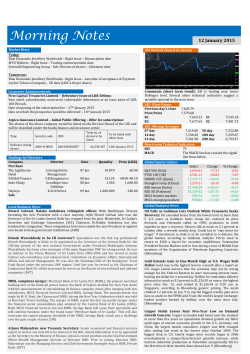

Morning Notes - Lanka Securities (Pvt)

udithgpseall14 21gpgppivg Morning Notes 11 February 2015 Market Diary ASI Outlook (based on charts) Today: Textured Jersey Lanka - XD Date (LKR 0.50 per share) John Keells Holdings - XD Date (LKR 1.00 per share) Tomorrow: No Alerts Corporate Announcements Interim Financial Statements 31-12-2014 - Central Finance Company (CFIN), Tal Lanka Hotels (TAJ), Trade Finance & Investments (TFIL), The Fortress Resorts (RHTL), Royal Ceramics Lanka (RCL), Millennium Housing Developers (MHDL), The Nuwara Eliya Hotels Company (NEH), The Lighthouse Hotel (LHL), A I A Insurance Lanka (CTCE), Piramal Glass (GLAS). Vidullanka – Acquisition of 15% stake by Aberdeen Holdings: Aberdeen Holdings acquired approx. 73mn shares (15.3% of issued shares) of Vidullanka at a price of 6.00 per share from Dr. T. Senthilverl on 10th February 2015. Millennium Housing Developers – Acquisition of 10% stake by Mr.V.R.Ramanan: Mr.V.R.Ramanan has purchased approx. 13mn shares amounting to 10% issued shares of Millennium Housing Developers at a price of LKR 6.70 per share from Nawaloka Construction Company (Pvt) Ltd on 10th February 2015. CT Holdings – Interim Dividend of LKR 0.80 per share: XD – 20th Feb 2015 Payment date – 03rd Mar 2015 Central Industries – Acquisition of 13% stake by Dr. T. Senthilverl: Dr. T. Senthilverl acquired approx. 1.3mn shares (13.1% of issued shares) of Central Industries at a price of 85.00 per share from D.G. Wijemanne on 10 th February 2015. Dealings by Directors Company Purchase Alumex Indo-Malay Good Hope Sale Asia Asset Finance Director Date R.P.Pathirana Goodhope Asia Holdings Goodhope Asia Holdings 06 Feb 06 Feb H.L.L.M.Nanayakkara Quantity Price (LKR) 3,749 100 15.90 1,656.00 06-09 Feb 301 1,600.001,620.00 05-06 Feb 4,150,000 1.70 Comments (short term trend): Most of the technical indicators suggest a clear downtrend. Cautions approach is advised. ASI - Pivot Points Previous day’s close Pivot Point R1 R2 ASI - Moving Averages 07 day 14 day 21 day 7,304.70 7,271.07 7,346.14 7,387.58 7,181.40 7,260.57 7,342.24 S1 S2 7,229.63 7,154.56 50 day 100 day 200 day 7,288.48 7,295.10 6,914.58 Short-term Technical Indicators RSI 51 MACD The MACD line has crossed the signal line from above. Global Equity Indices S&P 500 (USA) FTSE 100 (UK) NIKKEI 225 (Japan) Shanghai Comp (China) BSE Sensex (India) KSE All (Pakistan) MSCI frontier markets MSCI emerging markets Index 2,068.59 6,829.12 17,652.68 3,155.27 28,355.62 34,432.89 590.10 972.83 Change +21.85 -8.03 -59.25 +13.68 +128.23 -137.41 -2.48 -5.74 % Change +1.07 -0.12 -0.33 +0.44 +0.45 -0.40 -0.42 -0.59 Global Business News Local Business News Sri Lanka to strengthen the SOEs without privatizing them: Harsha De Silva: Sri Lanka’s State Owned Enterprises (SOE) management should be strengthened by removing political interference without privatizing, Deputy Policy Planning and Economic Affairs Minister Harsha de Silva has said. “Our position is to strengthen the management of the State Owned Enterprises. Give them the freedom to make their own decisions and also ensure that they work in an environment where then can adjust prices based on the cost of production,” he said. State enterprise losses which are financed by bank debt requires higher interest rates to crowd out private investment and slow growth, but the State usually prints money to keep interest rates down, triggering high inflation and currency depreciation. “All this time we were expecting them to be profitable, but they were not given the ability to price according to market.” (LBO) Brent crude rally ends as China inflation hits five-year low: Brent fell below $ 58 a barrel on Tuesday after China’s consumer inflation came in at a five-year low for January, raising worries about oil demand in the world’s second-largest economy. The International Energy Agency (IEA) also said the United States will remain the world’s top source of oil supply growth up to 2020, defying expectations of a dramatic slowdown in shale output and keeping fears of a continuing glut at the forefront. “The drive down today would most probably be due to weak China CPI figures which turned out to be lower than expectations,” said Daniel Ang of Singapore-based Phillip Futures in the Reuters Global Oil Forum, referring to monthly consumer price index data released on Tuesday. (DFT) Sri Lanka