General Education Outcomes and/or Related Instructional Outcomes (for technical courses) Met by Course: (list each outcome): Outcome #2 Use quantitative reasoning processes to understand, analyze, interpret, and solve quantitative problems. 1. Mana_~erial Accounting and the business environment. The work of management and the need for managerial accounting information Managerial accounting versus financial accounting Emerging trends in management and managerial accounting II.. Cost terms, concepts, and classifications General cost classifications Product versus period costs Financial statement cost classifications Cost classifications for decision making ill. Systems design: Job-order costing and process costing Job order costing - the flow of costs Overhead application in a job order costing system Job costing in service organizations Job order versus process costing Equivalent units of production Production report using the weighted average method IV. Cost Behavior and Cost-Volume-Profit Relationships Types of cost behavior patterns Contribution format income statement Basis cost-volume-profit analysis Break-even Analysis Cost Structure V. Activity-based management and activity-based costing The mechanics of activity-based costing Traditional costing versus activity-based costing VI. Profit Planning and Budgeting Basic framework of budgeting Preparing a master budget Budgeted financial statements Flexible Budgets VII. Standard Costs and the Balanced Scorecard Setting standards Variance analysis Balanced scorecard Vill. Segment reporting and Decentralization Segment reporting and profitability analysis Financial and non-financial information Return on investment and residual income IX. Relevant Costs for Decision Making Costs concepts for decision making Decision making criteria Activity based costing and relevant costs x. Capital Budgeting Decisions Discounted cash flows and net present value Discounted cash flows and internal rate of return Payback method Accounting rate of return Postaudit of investment projects Course Requirements (Expectations of Students) Upon completion, students are expected to know the cost concepts and procedures which make up managerial accounting. They are expected to be able to analyze financial data and produce computerized internal management schedules and reports. They are expected to be able to identify and describe emerging managerial accounting trends. Methods of Assessment/Evaluation: Homewwork and in-class assignments Quizzes and examinations Final grades are assigned according to published grading standards for the course.

© Copyright 2026