The structural form of the model can then be conveniently

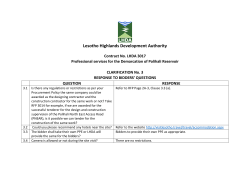

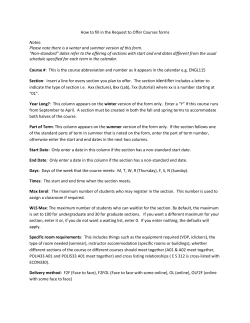

PhD Course: Structural VAR models III. Identification Hilde C. Bjørnland Norwegian School of Management (BI) Lecture note III: Identification Content 1. Identification (cont.) ¾ Choleski recursive restrictions and implication on the covariance matrix 2. Criticism of the recursive restrictions 3. Non-recursive restrictions on the contemporaneous matrix 4. Long run restrictions ¾ Criticism of long run restrictions 1. Identification (cont.) Recall the structural VAR y1t + ψ 12 y2t = α1 + φ11 y1t −1 + φ12 y2t −1 + ε1t y2t + ψ 21 y1t = α 2 + φ 21 y1t −1 + φ 22 y2t −1 + ε 2t , written in matrix notation as ⎡1 ψ 12 ⎤ ⎢ψ 1 ⎥ ⎦ ⎣ 21 ⎡ y1t ⎤ ⎡α1 ⎤ ⎡φ 11 φ12 ⎤ ⎡ y1t −1 ⎤ ⎡ε1t ⎤ ⎢ y ⎥ = ⎢α ⎥ + ⎢φ ⎥ ⎢ y ⎥ + ⎢ε ⎥ . φ ⎣ 2t ⎦ ⎣ 2 ⎦ ⎣ 21 22 ⎦ ⎣ 2t −1 ⎦ ⎣ 2t ⎦ Ψyt = α + Φyt −1 + ε t , ⎛ ⎛ 0⎞ ⎛ ε1t ⎞ ⎜⎜ ⎟ ⎜ ⎟ ~ iid where ⎜ ε ⎟ ⎜ ⎜⎝ 0 ⎟⎠ ⎝ 2t ⎠ ⎝ ⎛ ω12 0 ⎞ ⎞ ⎟⎟ ,⎜ ⎜ 0 ω 2 ⎟ ⎟ or, ε t ~ (0 , Ω ) . 2 ⎠⎠ ⎝ The structural moving average (SMA) representation was found as ∞ yt = v + ∑ Θ j ε t − j = v + Θ( L)ε t j =0 −1 −1 −1 −1 Where Θ( L) = B ( L)Ψ = Ψ + B1Ψ + B2 Ψ + ... ∞ −1 (Recall from lecture II, SVAR→ reduced form →SMA: yt = ν + ∑ Bet − j = ν + B ( L)Ψ ε t = ν + Θ( L)ε t j =0 −1 and et = Ψ ε t ). Suppose that ε2t has no contemporaneous impact on y1t, that is θ12,0=0 in the SMA above ⎡ y1t ⎤ ⎡v1 ⎤ ⎡θ ⎢ y ⎥ = ⎢v ⎥ + ⎢θ ⎣ 2t ⎦ ⎣ 2 ⎦ ⎣ 11, 0 21, 0 which is equivalent to 0 θ 22 , 0 ⎤ ⎡ε1t ⎤ ⎡θ ⎥⎢ ⎥+⎢ ⎦ ⎣ε 2t ⎦ ⎣θ 11,1 θ 12 ,1 21,1 θ 22 ,1 ⎤ ⎡ε1t −1 ⎤ ⎥⎢ ⎥ + ... ε ⎦ ⎣ 2t −1 ⎦ ⎡θ Θ0 = Ψ = ⎢ ⎣θ −1 11, 0 21, 0 0 θ 22 , 0 ⎤ ⎥ . ⎦ The equivalent restriction in the SVAR can be found from Ψ −1 = − ψ 12 ⎤ 1 1 ⎡1 = det(Ψ ) ⎢⎣− ψ 21 1 ⎥⎦ 1 − ψ 12ψ 21 or ψ 12 = 0 ⎡1 − ψ 12 ⎤ ⎢− ψ ⎥ , ⎣ 21 1 ⎦ Example: Assume a reduced form bivariate VAR(1) consisting of the variables, interest rate (it) and output growth (Δxt) that is driven by the two structural shocks, monetary policy shocks (ε MP,t ) and productivity shocks (ε PR ,t ) , and assuming zero mean. Let now output growth be ordered above the interest rate in the yt vector. The restriction θ12,0=0 implies that output growth does not respond contemporaneously to monetary policy shocks, as there is a lag (quarter or month, depending on sample frequencies) in the implementation of monetary policy shocks. By estimating the reduced form VAR yt = A1 yt −1 + et ⎡Δxt ⎤ ⎡a11 a12 ⎤ ⎡Δxt −1 ⎤ ⎡e1,t ⎤ ⎢i ⎥ = ⎢a a ⎥ ⎢i ⎥ + ⎢e ⎥ , ⎣ t ⎦ ⎣ 21 22 ⎦ ⎣ t −1 ⎦ ⎣ 2,t ⎦ we get the reduced form (infinite) moving average (MA) representation by multiplying with the finite order polynomial A(L)-1 yt = A( L) −1 et = ( I − A1 L) −1 et = B ( L)et , j where B 0 = I , B j = A1 . Assuming no contemporaneous effect of monetary policy shocks on output growth (equivalent to assuming ψ 12 = 0 ), or in terms of the structural VAR Δxt = α1 + φ11Δxt −1 + φ12it −1 + ε PR ,t it = α 2 − ψ 21Δxt + φ 2 1it −1 + φ 22 Δxt −1 + ε MP ,t . Using the SMA, the zero short run restriction can be found by assuming Ψ is lower triangular, so that ⎡1 0 ⎤ Ψ =⎢ ⎥ . ⎣ψ 21 1⎦ From Ψet = ε t , or in