Lifestyle Products in India

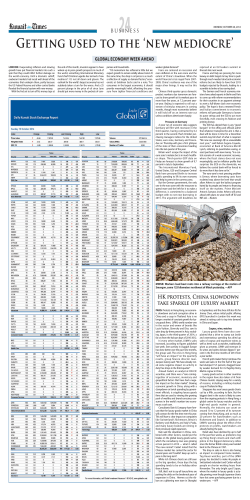

A BRIEF REPORT ON LIFESTYLE PRODUCTS IN INDIA February, 2015 A brief report on Lifestyle Products in India 1 LIFESTYLE PRODUCTS SECTOR IN INDIA 1.1 Background Twenty years ago, urban India’s lifestyles and buying trends were no way similar to what we see today. With limited choices, consumers had few brands to choose from. In 1991 India threw its doors open to international trade, and the situation changed dramatically and so did consumerism in India. Today, consumers are spoilt for choice and fully acknowledge that they rule the market. Manufacturers cater to their whims and give the consumer complete control of market trends. Despite India having a low per capita income, it still remains a lucrative market, even for trendy, lifestyle products. One reason is India’s large population. A sizable section of the country’s citizens forms the working population. As foreign trade grew, it opened up numerous jobs opportunities and gave the bulk of the working population significant spending power. The mantra of this section of society is ‘working hard and spending luxuriously’ and are responsible for the current boom in consumerism. In general, Indian consumers have a high degree of value orientation and thus brands need to strategically price their products to gain a foothold in India. Also the Indian consumer tends to associate himself with products that communicate the message of family values, traditions, care and affection. These nuances set India apart from other developing nations. Companies are forced to considerably tailor their products to suit the local market and meet the requirements of consumerism in India. Lifestyle changes occur due to following reasons: a. Major change in income, that is if the consumer has more money to spend therefore their life style started to change. b. Life style changes take place because of different age group c. Life styles can be environment driven new generation sweeps comes in and find that new things begin to happen, new technology comes, and new ways of doing things happens as we are seeing with the telecom world and the impact of media on us. 1.2 Present Scenario of Consumer Lifestyle India has over one billion people. Being a vast country, here people inhabit four climatic zones, form the temperate north to the tropical south, from the parched west to the inundated east, speak one or more of 15 official languages, follow several religious and personal beliefs, differ enormously in their food habits and social customs and live together under varying states of human development, from highly affluent to the utterly destitute. Around three fourths of India’s population live in rural areas and contribute one third of the national income. The high rate of industrialization, growth of service sector and better employment opportunities have increased consumers disposable income, developed new lifestyles and awareness and a drastic Private & Confidential Page 2 of 7 A brief report on Lifestyle Products in India change can be seen in their buying behavior. The Indian consumer now days want to live in present and prefers a life full of luxury & comfort and are not much price sensitive. They are highly aware about the product, price, quality and options available with them. Indian consumers believe that branded products are more reliable. The brand which identifies and support family values are more popular and accepted easily by them. Introduction of credit culture has made the Indian consumers to purchase products on credit and pay tomorrow. Since markets are changing rapidly, they create immense. Life- style, simply reflect on what you do, what your opinions are and what your interests are In typical marketing language they are activities, interests and opinions. The Indian consumer market, which is primarily dominated by young generation, is becoming increasingly sophisticated and brand conscious. A typical upper middle class young consumer is beginning to look beyond the utility aspect of a product to seek intangibles like brand and lifestyle statement associated with the product. This modern consumer wants his purchases to reflect his lifestyle or at least the one he aspires for. As a result of this brand consciousness, the food and beverage segment of the FMCG sector is already witnessing a significant shift in demand from loose to branded products .The Indian affluent class has always had a penchant for premium branded goods and this fetish will continue. The luxury market in India accounts for 10% of the total retail and expanding on a faster pace to reach $18 billion mark by 2017 from its existing level of $14 billion. Looking back into the past, the market was reported at 8.21 billion USD in 2013.Luxury retail in India is distinguished by a twin focus on short-term luxury products, notably jewellery, and long-term investment in luxury assets, particularly cars. Increasing brand awareness among the Indian youth and rising purchasing power of the upper class in tier II and III cities would lead to consumer spending touching $4.2 trillion by 2017. These facts and numbers shows that India is a fast growing luxury consumer market and is definitely the country that fashion and luxury brands should look at, for expansion and future development. International brands that have been drawn to India by its large “willing and able to spend” consumer base and the rapidly growing economy have benefitted in attaining quick acceptance in the Indian market and given their high desirability meter, most international brands have positioned themselves at the premium-end of the market, even if that is not the case in the home markets. In addition, Indian companies – manufacturers or retailers – have been more than ready to act as platforms for launching these brands in the market and today there are over 200 international fashion brands in the Indian market for clothing, foot wear and accessories alone, and their numbers are still growing. Global consumer spending is also rising and is expected to reach $40 trillion by 2020, with an unprecedented growth of $12 trillion in a decade. 