merchandise exports up 6.7-pct to US$11bn in 2014: Sri Lanka’s annual provisional merchandise exports increased by 6.67% to 11.079 billion rupees, Export Development board of Sri Lanka (EDB) said in a statement. These provisional numbers do not yet reflect the service exports values and therefore, actual exports values are expected to be much higher. Apparels earned 4.9 billion dollars up by 9.26% in 2014, industrial products at 8 billion rupees increased by 6.1 percent, tea at 1.6 billion up by 5.43% and agriculture products at 2.7 billion US rising by 9%, data released by EDB showed. Manufactured products at 2.4 billion US dollars up by 9%. Coconut exports up by 49% to 538 million dollars while fisheries increased by 8.5% to 265 million dollars. Natural rubber declined by 36% to 46 million dollars and other export crops dropped by a mere 3% to 506 million dollars. Diamonds and gems too experienced a decline 15% to 372 million dollars. (LBO) Six Countries Where Inflation Is Surging: hanks to an epic collapse in the ruble, price growth has hit crisis levels in Russia: Inflation reached 15 percent in January. Even worse, there's little respite in sight. Inflation will average 13 percent in 2015, according to the median forecast of economists surveyed by Bloomberg. Food prices rose 21 percent in January from last year, with sugar jumping 68 percent. Grains and legumes saw a 45 percent spike, while fruit and vegetable prices climbed 41 percent. Luckily, alcohol inflation has tracked at a relatively tamer 14 percent. (Bloomberg) Oman’s S&T inks partnership with Hayleys: Oman's S&T has entered into an exclusive joint venture agreement with the Hayleys Group to offer a complete range of interior fit-out contracting services in the Sri Lankan market. Services and Trade Co. LLC (S&T) is a leading interior fit-out and contracting company headquartered in Oman with operations across 14 Land countries. project, Under the agreement, a new company (S&T Interiors Pvt. Ltd) has been formed to operate the interior fit-out business in Sri Lanka. This new venture will build on unique local marketing know-how and will be pivotal in expanding S&T's presence in the country. Hayleys Chairman and Chief Executive Mohan Pandithage, said this partnership will add value to the hotel industry in particular given the vast experience that S&T brings to Sri Lanka.” (DN) Greece Offers Debt-Talks Compromise: Greece offered compromises ahead of an emergency meeting with its official creditors tomorrow as German Chancellor Angela Merkel remained unyielding over terms of the country’s bailout conditions. Greek Finance Minister Yanis Varoufakis told lawmakers on Monday that the government intends to neither tear up the existing bailout agreement, nor allow the budget to be derailed. He said Greece will implement about 70 percent of reforms already included in the current bailout accord. (Bloomberg) Morning Notes Local Business News Amendment to expand tobacco pictorial warning tabled in Parliament: New laws relating to an increase in the area of coverage of health warnings up to 80% of the front and rear sides of every packet, package and carton of cigarettes and other tobacco products were brought before Parliament yesterday. The health warning on the front and rear sides will differ from each other while the manufacturer is also instructed to use different health warnings on each product in their portfolio. Announcing the notice of conformity received from the Supreme Court, Deputy Speaker Chandima Weerakkody said: “The Cabinet of Ministers has certified and approved National Authority on Tobacco and Alcohol Amendment Bill for the betterment of the nation.” However, opposition lawmaker Dinesh Gunawardena expressing his concerns for presenting the amendments to the National Authority on Tobacco and Alcohol Act No.27 of 2006 in the form of an urgent bill noted: “At the party leaders meeting, it was agreed that a copy of an urgent bill, which is presented to the Supreme Court for guidance should also be given to the Leader of the Opposition and the party leaders in the opposition. This is the tradition to which we have agreed to and followed. Unfortunately this was not followed today.” (DFT) Indrani reappointed as IBSL Chief: Top civil servant Indrani Sugathadasa has been reappointed as the Chairperson of the Insurance Board of Sri Lanka, the insurance industry regulator. She