terms of matrix notation, ⎡1 0 ⎤ ⎢ψ 1⎥ ⎣ 21 ⎦ ⎡e1t ⎤ ⎡ε PR ,t ⎤ ⎢e ⎥ = ⎢ε ⎥, ⎣ 2t ⎦ ⎣ MP,t ⎦ we obtain ε PR ,t = e1t ε MP,t = ψ 21e1,t + e2t = ψ 21ε PR ,t + e2t Hence, in this case, the restriction implies a causal ordering that can be identified using the Choleski decomposition. The system is now just identified and ψ 21 can be uniquely identified from the elements of the reduced form covariance matrix Σ. ⎡σ 12 σ 12 ⎤ ⎥ As et = Ψ ε t and denoting the CVM of the bivariate VAR above as E (et et ' ) = Σ = ⎢ 2 ⎢⎣σ 12 σ 2 ⎥⎦ −1 E (et et ' ) = Ψ −1ΩΨ −1 ' = Σ ⎡σ 12 σ 12 ⎤ = ⎢ 2⎥ σ σ ⎣⎢ 12 2 ⎦⎥ ⎡ 1 ⎢− ψ ⎣ 21 ⎡ ω 12 − ψ 21ω12 ⎤ 0 ⎤ ⎡ω12 0 ⎤ ⎡1 − ψ 21 ⎤ = ⎢ ⎢ ⎥ 2 2 2 2⎥ 1⎥⎦ ⎣⎢0 ω 22 ⎦⎥ ⎢⎣0 1 ⎥⎦ − + ψ ω ω ψ ω ⎢⎣ 21 1 ⎥ 2 21 1 ⎦ Solving this, we get, σ 12 = ω12 , σ 12 = −ψ 21ω12 and σ 22 = ω 22 + ψ 212 ω12 hence, ψ 21 = − σ 12 σ 12 We can identify the parameter from the covariance between the two variables in the VAR. If the covariance is zero, the coefficient will also be zero, hence there will be no contemporaneous relationship. 2. Criticisms of recursive restrictions Cooley and LeRoy (1985) criticized the VAR methodology because of its “atheoretical” identification scheme. They argued that Sims did not explicitly justify the identification restrictions and claimed that a model identified by this arbitrary procedure cannot be interpreted as a structural model, because a different variable ordering yields different structural parameters. In the example above, the restriction θ12,0=0 implies that output growth does not respond contemporaneously to monetary policy shocks, as there is a lag in the implementation of monetary policy shocks. Alternatively, had the interest rate been ordered above output growth, the restriction would have implied that monetary policy, (i.e. the central bank) does not react contemporaneously to technology shocks, (hence they observe productivity changes with a lag). Both are plausible assumptions. Which should you choose? Difficult to test, as rearranging the order of variables (as suggested originally by Sims) may not allow you to uncover the “true” structural relations, as you always assume one of the contemporaneous relationship to be zero. If there is a degree of simultaneity between two variables, is it measurable? In the example from Bjørnland (2006), (see Lecture notes II), where the interdependence between monetary policy and the exchange rate was analyzed, the two different Choleski orderings gave responses close to zero (for all countries but Canada). Hence, we would expect the covariance between the two variables of interest to be zero. However, a covariance of zero may NOT imply that the ordering does not matter, as illustrated below. Figure 1. Response in the exchange rate to a 1 pp. monetary policy shock; two different Choleski orderings a) Australia b) Canada c) New Zealand 2 1.4 0.6 Real exchange rate Real exchange rate (exc-i) 1.2 Real exchange rate Real exchange rate (exc-i) Real exchange rate Real exchange rate (exc-i) 0.5 1.5 1 0.4 1 0.8 0.3 0.6 0.5 0.2 0.4 0.1 0 0.2 0 -0.5 0 -0.1 -0.2 -1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 -0.2 