1.3 Luxury Products The luxury products market in India is expanding its ambit from the conspicuous-consumption consumers of the early years to the truly affluent households that wish to stand apart from the crowd. In the rapid growth of the luxury market, the consumers are accepting and adopting global trends much faster than anticipated. Digital and social media have made it possible for companies to connect with the once hard-to-reach Indian consumer. Private & Confidential Page 3 of 7 A brief report on Lifestyle Products in India 1.3.1 Categories of luxury products Among different sectors, luxury jewellery, electronics, cars, and fine dining have grown beyond expectations, while apparel, accessories, wines, and spirits have continued their strong growth. While various estimates exists on the size and growth potential of the Indian luxury market; most estimates align on anticipated growth rates of 20% given the tremendous potential waiting to be harnessed such products: apparel and accessories, pens, home décor, watches, wines & spirits & jewelry etc. 1.3.2 Market size for each segment Jewellery and watches are the largest luxury industry segments with 47% of the total market followed by apparel and accessories with 14% of the total luxury market. The luxury electronics and car segments have seen a growth of above 35%, while fine dining has seen a whopping 40% growth in this period. All of these segments have seen higher growth than expected in the last year. Apparel and accessories, watches and personal care have also seen robust growth, between 24-30%. 1.3.3 Major brands of luxury products available in India Product Jewellery Watches Apparel Automobile Private & Confidential Brand Maria Cristina Buccellati Omegas, Rolexes, Tissots and Mont Blancs Louis Vuitton, Giorgio Armani, Hermes Rolls Royce, Bentley, Mercedes, BMW, Audi and Porsche Page 4 of 7 A brief report on Lifestyle Products in India 2 NEW MARKET PLAYERS Indian luxury brands are no longer a myth. Luxury brands, which are always cautious in their approach before entering any market, usually adopt the route of distributors and franchisees since they do not want their investments to get stuck because of strict investment norms. Brands like Burberry, Dior and Ed Hardy have adopted this approach. Italian apparel and shoe brand Geox Group, which is among the top brands in Italy and a seller of premium and life-style casual footwear products globally, has also approached Indian company G&B Footcorp to start distribution of products in India. Today, G&B is responsible for the Indian presence of Sisley and Dell as well. Similarly, the $10-billion Japanese fashion retailer Uniqlo is also selling trendy and casual merchandise at competitive prices, with ambitions to become the world's top fashion retailer toppling Zara and H&M. Many international brands are venturing different strategies to enter into the market. Instead of setting up shop in luxury malls, as has been the trend over the past few years, Hermes has ventured into market with standalone stores in iconic buildings in Mumbai and Pune. Kalyan Jewellers has raised around Rs 12 billion (US$ 188.59 million) from Warburg Pincus in one of the largest private equity (PE) deals in the jewellery manufacturing segment in India. The Government of India has taken various initiatives to improve the retail industry in India. Some of these initiatives are: The Foreign Investment Promotion Board (FIPB) has cleared five retail proposals worth around Rs 4.2 billion (US$ 66.01 million) from companies such as Bestseller, Puma SA and Flemingo. Additionally, the board cleared three 100 per cent single-brand retail proposals worth Rs 2.22 billion (US$ 34.97 million), suggesting renewed interest in India’s growing retail market. Some of the industry experts believe counterfeit goods result in a sizeable loss of revenue and serve as a major hurdle to conduct operations in India. Also, more corrective measures need to be taken to lock down the emergence and continued existence of this market in the form of effective IP enforcement, plugging loop holes in the legal & judicial structure and higher conviction rates since the absence of these measures collectively lead to the global brand’s equity getting diluted and reduced consumer trust in their brands. Recently, American luggage brand Hartmann entered the Indian market by opening its first store in Bangalore, with plans to open another five outlets by end of next year. Samsonite South Asia, makers of Samsonite and American Tourister, which had acquired Hartmann, will be targeting to capture the top end of the market with the brand. Besides, some global brands are not only eyeing the Indian market, but are also planning to expand their roots through various channels. Off late, the growth of luxury retail in India has been a driving force for global brands to venture into the country. Jamin Puech Paris chose Indian market because their presence in Asia (particularly in Japan and China) is getting wider via EBOs and MBOs, and this is rational for them to keep expanding in the Private & Confidential Page 5 of 7 A brief report on Lifestyle Products in India region. Also, the exclusive and refine design of bags should definitely be appealing to Indian clientele, who are very sensitive to seek refined fashion products. The Temperley brand has made its India foray via multi-designer store Kitsch, a property co-owned by Priya and Charu Sachdev. Indian consumers and their preferences have changed over the years, and many retailers are considering it to be a positive factor to invest in India. Private & Confidential Page 6 of 7 A brief report on Lifestyle Products in India 3 MARKET GROWTH Key Growth Drivers India’s consumer class is estimated to grow nearly twelve-fold (from 50 million at present) to 583 million by 2025, with more than 23 million people likely to be listed among the world’s wealthiest citizens An increase in the young working population especially women and growing opportunities in the service sector act as biggest growth drivers for the luxury retail sector in India. 