was first appointed as IBSL Chairperson in May 2010 and considering her integrity and professionalism the Minister of Finance Ravi Karunanayake has re-appointed her. She was also a former Chairperson of the Securities and Exchange Commission. As a member of the Sri Lanka Administrative Service (SLAS) since in 1977, Sugathadasa has held various positions including Secretary, Ministry of Child Development and Women’s Empowerment and Secretary, Ministry of Plantation Industries. (DFT) BOC signs MoU with Tokyo Bank: The Bank of Tokyo-Mitsubishi UFJ Ltd. (BTMU) entered into a Memorandum of Understanding recently with the Bank of Ceylon (BOC) with the purpose of developing tighter cooperation in promoting a wide range of financial services between Sri Lanka and Japan. The MoU with BOC will strengthen BTMU’s ability to serve Japanese corporates investing in Sri Lanka, BTMU said in a release. In recent years the Sri Lankan economy has grown rapidly owing to strong reconstruction demand and expansion of its tourism industry. In addition, Sri Lanka has been accelerating its investment in infrastructure projects. With increasing political and social stability, foreign investors, including Japanese corporations, have been redirecting their focus to Sri Lanka as it offers a high quality workforce, geographical advantages and abundant tourism resources. (DFT) Exporting boats to Philippines: With bilateral trade with the Philippines a mere US$ $40 million, Philippines, Asia's second fastest growing nation said that it is ready to renew trade with Sri Lanka in a 'bigger way.' "We welcome input from your business chambers on the various sectors that they want to partner in Sri Lanka. Thereafter, we shall facilitate them towards business matchmaking. We signed a trade agreement with Philippines in 1980 but it is not active. We need to re-activate this important agreement. The policy and decision-makers on both sides get involved with their interaction so that the export efforts of President Maithripala Sirisena could be strengthened." said Vicente Vivencio T. Bandillo (Dhaka based Philippines Ambassador for Sri Lanka). (CFT) Abans launch Apple Ipad Mini 3, Ipad Air 2 with smart warranty: Apple iPads have reigned supreme as market leaders amongst tablet computers for several consecutive years. To display their confidence in the durability of Apple iPads, Abans, the authorized reseller and service provider in Sri Lanka, recently introduced a Smart Warranty for iPads purchased through Abans only. The warranty covers accidental drop damages and water damages. If for any reason the iPad cannot be repaired, then Abans will give a one to one replacement under the warranty free of charge. The Smart Warranty also provides for repair or replacement coverage, both parts and labor, by Apple certified authorized technicians. (DN) Beauty Central opens unit at Asiri Central Hospital: With a combination of leading Consultants in cosmetology and dermatology providing first class aesthetics for discerning patients, 'The Central Hospital'; the newest addition to the Asiri Group of hospitals, recently opened its doors to their new designated unit dedicated to cosmetic procedures. 'Beauty Central' is equipped to handle various procedures across a complete spectrum of treatment options for beauty enhancement, which include laser hair removal, erasing vascular birthmarks, dermatological procedures and laser treatments, facial rejuvenation and face-lifts, keloid scar reductions plus a host of aesthetic treatments that do not involve incisions, surgery or general anesthesia. (DN) Silvermill mulls foray into Philippines, Indonesia: A. Silva & Sons Lanka (Pvt) Ltd., a pioneer in the manufacture and export of value added coconut products since 1920, is looking at investing in Philippines or Indonesia. Chief Executive Officer, S.A. Silva & Sons Ltd, Cedric Wijegunawardane speaking to Daily News Business said that the main reason for the company to venture overseas is the lack of coconuts in the local market and the high prices they have to pay for nuts. “A coconut in these countries is around Rs.18 and almost 350 grams bigger than the local coconut.” (DN) 11 February 2015 Global Business News Oil Producers Outside OPEC Caught in Crossfire With Shale: Oil producers outside OPEC and U.S. shale fields are getting caught in the confrontation over market supremacy that has brought