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 d) Sweden 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 e) UK 1.5 0.4 Real exchange rate Real exchange rate (exc-i) Real exchange rate Real exchange rate (exc-i) 0.3 1 0.2 0.1 0.5 0 0 -0.1 -0.2 -0.5 -0.3 -0.4 -1 1 1) 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Source Bjørnland (2006) The solid line corresponds to the Choleski decomposition where the interest rate is ordered before the exchange rate in the VAR. In the alternative ordering (exc-i), the interest rate and the exchange rate swap places. An increase in the exchange rate implies depreciation. In particular, assume for simplicity a system in two variables, the interest rate and the exchange rate. The reduced form residuals, will be linear relationship of the structural shocks, that is, a structural monetary policy shock and an exchange rate shock, ei ,t = ε mp ,t + αε exc ,t eexc ,t = βε mp ,t + ε exc ,t [ ] 2 2 cov(ei ,t , eexc,t ) = E (ε mp ,t + αε exc,t )( βε mp ,t + ε exc,t ) = αω mp + βω exc A covariance close to zero implies either that the true structural relationship is zero, cov(ei ,t , eexc,t ) = 0 → α =β =0 or that the effects are equal, but opposite in signs! 2 ω mp β =− 2 α ω exc Only by allowing the parameters to be freely estimated, can we test if the “orderings matter”. Need to use other identifying restrictions, short run or long run. As an alternative to the recursive identification scheme, Bernanke (1986) and Blanchard and Watson (1986) among others introduced non-recursive restrictions on the contemporaneous interactions among variables for identification. As economic theory often does not provide enough meaningful contemporaneous restrictions (and the more variables you put into your system, the more restrictions you need), the search for additional identifying restrictions led Blanchard and Quah (1989) and subsequently Shapiro and Watson (1988) and Galí (1992) to introduce restrictions on the system’s long run properties. These long run restrictions are usually based on neutrality postulates. More recently, imposing sign restrictions, allows you to test the implications of all types of restrictions. By dropping one after one of the “dubious restrictions”, one can test whether the responses to shocks are sensitive to the restrictions often imposed. 3. Alternative non-recursive restrictions Eventhough the structural model cannot be written in lower triangular from, we can still give a structural −1 interpretation to the VAR exploring the relationships et = Ψ ε t , i.e. Σ = Ψ −1ΩΨ −1 ' . As an alternative to the recursive identification scheme, one could introduce non-recursive restrictions on the contemporaneous interactions among variables for identification. For an open economy application related to the discussion on the exchange rate, Kim and Roubini (2000) adopt identification schemes that do not employ the recursiveness assumption. Rather than assuming the recursive assumption between interest rates and the exchange rate (Eichenbaum and Evans, 1995), they suggested that one should allow for a contemporaneous interaction between monetary policy and the