60 per cent of India‘s population is below the age of 30 Growing incomes coupled with optimism about the future. A recent report by The Nielsen Company puts India on top of the consumer confidence index Easier consumer credit & loans - With the emergence of concepts such as quick and easy loans, easy monthly installments (EMI), loan through credit cards and loan over phone, it has become easy for Indian consumers to purchase expensive products Real estate development in the country, for example, the construction of mega malls and shopping malls, is augmenting the growth of the organized retail business. On-going liberalization of retail sector. Already, 51% FDI allowed in the luxury sector in India by the government The number of Ultra High Net (UHN) worth Households, with a minimum net worth of Rs 250 million is expected to triple to 0.5 million in next five years with a five-fold increase in their net worth to Rs 260 trillion. HNIs will be double in number by 2015 to over 0.4 million with a collective wealth of USD 2645 billion. These projections along with the increasing price parity in the luxury products with other international destinations like Singapore or Hong Kong, and customized products offerings would indicate that the luxury market in India would evolve quickly Foreign investment in luxury retail comes with strings attached-100 per cent FDI in both single and multi-brand retail requires 30 per cent of local sourcing, a clause which luxury players find difficult to comply with-and there just isn't enough quality retail real estate available. These issues have been known since the outset. Industry growth of 23 per cent, while good, is expected, given the small base. Many larger consumer industries do grow in mid-double digits With this level of growth and subsequent investment from luxury businesses, it is estimated that by 2020 the luxury market in India will be responsible for employing 1.8 million people. This will not only preserve traditional craft skills and heritage, but will also support communities, create employment and provide training Private & Confidential Page 7 of 7 A brief report on Lifestyle Products in India 4. FUTURE PROSPECTS With increasing brand awareness amongst the Indian youth and purchasing power of the upper class in tier II and III cities, Indian consumer spending are expected to grow four times to USD 4.2 trillion by 2017. The ideal marketing strategy to penetrate in these towns is to begin retailing ‘ladder to luxury’ brands. This segment bridges the gap between the luxury and mid- market segments and provides an entry point for new consumers of luxury. High internet penetration across tier-II and tier-III cities along with high disposable income shall lead to approx. 80 million transactions on the Internet by 2020. As a result, the luxury consumption is going to increase manifold in the country. The growing exposure of international brands and the desire to indulge in luxury has penetrated smaller cities and towns of India and it is not surprising to note that more than 50% are using social media platforms as a brand connects and to increase awareness within this new target segment. Thirty percent of India’s population lives in cities, which is predicted to rise to 40% by 2030. Indian consumers have shown increased demand for premium products and services and that the luxury market is expected to grow by 21% by 2015. Bollywood and celebrity endorsements are changing the grooming habits of urban men with more of them paying attention to personal grooming as a result of the mass influence that two mediums have. Even outside cities, although less affluent than their urban counterparts, rural India is being described as a new goldmine with it being worth an estimated $425 billion. Despite being less well off than their urban counterparts, rural consumers are increasing their consumption due to their increasing aspirations towards a better lifestyle. The growth in India between 2015 and 2020 will become even larger as more people come into the consumption curve. Nine million households will be targets for luxury or near luxury consumption. Almost 22 per cent of Indian consumers try foreign products and brands. With the Indian luxury market estimated to touch $30 billion mark by 2015 and the country aiming to become the world’s fifth largest consumer market by 2025, this conference surely struck the right chord in its target premium segment of a rapidly growing economy. While China is on track to become the world’s second largest luxury market within the next five years, India too is not far behind. With positive regulations and policies for the retail industry being put in place by the government along with a burgeoning middle class which aspires to own and experience luxury goods and services, India is a market that can no longer be ignored by international brands. Private & Confidential Page 8 of 7

© Copyright 2026