crude prices to near six-year lows. High-cost regions from aging North Sea fields to untapped resources in East Siberia and deep-water projects off Latin America will suffer the most from the clash, say Standard Chartered Plc, Citigroup Inc. and BNP Paribas SA. (Bloomberg) Chinese economy more sustainable now: China central bank: China's economy is now more sustainable and domestic consumption is steadily rising, Chinese Central Bank Vice Governor Yi Gang told a G20 meeting of finance officials earlier this week. Yi's remarks came after China posted its slowest economic growth in 24 years in 2014, with a cooling housing market, slowing investment and recent underwhelming exports expected to weigh further on domestic demand this year. (Reuters) Crude’s Pain Is Others’ Gain as Consumer Boost Outweighs Layoffs: Low oil prices are biting deeper into the energy industry as Halliburton Co. eliminated thousands more jobs and Canadian producer Talisman Energy Inc. wrote down the value of drilling assets by $1.3 billion. The global oil industry has cut more than $40 billion in spending and fired 50,000 or more workers to cope with oil prices that sank below $50 for most of January. (Bloomberg) U.K. Commercial Real Estate Investment Climbs to Record: Investors spent a record 70.7 billion pounds ($108 billion) on U.K. commercial real estate last year as they sought alternatives to the low returns of fixed-income assets. (Bloomberg) Morning Notes 11 February 2015 Local Business News Activity continues to remain subdued ahead of weekly bill auction: Activity in secondary bond markets continued to remain subdued yesterday as well, with a limited amount of movement witnessed on the six year maturity of 1 May 2021 and the seven year maturity of 1 July 2022 as its yields were seen increasing to intraday highs of 7.70% each on very thin volumes in addition to the four year maturity of 1 July 2019 changing hands at levels of 7.18%. In money markets yesterday, the Open Market Operations (OMO) department of the Central Bank refrained from conducting any auctions for a second consecutive day as overnight surplus liquidity dropped to Rs 9.36 billion. The weighted average on overnight call money and repo rates increased further to 6.50% and 6.31% respectively. (DFT) Rupee steady; downward pressure remains despite CB moves: The rupee ended steady on Tuesday despite importer dollar demand, a day after Finance Minister Ravi Karunanayake said the currency would be held at the current level as the central bank prevented its fall through moral suasion. Actively traded three-month forwards ended at 134.50/65 per dollar, while all other forwards ceased trading for the second straight session after the Central Bank narrowed the per day premium to two cents on Monday from Friday’s five cents, dealers said. “Everything is restricted, nothing is happening,” said a currency dealer asking not to be named. Another dealer said exporters might convert dollars, which might help ease the pressure if the Central Bank held the rupee at these levels for the next few days. Officials from the central bank were not immediately available for comment. The Finance Minister told Reuters in an interview on Monday that the rupee will be held steady at current levels and “there won’t be any devaluation at all.” The rupee is under pressure due to higher imports and rising private sector credit in a lower interest-rate regime. Dealers said policy uncertainty weighed on the currency as the Government has sent mixed signals on investment, discouraging exporter dollar sales amid continued importer demand. They expect the pressure on the rupee to ease with some equity-related inflows. (DN) The information contained in this report, researched and compiled for purposes of information do not purport to be complete description of the subject matter referred to herein. In preparing this report care has been exercised to collect information from sources which we believe to be reliable although we do not guarantee the accuracy and completeness thereof. Lanka Securities (Pvt) Ltd. and/or its affiliates and/or its directors, officers and employees shall not in any way be responsible or liable for loss or damage which any person or party may sustain or incur by relying on the contents of this report and acting directly or in directly in any manner whatsoever. Lanka Securities Research

© Copyright 2026