exchange rate. Instead they assume that the monetary policymaker can not respond contemporaneously to the foreign interest rate. They observe fewer puzzles in the exchange rates than other studies. However, still not an assumption allowing for simultaneous response between the interest rate differential and the exchange rate. Figure 2. Response in the exchange rate to a 1 pp. monetary policy shock; Choleski versus non-recursive restrictions between the interest rate and the exchange rate (assuming instead that the monetary policymaker can not respond contemporaneously to the foreign interest rate) 0.25 Cholesky Cholesky (reverse order) Kim and Roubini 0.2 0.15 0.1 0.05 0 -0.05 -0.1 -0.15 -0.2 1 2 3 4 5 Source Bjørnland (2005) 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 4. Long run restriction Following Blanchard and Quah (1989), SVAR can also be identified using “long run restrictions”. These are restrictions on sums of coefficients in θ (L) and not only on the contemporaneous effect in θ 0 only. These restrictions usually follows from some economic theory, and are therefore considered as being more sophisticated than the “delayed reaction” theory underlying most zero restrictions on θ 0 . Long run restrictions are often with regard to neutrality of the effects of certain shocks over time. Blanchard and Quah (henceforth BQ) imposed restrictions on the long-term multipliers of a model (including the growth of output and unemployment) to identify a permanent and transitory components of output. They then postulated that the variables were driven by two orthogonal structural shocks (“supply” and “demand”), and argue that a demand shock should have no permanent effect on the level of output, whereas a supply shock could. The unemployment rate was considered stationary; hence no shocks could change unemployment permanently. Based on the identification, GDP could potentially be split into two different components; a component determined by shocks that have a permanent effect on the supply side of the economy, and a component determined by shocks that only affect demand in the short term. The first component represents potential GDP and will consist of the accumulated supply shocks, while the latter can be interpreted as the output gap and will consist of the accumulated demand shocks. Example: The (bivariate) SMA representation ∞ yt = v + ∑ Θ j ε t − j , where ε t ~ (0 , Ω ) j =0 ⎡ y1t ⎤ ⎡v1 ⎤ ⎡θ ⎢ y ⎥ = ⎢v ⎥ + ⎢θ ⎣ 2t ⎦ ⎣ 2 ⎦ ⎣ 11, 0 θ 12 , 0 21, 0 θ 22 , 0 ⎤ ⎡ε1t ⎤ ⎡θ ⎥⎢ ⎥+⎢ ⎦ ⎣ε 2t ⎦ ⎣θ 11,1 21,1 θ ⎤ ⎡ε1t −1 ⎤ + ... ⎥ θ 22,1 ⎦ ⎢⎣ε 2t −1 ⎥⎦ 12 ,1 Suppose ε2t has no long run cumulative impact on y1t, then we could write, ∞ θ 12 (1) = ∑θ s =0 11, s =0 (1) So that ⎡∞ ⎢∑ θ s =0 Θ(1) = ⎢ ∞ ⎢ ⎢∑ θ ⎣ s =0 11, s 21, s ⎤ ⎥ ⎡θ (1) 0 ⎤ ⎥ = ⎢ 11 ⎥ ∞ ⎥ ⎣θ 21(1) θ 22 (1)⎦ θ 22,s ⎥ ∑ s =0 ⎦ 0 This turns out to be a non-linear restriction on the coefficient of the SVAR Θ(1) = B (1)Ψ −1 = A(1) −1 Ψ −1 = ( I − A1 ) −1 Ψ −1 = ( I − Ψ −1Φ ) −1 Ψ −1 (2) An interesting case Assume the MA representation from the reduced form VAR (ignore constant) yt = B ( L)et −1 Again we assume the relationship between the reduced form VAR and the SVAR, et = Ψ ε t , and B ( L) Ψ −1 = Θ( L) . Let the structural shocks εt‘s be normalized so they all have unit variance ε t ~ (0 , I ) . From the normalisation of var(εt) it follows that Σ = Ψ −1ΩΨ −1 ' = Ψ −1Ψ −1 ' . If you order the variables so that the long run matrix Θ(1) turns out to be lower triangular, we can use this to recover Ψ −1 . In particular, combining the expression for Σ and the long run representation implies B(1)Ψ −1 = Θ(1) B(1)Ψ −1 ( B(1)Ψ −1 )' = Θ(1)Θ(1)' B(1)ΣB(1)' = Θ(1)Θ(1)' (3) (3) can be computed from the estimate of Σ and B(1)(=A(1)-1). As Θ(1) is lower triangular, expression (3) implies that Θ(1) will be the unique lower triangular Choleski factor of B (1)ΣB(1)' . Example 1: The original paper with LR restrictions Blanchard and Quah (1989) Estimate a model in GDP growth and unemployment. Assume aggregate demand shocks can have no long run effect on the level of output. Equivalent to assuming the sum of the differences will eventually be zero ⎡Δy ⎤ ⎡θ 11(1) ⎢u ⎥ = ⎢θ (1) ⎣ ⎦ t ⎣ 21 0 ⎤ ⎡ε AS ⎤ ⎢ ⎥ θ 22 (1)⎥⎦ ⎢⎣ε AD ⎥⎦ t The important issue is to include a variable that is stationary (i.e. do not need to impose any restrictions) and has dynamic interactions with GDP. More recent papers have tended to use Δp in the vector instead of u. However, results are not robust to the inclusion of another variable, as illustrated by Faust and Leeper (1997). Example 2: Evaluating different output gaps (using alternative methods) for forecasting inflation Bjørnland, Brubakk and Jore (2005) Augment BQ by estimating a three variable VAR (unemployment growth, GDP growth and inflation). Identify three shocks; Nominal and real demand shocks and one supply shock. Assume nominal demand shock can have no long run effect on GDP nor unemployment, whereas the real demand shock could potentially affect GDP in the long run, but not unemployment. No restrictions on inflation that is stationary. ⎡Δu ⎤ ⎡θ 11(1) ⎢Δy ⎥ = ⎢θ (1) ⎢ ⎥ ⎢ 21 ⎢⎣Δp ⎥⎦ t ⎢⎣θ 31(1) ⎤ ⎡ε ⎤ ⎢ ⎥ 0 ⎥⎥ ⎢ε RD ⎥ θ 33 (1)⎥⎦ ⎢⎣ε ND ⎥⎦ t 0 0 θ 22 (1) θ 32 (1) AS Output gap will be the accumulated nominal demand (monetary policy) shocks that can be found as Δy t = θ ε + θ13,1ε1t −1 + θ 13, 0 1t ε 13, 2 1t − 2 ∞ + ..., where ∑ θ13, j = 0 j=0 so that the sum of coefficients will be zero (what’s going up has to go down). However, we also allow for short run contribution form real demand shock, by adding the 8-th step forecast error to the output gap. Movement after that will contribute to trend movement. Figure 3a Impulse responses for GDP Figure 3b Accumulated demand shocks, (historical decomposition) Chart A.6 Structural vector autoregressive method (SVAR). Output gap. Percentage of potential GDP. 0.9 AS RD ND 0.8 0.6 0.5 0.4 0.3 0.2 0.1 0 1 5 5 4 3 2 1 0 -1 -2 -3 -4 -5 5 4 3 2 1 0 -1 -2 -3 -4 -5 0.7 9 13 17 21 25 29 33 Source: Bjørnland, Brubakk and Jore (2005). 37 41 45 78 80 82 84 86 88 90 92 94 96 98 00 02 04 Example 3: Core inflation Quah and Vahey (1995) Core inflation is defined as the component in inflation that has no long run effect on output. Compute core inflation through historical decompositions, (as in the example with output gap) i.e. ⎡Δy ⎤ ⎡θ 11(1) ⎢Δp ⎥ = ⎢θ (1) ⎣ ⎦ t ⎣ 21 0 ⎤ ⎡ε NC ⎤ ⎢ ⎥ θ 22 (1)⎥⎦ ⎢⎣ε CORE ⎥⎦ t Provides the Central Bank with a concept of core inflation that is more “economically founded”. Note that place no restrictions on inflation, hence can test for overidentifying restrictions (do the impulse responses look reasonable?) What is non-core? VAR a means to obtain an estimate of core inflation. Criticism of long run restrictions Faust and Leeper (1997) have criticised the use of long run restrictions to identify structural shocks, and show that unless the economy satisfies some types of strong restrictions, the long run restrictions will be unreliable. They argue that for a long-run identifying restriction to be robust, it has to be tied to restriction of finite horizon dynamics. Substantial distortions are possible due to small sample bias and measurement errors. The aggregation of shocks in small models should be checked for consistency using alternative models. References Bernanke, B. (1986). “Alternative Explanations of the Money-Income Correlation”, Carnegie Rochester Conference in Public Policy, 25, 49-100. Bjørnland, H.C. (2005), “Monetary Policy and Exchange Rate Interactions in a Small Open Economy,” Working Paper 2005/16, Norges Bank. Bjørnland, H.C. (2006), “Monetary policy and exchange rate overshooting: Dornbusch was right after all”, Manuscript, University of Oslo. Bjørnland, H.C. Brubakk, L. and A.S. Jore (2006), “Forecasting inflation with an uncertain output gap” Working Paper 2005/16, Norges Bank. Blanchard, O. J. and M.W.Watson (1986). “Are Business Cycles All Alike?” in R. Gordon, ed., The American Business Cycle - Continuity and Change, NBER Studies in Business Cycles, Vol. 25, Chicago, University of Chicago Press. Blanchard, O. J. and D. Quah (1989). “The Dynamic Effects of Aggregate Demand and Supply Disturbances”, The American Economic Review, 79, 655-673. Cooley, T. F. and S. F. Leroy (1985). “Atheoretical Macroeconometrics. A Critique.” Journal of Monetary Economics, 16 , 283-308. Eichenbaum, M. and C. Evans (1995), “Some empirical evidence on the effects of shocks to monetary policy on exchange rates,” Quarterly Journal of Economics, 110, 975-1010. Faust, Jon and Eric M. Leeper (1997) “When Do Long-Run Identifying Restrictions Give Reliable Results?” Journal of Business and Economic Statistics. 345 ? 353. Gali, J. (1992) “How Well Does the ISLM Model Fit Postwar U.S. Data?” Quarterly Journal of Economics, 107, 709-38. Gali J. (1999), “Technology, employment, and the business cycle: do technology shocks explain aggregate fluctuations?”, American Economic Review, Vol 89, p 249-271. Kim, S. and N. Roubini (2000), “Exchange rate anomalies in the industrial countries: A solution with a structural VAR approach”, Journal of Monetary Economics, 45, 561-586. Quah, D.T and S.P. Vahey (1995) “Measuring Core Inflation?”, Economic Journal, 105, 1130–1144. Shapiro, M.D. and M.W. Watson (1988). “Sources of Business Cycle Fluctuations”, in S. Fischer (ed.), NBER Macroeconomics Annual 1988. The MIT Press, Cambridge (Mass.) and London.

© Copyright 2026